VAT in Purchases

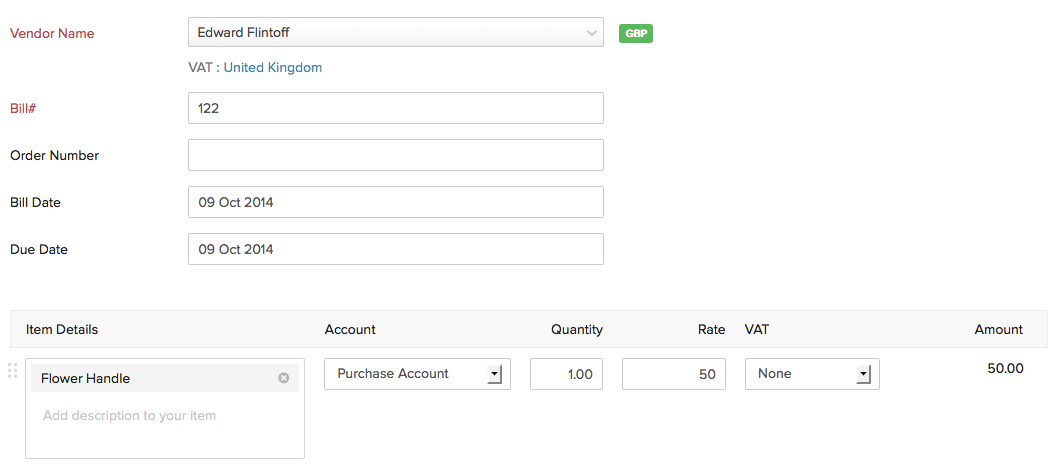

For creating a purchase (Bills, Expenses, Purchase Order) transaction that is within the United Kingdom,

- Select the customer whose VAT treatment is for United Kingdom.

- Add the item for which you are creating the purchase transaction and select the VAT amount.

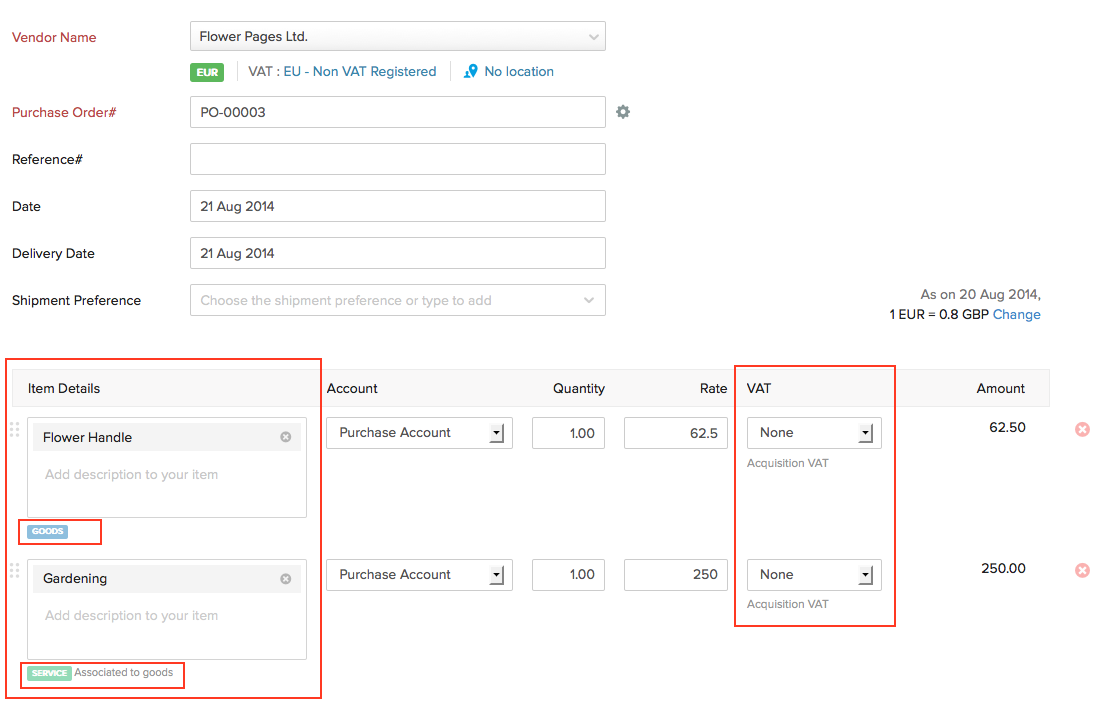

Purchases from Outside UK

For purchases that are from outside the UK, labels will denote the goods and services. If you are ordering for a service in the same purchase order where items are being purchased from outside the UK, then the service will be associated to the item and will be labelled as Service Associated to Goods. For the EU Countries, VAT for goods and services associated with the goods are called as Acquisition VAT.

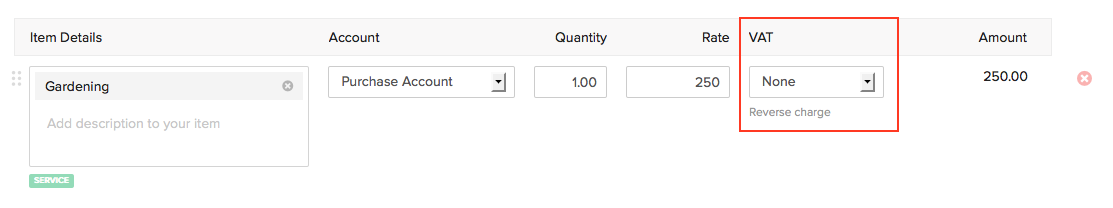

If there is only a service being rendered from outside the UK, then the VAT associated with the service will be handled as Reverse Charge.

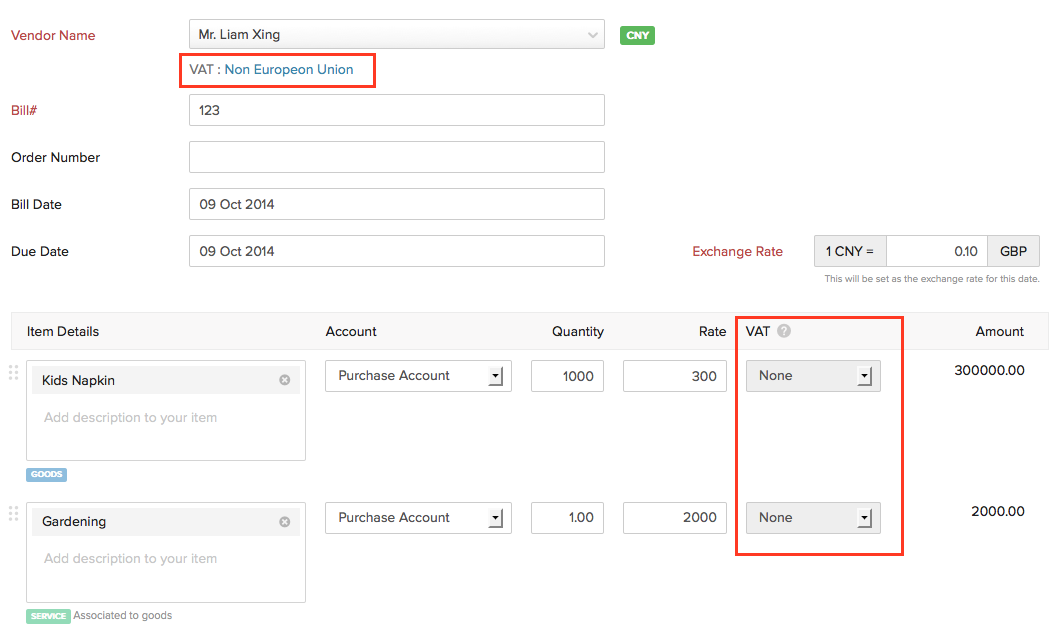

Purchase from Non-EU Countries

For the Non-EU Countries, VAT for goods and services associated with the goods are called as Import VAT. This import VAT comes under Input VAT.

While creating a purchase transaction for a customer who is from a non-EU country, the VAT field will not be editable. Thus the import VAT cannot be added for the transaction on the bill, expense or purchase order created.

To record the import VAT, you can create an expense separately by manually calculating the VAT applicable for the goods or services purchased.

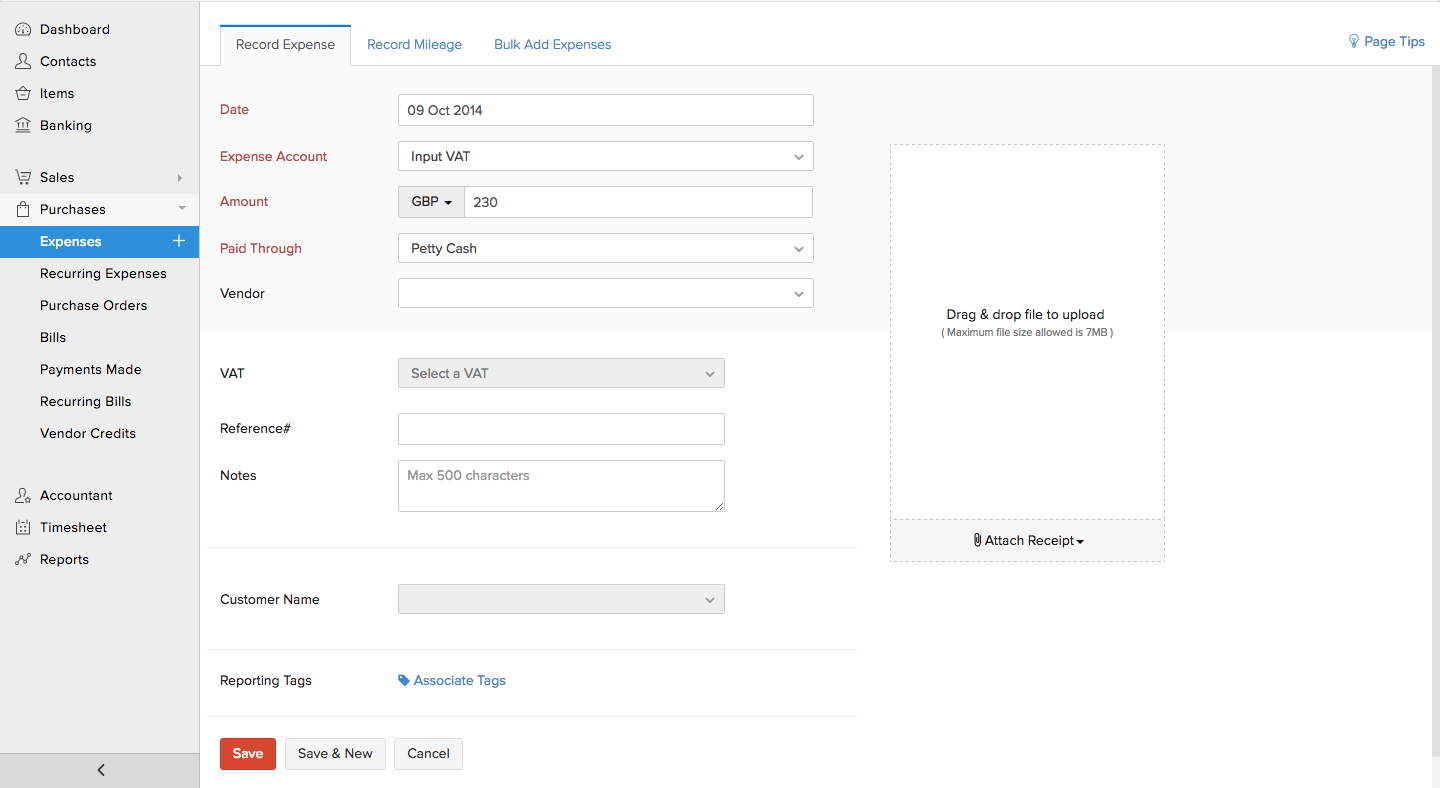

- Navigate to Expenses module and select the + New option placed on top right corner.

- Select Input VAT as the Expense Account from the drop down.

- Enter the calculated VAT amount in the Amount field.

- Choose an appropriate Paid Through account.

- Click Save.