Inventory

Inventory

Value Added Tax(VAT) - U.K.

VAT - Value Added Tax. According to HMRC, VAT is a tax that is charged on most goods and services that VAT registered businesses provide in the UK. It is also charged on goods and some services that are imported from countries within and outside the European Union (EU).

Guide Layout:

- Prerequisites

- VAT Terms.

- Setting up VAT in Zoho Inventory

- Managing VAT Rates in Zoho Inventory.

- Contacts & VAT

- Items and their association with VAT

- VAT in Sales

- VAT in Purchases

Prerequisites

When you create a New Organisation, choose your country as the United Kingdom to make use of this feature.

VAT Terms

HMRC: Her Majesty’s Revenue and Customs

Sales to Countries Outside UK:

- Dispatch: - Selling items from UK to countries under the European Union.

- Generally, Sales under the European Union with VAT registered customers is given a Zero rated VAT. But you can only zero rate when the conditions provided by HMRC are met. Click Here to view the conditions.

- Export: - Selling items from UK to countries outside the European Union.

- Sales is outside the scope of UK VAT, therefore no VAT for this transaction.

Purchases from Countries Outside UK:

- Goods:

- Acquisition: Items purchased from countries under the European Union.

- Import: Items purchased from countries outside the European union.

- Services:

- Reverse Charge: For services which are rendered from countries outside of UK, you may have to account for the VAT yourself. This is called as Reverse Charge.

- You act as your own supplier and the customer. You charge VAT for yourself and assuming a VAT taxable service you claim it back, therefore the two taxes cancel out and there is no net cost for you.

- Services sold to both EU and non EU countries does not come under reverse charge.

- Click Here to learn more about reverse charge from HMRC.

- Here are some use cases on how reverse charges can be applied.

Setting up VAT in Zoho Inventory

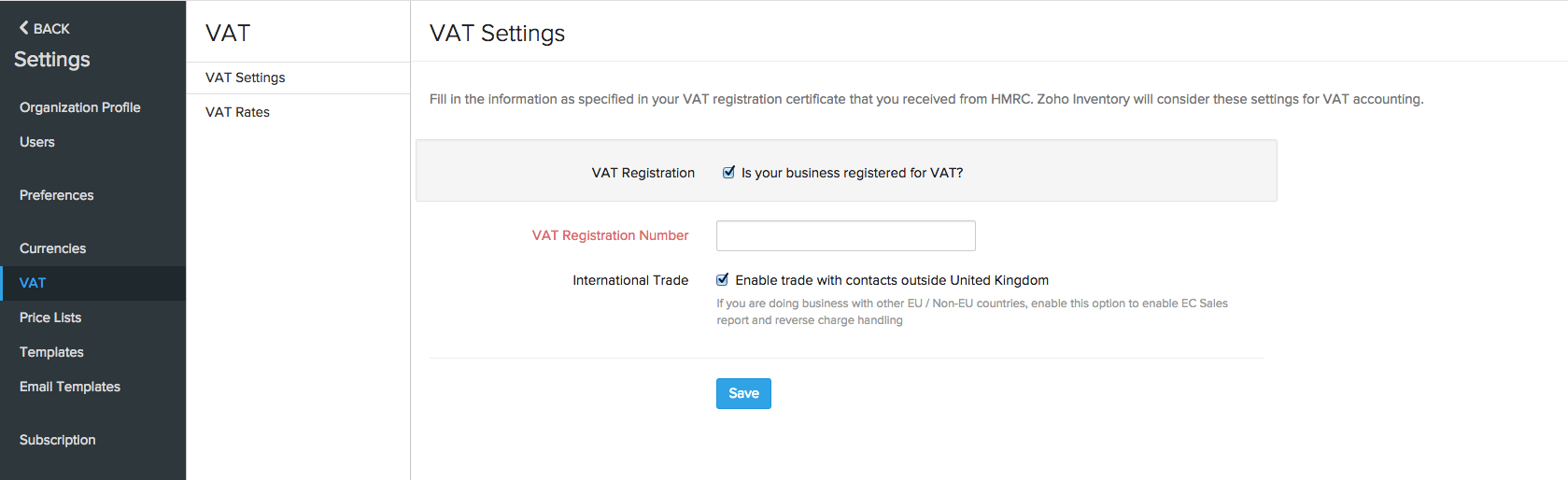

VAT Settings

To start setting up your VAT in Zoho Inventory,

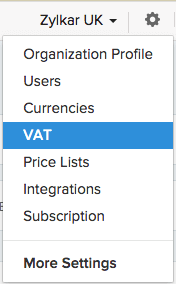

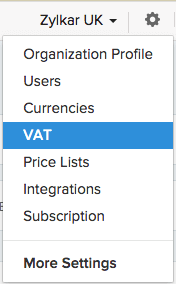

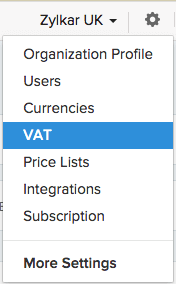

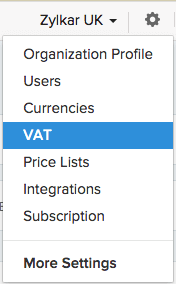

- Click on the gear icon(Settings) on the top-right corner.

- Select VAT from the drop-down.

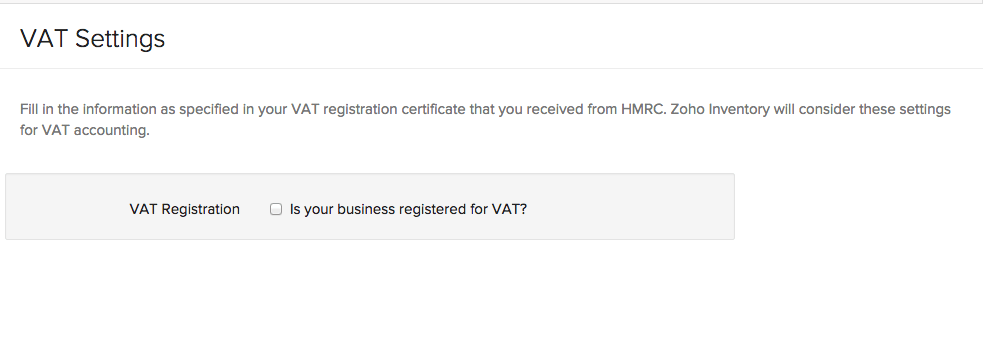

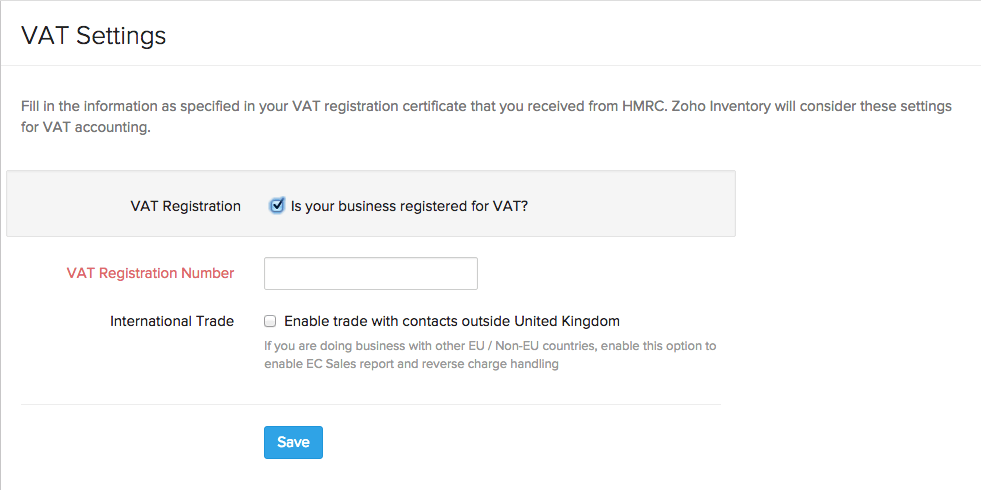

- Check the box adjacent to VAT Registration.

- If your business is VAT registered, HMRC would provide you with a certificate containing the VAT details for your business. Enter the VAT Registration Number from your HMRC certificate into the VAT settings page in Zoho Inventory.

- If you take part in international trade, then check the box near International Trade.

- After filling up the above details, click on Save.

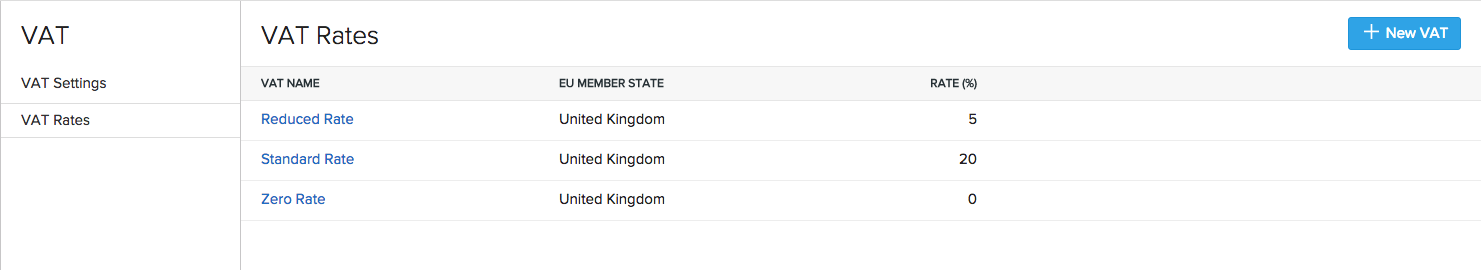

- Doing this will enable a VAT Rates section with a few default VAT rates.

- Important Note: Zoho Books, the sister app of Zoho Inventory will have more options to configure your VAT. On integrating the two apps, your VAT settings in Zoho Books will be automatically reflected here.

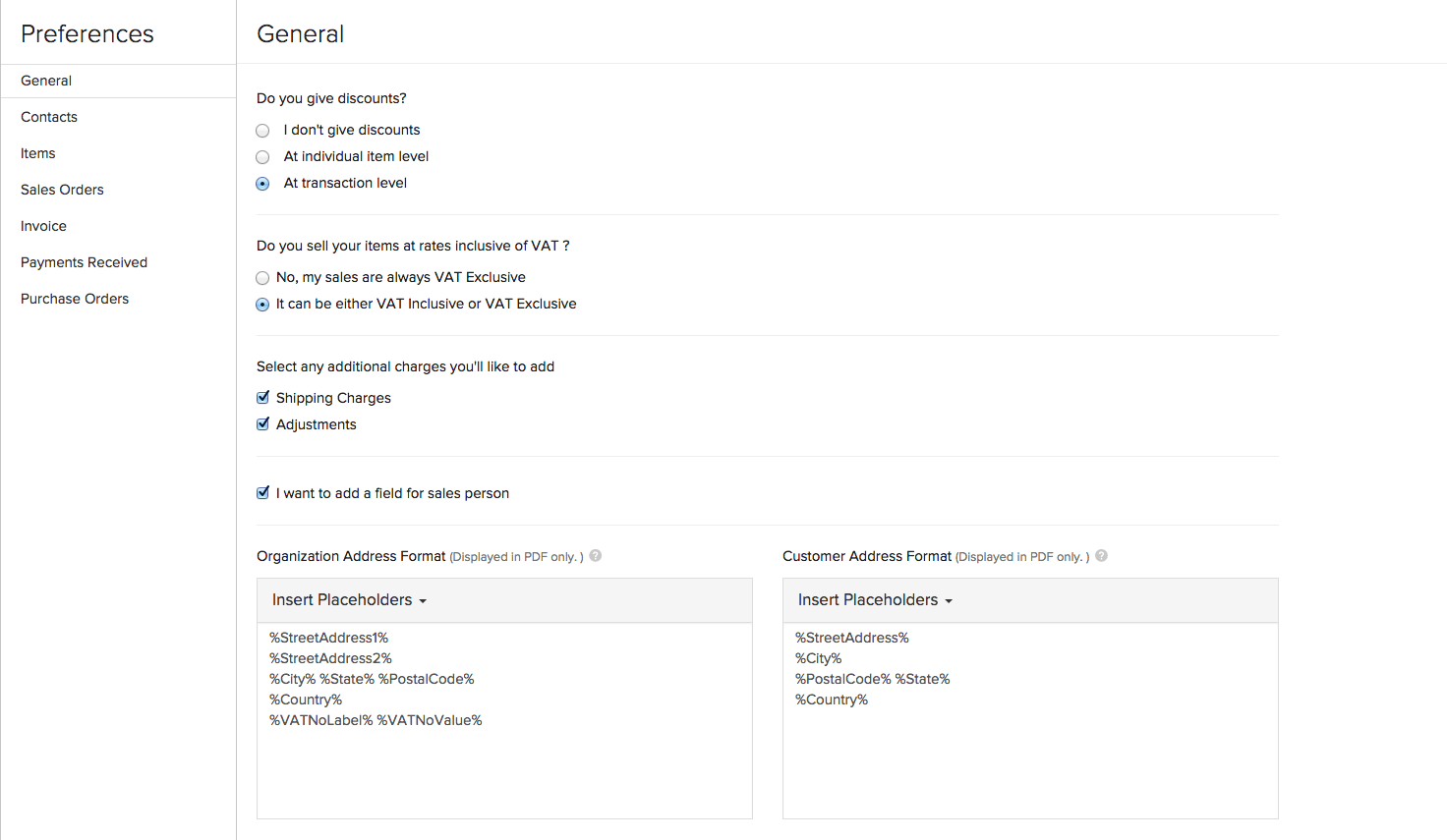

VAT preferences

Depending on how you operate your business you can choose to charge your item prices either inclusive or exclusive of VAT. To do so:

- Click on the gear icon on the top-right corner.

- Select the More Settings option.

- Under general preferences, you will be able to find the option to sell items either inclusive of VAT or exclusive of VAT.

- Make your choice and click Save.

Important! Thought this can be configured at any point of time, please stick to one choice inorder to ensure precision and accuracy when it comes to reports and accounting.

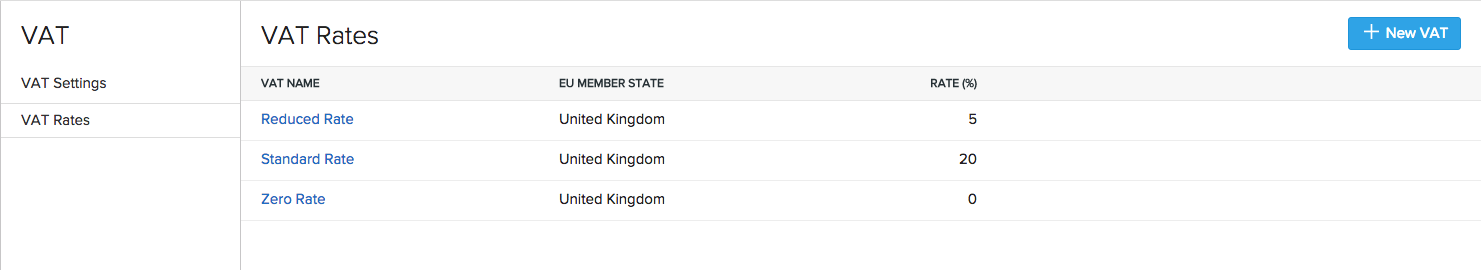

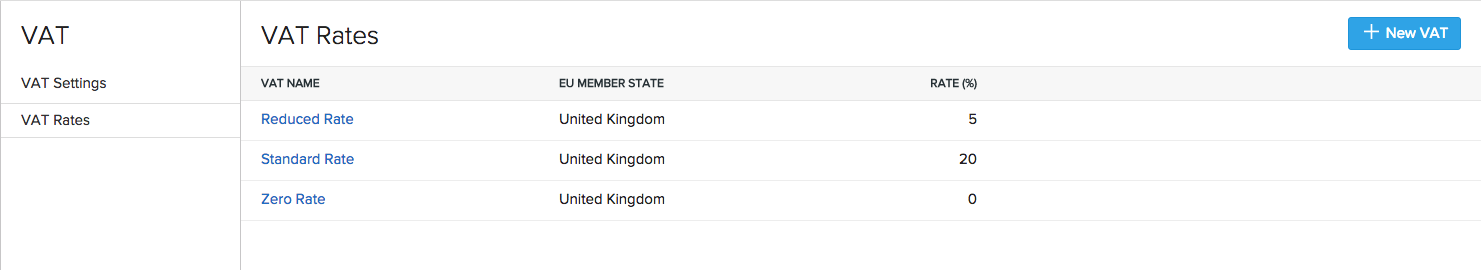

Managing VAT Rates in Zoho Inventory

Adding VAT Rates

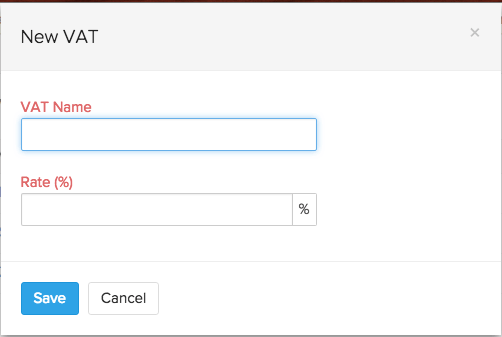

To create or add a New VAT rate:

- Navigate to gear icon(Settings) on the top-right corner.

- Select VAT from the drop-down.

- Now select the VAT Rates tab.

- Click on +New VAT button on the top-right.

- A new VAT rate form will appear.

- In the new vat rate form, enter the VAT Name, i.e: Austrian VAT or Belgium Reduced VAT etc.

- Enter the VAT Rate(%) for the EU member country.

- Click on Save.

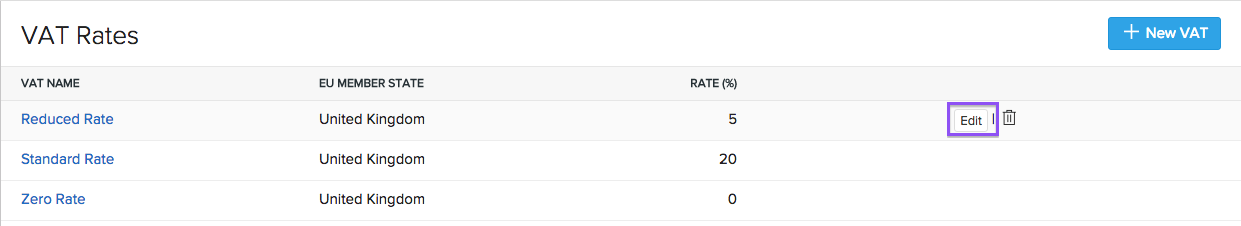

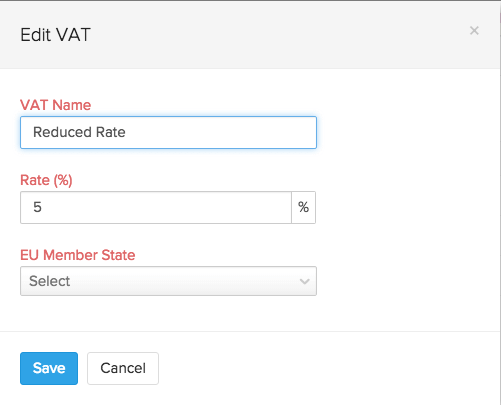

Editing a VAT Rate

To edit a VAT rate,

- Navigate to gear icon(Settings) on the top-right corner.

- Select VAT from the drop-down.

- Now select the VAT Rates tab.

- Here from the list of available VAT rates, hover your mouse over the preferred VAT rate.

- Click on the Edit button.

- On the edit VAT rate form, update or change the necessary details.

- Click on Save to implement the changes.

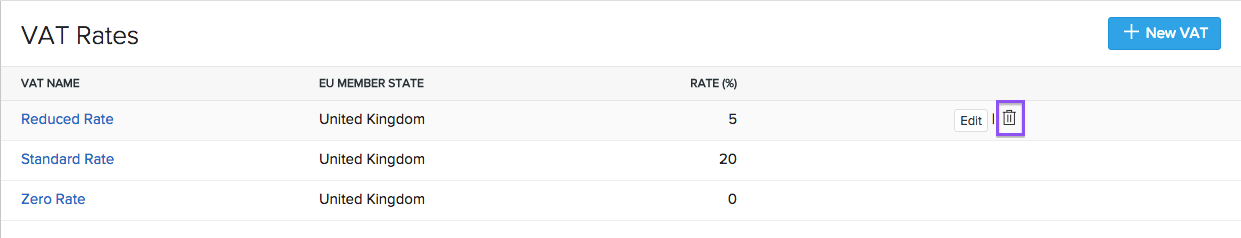

Deleting a VAT Rate

To delete an existing VAT rate, follow the steps below:

- Click on the Gear icon found on the top-right hand side corner of the screen.

- Select the VAT option from the drop-down.

- Select the VAT Rates tab.

- Scroll over the desired VAT rate.

- Click on the trash bin icon which appears.

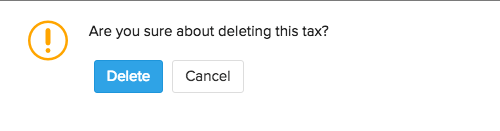

- A confirmation pop-up screen will double check your intention.

- Click OK to delete or Cancel to skip.

Contacts & VAT

VAT Treatment in Contacts

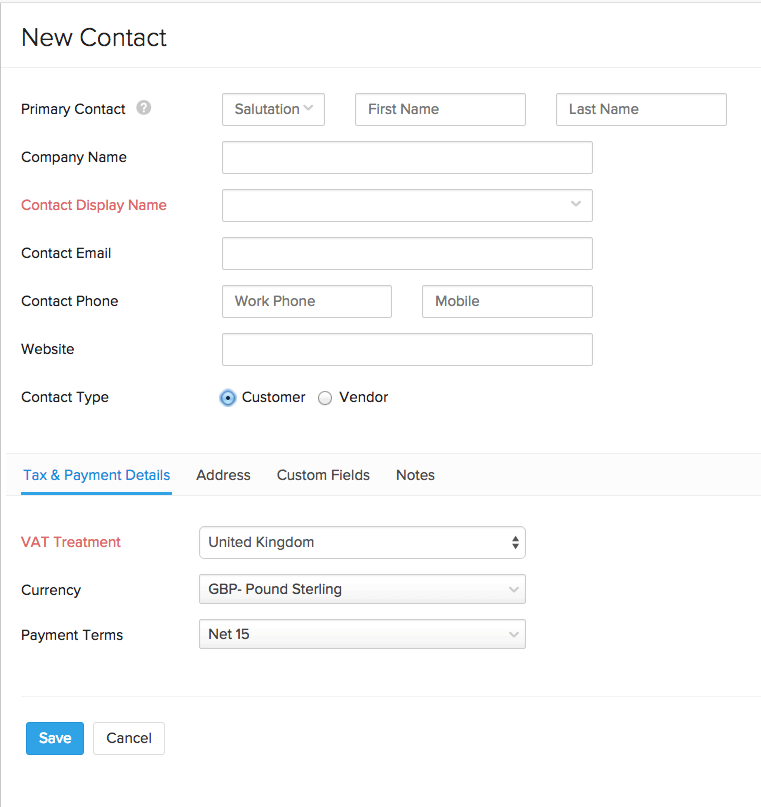

You can configure your customer’s VAT treatment at the time of creating a contact in Zoho Inventory. You can learn more about how to create a contact, by clicking here.

During the contact creation process, except for the way the taxes are associated and handled for a customer, everything else remains the same across different country specific editions of Zoho Inventory. Hence, we are going to focus solely on how you can configure and associate VAT to a customer.

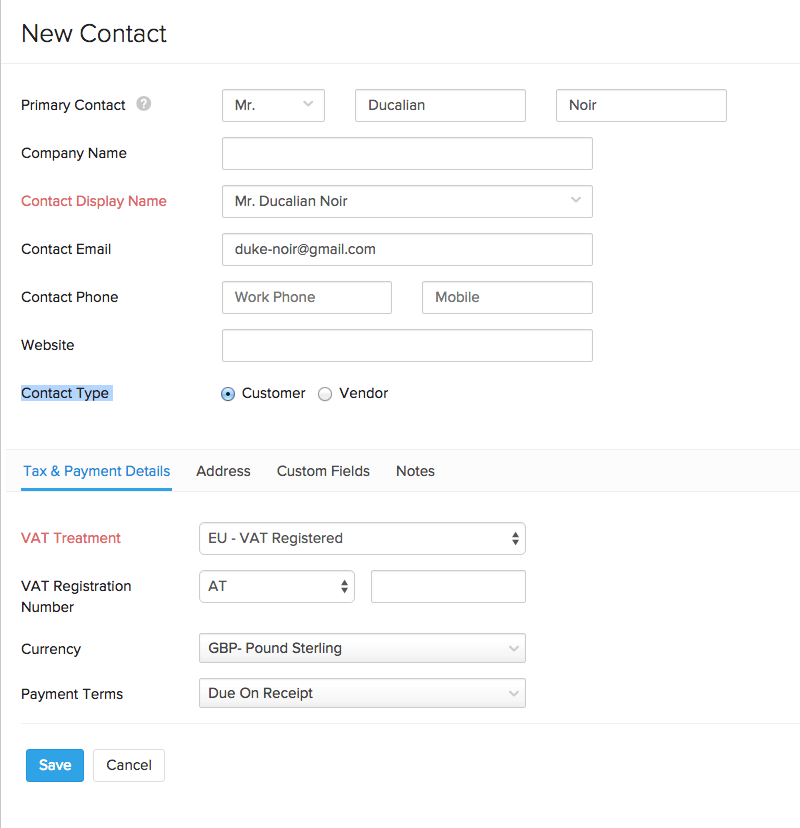

-

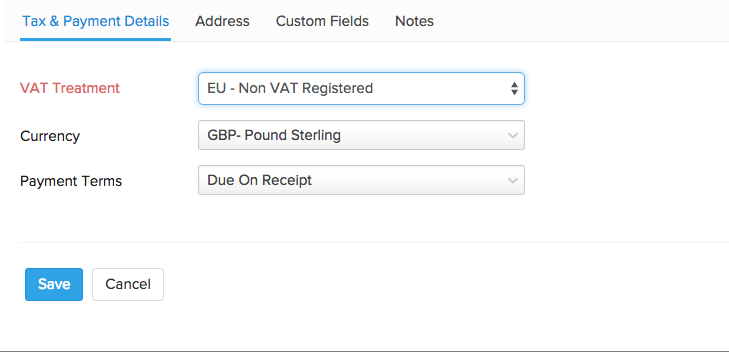

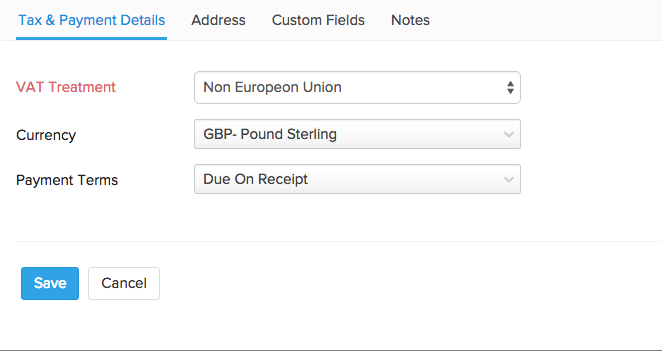

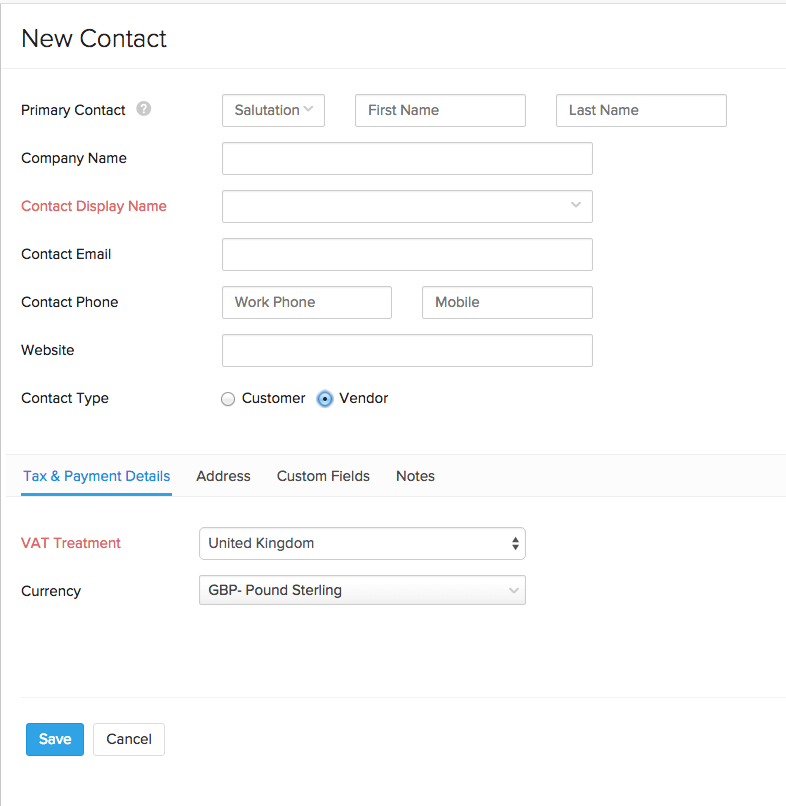

Under the Tax & Payment Details section of the new contact page, you can select the customer’s VAT Treatment, Currency and Payment Terms.

-

Before we move into the specifics, let’s take a look at what is VAT Treatment.

Enabling VAT Treatment

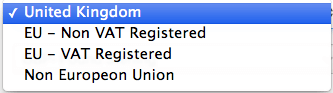

- In the UK edition of Zoho Inventory, you can create contacts based on their region, i.e UK, EU or Non-EU.

- To support transactions with currencies other than GBP, International Trade needs to be enabled in VAT Settings page.

- When international trade is enabled, the VAT Treatment drop down appears during contact creation.

| VAT Treatment | Description |

|---|---|

| United Kingdom | This option is for your customers who are based in the UK and can have transactions only in GBP.  |

| EU - Non VAT Registered | This option is for your customers who belong to the European Union and are not registered for VAT.  |

| EU - VAT Registered | This option is for your customers who belong to the European Union and are registered for VAT. Enter the VAT registration number of the contact. Choose the Country Code from the drop down provided and enter the registration number in the box. It is important for you to enter the VAT registration number of your customer, as it is required while submitting the EC Sales List. In order to zero rate the sales for a EU customer who is VAT registered, HMRC requires your customer’s VAT registration number to be shown in invoices.  |

| Non European Union | This option is for your customers outside the European Union.  |

- EU - Non VAT Registered, EU - VAT Registered and Non European Union support transactions in currencies other than GBP. You can select the currency for the contacts from the Currency drop down.

Note: VAT Treatments can also be associated with vendors.

Items and their association with VAT

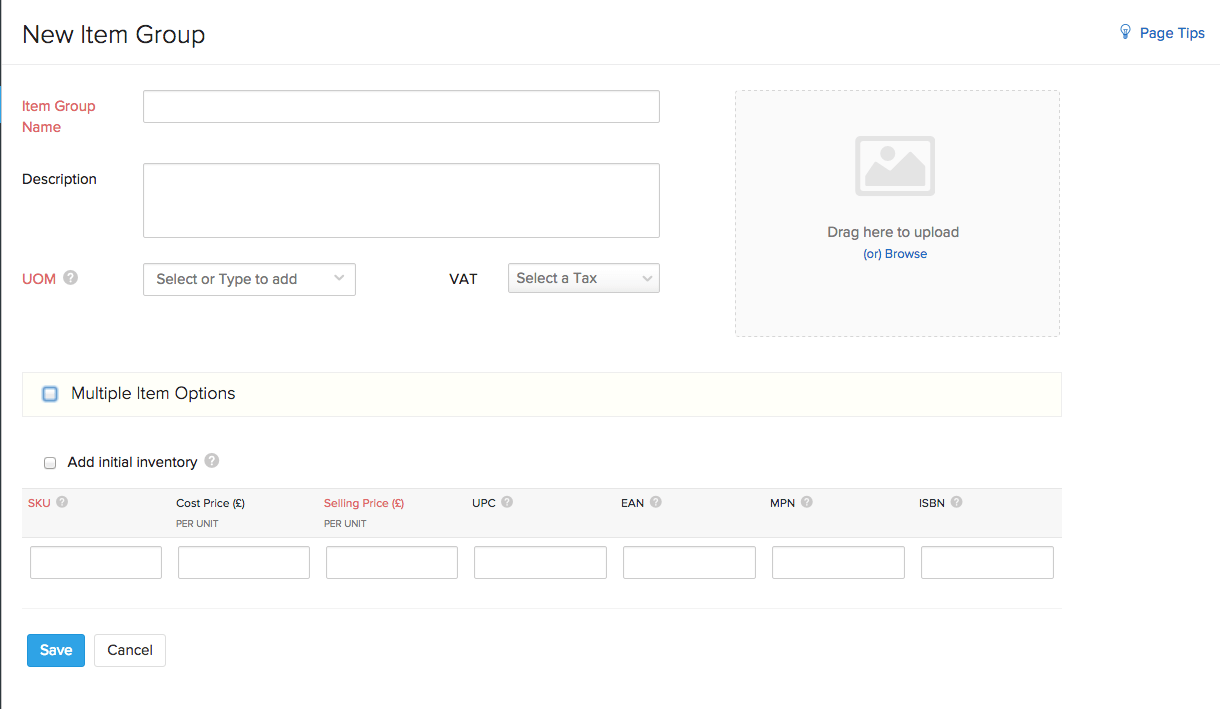

VAT in Items

- During item creation, you also have an option to associate VAT that applies to that particular item.

- You can select the VAT involved by selecting a VAT rate from the drop-down. You can also add a new VAT rate from this page by clicking on the +New Tax option.

- This VAT rate will be applied to this item when you add it to orders.

VAT in Sales

VAT is included in both the sales and purchases for your business. There are different methods in which VAT is calculated on sales, according to the region and VAT treatment of your customers and vendors.

In Zoho Inventory, VAT treatment of your contact is taken into account and the VAT associated with the item is automatically populated. Making it simple for your order management purposes.

Sales

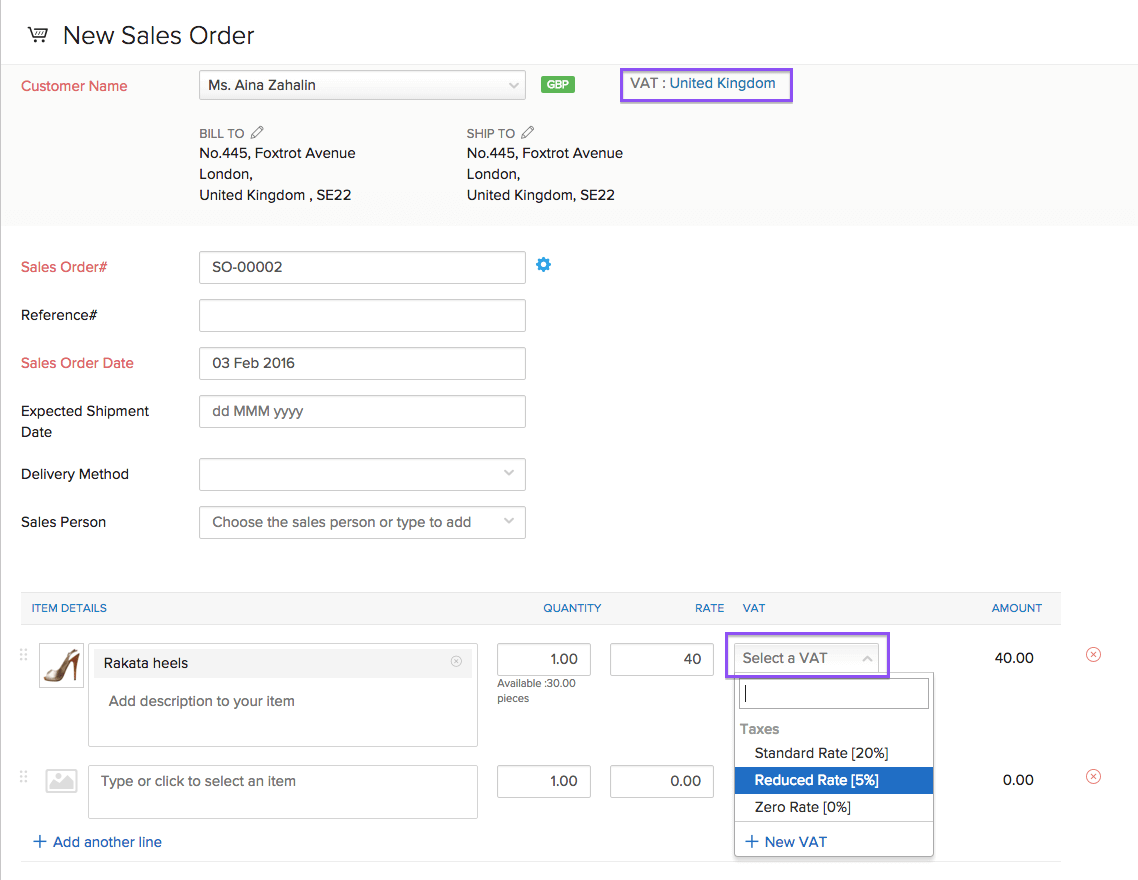

For creating a sales(Invoices or Sales Orders) transaction that is within the United Kingdom,

- Select the customer whose VAT treatment is for United Kingdom.

- Add the item for which you are creating the sales transaction and select the VAT amount.

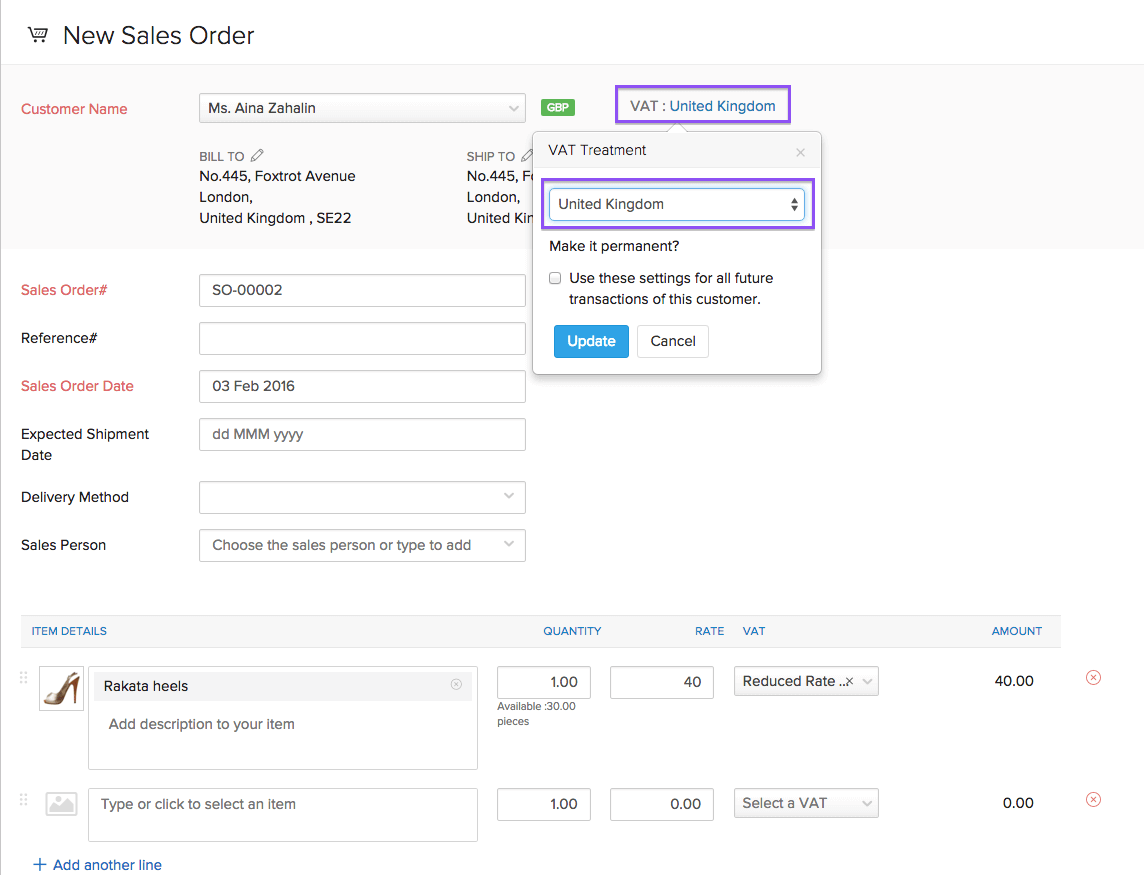

- You are also given an option to change the VAT treatment of your customer only for that invoice or order you create.

- Click on the notification, select the VAT treatment you prefer and click on Update.

- You can also set the VAT treatment as a permanent change by checking on the Make it permanent? box.

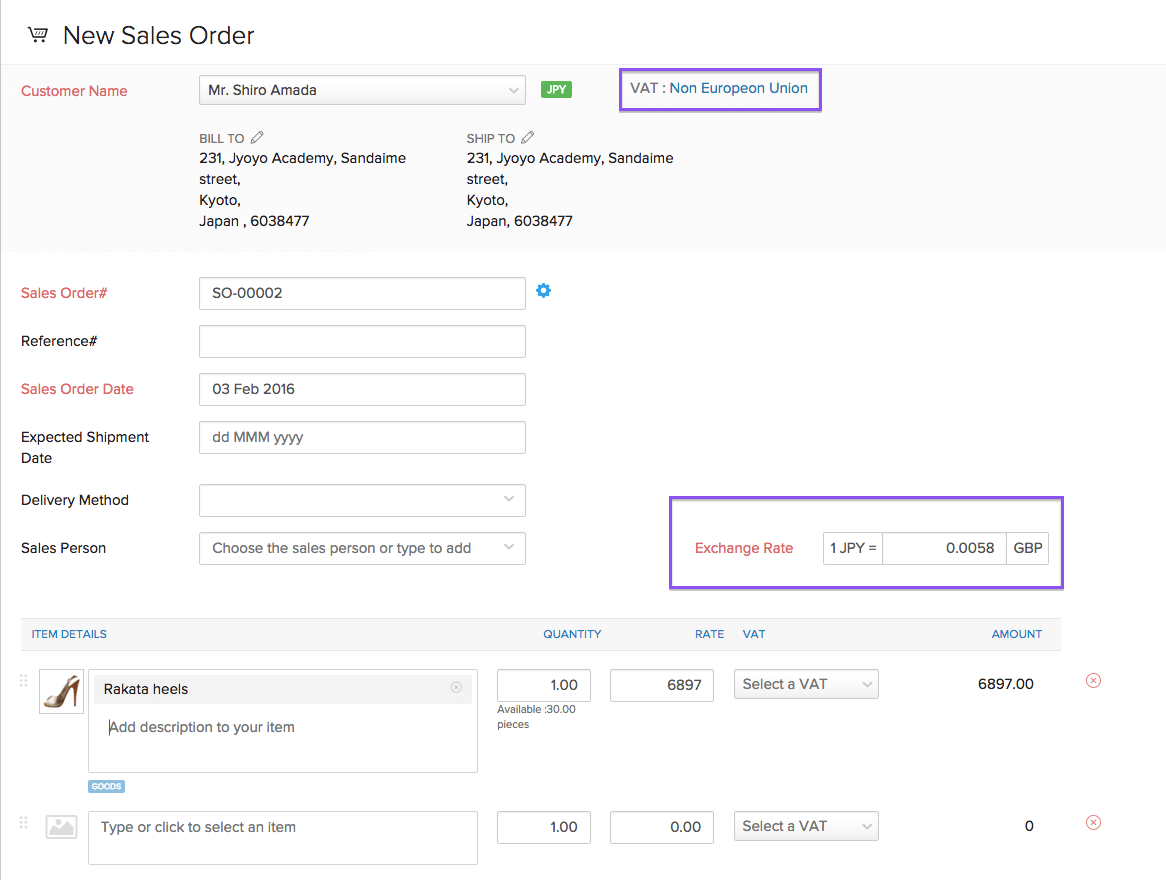

Sales Outside UK

For sales (Invoices, and Sales Orders) that are made outside the UK, you have to specify the VAT involved by yourself. For Contacts having currencies other than GBP, an Exchange Rate field is provided for you to enter the rate and the value will be calculated.

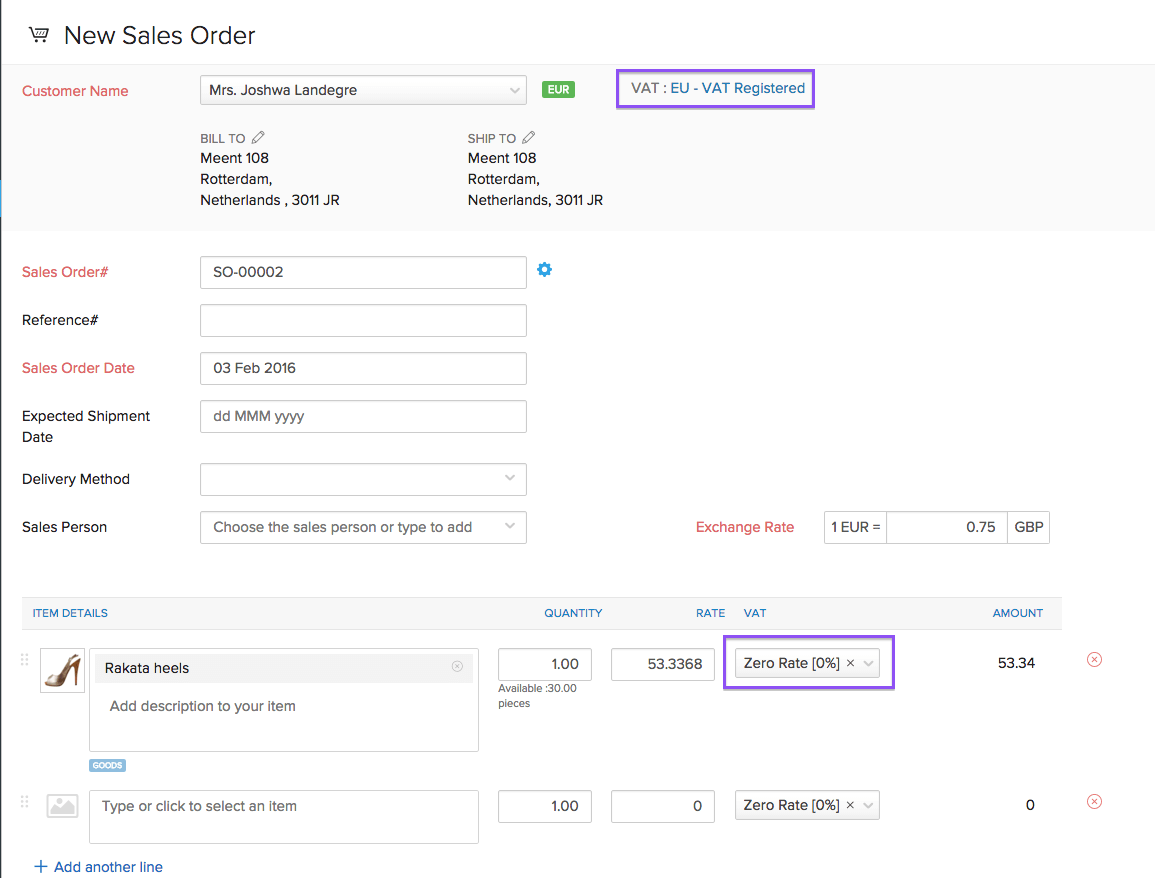

Sales to EU-VAT Registered Customers

If you are selling a product or a service to your customer who is a part of the EU and VAT Registered, then the VAT can be Zero-Rated or a Zero Rate (0%) VAT is charged on your export.

VAT in Purchases

Purchases

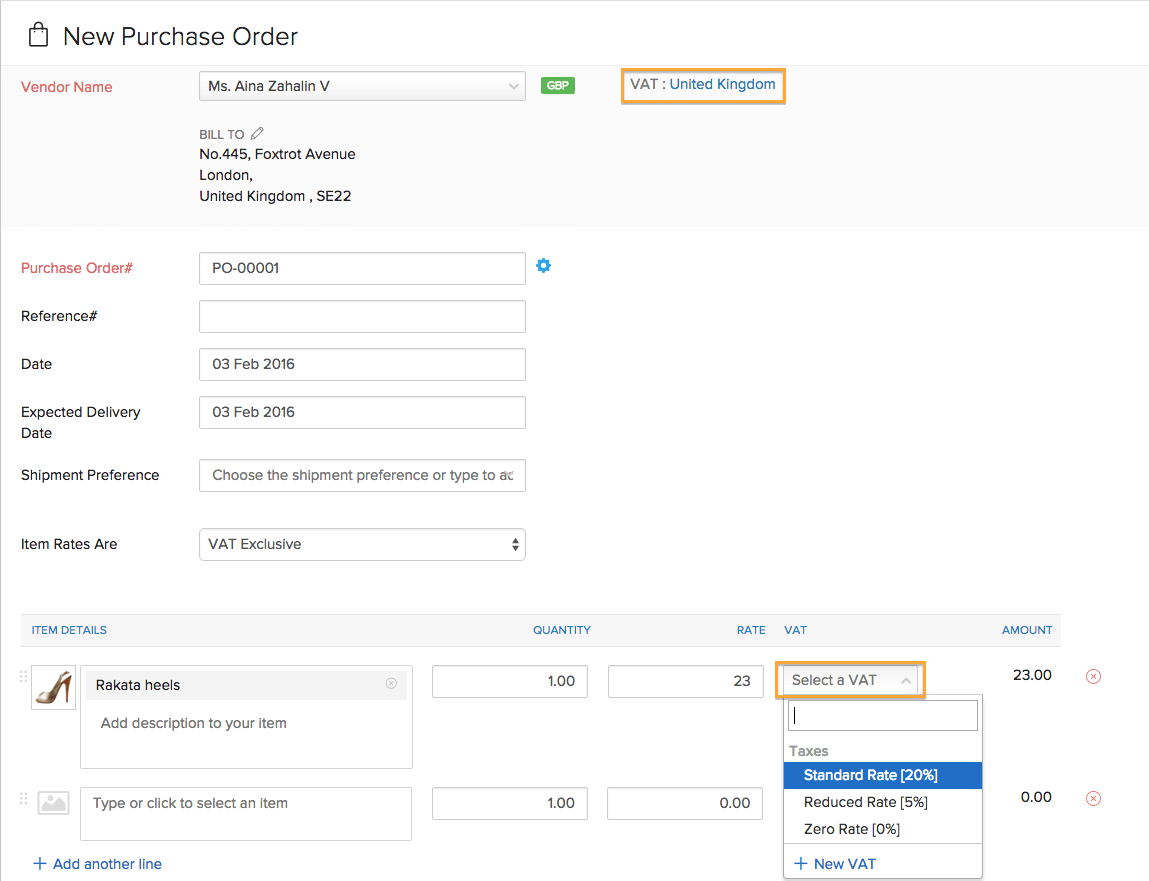

For creating a purchase(Bills and Purchase Orders) transaction that is within the United Kingdom,

- Select the customer whose VAT treatment is for United Kingdom.

- Add the item for which you are creating the purchase transaction.

- Select the VAT amount.

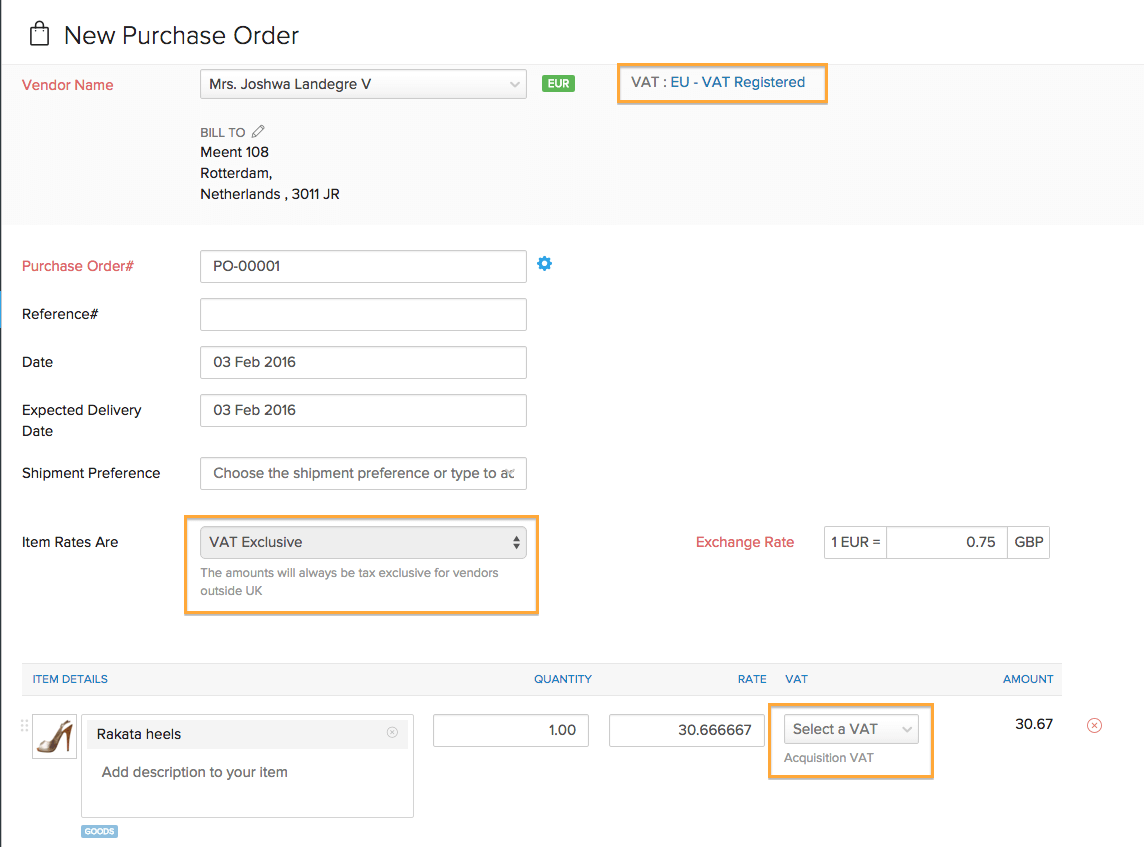

Purchases from Outside UK

For purchases that are from outside the UK, you can select the VAT or the reverse charge involved to have it reflected on the purchase transaction.

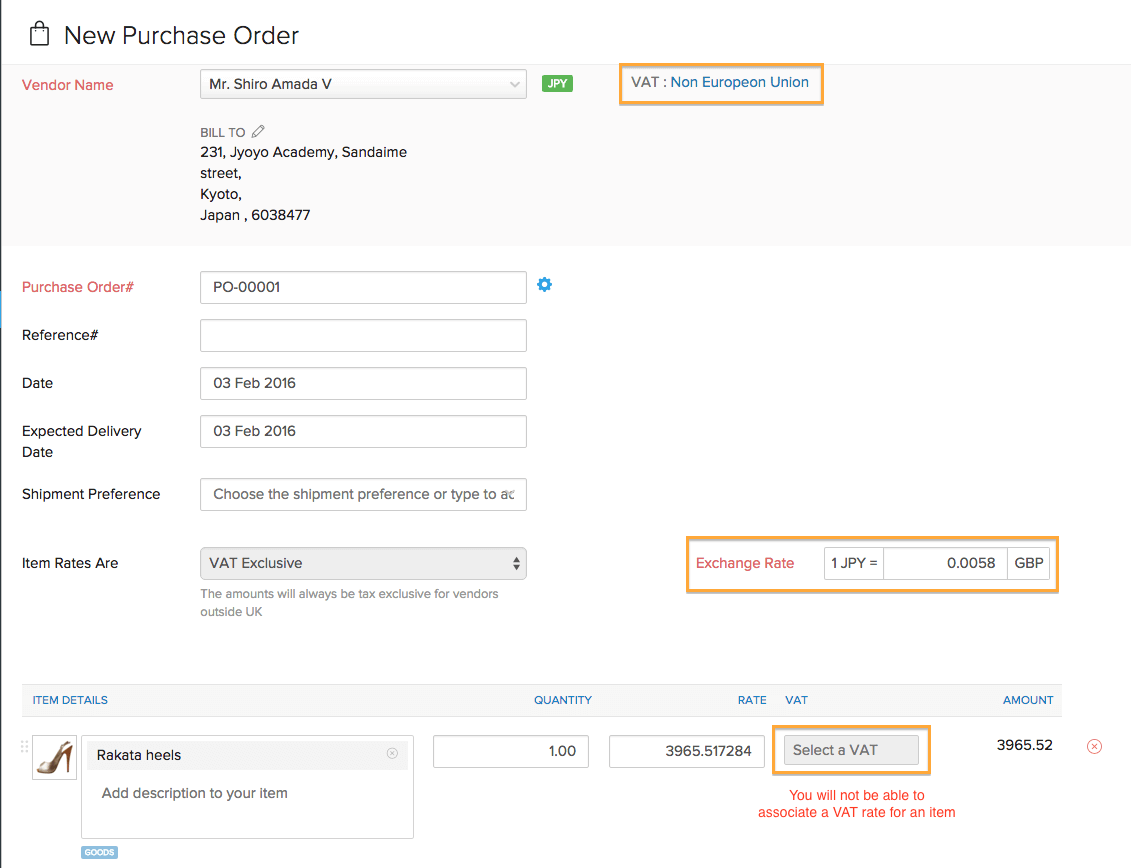

Purchases from Non-EU Countries

For the Non-EU Countries, VAT for goods and services associated with the goods are called as Import VAT. This import VAT comes under Input VAT.

While creating a purchase transaction for a vendor who is from a non-EU country, the VAT field will not be editable. Thus the import VAT cannot be added for the transaction on the bill or purchase order created.

To record the import VAT, a manual journal entry in the integrated Zoho Books organization(the same organization in Zoho Books) is needed.