Mileage Expenses

In Zoho Books, you can record the distance you travel and be billed according to the mileage rate. The expense is calculated based on the distance traveled and the mileage rate. You can record mileage expenses using:

- The web application

- The Android app

- The iOS app

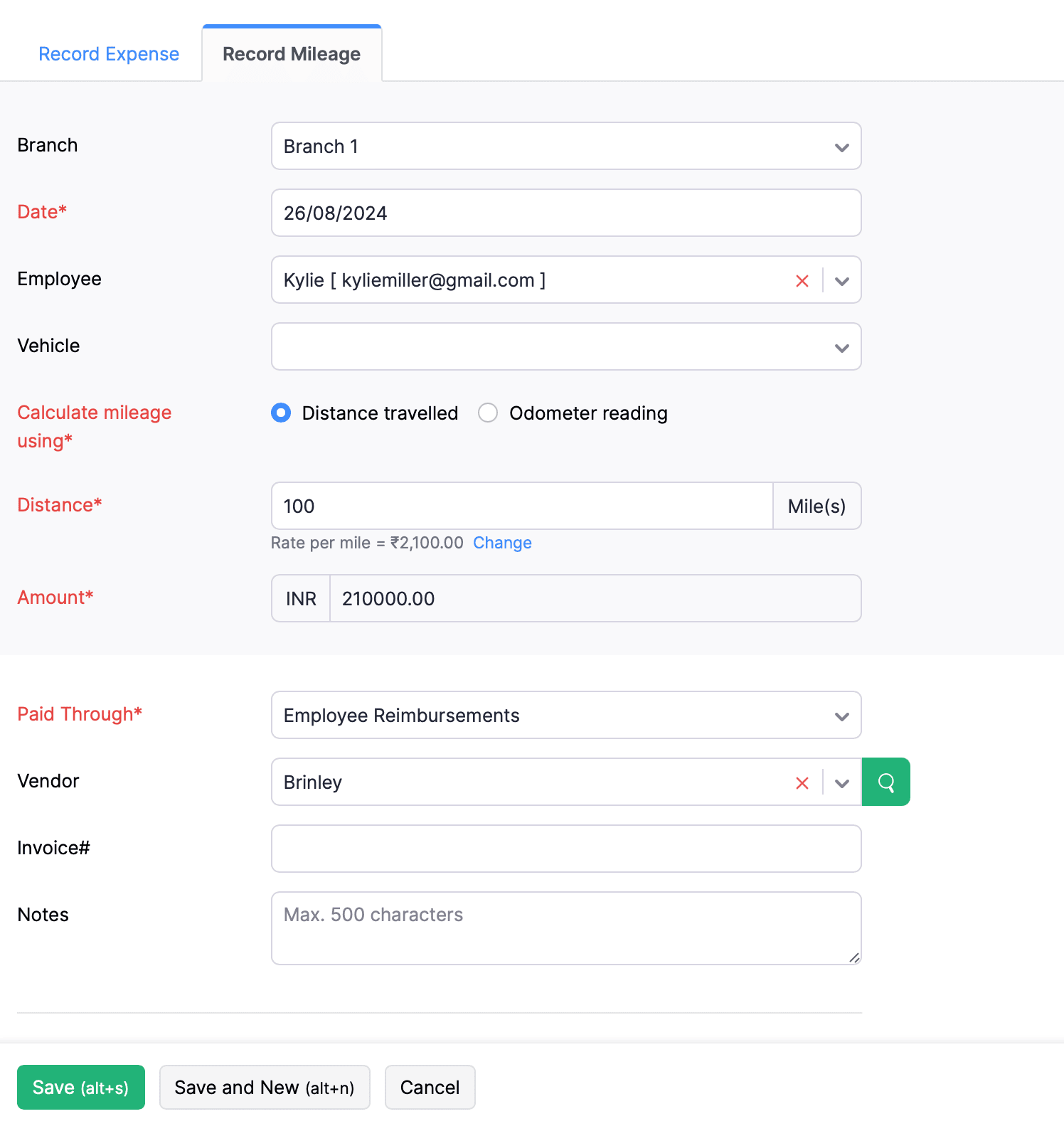

Using the Web Application

To record a mileage expense using the web application:

- Go to Purchases on the left sidebar and select Expenses (or press shift + x).

- Click + New in the top right corner of the page.

- Select the Record Mileage tab on top of the page.

- Enter the following details:

| Fields | Description |

|---|---|

| Date | Select the date on which the expense is created. |

| Employee | You can add and associate an employee to a bill. |

| Calculate Mileage | Mileage can be calculated based on: Distance travelled: If you enter the distance travelled, the expense is calculated based on the mileage rate. Odometer reading: If you enter the start and end readings of the odometer, the distance will be calculated based on the difference (end reading - start reading). The expense amount is then calculated based on the mileage rate. |

| Amount | The expense amount is auto-generated based on the distance and the mileage rate. |

| Paid Through | This account will be credited, and the Fuel/Mileage Expenses will be debited once the mileage expense is recorded. |

| Vendor | Select a vendor to whom you want to associate the expense. |

| Notes | Add any notes in the expense for personal use. |

| Customer Name | Associate the expense to a customer. You can also mark the expense as Billable. |

- After entering the details, click Save (or press alt/option + s) or Save & New (or press alt/option + s).

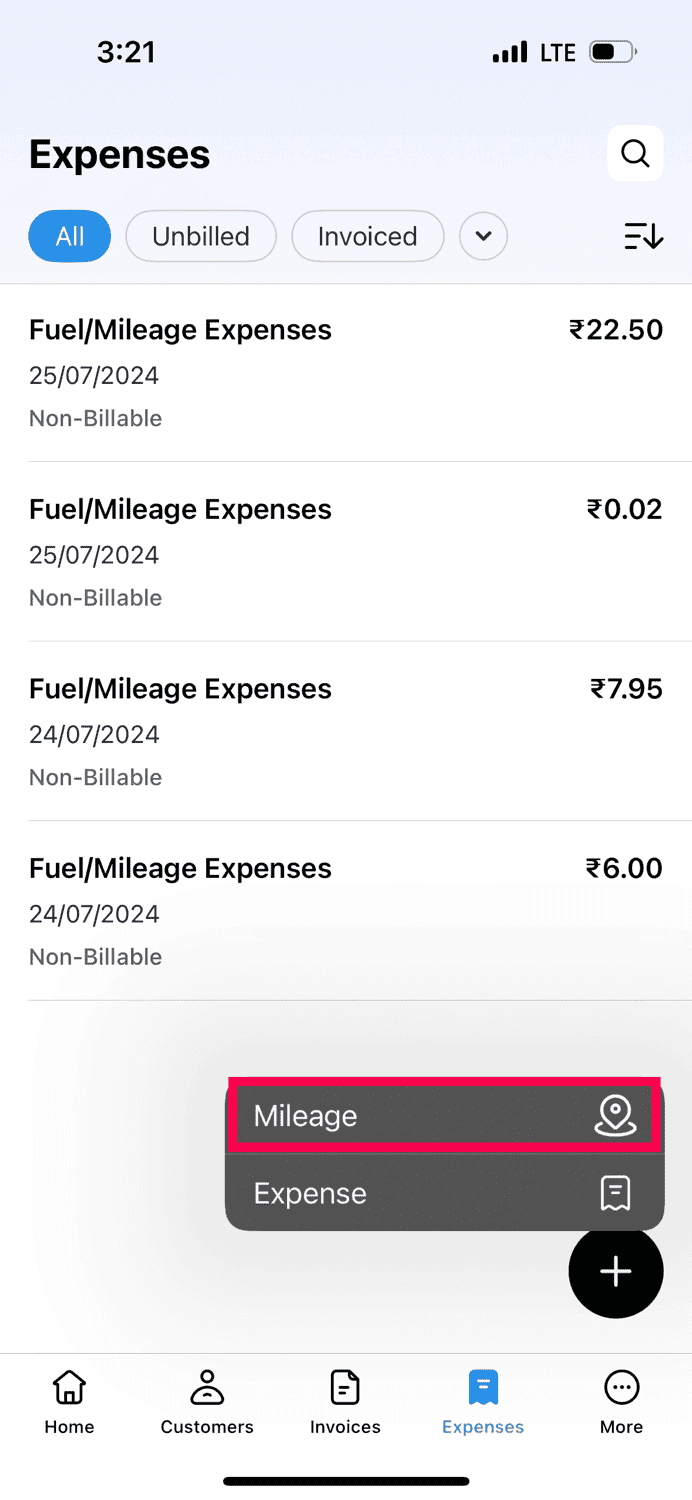

Using the iOS Application

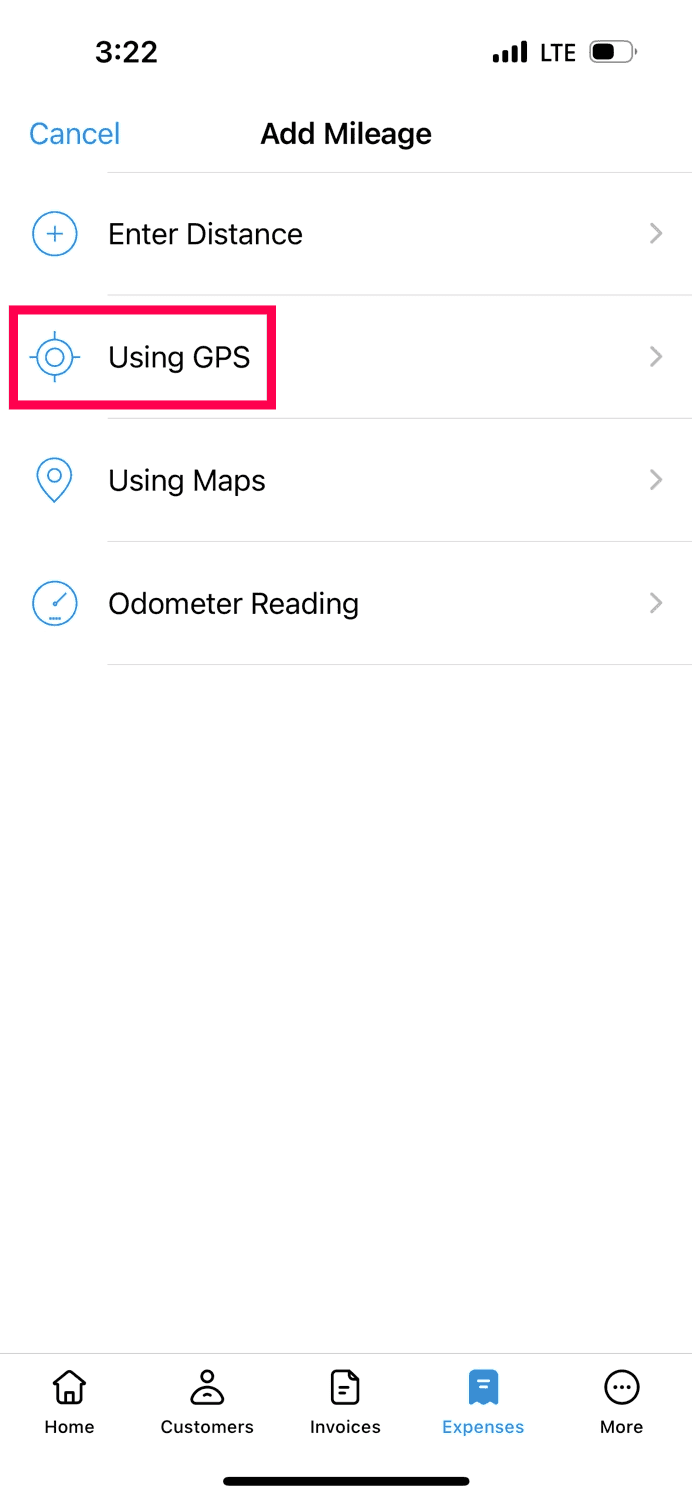

Mileage expenses are calculated based on the distance travelled and the applicable mileage rate. You can use the Zoho Books iOS app to track your mileage expenses through various methods. There are four ways to add a mileage expense in Zoho Books:

- Enter Distance Manually

- Using GPS

- Using Maps

- Using Odometer Reading

Enter Distance Manually

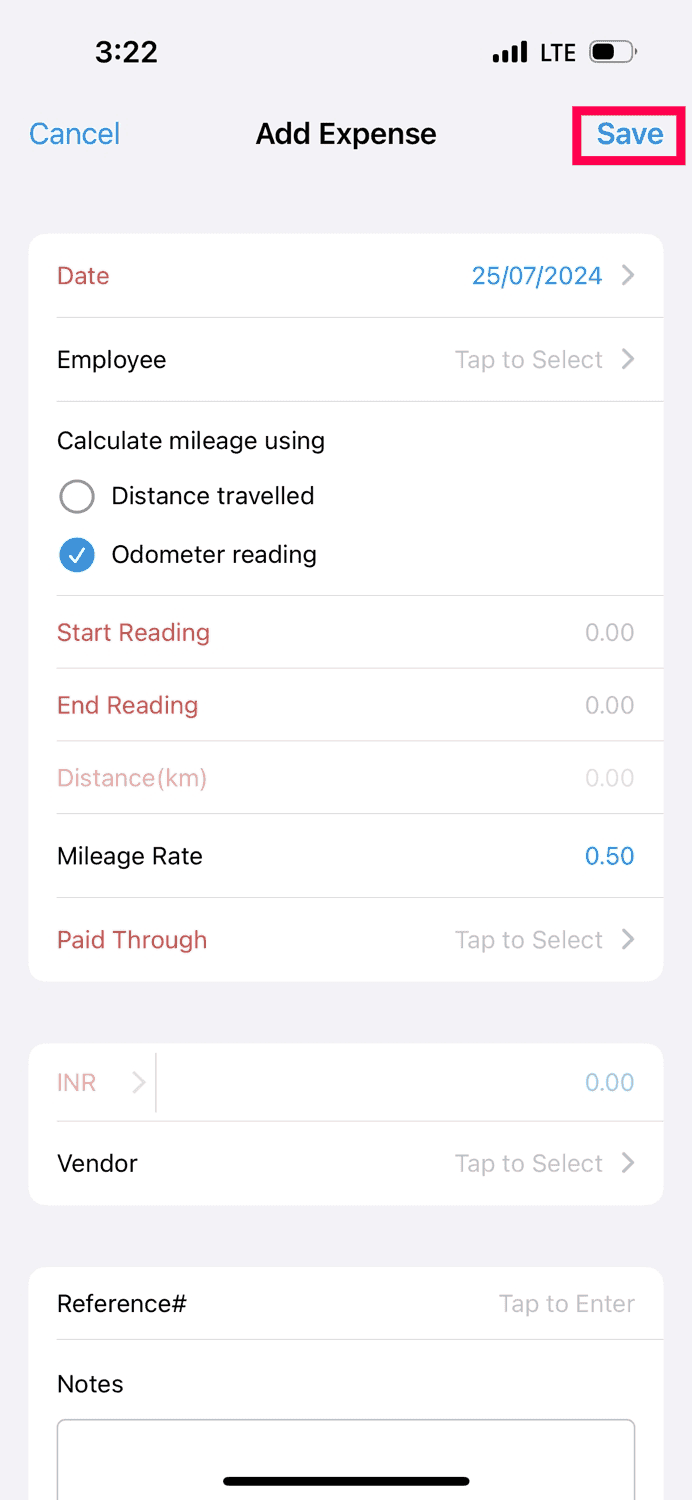

You can enter the distance you traveled manually to calculate the mileage expense for it. Here’s how:

- Open the Zoho Books app and click Expenses in the bottom navigation bar.

- Click the Add icon on the bottom right corner and select Mileage.

- In the next page, click Enter Distance.

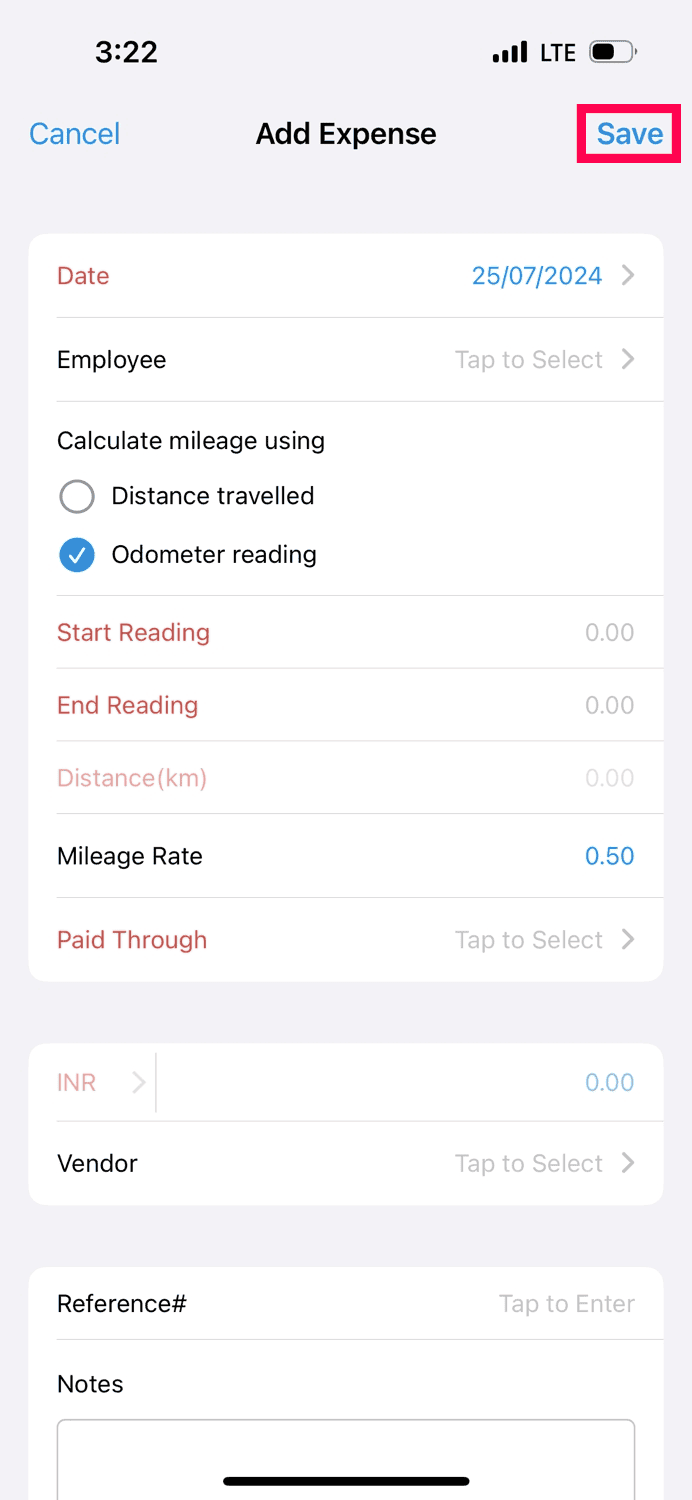

- In the Add Expense page, go to the Calculate Mileage Using section.

1.Select Distance travelled if you want to enter the total distance traveled.

- Next, enter the Date, Distance, and select a Paid Through account.

- Click Save to add the expense.

2.Select Odometer reading if you want to record the start and end readings of the odometer.

- Enter the Date, Start Reading, and End Reading, and select a Paid Through account.

- Click Save to add the expense.

The mileage expense will be recorded in your Zoho Books organization.

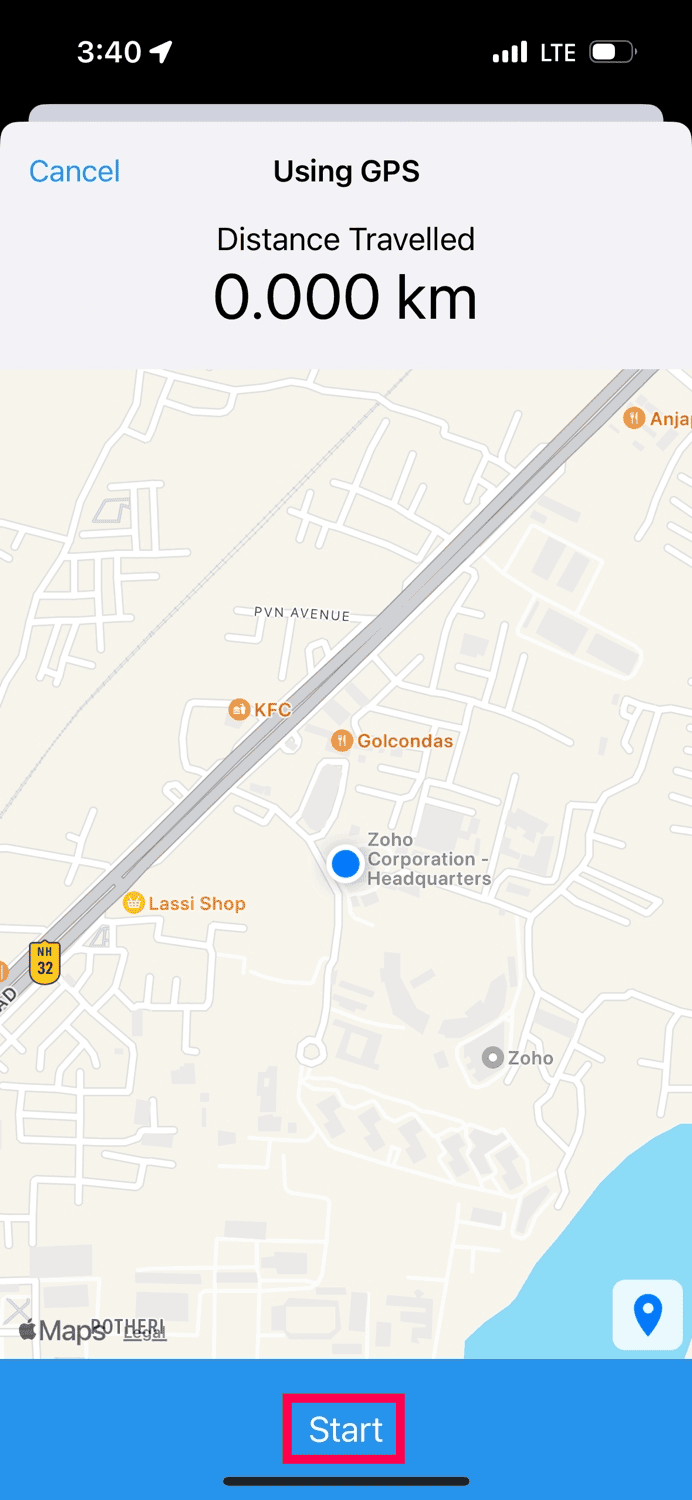

Add Mileage Using GPS

You can easily track mileage rates using your phone’s GPS. The GPS will automatically record the start and end locations of the trip along with the distance traveled. You can use this data to calculate the mileage. Here’s how:

- Open the Zoho Books app and click Expenses in the bottom navigation bar.

- Click the Add icon on the bottom right corner and select Mileage.

- In the next page, click Using GPS.

In the popup that appears, grant Zoho Books permission to access your location by selecting Allow While Using App.

In the Maps page, click Start to start mileage tracking.

At the end of your trip, click Stop at the bottom of the screen, and confirm by clicking Stop again in the alert message to stop mileage tracking.

In the Add Expense page, go to the Calculate Mileage Using section.

- Select Distance travelled if you want to enter the total distance traveled.

- Next, enter the Date, Distance, and select a Paid Through account.

- Click Save to add the expense.

- Select Odometer reading if you want to record the start and end readings of the odometer.

- Enter the Date, Start Reading, and End Reading, and select a Paid Through account.

- Click Save to add the expense.

The mileage rate calculated will now be recorded as expense.

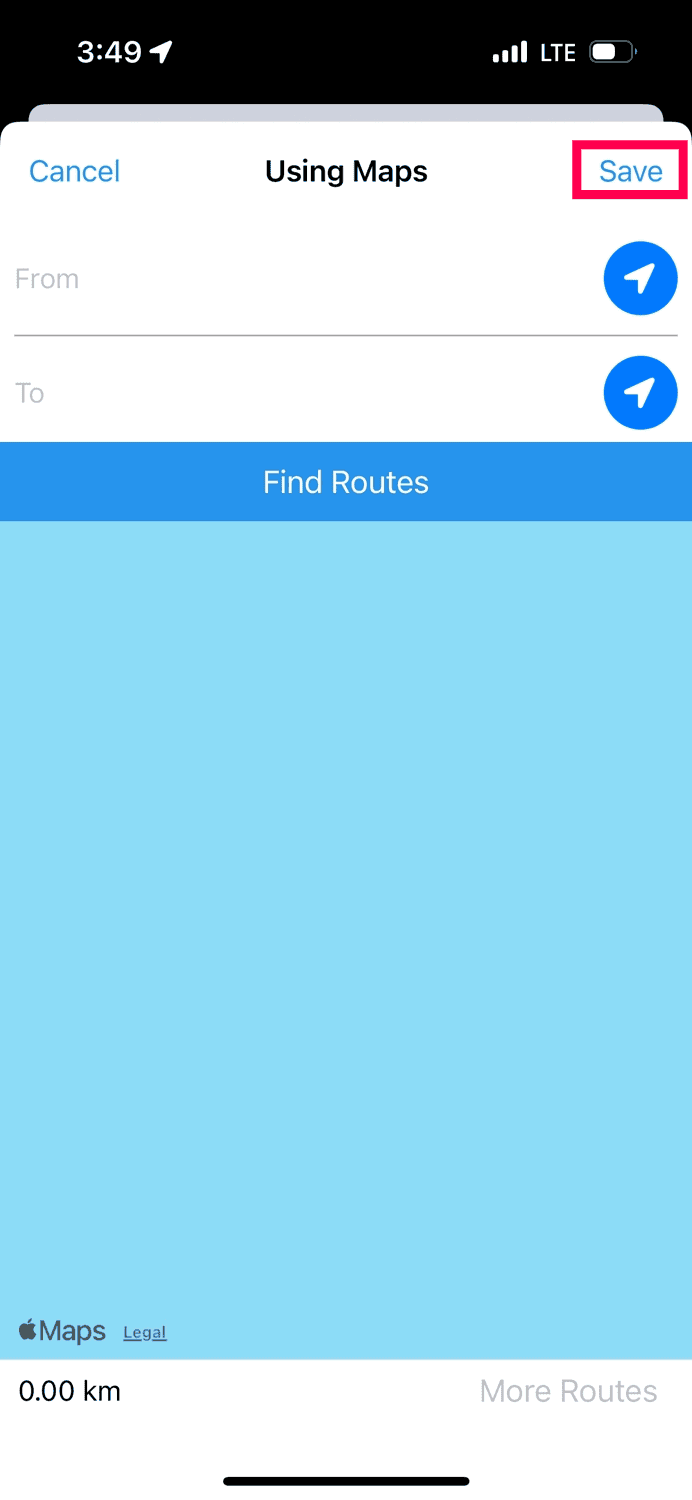

Add Mileage Using Maps

You can now track your mileage expenses by calculating the distance traveled using Maps. Here’s how:

- Open the Zoho Books app and click Expenses in the bottom navigation bar.

- Click the Add icon on the bottom right corner and select Mileage.

- In the next page, click Using Maps.

- In the Using Maps page, enter the starting location in the From field and the ending location in the To field.

- Click Find Routes.

- Check the total distance between the routes displayed at the bottom of the screen and click Save.

Note:Click the arrows next to the From and To addresses to check the route on the map.

- In the Add Expense page, go to the Calculate Mileage Using section.

- Select Distance travelled if you want to enter the total distance traveled.

- Next, enter the Date, Distance, and select a Paid Through account.

- Click Save to add the expense.

- Select Odometer reading if you want to record the start and end readings of the odometer.

- Enter the Date, Start Reading, and End Reading, and select a Paid Through account.

- Click Save to add the expense.

The mileage rate that you recorded with maps will be recorded as expense.

Add Mileage with Odometer Reading

You can track your mileage expenses using the odometer reading of your vehicle. Here’s how:

- Open the Zoho Books app and click Expenses in the bottom navigation bar.

- Click the Add icon on the bottom right corner and select Mileage.

- In the next page, click Odometer Reading.

- In the next page, enter the Start Reading and the End Reading of your odometer.

- Click Done.

- In the Add Expense page, go to the Calculate Mileage Using section.

- Select Distance travelled if you want to enter the total distance traveled.

- Next, enter the Date, Distance, and select a Paid Through account.

- Click Save to add the expense.

- Select Odometer reading if you want to record the start and end readings of the odometer.

- Enter the Date, Start Reading, and End Reading, and select a Paid Through account.

- Click Save to add the expense.

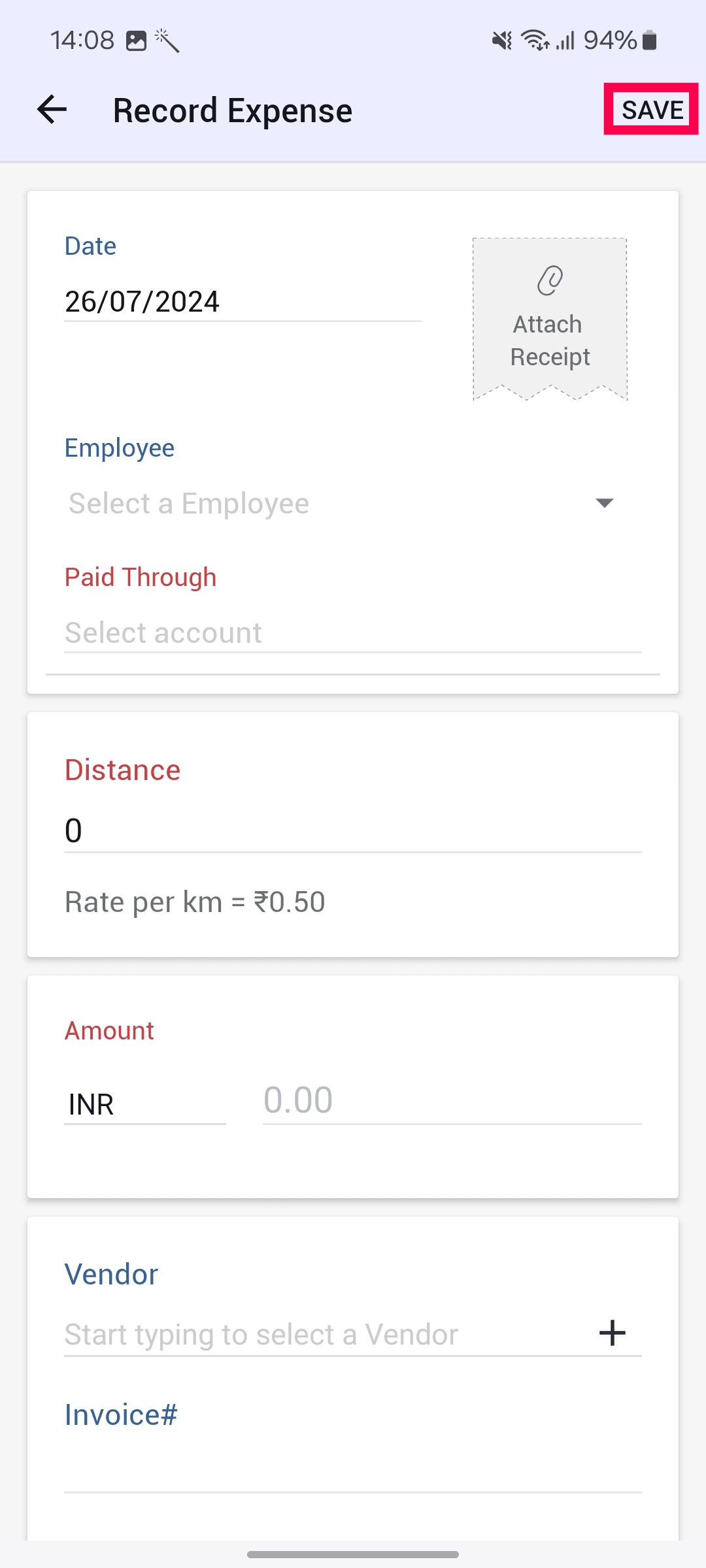

Using the Android Application

You can use the Zoho Books Android app to track your mileage expenses through various methods. There are three ways to add a mileage expense in Zoho Books:

- Enter Distance Manually

- Using GPS

- Using Odometer Reading

Using the GPS

You can easily track mileage rates using your phone’s GPS. The GPS will automatically record the start and end locations of the trip along with the distance traveled. You can use this data to calculate the mileage. Here’s how:

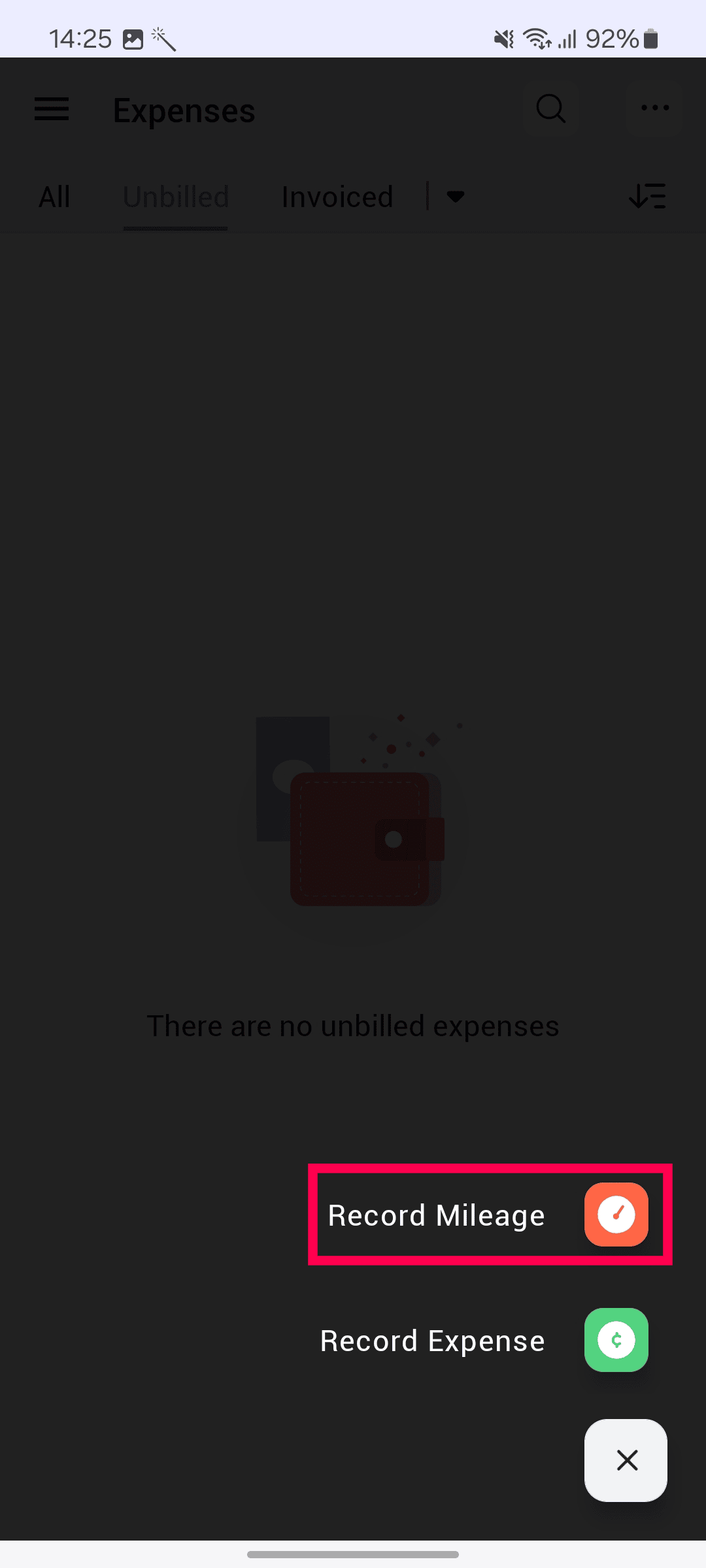

- Open the Zoho Books app, go to Purchases on the left sidebar, and select Expenses.

- Click the Add icon on the bottom right corner and select Record Mileage.

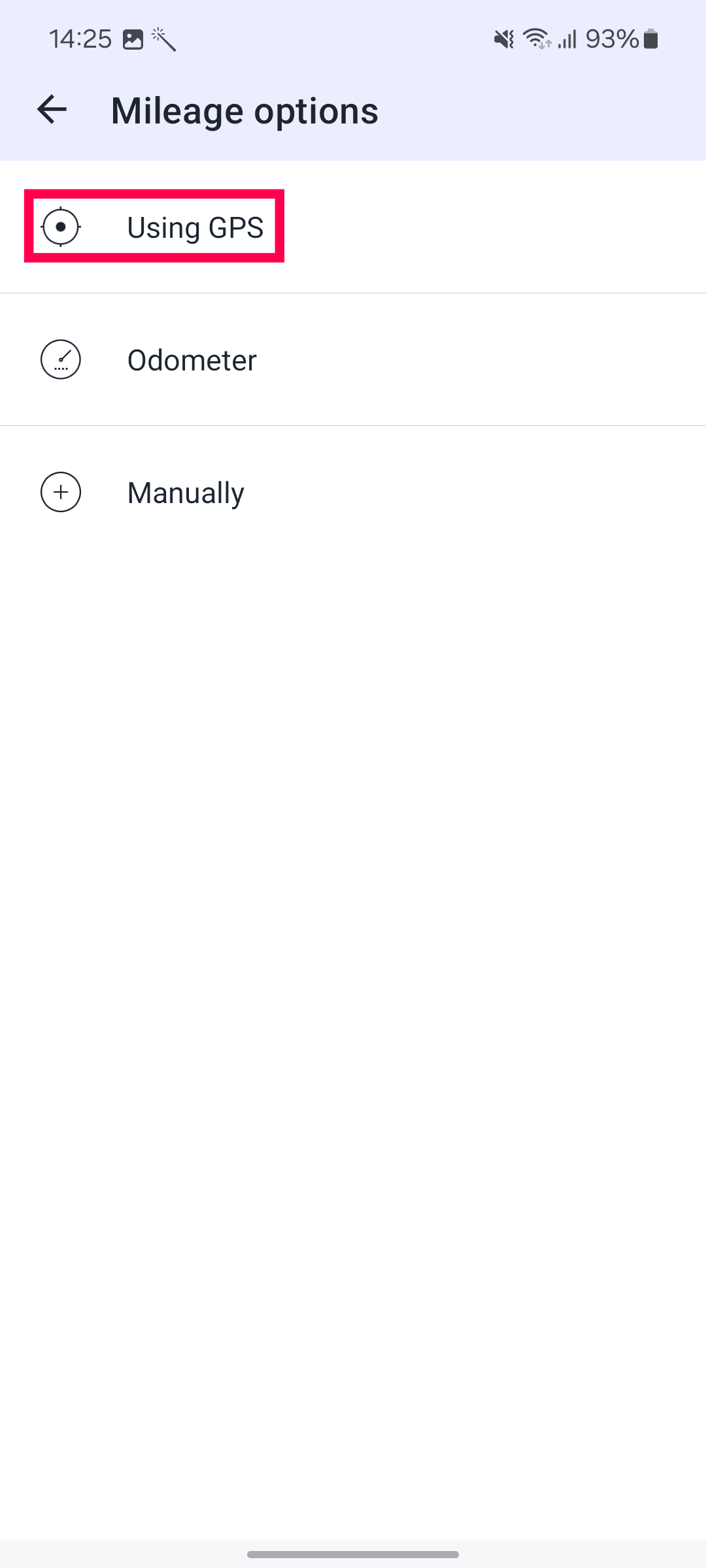

- In the Mileage options page, click Using GPS.

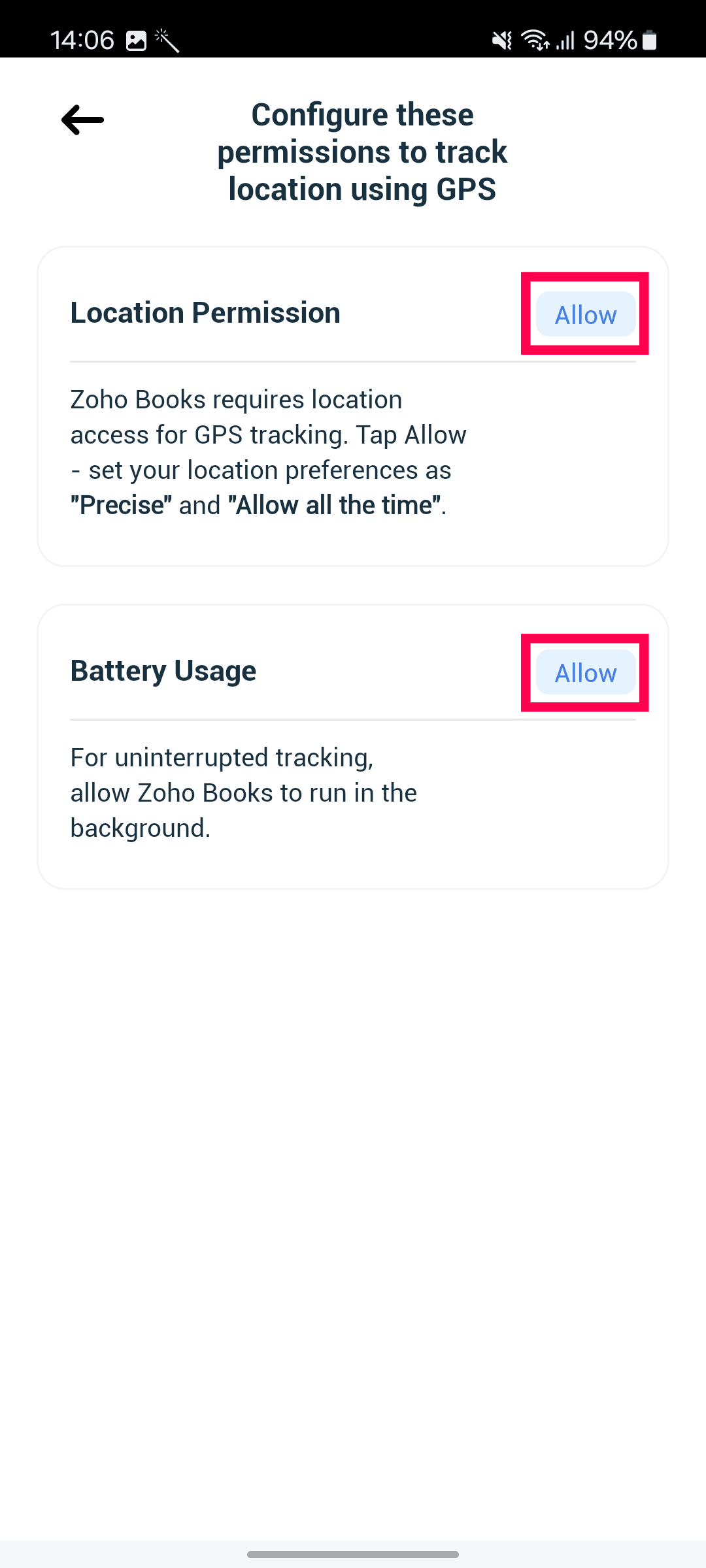

- Click Allow in the Location Permission and Battery Usage sections to allow Zoo Books to track your location uninterruptedly.

- In the next page, click Start GPS.

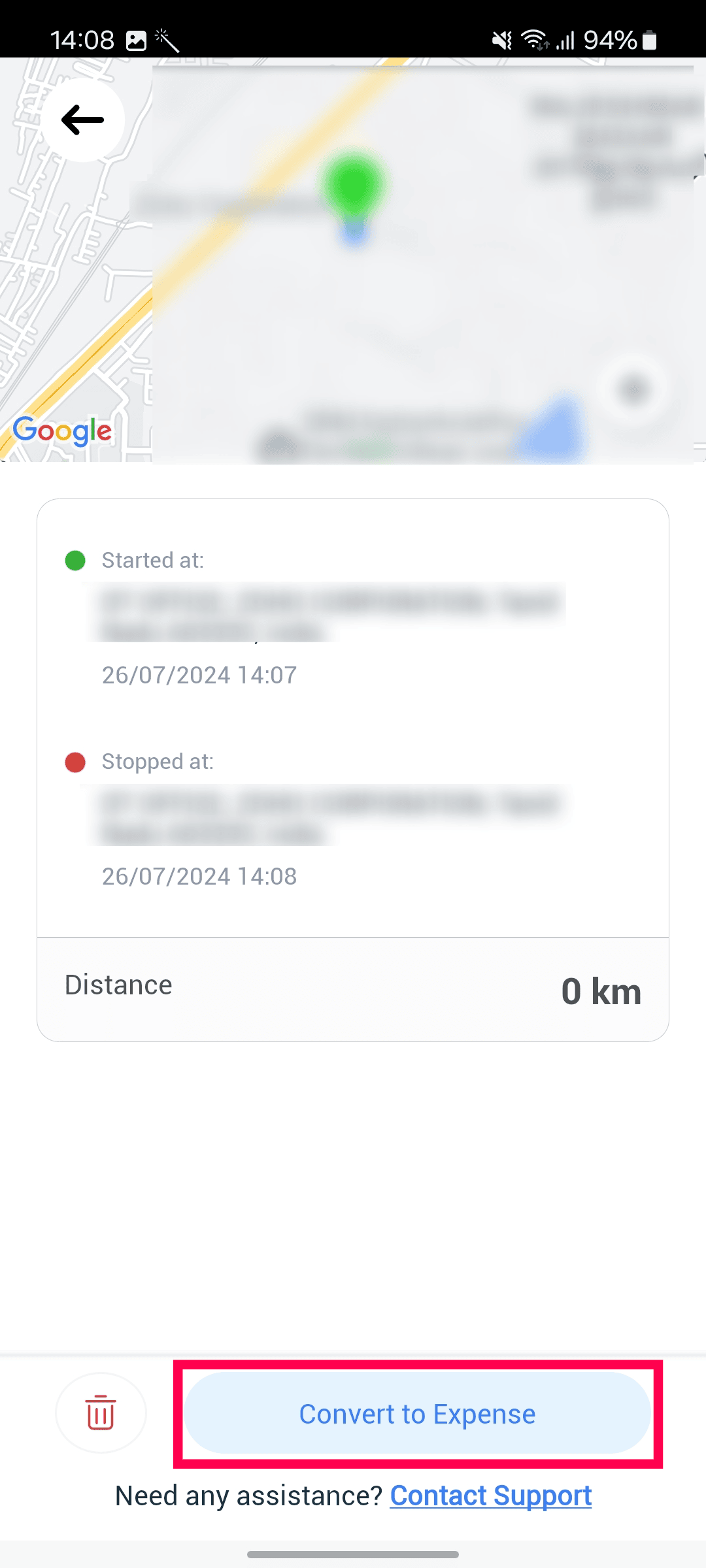

- At the end of your trip, click Stop at the bottom of the screen, and confirm by clicking Stop again in the alert message to stop mileage tracking.

- Click Yes in the alert message that appears.

- Click Convert to Expense at the bottom of the screen.

- In the following Record Expense page, the Date, Branch, Distance, and Amount will be auto-populated.

- Select a Paid Through account.

- Click Save at the top of the page.

Your mileage rate will now be recorded as expense.

Using the Odometer Reading

You can also track your mileage expenses with odometer readings. Here’s how:

- Open the Zoho Books app, go to Purchases on the left sidebar, and select Expenses.

- Click the Add icon on the bottom right corner and select Record Mileage.

- In the Mileage options page, click Odometer.

- In the following Record Expense page, the Branch name will be auto-populated.

- Select a Paid Through account.

- Enter the Start Reading and End Reading of your vehicle’s odometer.

- The Distance and Amount will be automatically calculated based on the readings.

- Click Save at the top of the page.

Using Manual Entry

You can enter your distances manually to track mileage expenses. Here’s how:

- Open the Zoho Books app, go to Purchases on the left sidebar, and select Expenses.

- Click the Add icon on the bottom right corner and select Record Mileage.

- In the Mileage options page, click Manually.

- Select a Paid Through account and enter the Distance travelled.

- The Amount will be automatically calculated based on the mileage rate configured.

- Click Save at the top of the page.

The mileage expense will be recorded in your Zoho Books organization.

Next >

Other Actions for Expenses

Related

Yes

Yes