Filing With TaxBandits

TaxBandits is an e-filing provider of Payroll and Employment Tax Forms, allowing businesses to stay compliant with the IRS. You can connect your Zoho Books organization with TaxBandits to file your 1099-MISC and 1099-NEC forms to the IRS easily.

Prerequisite: Ensure you’ve set up 1099 tracking and generated the 1099 - MISC or 1099 - NEC report in Zoho Books.

IN THIS PAGE…

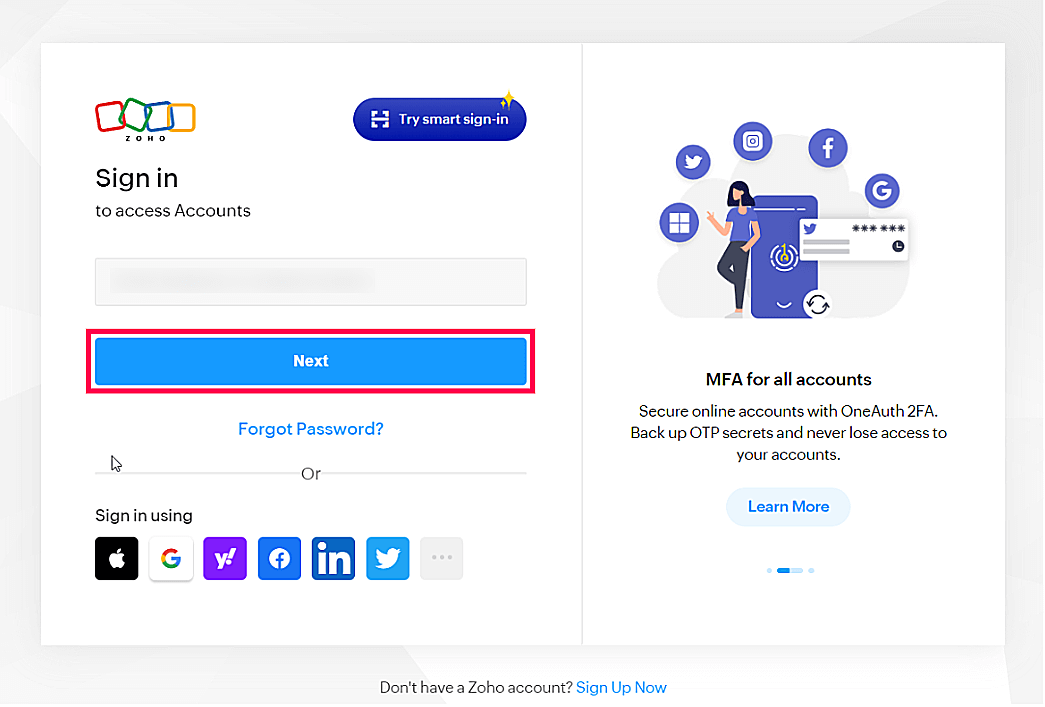

Sign In to TaxBandits

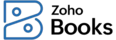

Before you start filing your 1099 forms through TaxBandits, sign in to your TaxBandits account. Here’s how:

- Sign in to TaxBandits using your registered Email Address and Password.

- Click Sign In to access your TaxBandits account.

Note: If you don’t have an account, click Sign Up and create a new TaxBandits account.

Once you sign in to TaxBandits, you will be able to connect it with your Zoho Books organization and file your 1099 forms.

Connect Zoho Books to TaxBandits

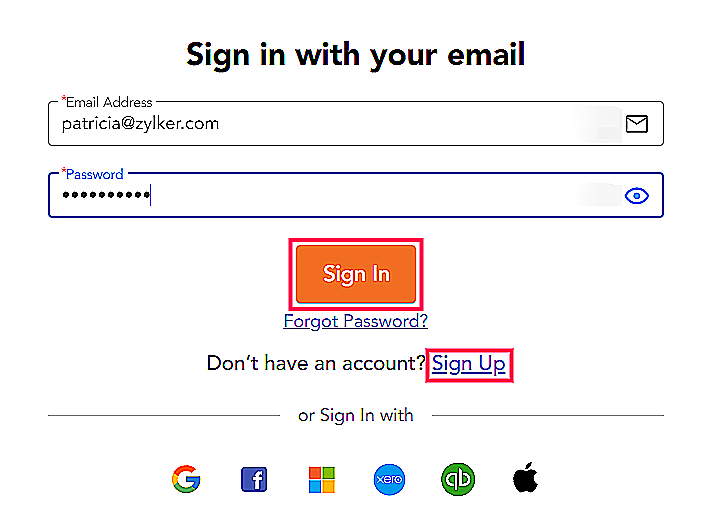

After signing into TaxBandits, select the 1099 form you want to file, and connect your Zoho Books account with TaxBandits to import the form details. To do this:

- Go to your TaxBandits account.

- Click File Now next to the 1099-MISC or 1099-NEC tax form you want to file.

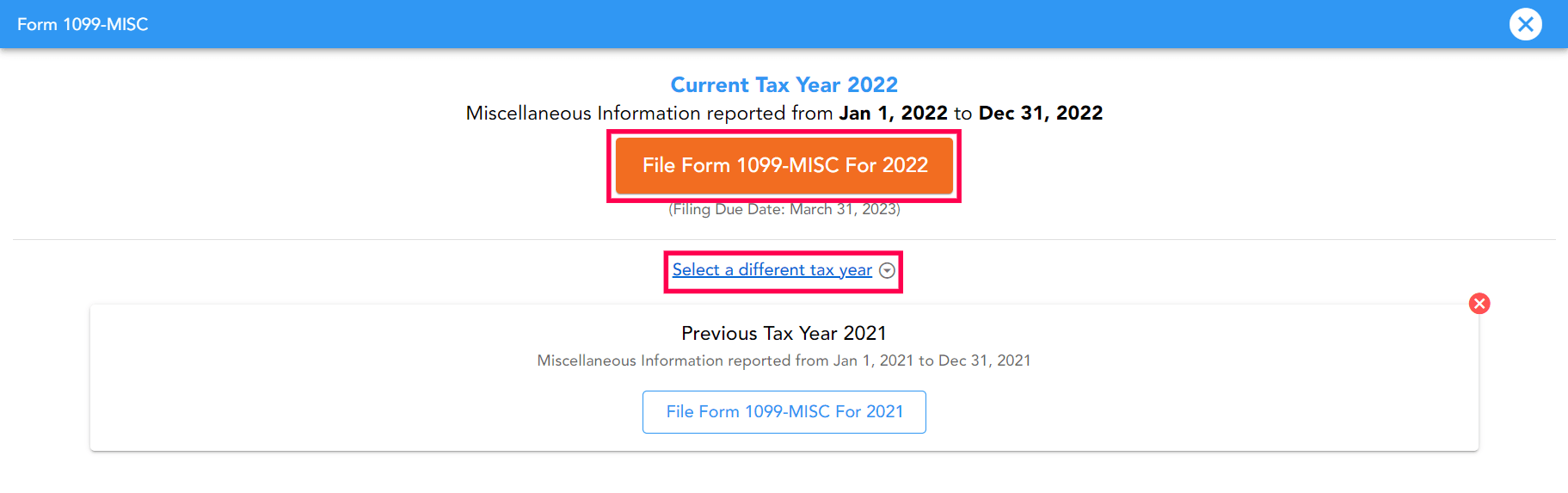

- In the next page, click File Form 1099 - MISC or 1099 - NEC to file the form for the current tax year and you will be redirected to the How would you like to create the form? page.

Note: If you want to file your 1099 form for the previous tax year through TaxBandits, click Select a different tax year in the same page.

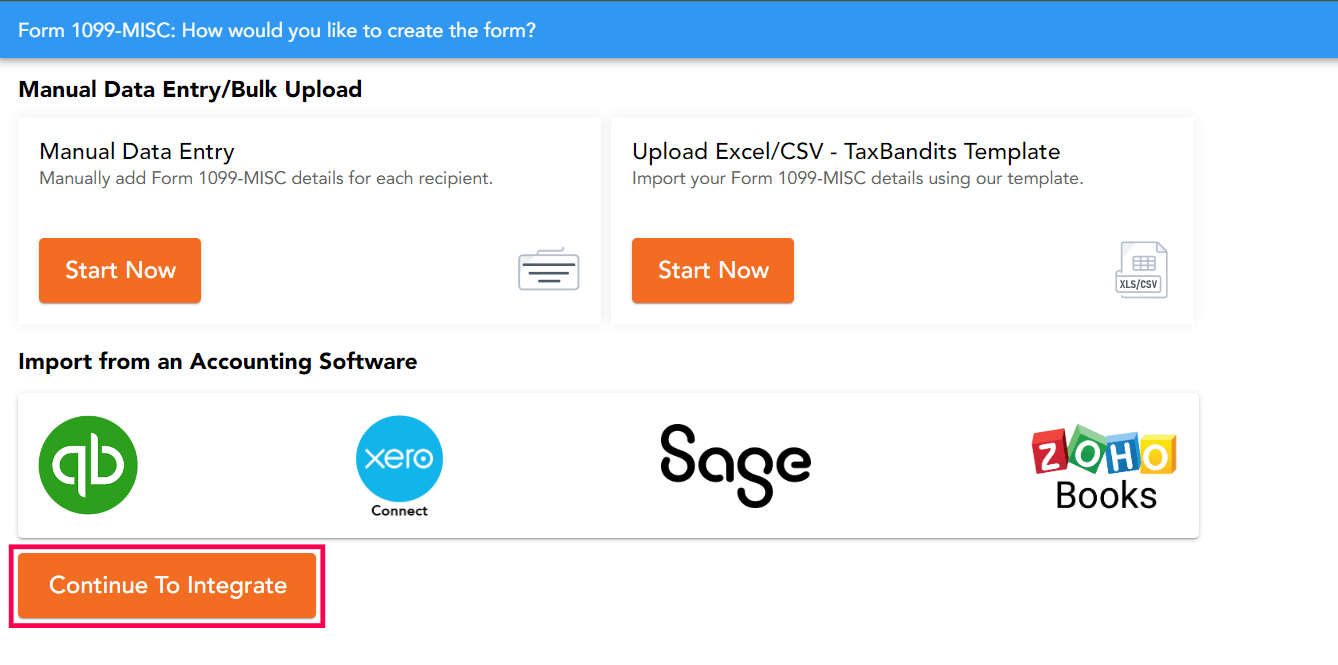

- In the Import from an Accounting Software section, click Continue to Integrate to import your 1099 form details from Zoho Books.

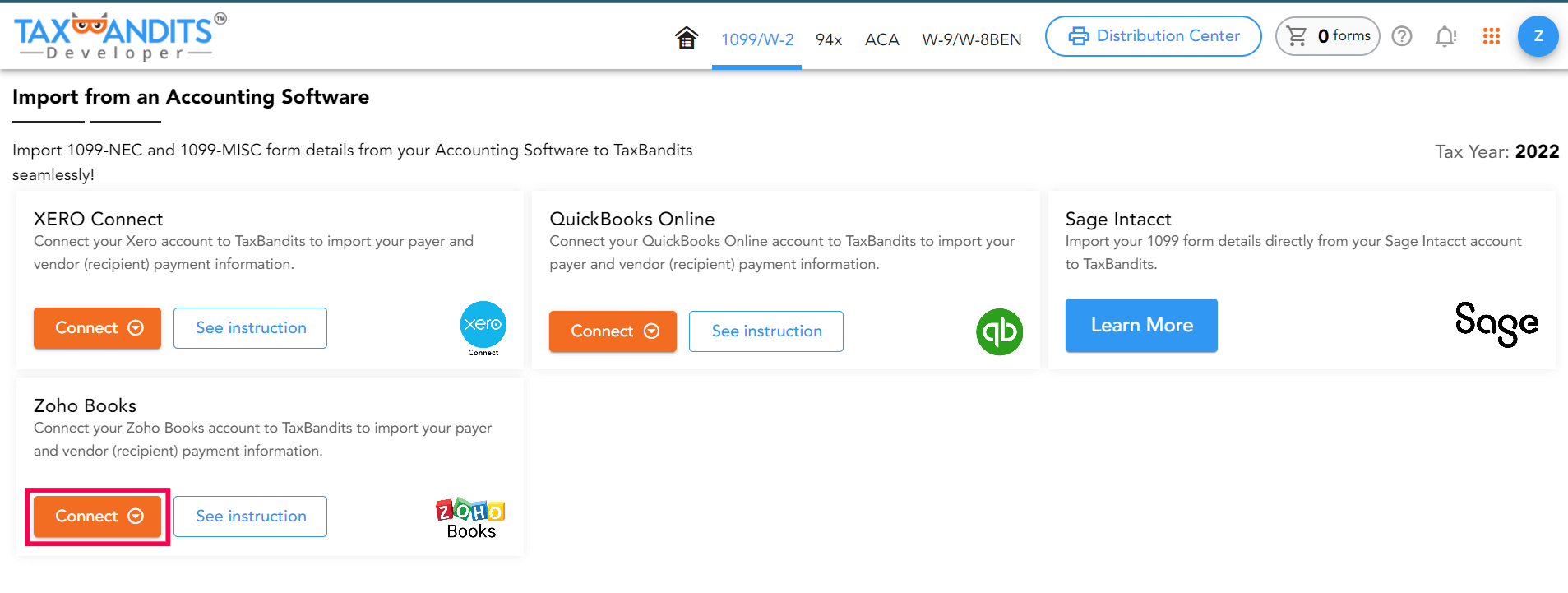

- Click Connect under Zoho Books and you will be able to sign in to Zoho Books to provide access to TaxBandits

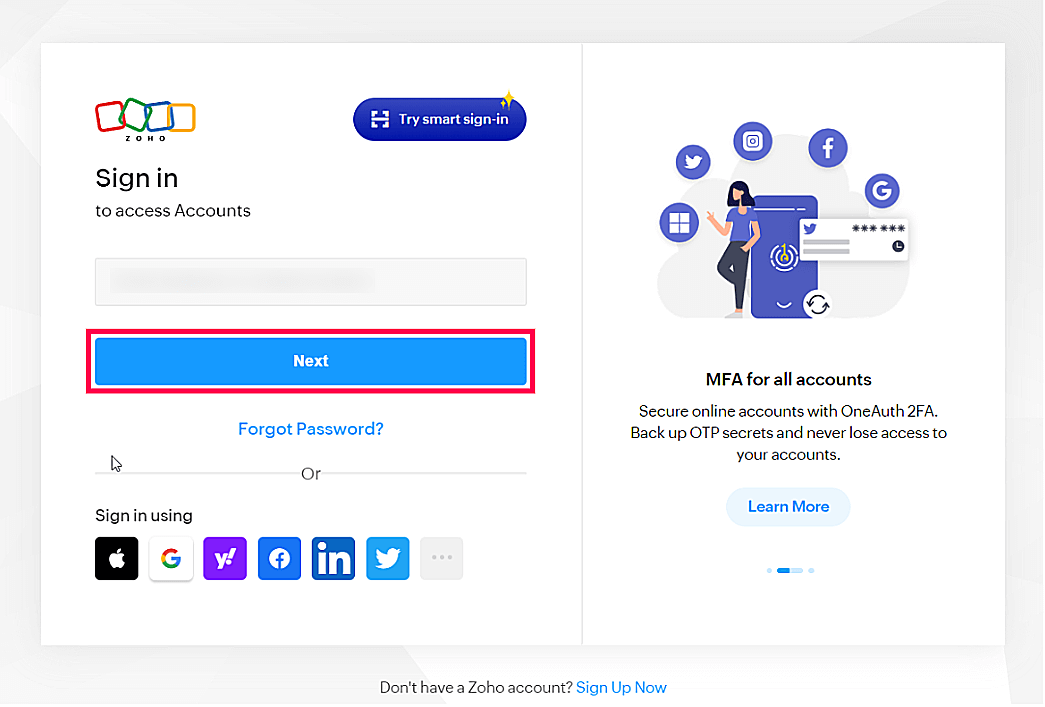

- Sign in to Zoho Books using your registered email address and password.

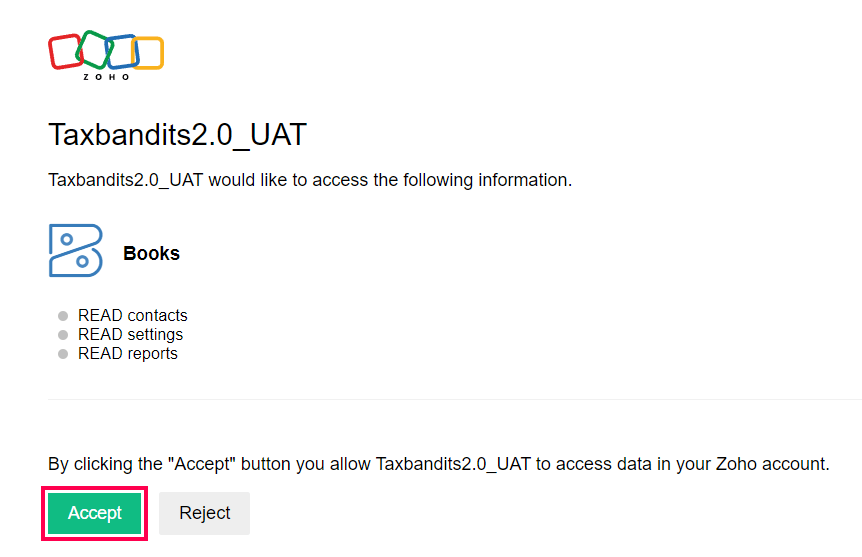

- Click Accept in the following page to allow TaxBandits to access your details.

Your Zoho Books account will now be connected to TaxBandits.

Import and Review Data

Import Business Information

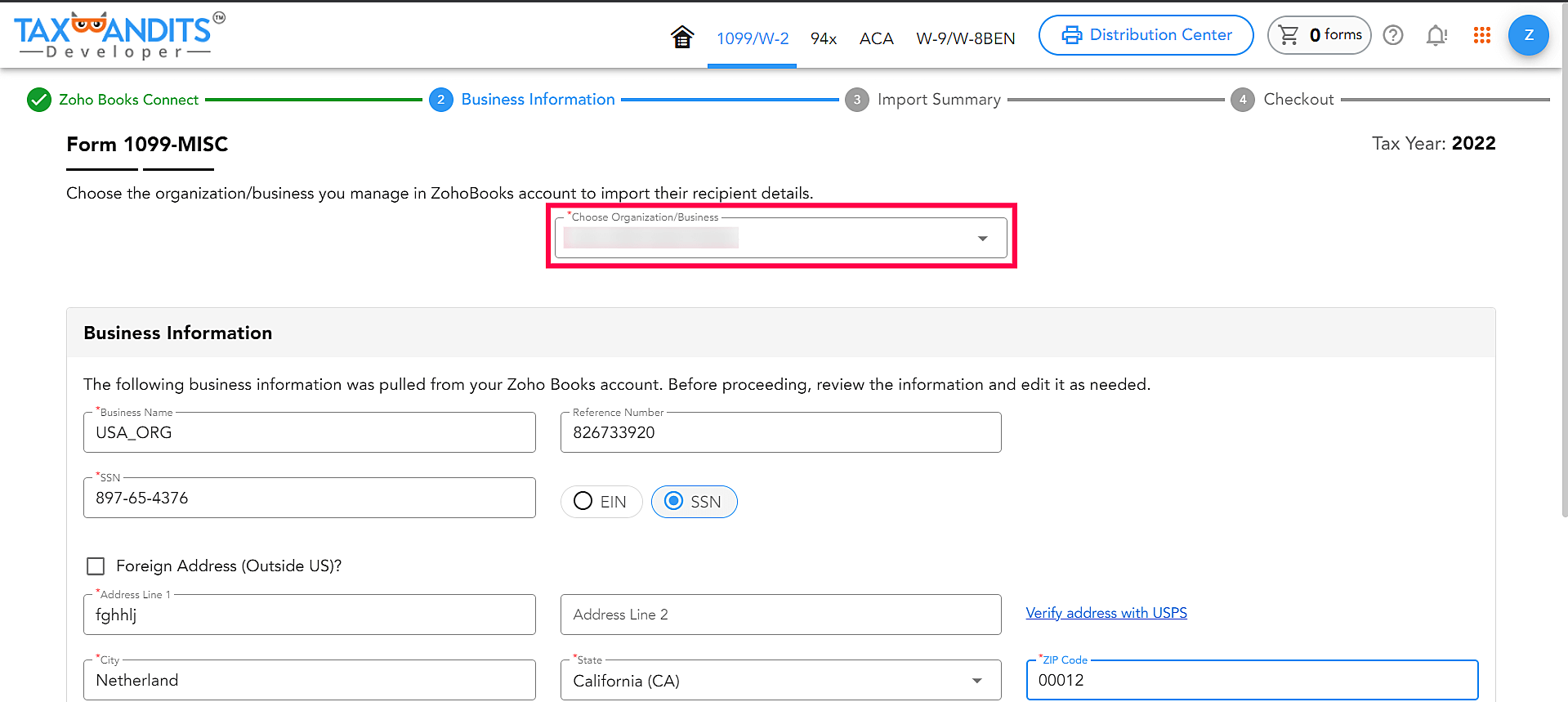

After connecting your Zoho Books account with TaxBandits, you will be redirected to the Business Information section in TaxBandits. Here, you should import your organization details and your 1099 form from Zoho Books. To do this:

- Select the Zoho Books organization in the Choose Organization/Business dropdown and TaxBandits will automatically fetch your Organization Profile and 1099 report.

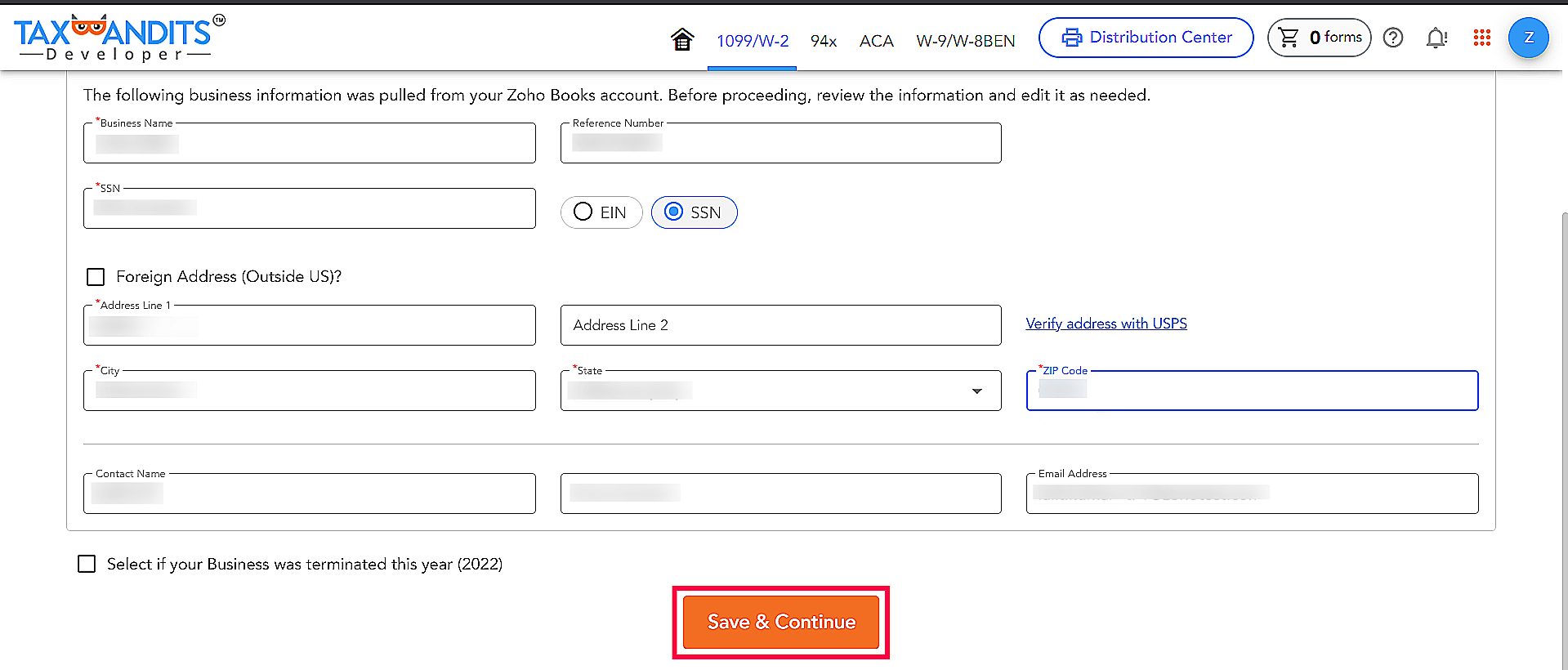

- Review your organization profile and click Save & Continue.

Insight: TaxBandits imports your organization’s details as the IRS requires your recipient or business information on Form 1099-MISC or 1099-NEC. This includes:

- Recipient Name (Business Name)

- Recipient Address (Street, City, State, Country, ZIP, and Contact Number)

- Recipient TIN (Tax Identification Number)

Your organization details will be saved in TaxBandits and you will be redirected to the Import Summary section.

Review Import Summary

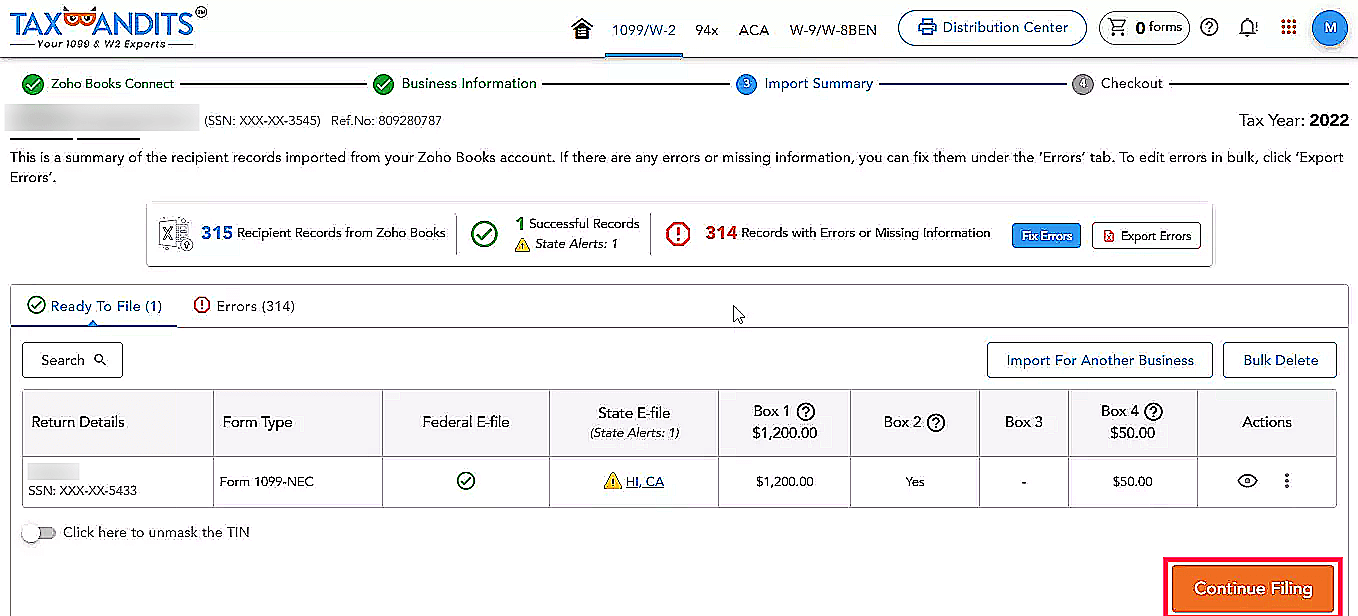

In the Import Summary section, you can review the number of recipient (vendor) records fetched from your 1099 report.

Note: If there are any errors in the imported data, click Fix Errors to fix each record or Export Errors to fix them in bulk. Learn how to fix your recipient records.

- After verifying your 1099 vendor records, click Continue Filing.

Your vendor records will be saved and you will be redirected to the Review and Select Services section.

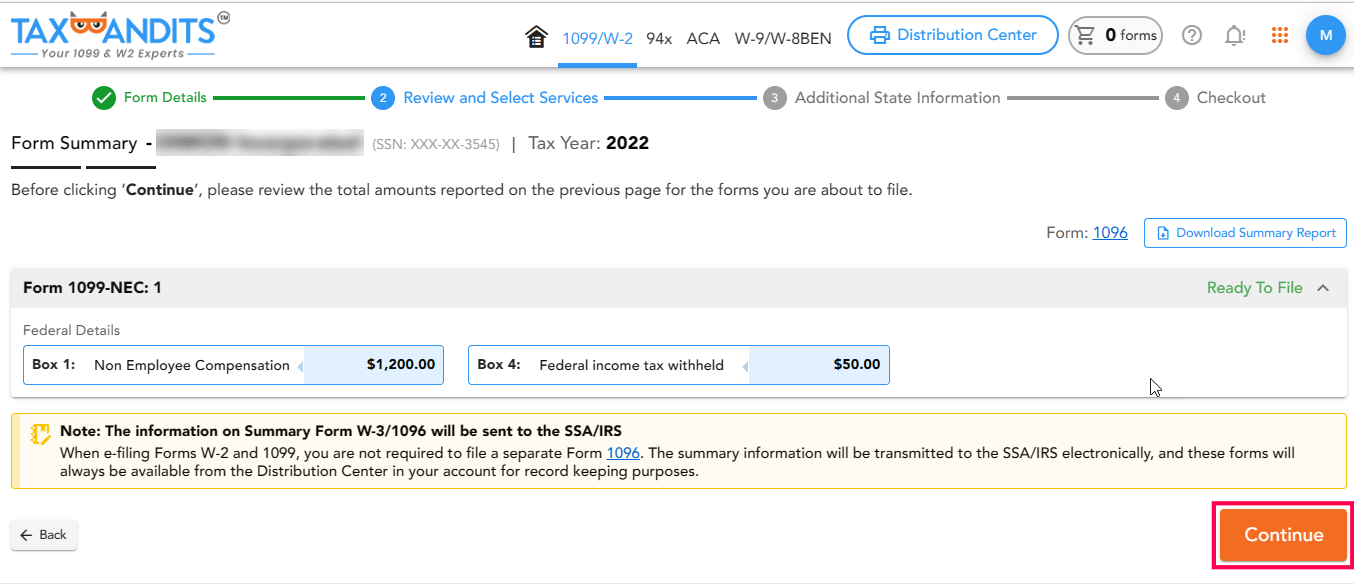

Review and Select Services

In this section, review and choose the services through which you want to transmit the 1099 form to the IRS.

Note: Visit the TaxBandits pricing page to check out the prices for each service.

- Choose the preferred services (such as Postal Mailing, Online Access, State E-File, or Federal E-File) and click Continue.

- Verify the total payments fetched from your 1099 report and click Continue.

You will now be redirected to the Cart Summary to transmit the form to the IRS.

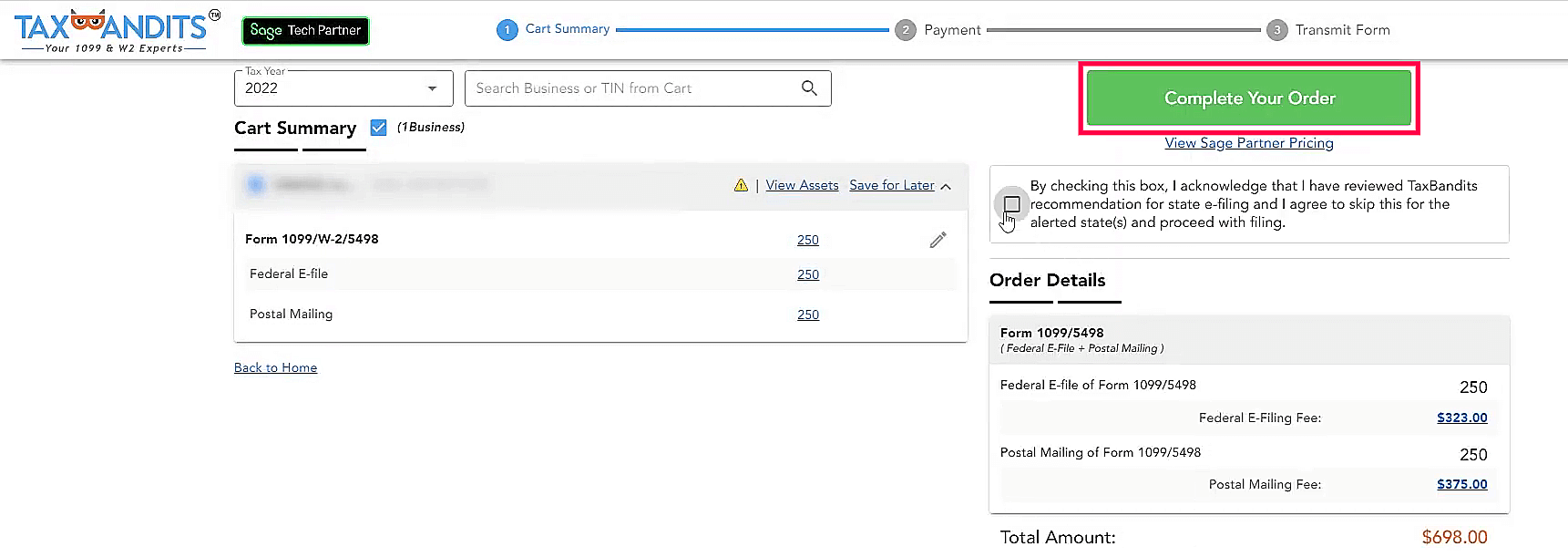

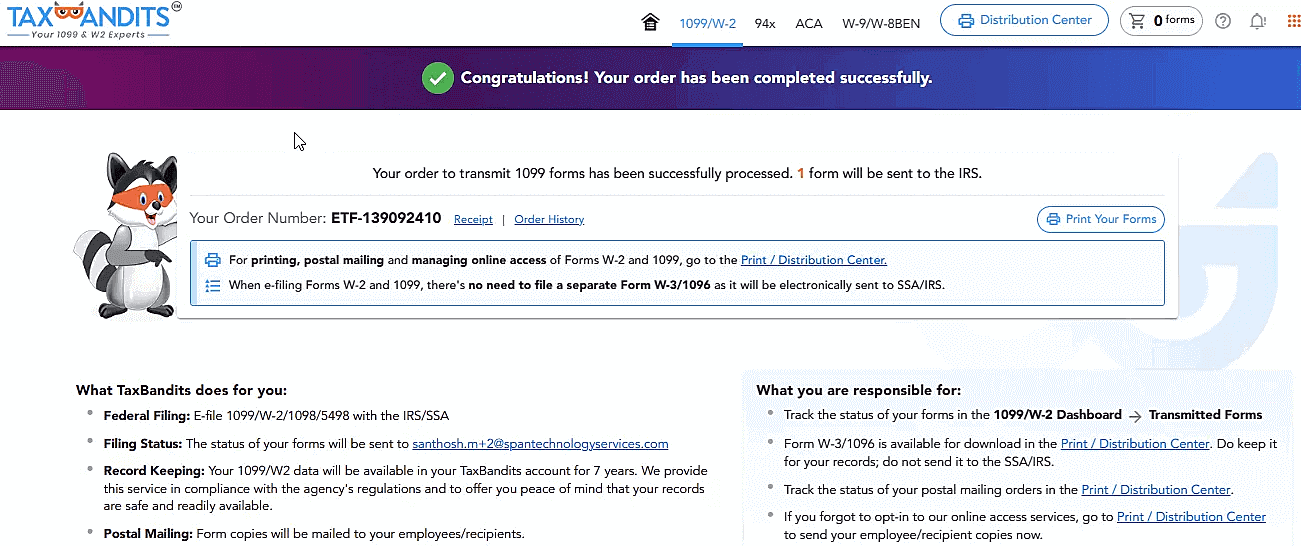

Transmit 1099 Form to the IRS

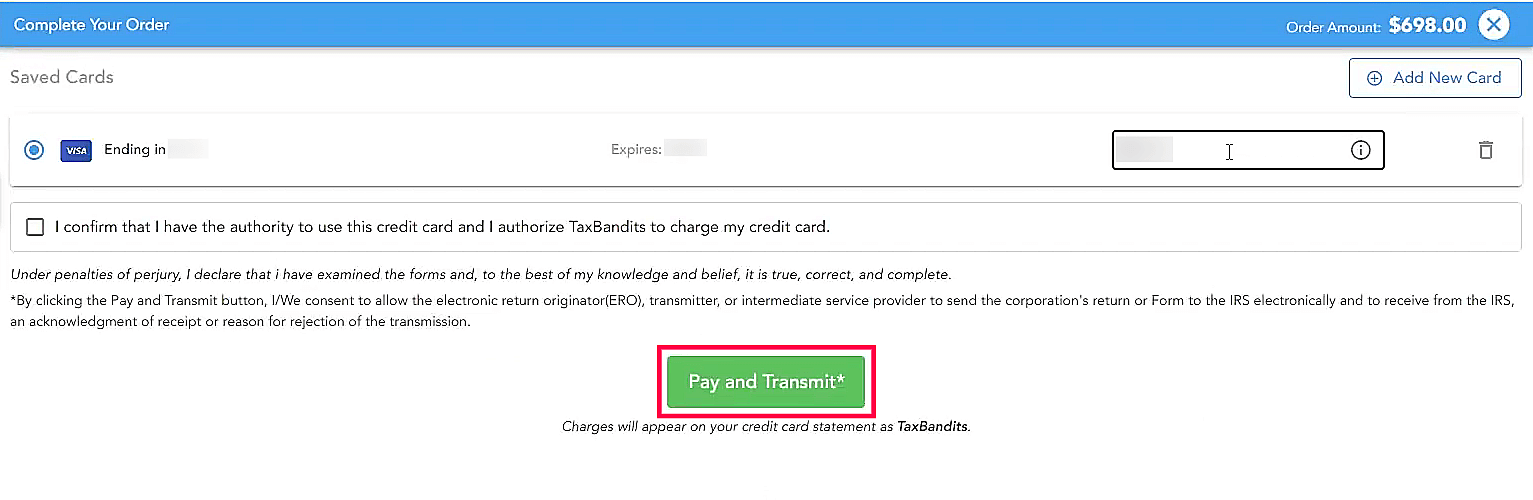

After reviewing the imported data, you should pay for the TaxBandits services you’ve selected and transmit your 1099 form to the IRS. Here’s how:

- In the Cart Summary page, verify the order details for the services you’ve chosen and click Complete Your Order.

Enter your debit/credit card information to make the payment in the following page.

Click Pay and Transmit.

Your order is now complete, and TaxBandits will transmit your 1099 form to the IRS through the selected services.

Yes

Yes

Thank you for your feedback!

Thank you for your feedback!