Set Up Taxes

If you haven’t set up your VAT information while setting up your organization, here’s how you can do it:

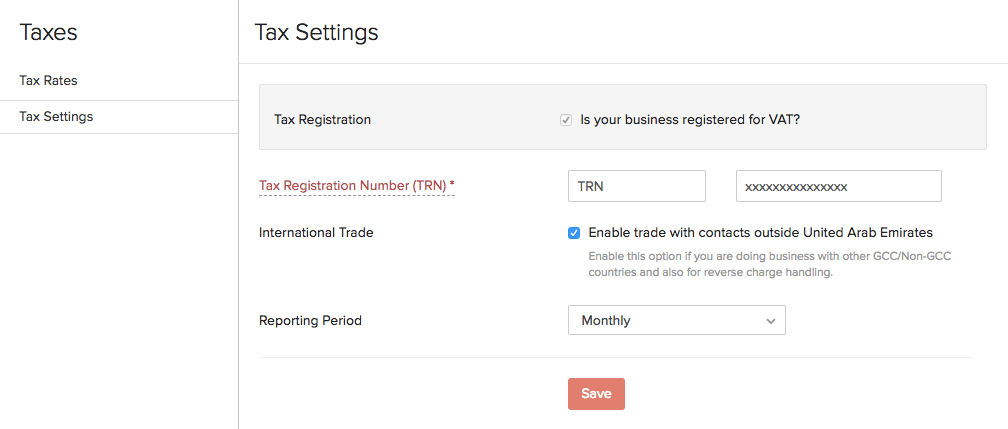

- Go to Settings > Taxes & Compliance > Taxes > Tax Settings.

| Fields | Description |

|---|---|

| TRN | Enter the Tax Registration Number provided to you by the FTA. |

| International Trade | If you deal with businesses outside the UAE, mark the box Enable trade with contacts outside the United Arab Emirates. |

| Reporting Period | You can file your tax returns either Monthly or Quarterly. This reporting period is decided by the FTA when they approve you as a VAT-registered person. |

After you set up your tax information, the different tax rates that will be auto-populated while creating transactions are:

Standard Rate [5%]

VAT of 5% can be applied on transactions created in Zoho Books.

Most of the transactions that occur in the UAE fall under this tax rate.

Zero Rate [0%]

VAT of 0% can be applied on transactions created in Zoho Books.

Learn more about sectors which are taxed at 0%.

Exempt

If any of the items are exempted from VAT, you can select them as exempted from VAT while creating transactions. You don’t need to create a new tax for such transactions.

Learn more about sectors which are exempted from VAT.

Out of Scope

If the supply of any of your items does not fall under the scope of VAT, then you can select this option while creating transactions for them.

Next:

Contacts >

Yes

Yes