Inventory

Inventory

Generate e-Way Bills

There are two primary ways by which you can generate e-Way bills:

You can also generate e-Way bills via other modes such as SMS, API and android applications.

Note: When you create an e-Way bill through Zoho Inventory, your e-Way bill credentials will be shared with EWB.

Generate e-Way Bills in Zoho Inventory

If you have to generate several e-Way bills for your day-to-day transactions, instead of typing the bill details individually in the EWB portal, you can generate them in bulk in Zoho Inventory. You are only required to enter your transporter’s details while Zoho Inventory pre-fills the transaction details.

Step 1 - Register Zoho Corporation as Your GST Suvidha Provider

Before you begin, you have to register Zoho Corporation as your GST Suvidha Provider. To do this:

- Log into the EWB portal (https://ewaybillgst.gov.in/).

- Scroll down in the left navigation pane and click the Registration dropdown.

- Select For GSP from the menu. Your GST registered email ID and phone number gets populated.

- Click Send OTP and you will receive a one time password to you registered mobile number.

- Enter the 6 Digit OTP and click Verify OTP.

- Click the Add/New button, in the following screen.

- Select Zoho Corporation in the GSP Name dropdown.

- Enter the Suffix ID and a password.

- Re-enter the User Name and Password.

- Click Add.

Zoho Corporation will be listed under the View tab and you will be able to generate e-Way bills from Zoho Inventory.

Note: This is a one-time registration. After registering, you can proceed to generate e-Way bills from Zoho Inventory.

Step 2 - Generate e-Way bills in Zoho Inventory

To generate e-Way bills in Zoho Inventory:

-

Navigate to the e-Way Bills module in the sidebar.

-

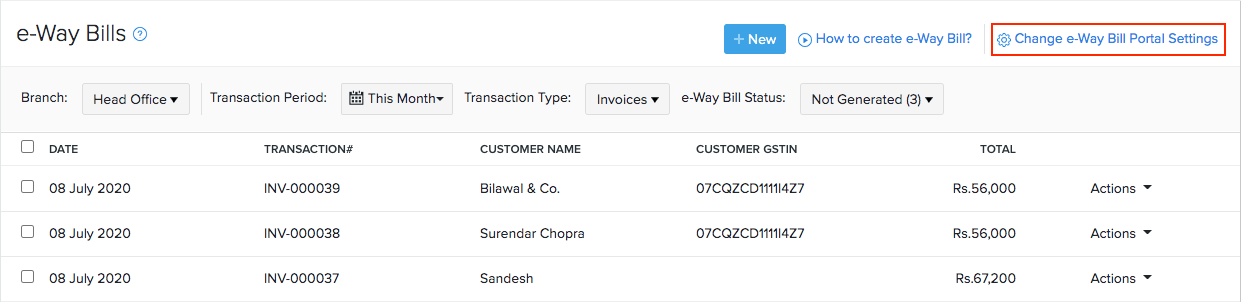

Click Change e-Way Bill Portal Settings on the top right corner of the page.

-

Click the Connect Now button under Actions.

-

Enter the Username and Password that you used while registering Zoho Corporation as your GST Suvidha Provider(GSP) in the e-Way Bill system’s website.

-

Click Save & Validate.

-

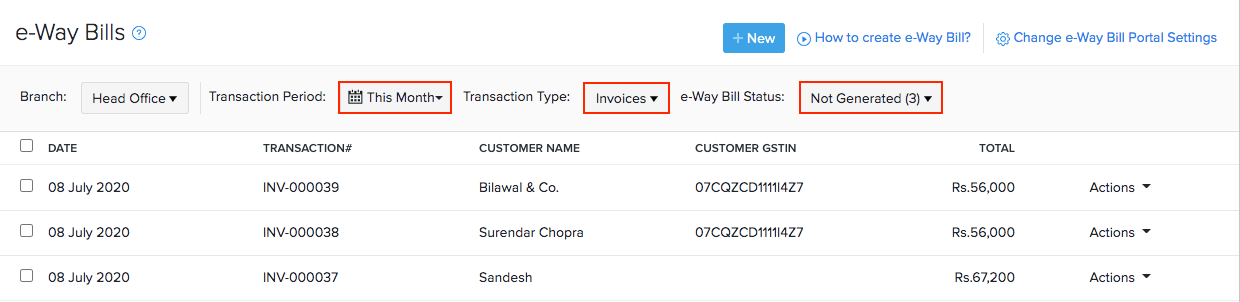

Select the Transaction Period, Transaction Type and keep the e-Way bill status as Not Generated.

-

Click the transaction for which e-Way bill has to be generated.

-

Choose Create New e-Way Bill.

-

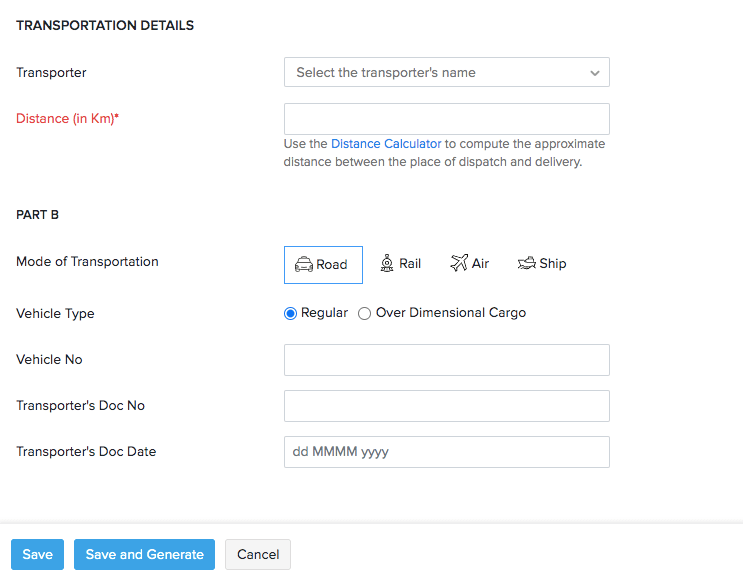

Enter the details in the required fields.

-

Click Save or click Save and Generate to generate an e-Way bill from Zoho Inventory.

The e-Way bill is generated and its validity details are updated automatically in Zoho Inventory.

Insight: As per government norms, in the case of a sales return, e-Way bills which are created for a credit note are saved with the document type as Delivery Challan in Zoho Inventory.

Generate e-Way bills from the EWB portal

If you do not want to generate e-Way bills from Zoho Inventory, you can generate them in the EWB portal. To do so:

- Export your invoices or credit notes as a JSON or Excel file from Zoho Inventory.

- Upload the JSON file to the EWB portal to generate e-Way bills for multiple transactions.

- Update the e-Way bill numbers in Zoho Inventory.

Step 1 - Export the JSON file from Zoho Inventory

-

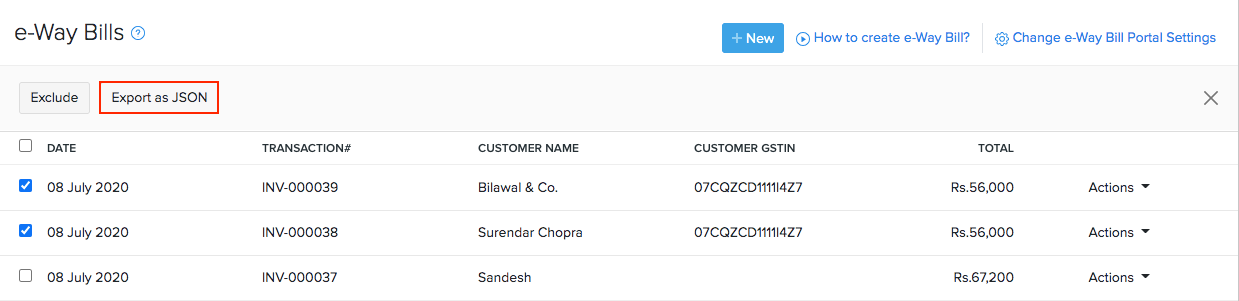

Navigate to the e-Way Bills module in the left sidebar.

-

Select the transactions by clicking the checkbox near it. Before you do, open the transactions and check whether you have entered all the mandatory fields. The mandatory fields are Customer Shipping PIN code, Place of Supply, Distance, Vehicle Number/(Transporter Document Number/Document Date), Transportation Mode, Supply Type, HSN for Goods and Organisation Address.

-

Click the Export as JSON button on the menu bar.

The JSON file will be downloaded to your system and you can upload it to the EWB portal to generate e-Way bills for multiple transactions.

Step 2 - Upload the JSON file to the EWB portal

-

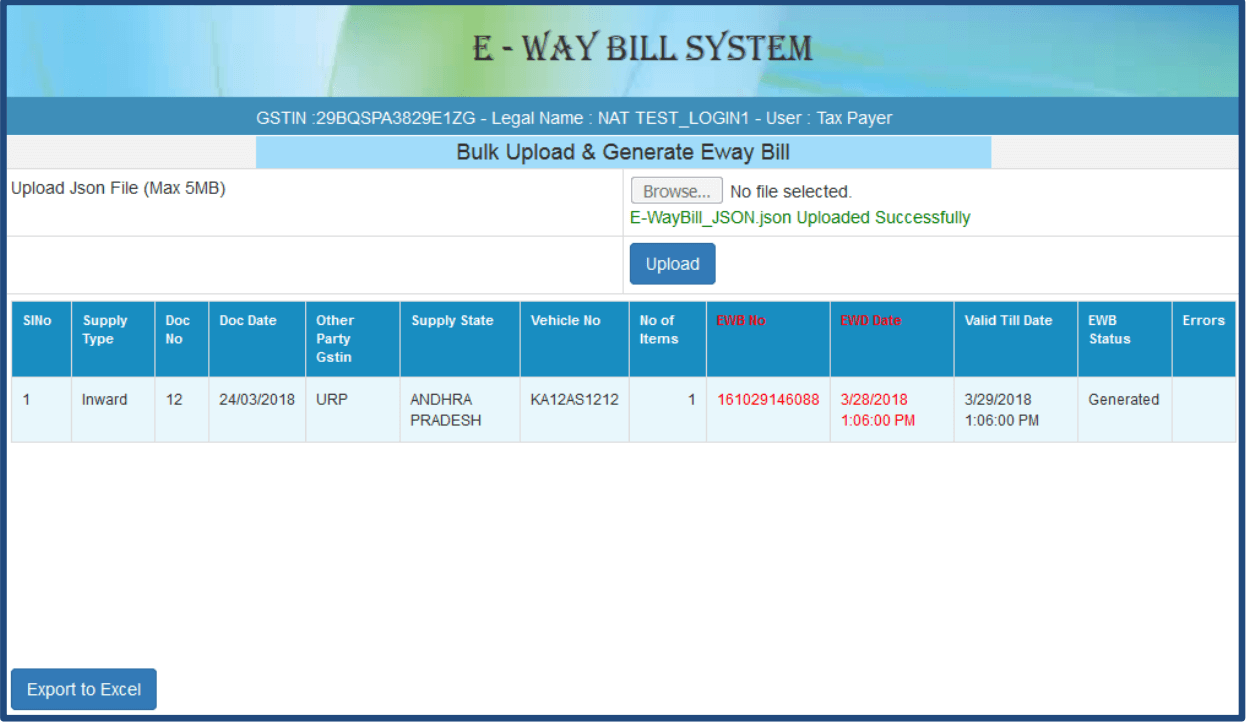

Log into the EWB portal(https://ewaybill.nic.in/ ).

-

Navigate to e-Way Bill section in the side bar of the home page.

-

Select Generate Bulk from the drop down.

-

Click on Browse and select the JSON file from your system.

-

Click Upload to load the JSON into the EWB portal.

Step 3 - Update e-Way bill number in Zoho Inventory

As per the GST regime, it is mandatory to display the e-Way bill number on invoices, credit notes and delivery challan. Hence, if you’ve generated the e-Way bills in the EWB portal, you need to update the e-Way bill number in Zoho Inventory.

To do so:

-

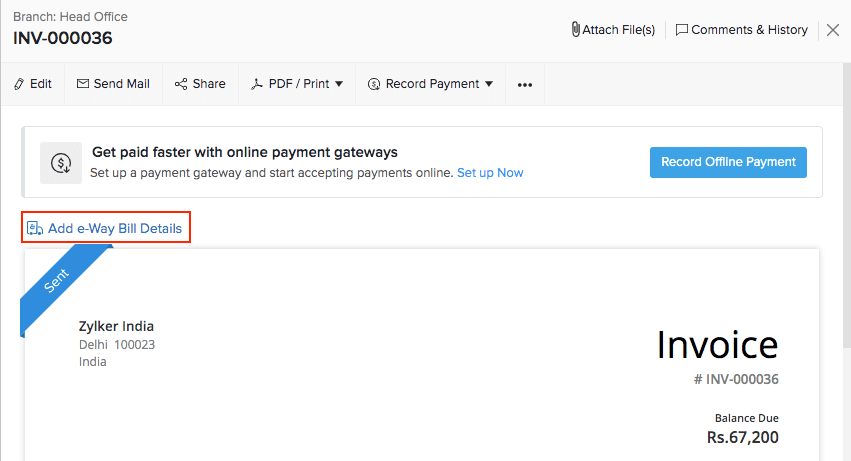

Navigate to the respective module (Invoice, Credit Notes, Delivery Challan, etc.).

-

Click on the respective document to view its details.

-

Click Add e-Way Bill Details in the invoice details page.

-

Choose Associate e-Way Bill Number.

-

Enter the e-Way bill number in the pop-up box and make sure there is no space between the numbers.

-

Click Save.

Pro Tip: If your invoice value is less than Rs.50,000, click the Ellipsis icon […] on the menubar and select Add e-Way Bill Details from the dropdown.

Related >