Puma has been using Zoho Expense in Oceania for over 3 years and our users have found the web interface and the phone apps to be feature rich and always improving.The look and feel is modern and pleasing

to the eye. Puma has recently expanded the usage of Zoho Expense to multiple new regions around the globe, and throughout, the Zoho team has been extremely supportive to the unique requirements of each region

and helped to make the onboarding experience painless.

Mark Hawkins

Director, Operations PUMA SEA

We started using Zoho Expense across our whole IFFCO group for Travel and Expense Management as one of the key aspects to keep control on spends.

It was a challenge to manage employee spend and expense reporting across our multiple office locations with disparate solutions. We found Zoho Expense

as a very powerful and flexible tool which allows us to accommodate many different expense policies and compliances in respect to many different countries' regulations.

Jaroslaw Pietraszko

Director ERP & Digital Transformation, IFFCO Group

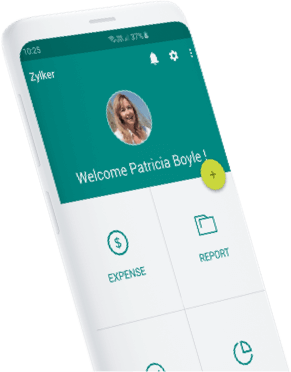

The Zoho Expense team has provided us with the best features—especially the receipt auto-scan, which eases our expense reporting journey with its mobile functionality.

Our employees use Zoho Expense and its features extensively, particularly the mobile app. Above all, with the Zoho Analytics integration, we always get the insights we need

with multiple dashboards to analyze our business spend. We’re one of those happy customers who are looking forward to seeing many new features and integrations within the application.

Amit Rai

CHRO, Tata Play Fiber