VAT

Zoho Books is compliant with Bahrain’s VAT and has been tailor-made to suit your accounting needs. With Zoho Books, you can:

- Create & send VAT-compliant invoices.

- View business reports.

There’s a lot more that you can do with Zoho Books. Let’s start off with the basic configuration of VAT in Zoho Books.

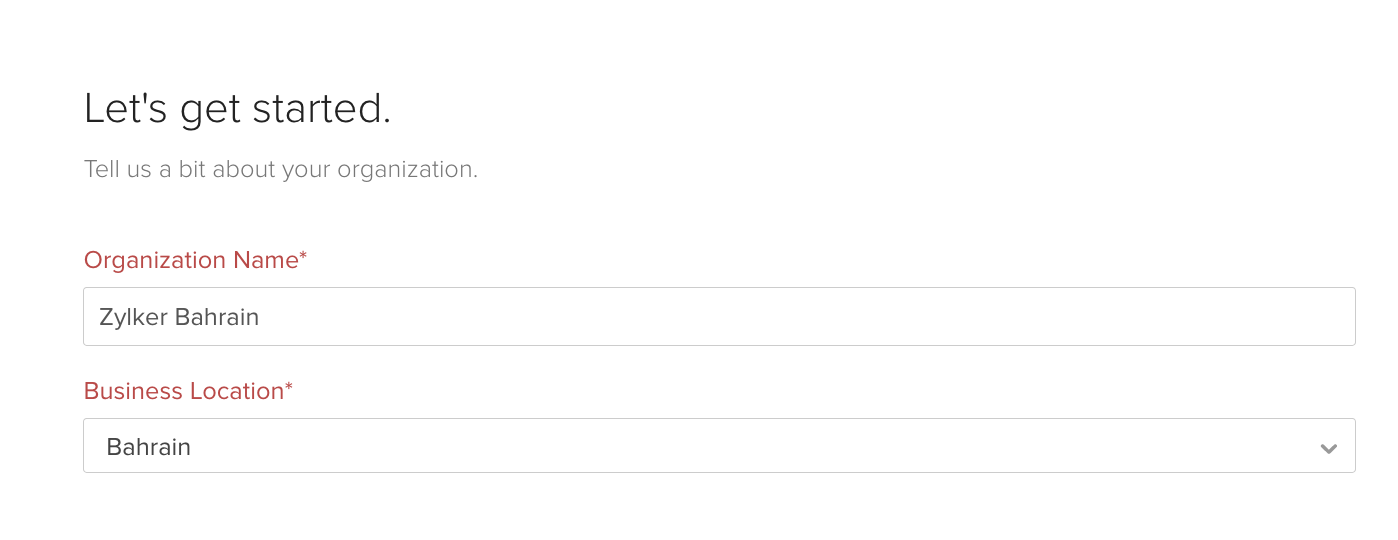

Set up Your Organization

When you are initially setting up your organization in Zoho Books, you will have to follow the steps below in order to configure your VAT settings:

- Enter your organization’s name.

- Select the Business Location as Bahrain.

- Click Save & Continue.

The Business Location cannot be changed once you have entered it while setting up your organization.

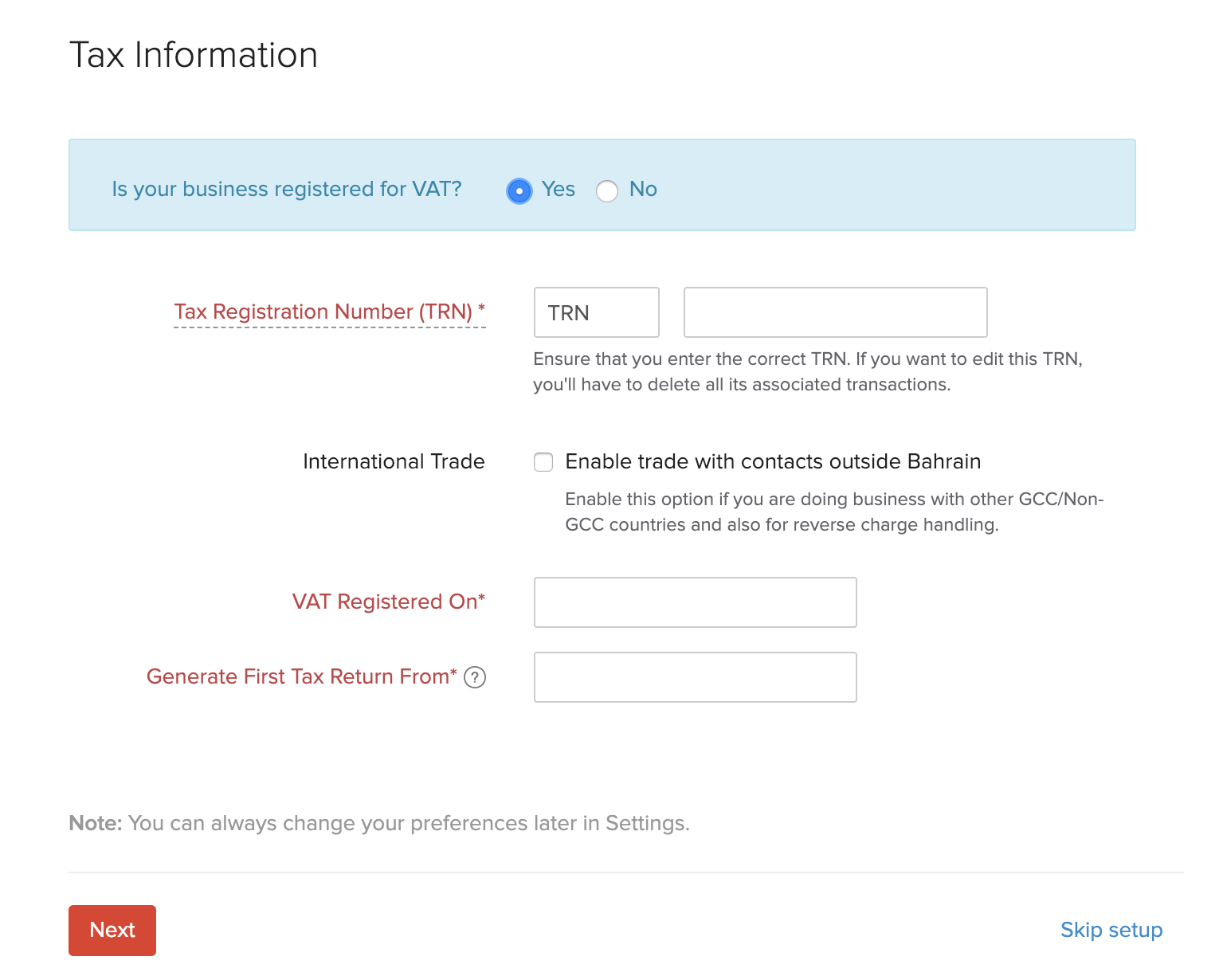

Enter Your Tax Information

-

TRN - A unique 15-digit number provided to you by the NBT for tax purposes.

-

If you deal with businesses outside Bahrain, check the Enable trade with contacts outside Bahrain box.

-

International Trade - Enable this option if you do business with other countries, and also for reverse charge handling.

-

VAT Registered On - Enter the date on which you registered for VAT. You cannot apply VAT on transactions created before this date in Zoho Books.

-

Generate First Tax Return From - Select the date from which you want your tax returns to be generated in Zoho Books. Any transactions before this date will not be included in your VAT returns.

-

Click Save.

Now, you have successfully entered the VAT details related to your organization.

Next:

Set Up Taxes >