Home / Audit and compliance / Expense Report Audit

Audit expense reports efficiently

Tax season can be hectic. It's difficult to juggle between finding erroneous expenses, getting the required documents ready, and filing your returns. Zoho Expense eases this burden with efficient expense report audit features.

Detect fraud automatically

Detect fraud automatically

Expense reporting is meant to stop fraudulent activity. Zoho Expense's AI-driven fraud detection engine scans through your expense reports and finds suspicious transactions automatically so you don't have to manually review every transaction.

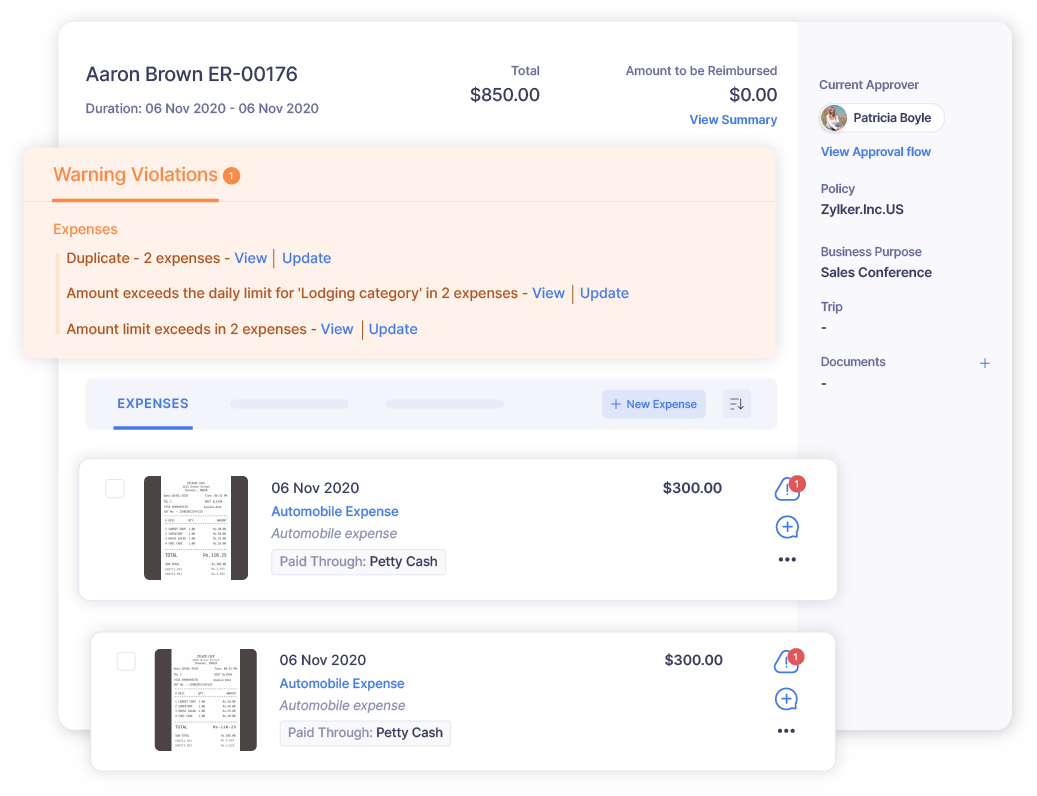

View violations instantly

View violations instantly

Auditors no longer have to look for the needle in a haystack. In Zoho Expense, policy violations and duplicate entries are prominently flagged on an expense report so that managers don't miss them while auditing.

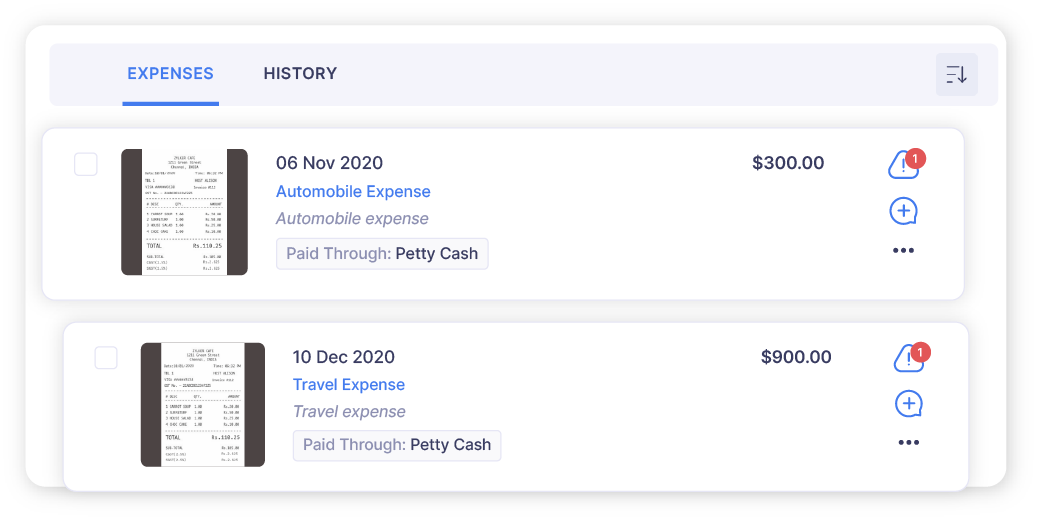

Ensure receipts are attached as proof

When you autoscan receipts to create expenses, a digital copy of the receipt will be included with the report. This ensures there is solid proof for the expense incurred. Employees can also attach receipts to manually created expenses.

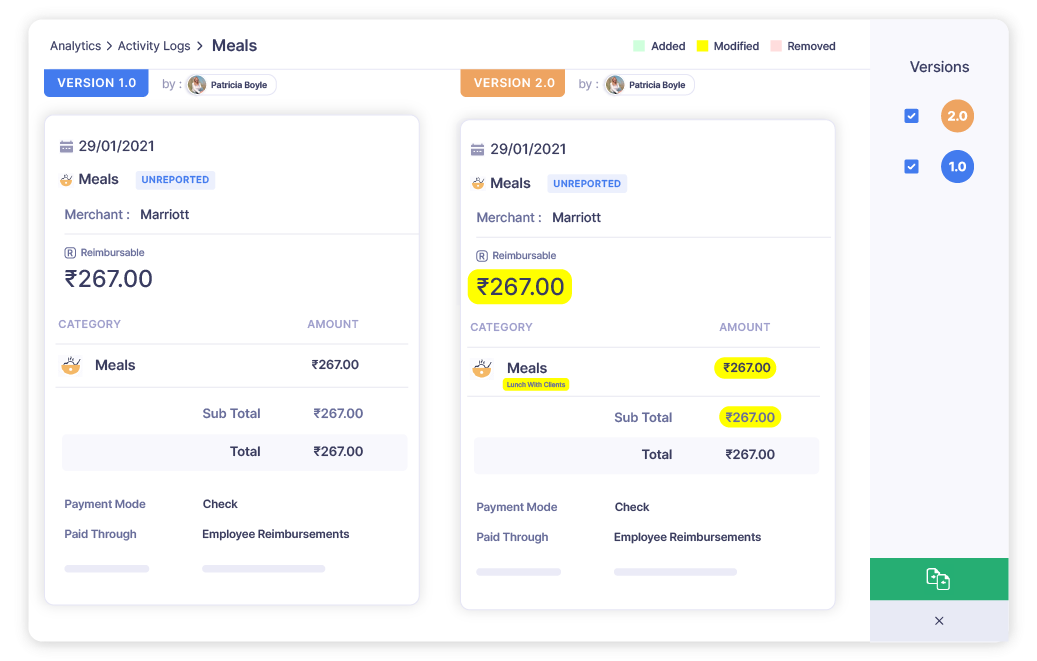

Run audit trail reports

Run audit trail reports

Get a detailed log of every activity that happens inside your Zoho Expense account. Run audit trail reports and know when a transaction is created, modified, or deleted. This will help you find suspicious activity while auditing.

Back up your data

Zoho Expense enables you to back up your data on your computer in just a couple of clicks. You can also choose to back up your receipts alone. What's more, you can schedule backups to be initiated automatically according to your needs.

Testimonials

One of my responsibilities is to oversee the AP function, and expense reporting is by far one of the most tedious aspects. Zoho Expense helps alleviate a bit of that headache with their online and mobile app platforms that allow users to upload and submit information electronically. Moreover, Zoho Expense has the capability to export their information in far more detailed fashions than other desktop and mobile applications including AMEX and Citi. I also like the approver and reminder functionality the app enables for the management team.

Brittany Cisneros

AVP Finance, Impact Floors of Texas LP

I believe, the most convenient feature for our employees is the easy-to-use mobile version of the tool. You click a picture of the bill you just spent on, select the relevant expense head and hit submit. Additionally, scanned copies of bills/ receipts, expenses, approvals, comments are now available in one report which forms the basis for any reimbursement claim posted to our accounting software.

Janani

Director of Finance, Exotel

In the past, I spent a ton of time chasing down our company credit card users because they often did not provide me with the receipt or even notation of their spending, so when the statement came, I had no idea which budget areas to pay the invoice from. Now, they each have a Zoho Expense account to track their spending in, and since getting the receipts into the account is so easy, and they can see their own bank feeds, it is working tickety-boo!

Becky Retzlaff

Financial Manager, Lakeside Lutheran High School

Not just for all business teams, Zoho has helped the accounting team as well. Expense related reports are all available at one place. A remarkable thing about the Zoho experience, is the constant support they give us, for every little query. Zoho has made life easier for us.

Hector Beverages Paperboat

Expense reporting has been so easy after we started using Zoho Expense. The efficiency of expense reporting and reimbursement has improved multifold.

Razorpay

Zoho expense is a good tool. It is helping us to manage expense records in a seamless manner. In our line of business where international business travel is routine, Zoho Expense has helped us to create a paperless and fully traceable process. It is great value for money and extremely user-friendly!

Ms. Sushama Telang

COO, Sarla Advantech Pvt. Ltd

Expense report audits made more efficient

Stay CompliantOther Features

Receipt Management

Managing receipts shouldn't have to be tedious. With features that allow you to autoscan receipts, forward them automatically, import in bulk, or even import from other cloud applications, Zoho Expense ensures that no receipt goes untracked. The best part? Receipts are digitally stored in your Zoho Expense account, so you never have to worry about losing paper copies.

Learn MoreExpense Management

Manage expenses more efficiently with Zoho Expense. We support multiple methods for uploading expenses, no matter the currency. They can be itemized, split, added as per diem allowances, or consolidated under one expense type. As an admin, edit the expense creation forms to suit your organization's requirements and choose what fields employees must fill in while submitting expenses.

Learn MoreMileage Tracking

Tracking business mileage is an important part of managing your organizational spending. Zoho Expense offers 100% accuracy when it comes to mileage tracking. Add mileage expenses through 4 different methods using your Android, iPhone, or even Apple Watch.

Learn MorePer diem

Zoho Expense automates per diem calculations. Set pre-defined rules based on country compliance and location. No more manual calculations, just accurate expense reports, fast.

Learn MoreCorporate Card Reconciliation

Connect your corporate cards to Zoho Expense and speed up the reconciliation process. Associate cards with specific employees and fetch card feeds instantly. Weed out any personal spending, and then automatically match and reconcile your business expenses. Our dashboard also gives you a complete reconciliation overview for your convenience.

Learn MoreExpense Report Management

Make expense reporting for employees a cinch. They can create expense reports with all the important details they need. Apply cash advances, download expense report PDFs, and streamline the reporting process with report types.

Learn MoreExpense Report Automation

Tired of creating reports manually? Or maybe you keep forgetting to add your expenses and submit the report online? With expense report automation, you can put the whole process on autopilot. Zoho Expense will automatically add expenses to a report and submit it for you.

Learn MoreTrips

Provide ticket options, set up approval for trips and ticket costs, manage itineraries, handle expenses, and make the travel and expense management process easier with Zoho Expense.

Learn MorePurchase requests

Use Zoho Expense to manage your purchase requests and make your ordering process easy and problem-free.

Learn MoreSimplified Approvals

If you're from an organization that follows a linear, hierarchical approval flow for your expense reporting, you can set up default approvals using Zoho Expense. You can configure out-of-office approvers and reminders for approvals as well.

Learn MoreCustom Approvals

Every organization's approval requirements may vary. If you want a custom, non-linear, or multi-stage approval flow, Zoho Expense has you covered. Design multiple complex approval flows and ensure that all transactions are overseen by the proper set of people before being approved.

Learn MoreCompliance

Zoho Expense is GDPR compliant and ISO certified. In addition to a global edition, Zoho Expense has 8 dedicated editions for the US, the UK, India, Canada, Australia, the UAE, and Saudi Arabia. Never worry about local compliance laws again.

Learn MoreReimbursement

Process expense reimbursements in a faster, more efficient manner. Sync settlements with payroll and ERP software. Make employees happier with quicker expense reimbursements, delivered directly to their accounts.

Learn MorePolicies

Set up policies for different branches, departments, or cost centers, and ensure no employee expense is outside the policy limits. If there are violations, you can be notified instantly. Create mileage and per diem rates for different policies as well.

Learn MoreExpense Rules

Set up limit rules based on fixed amounts, expense count, mileage limit and more. Choose to warn or entirely block employees from submitting expense reports when a rule is broken. Set up daily, monthly, or yearly expense limits, or place a rule for a custom duration as well.

Learn MoreBudgets

Create budgets for expense categories or expense types and put a lid on the spending. Warn or block employees from creating an expense when it exceeds the budget. Get analytics on the actual spending vs the budget initially set and stay on top of your spending.

Learn MoreAutomation

Historically, expense reporting has been a manual process predominantly. But, with amazing automation features from Zoho Expense, you don't have to carry out mundane expense reporting tasks anymore.

Learn MoreCollaboration

Quit sending back and forth emails about expense reports. Collaborate with employees contextually and without delay.

Learn MoreCustomization

Set up custom components, customize what employees see when they use Zoho Expense, and personalize your expense management process.

Learn More