Items

Items are goods or services that you deal with in your business.

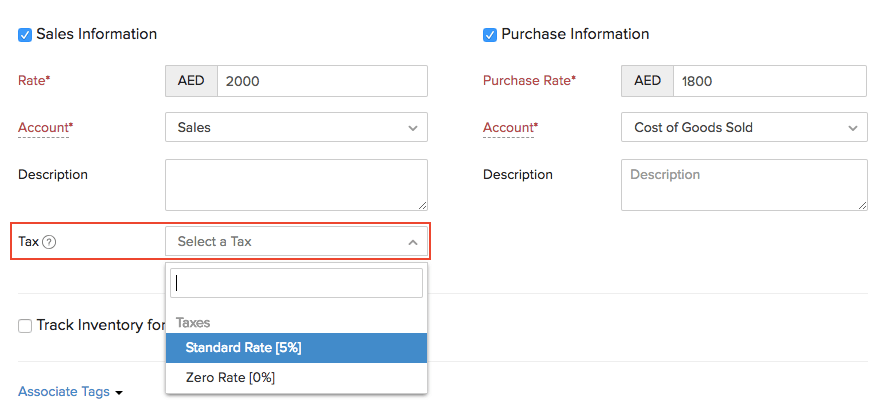

While you add an item in Zoho Books, you can select the appropriate tax applicable on it. Whenever you create transactions for this item, the tax applicable on it will be auto-populated.

- Go to the Items module and select Items.

- Click + New in the top right corner of the page.

- Select the Tax applicable on the item.

There are different tax treatments in Zoho Books:

Standard Rate [5%]

VAT of 5% is applicable on the goods or services that you are adding in Zoho Books. Most of the transactions that occur in the UAE fall under this tax rate.

Zero Rate [0%]

VAT of 0% is applicable on the goods or services that you are adding in Zoho Books.

Learn more about sectors which are taxed at 0%.

Exempt Tax

Goods or Services that are exempted from VAT. You can choose an item as exempted from tax while creating transactions. For the exempt tax, you don’t need to create a new tax in Zoho Books, you will be able to select the tax exempt option while creating the the transactions.

Learn more about sectors which are exempted from VAT.

Out of Scope

If the supply of any of your items does not fall under the scope of VAT, then you can select this option while creating transactions for them.

Yes

Yes