Organization Profile and Branding

You can set up your organization’s profile by providing details like the organization name, company address, and primary contact.

To set up the organization profile:

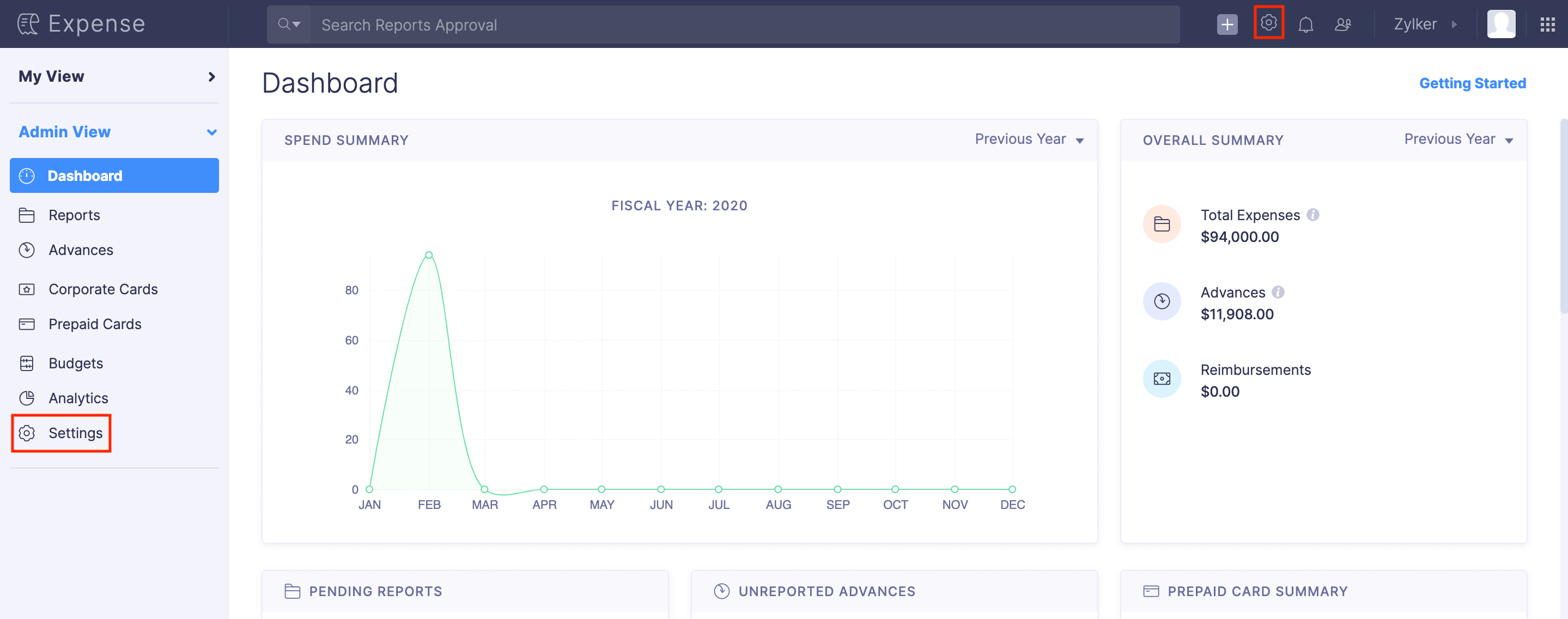

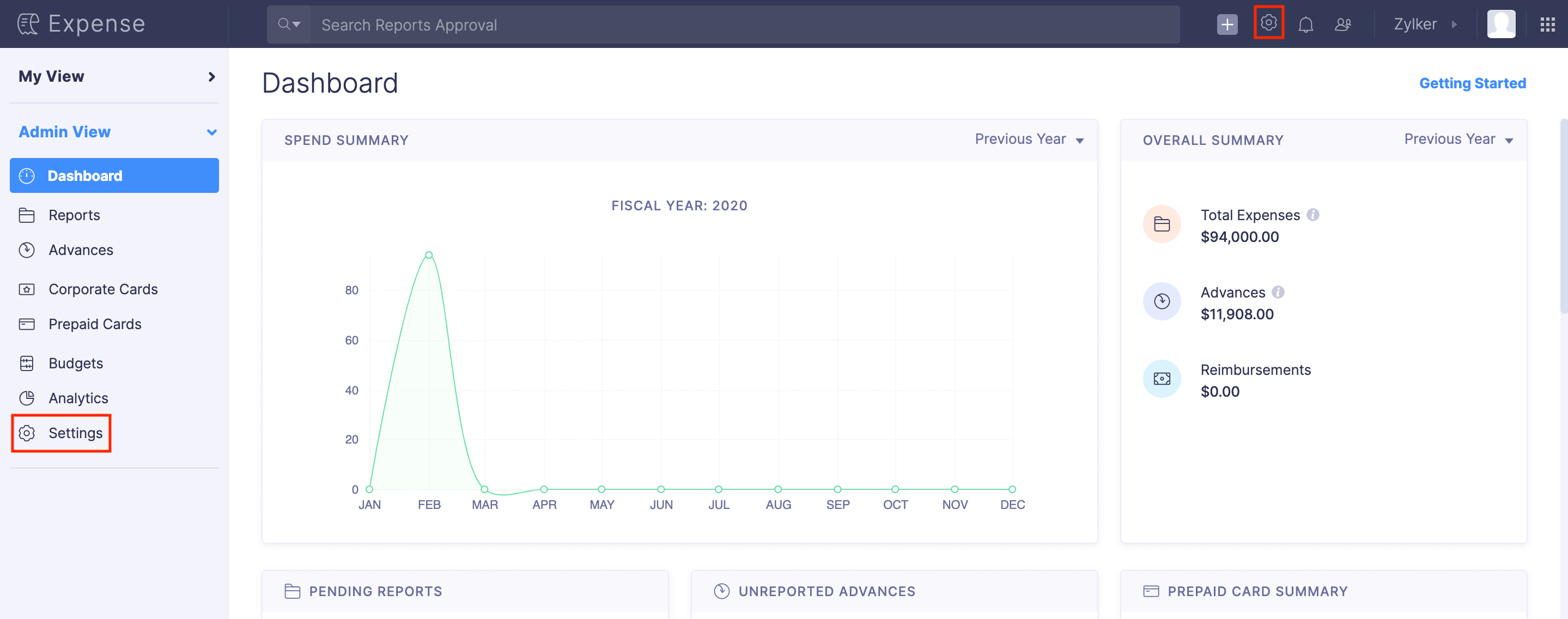

- Click Admin View.

- Go to Settings on the left sidebar.

(OR)

Click the Gear icon at the top right side.

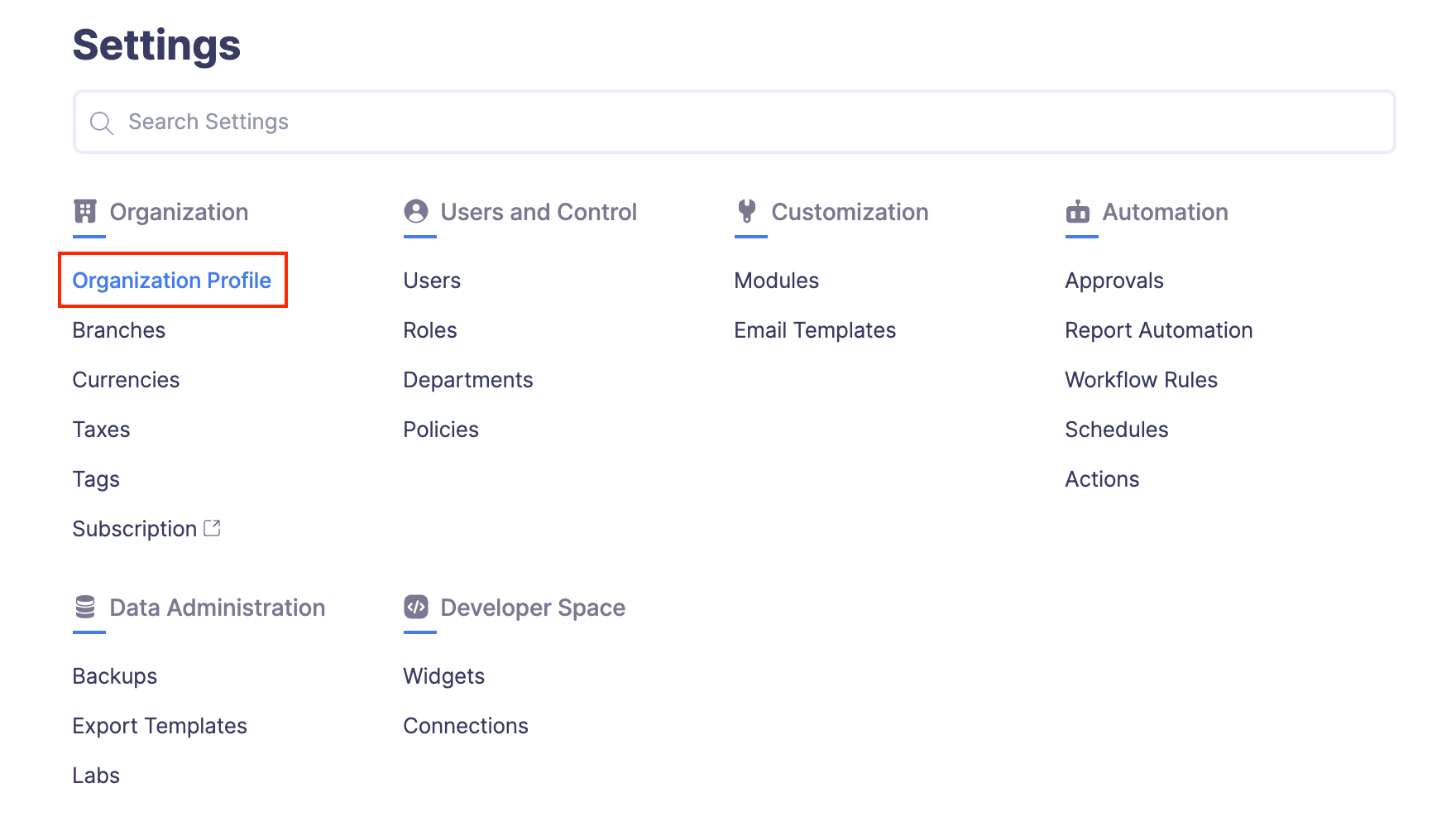

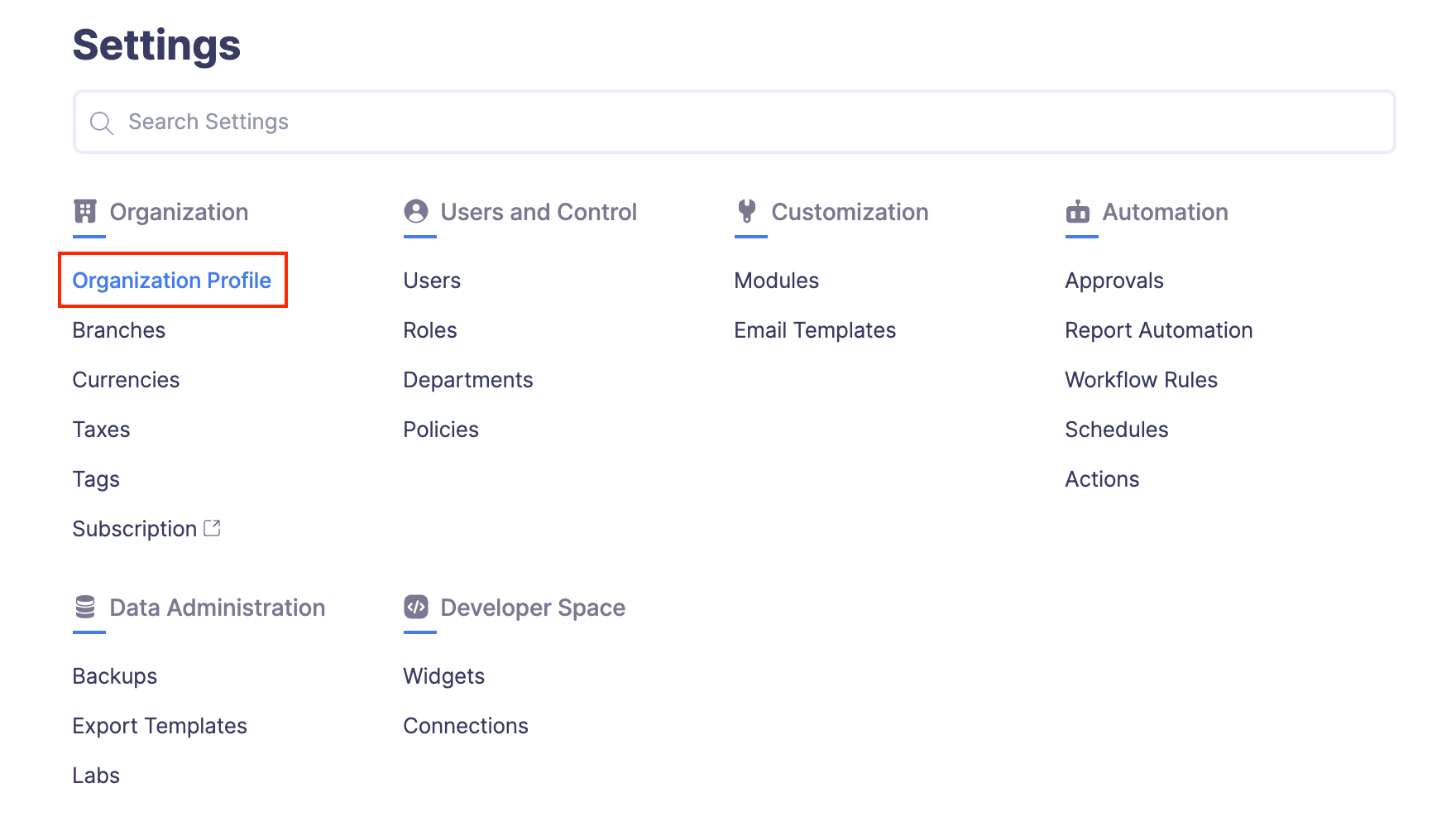

- Click Organization Profile under Organization.

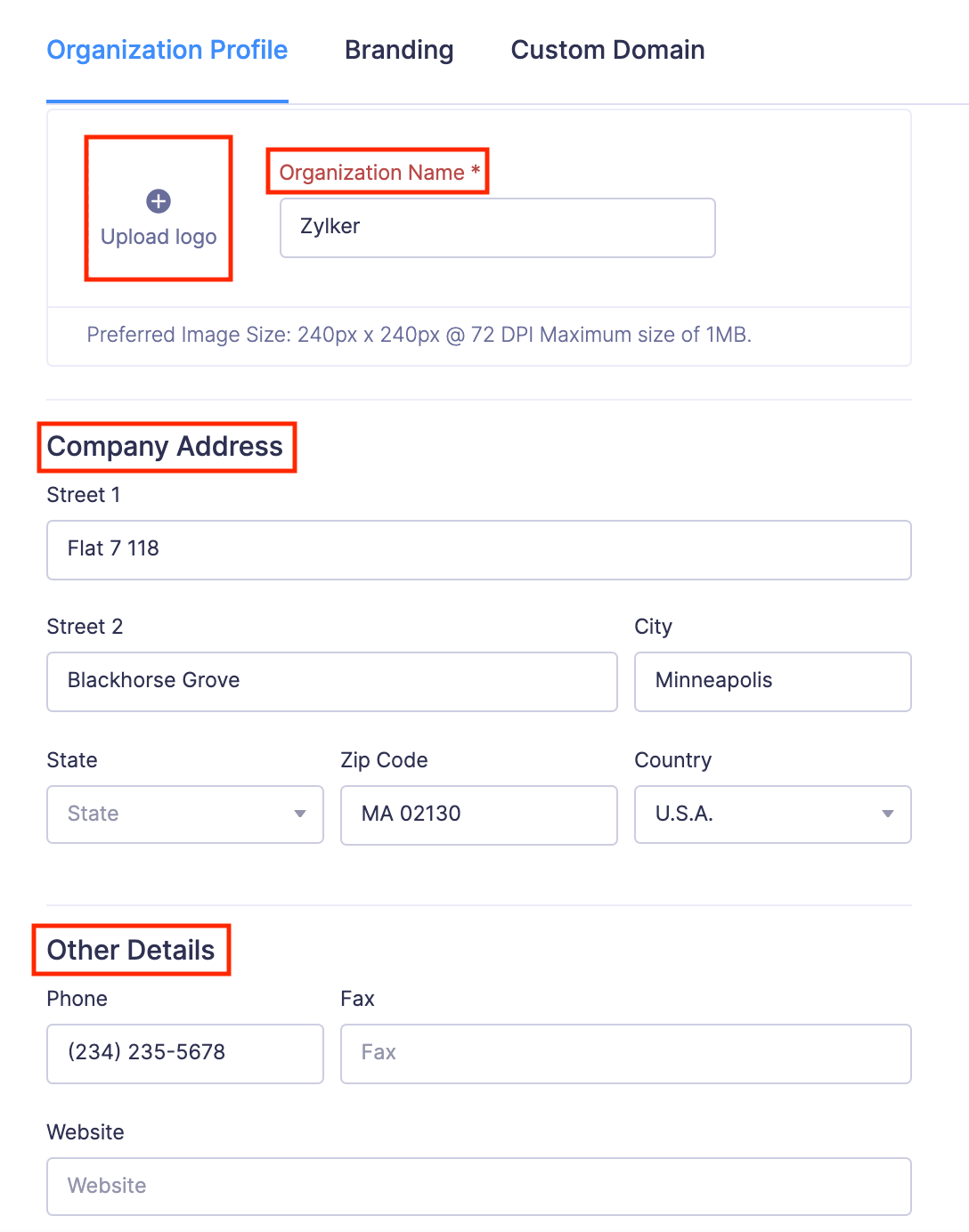

- You can edit the following parameters:

- Company Logo: The logo you upload here will be reflected in all your documents. You can simply click the Upload Logo button, select the image file, and upload it. Preferred Size: 240px*240px with 72 DPI. Maximum File Size: 1 MB.

- Organization Name: You can edit your organization name entered during quick setup, if required.

- Company Address: Provide your company’s address details such as the street, city, state, zip code, and country.

- Other Details: Enter your contact details such as the phone number, fax, and website.

Primary Contact

You can change or edit the primary contact. Emails across the organization will be sent from the primary contact’s email address.

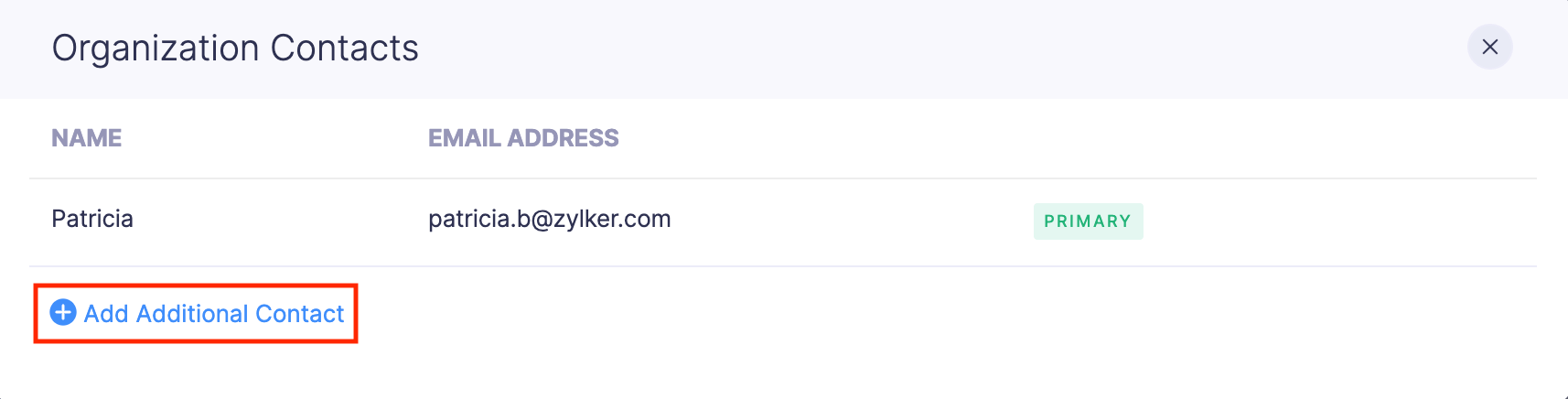

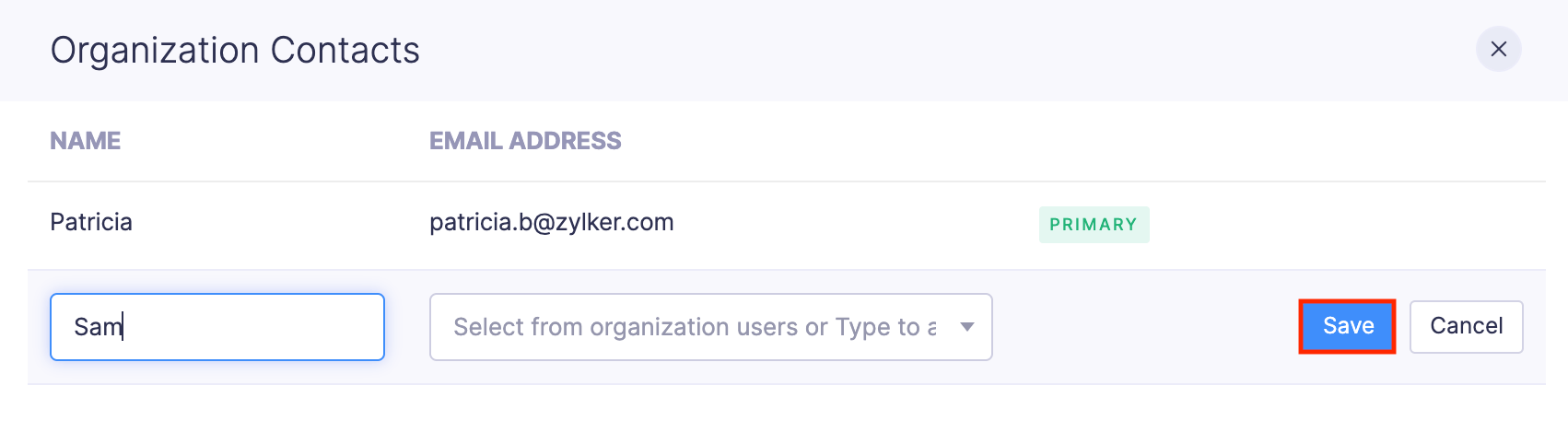

To add new organization contacts:

- Click Configure Emails.

- In the popup that opens, click + Add Additional Contact.

- Enter the user’s name and email address. Click Save. Your new contact will be added.

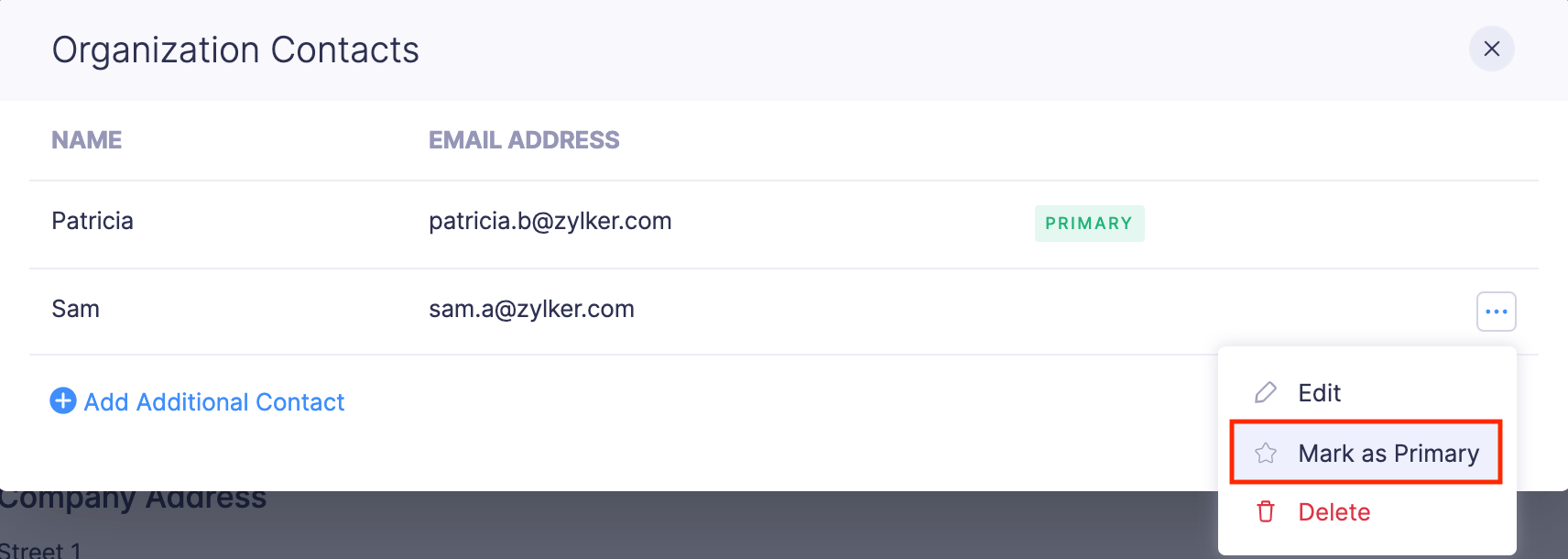

To mark that user as a primary contact:

- Hover over the user and click the More icon at the right corner of the user you want to mark as primary.

- Click Mark as Primary. Your new contact will now be the primary contact and all the emails across the organization will be sent from the primary contact’s email address.

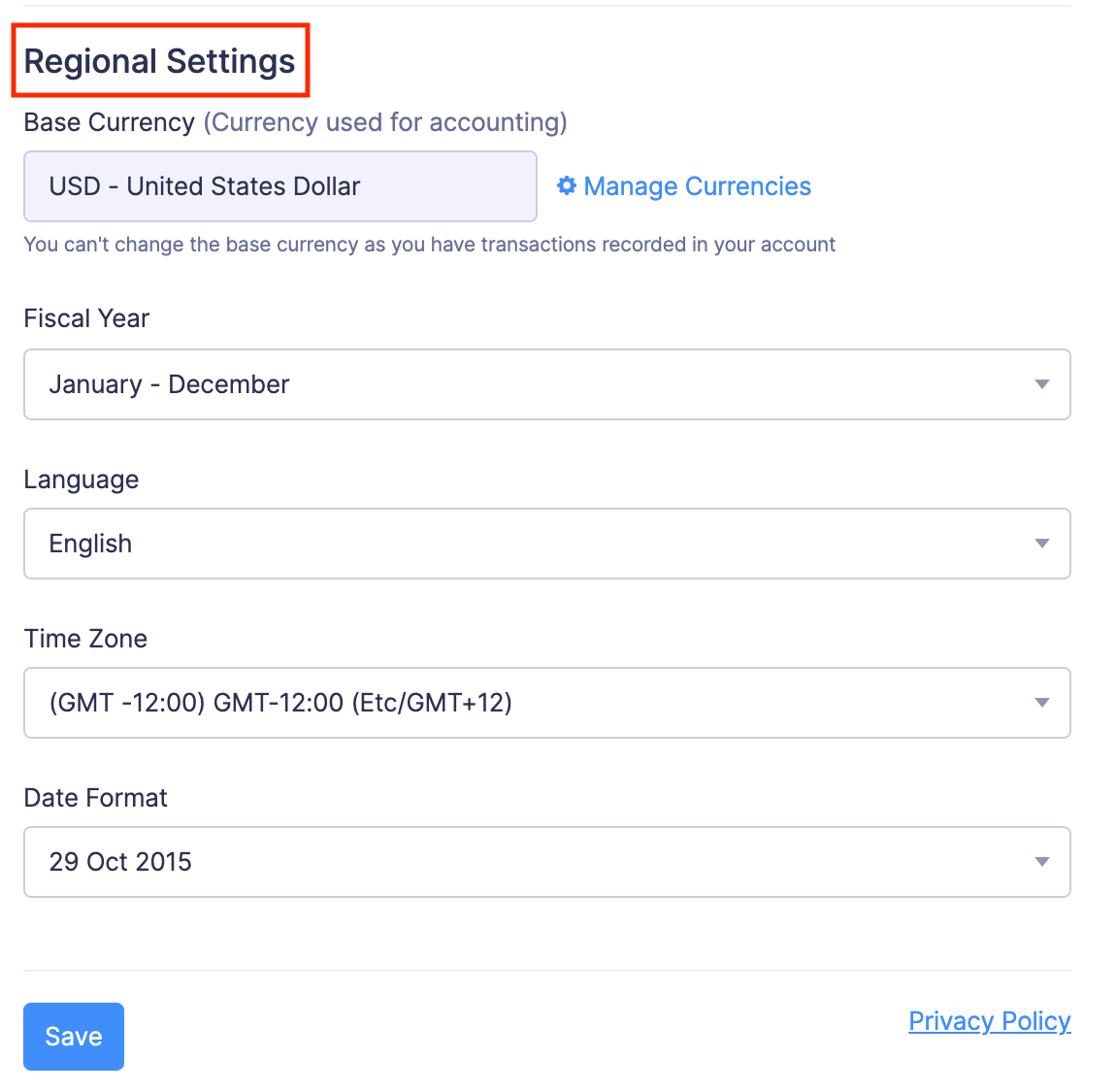

Regional Settings

Configure the basic settings of your organization in this section.

- Base Currency: You can choose the base currency in which all your accounting is done. You can also manage currencies efficiently using the Manage Currencies option present right next to the base currency text field.

- Fiscal Year: Choose the accounting year of your organization.

- Language: Select the language with which you want to use your Zoho Expense organization.

- Time Zone: Change or edit your time zone.

- Date Format: Change or edit the date format according to your requirements.

Note: You cannot change the base currency once a transaction is created using it. You will have to delete all transactions to change the base currency.

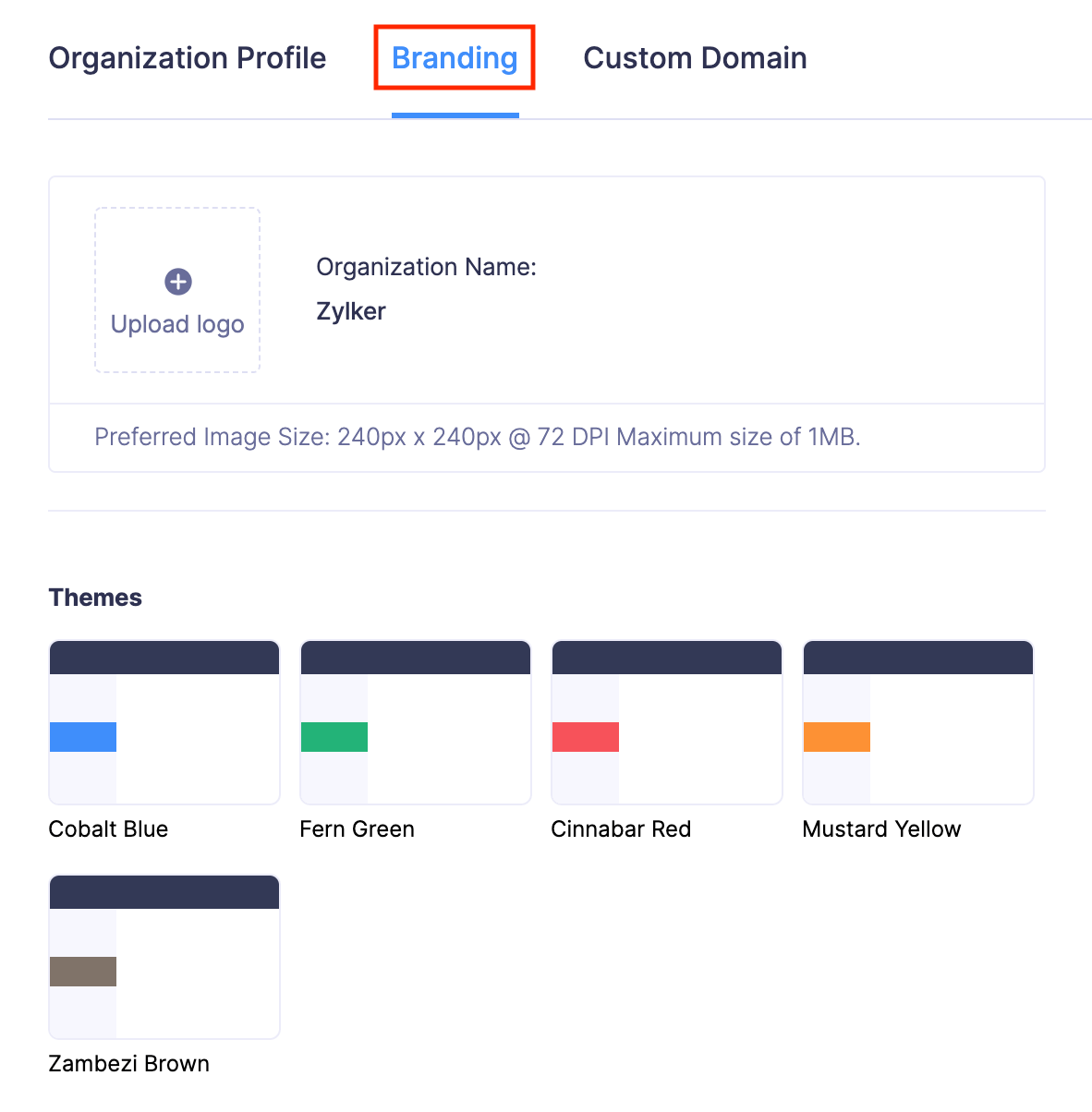

Branding

Give a personal touch to your Zoho Expense account. Choose a theme that will go well with your company. To change the theme:

- Click Admin View.

- Go to Settings on the left sidebar.

(OR)

Click the Gear icon at the top right side.

- Click Organization Profile under Organization.

- Navigate to the Branding tab.

- Upload your organization’s logo that will be visible in the PDF of your expense reports.

- Choose a theme of your choice. If you have multiple organizations, you can differentiate among them by using different themes.