Overview - Expenses

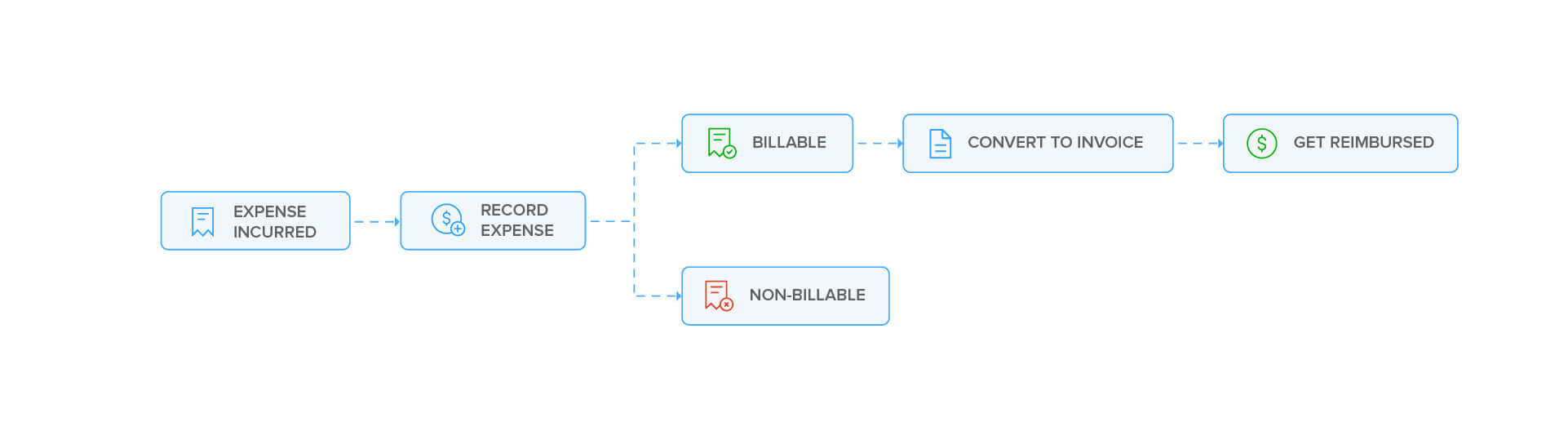

Expenses are costs incurred for running a business. They can be incurred on various day-to-day business activities including travel, food and lodging. Some of these expenses can be reimbursed by users in an organization.

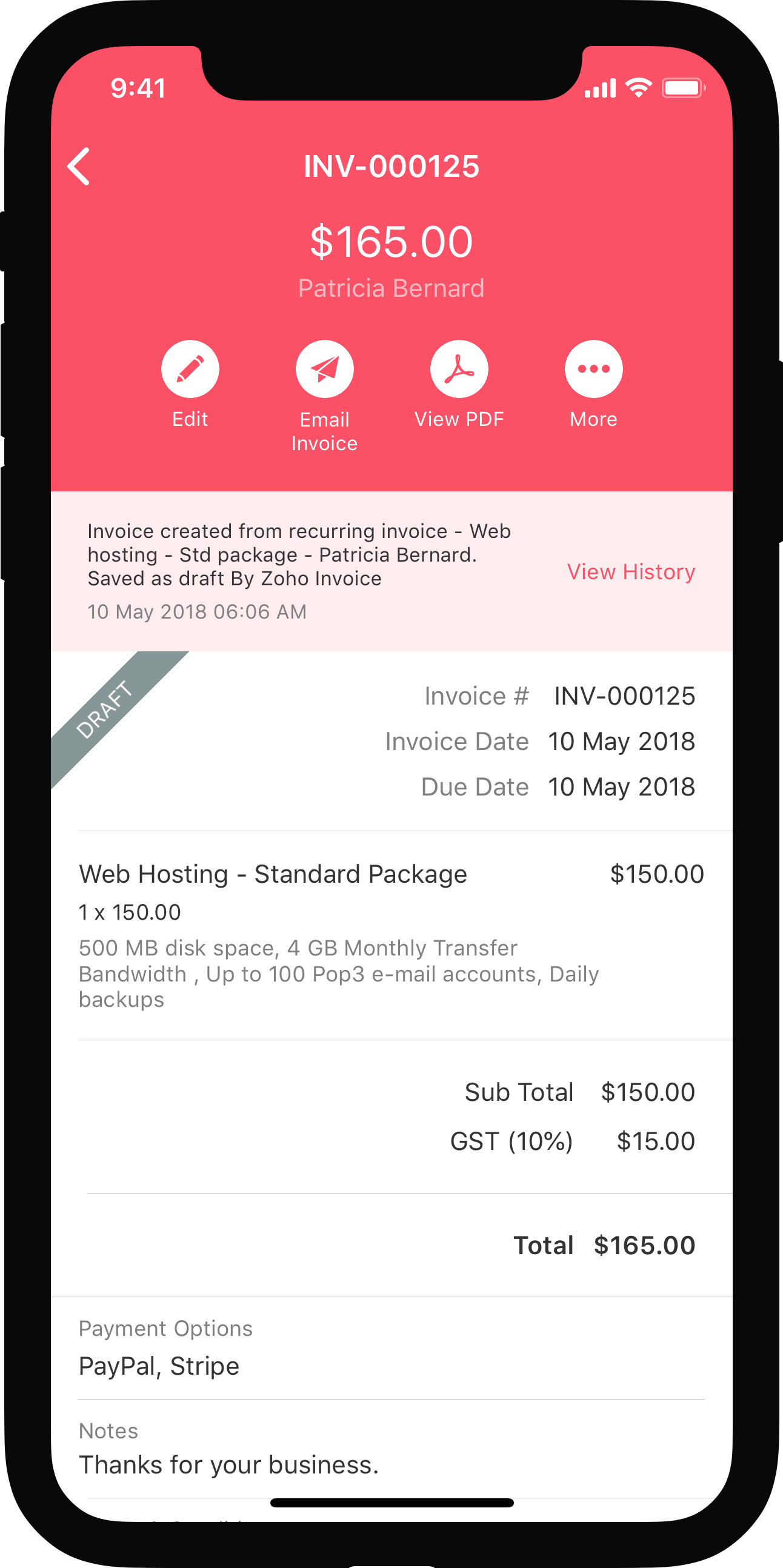

In Zoho Books, expenses can be recorded, marked billable, converted to an invoice and be reimbursed by users.

In the Expenses module, you’ll have the following sections:

- Basic Functions in Expenses

- Manage Expenses

- Mileage Expenses

- Other Actions for Expenses

- Expense Preferences

Keep track of your payables and manage your expenses online with Zoho Books.