Register on the e-Invoicing Portal-IRP

The Invoice Registration Portal (IRP) is the e-Invoicing portal to which you need to send your invoice details. The IRP will then issue a unique Invoice Registration Number (IRN) and QR code for each invoice submitted. All GST registered taxpayers who want to generate e-Invoices should first register on the IRP and create an account.

Insight: If your business generates e-Way bills and has already registered the GSTIN on the e-Way Bill (EWB) portal, you can use your EWB portal username and password to log in to the e-Invoicing portal as well. You can skip the steps mentioned below.

Prerequisite: To create an account, you need to have your business’s valid GSTIN and the mobile number registered for it with the GST system.

To create an account on the IRP:

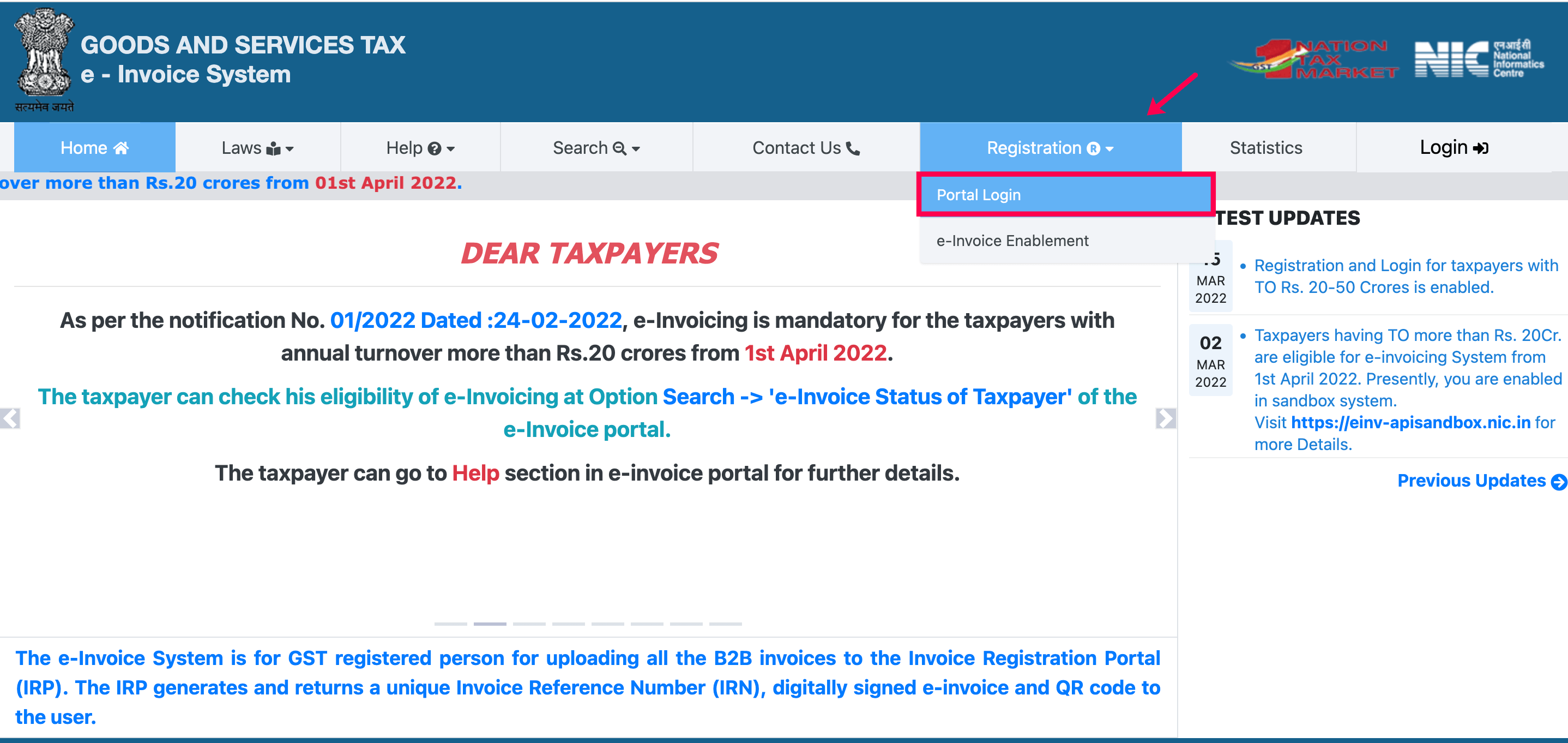

- Go to the e-Invoicing portal-IRP.

- Click Registration and select Portal Login from the dropdown.

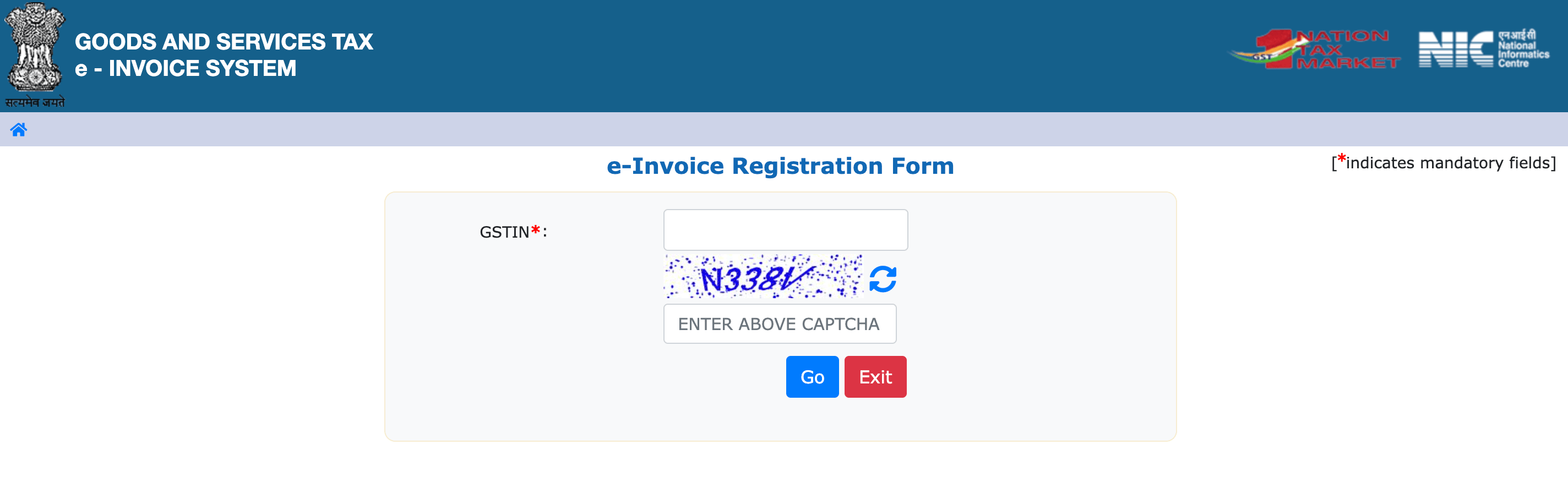

- Enter your business’s GSTIN and type in the captcha.

- Click Go.

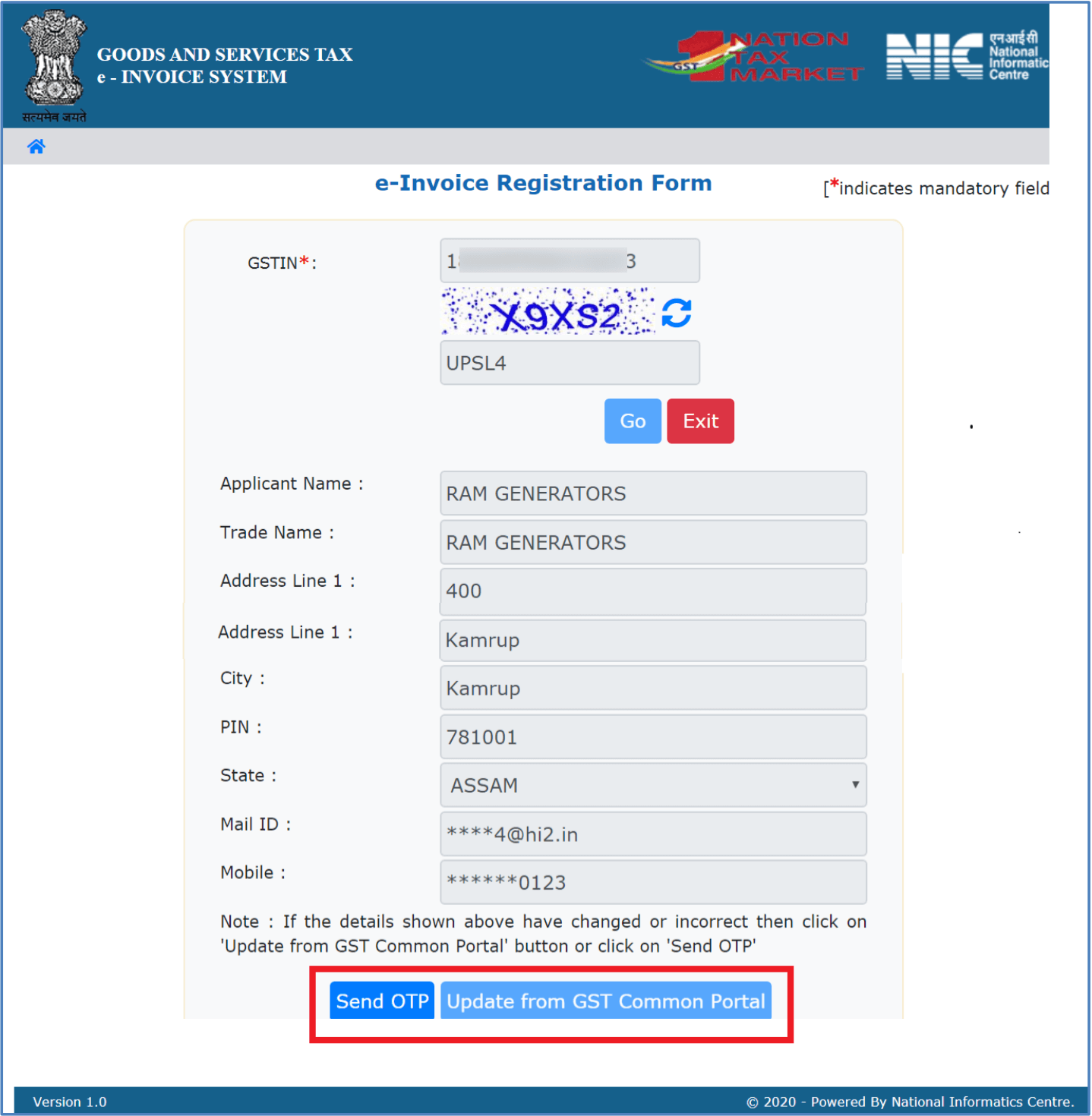

- The details relating to the GSTIN entered, such as the Trade Name and Address, will be filled in automatically.

- Verify the details and click Send OTP.

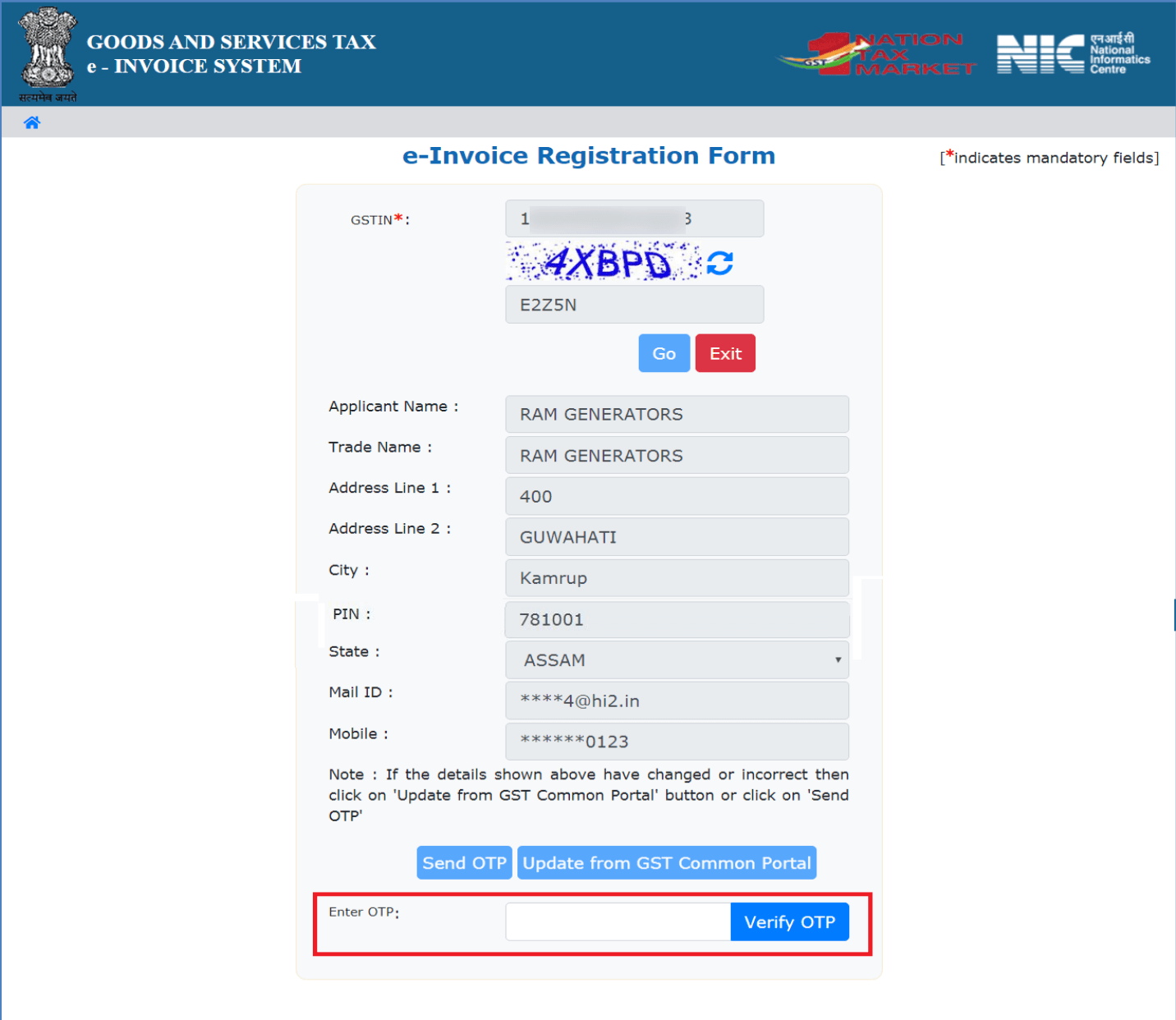

- An SMS will be sent to the mobile number registered for this GSTIN. Enter the OTP mentioned in it.

- Click Verify OTP.

- Once the OTP is verified, you’ll be prompted to enter a Username (it should be within 6-15 characters in length) and a Password.

- Re-enter the Password to confirm it.

- Click Save.

Your IRP account will be created and you can log in to it with the set username and password. Once you’ve created an account, you can enable e-Invoicing in Zoho Books and connect it to the IRP.

Yes

Yes