Taxes

VAT Ready Features in Zoho Books

This section will give you a brief overview about the VAT Ready features that are available in Zoho Books.

Configuring your Zoho Books account

Zoho Books is now VAT ready. As part of the rollout, you will have to follow a few basic steps in order to get your organization ready for VAT.

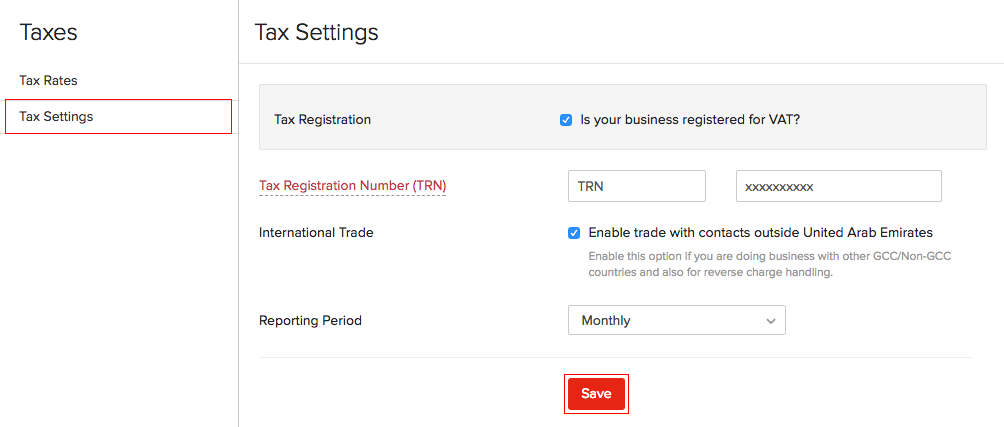

Enabling Tax Settings

To enable the VAT settings for your organisation in Zoho Books:

- Go to Settings on the top right corner of the page.

- Select Taxes under Taxes & Compliance.

- In the Taxes pane, select Tax Settings.

- Check the Is your business registered for VAT? option.

- Enter the VAT Label and VAT Registration Number.

- If your business involves international trade (importing or exporting outside GCC), check the box Enable trade with contacts outside United Arab Emirates.

- Click Save.

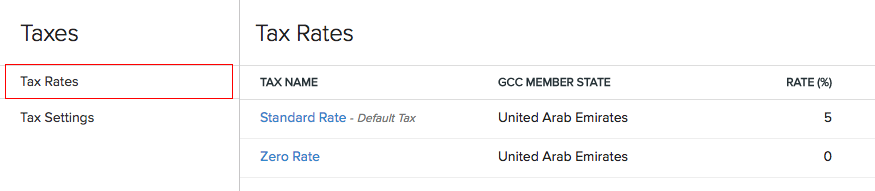

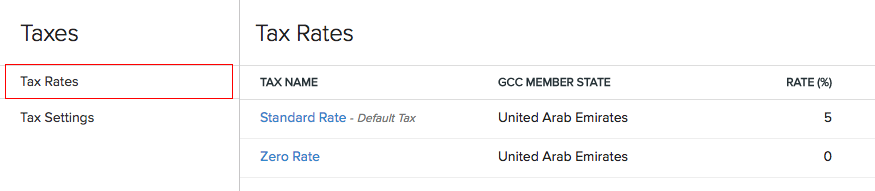

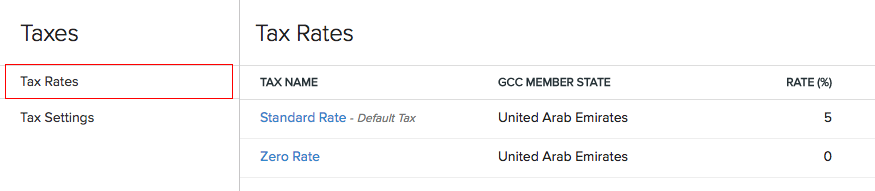

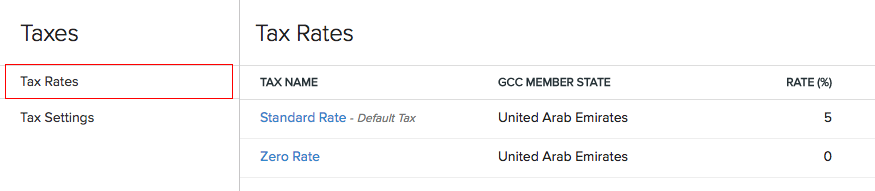

Setting up Tax Rates

Once you’re done with the VAT Settings, the next step is to set up the VAT Rates.

There are two default VAT rates:

- Standard Rate (5%)

- Zero Rate (0%)

To add additional VAT rates:

- Click the Tax Rates sub-module on the left menu from the same VAT page.

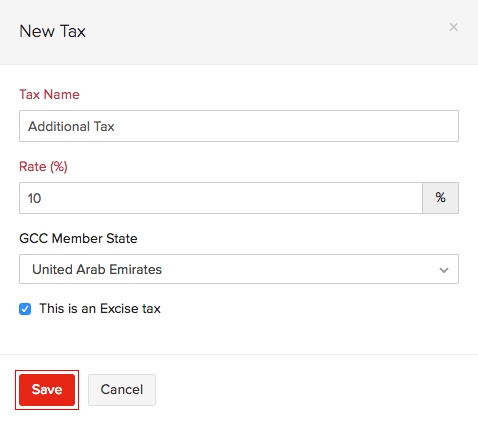

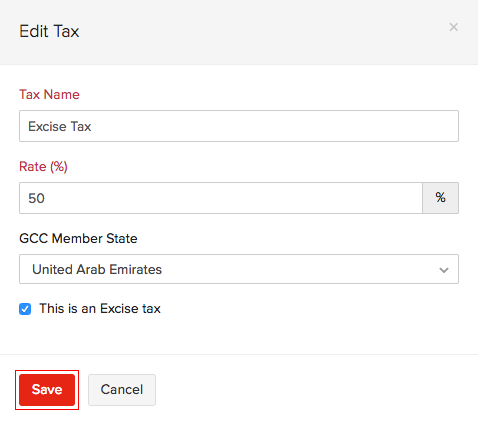

Adding New Taxes

To create or add a new tax:

- Go to Settings on the top right corner of the page.

- Select Taxes under Taxes & Compliance.

- In the Taxes pane, select Tax Rates.

- Click + New Tax on the top right corner of the page.

- Fill in the Tax Name and Rate (%) in the New Tax page.

- If the tax is an Excise tax, choose the option This is an Excise tax.

- Click Save.

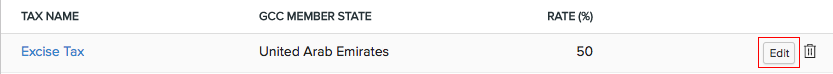

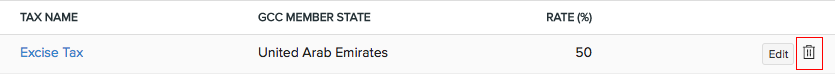

Editing Taxes

To edit an existing tax:

- Go to Settings on the top right corner of the page.

- Select Taxes under Taxes & Compliance.

- In the Taxes pane, select Tax Rates.

- Click the Edit button on the right side of the tax to edit.

- Click Save.

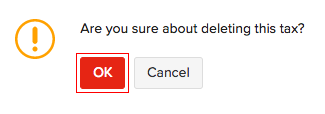

Deleting Taxes

To delete an existing tax:

- Go to Settings on the top right corner of the page.

- Select Taxes under Taxes & Compliance.

- In the Taxes pane, select Tax Rates.

- Click the Trash button on the right side of the tax to delete.

- Click OK.

Yes

Yes