Taxes

In Zoho Expense, you can associate taxes to your expenses. The Taxes section under the Settings allows you to:

Creating a New Tax

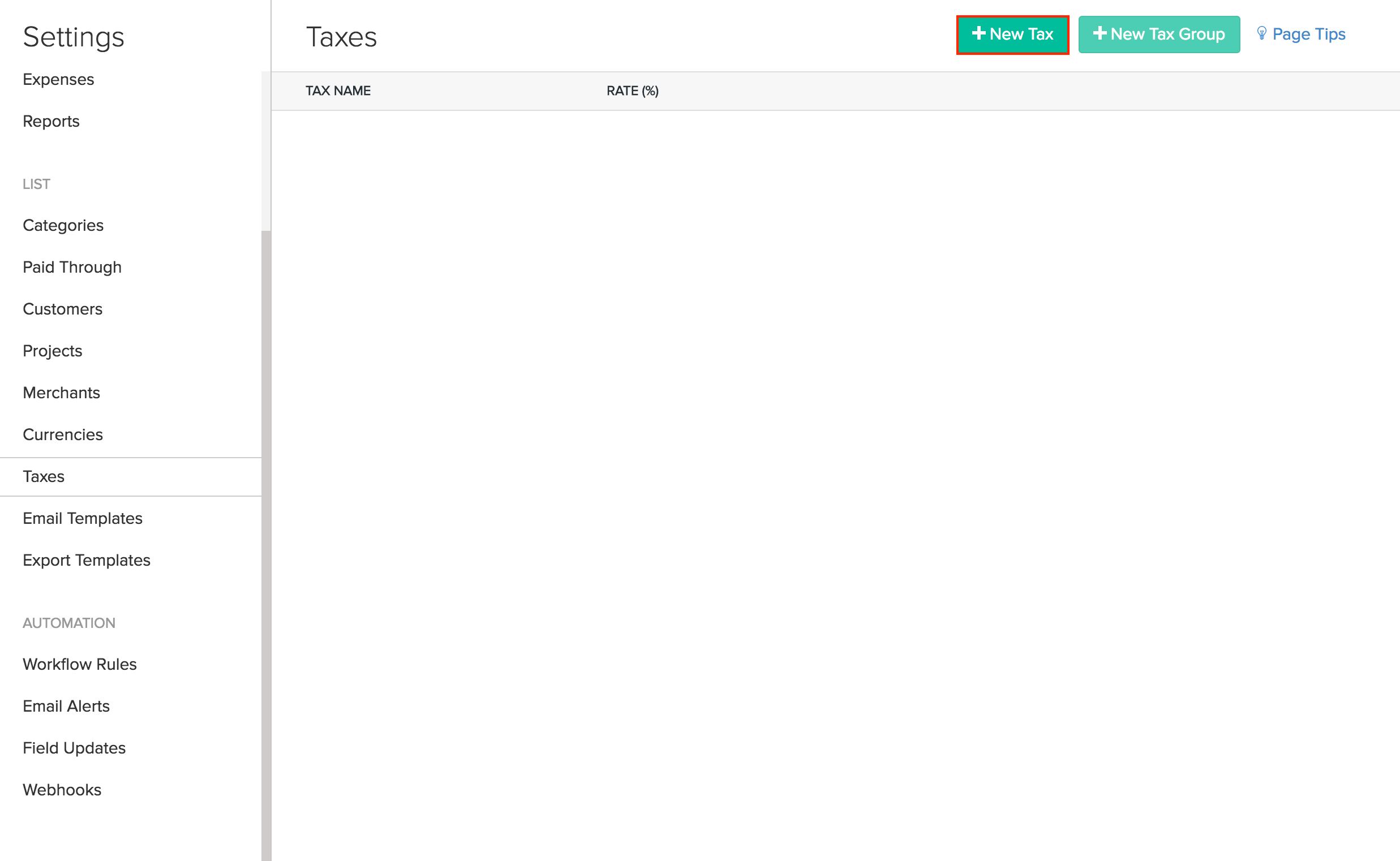

- Navigate to Admin > Settings.

- Go to the Taxes tab and click on the + New Tax button.

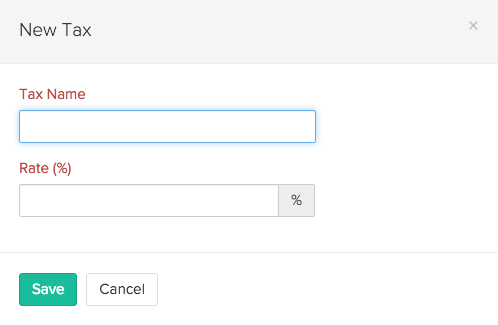

- Provide a name for your tax and set the percentage.

- Click Save to add your newly created tax.

Creating a Compound Tax

Compound tax is calculated on top of the primary tax.

Let’s take an example where the price of an item is $100. After applying 10% primary tax, the value of the item sums up to $110. Now, adding a 10% compound tax will add 10% of $110 to the resultant value. Thus, the end value after applying the compound tax would be $121.

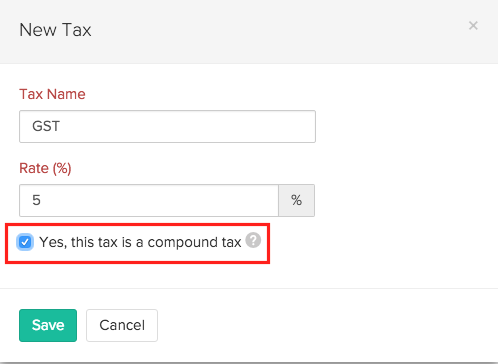

- Go to the Taxes tab and click on the + New Tax button or click on an existing tax entry.

- A new pop-up window will appear on the screen.

- If you wish to convert the tax into a compound tax, check on the ‘Yes, this tax is a compound tax option.

- Click Save for the changes to take effect.

- Now your tax of choice will be converted into a compound tax.

Creating a New Tax group

- Navigate to Admin > Settings.

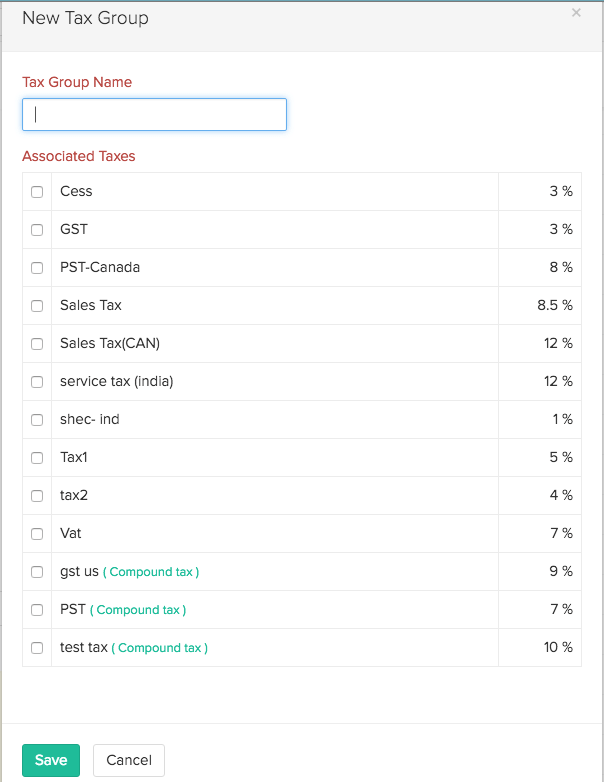

- Go to the Taxes tab and click on the + New Tax Group button.

- You will see a window with the list of available taxes created under the Taxes tab.

- Provide a name for your tax group and check the taxes which you would like to add to your newly created tax group.

- Click Save to save your newly created tax group.