Defining payroll software

Any HR or Payroll professional will tell you that there's more to payroll processing than just calculating pay checks. From enrolling employees onto the company's payroll to ensuring spotless compliance, and maintaining payroll records till exit, there's a series of repetitive tasks every month. Payroll software helps the professionals keep tabs on all these activities effortlessly from one place. Watch a quick overview video on the typical functions of payroll software.

Importance of payroll software for your business

Payroll processing and management involves a wide range of activities in order to look after an organization's critical asset - Its people. Done manually, or with an outdated system or through a spreadsheet, it becomes complex, time-consuming, and sometimes inaccurate. Dedicated software helps payroll professionals streamline other payroll tasks allowing HRs and small business owners to create space for important business projects.

-

Automating payroll

Processing payroll manually means you are leaving the door open for unintenional mistakes that could prove very costly. Payroll software can automate both complex and simple tasks, empowering you to tackle payroll better. From getting payroll ready to closing out the pay period, a good payroll software keeps the process organized, easy, and efficient.

-

Tracking payroll expenses

For any business, payroll is always a recurring expense. As your business grows bigger, your payroll expenditure goes up, and you need complete visibility on one of the biggest contributors to your profit & loss statement month to month. Payroll software can generate all these reports right from employee salary registers to their statutories, to their bonus payouts, allowing you to track expenses down to its last rupee.

-

Making taxes less-taxing

We've seen scenarios of businesses being penalized for non-remittance of taxes. Payroll software helps you adapt to changing tax laws, choose statutories that will be applicable for your business, control the PF contributions, and more. Your organization can stay confident of making accurate tax deductions always.

-

Integration with relevant business apps

Payroll staff coordinate with multiple teams to get inputs for payroll processing every month. The process is complex and time bound, and with a growing business it is only going to become even more tough. Secure integrations allow you to access data from multiple teams in one place. Payroll software closely integrated with HR and Accounting platforms helps you to bring three different but crucial departments under one roof.

-

Securing your payroll data

Payroll system is home to sensitive information about your employees like salary, taxes, bank accounts and more. Payroll software can enhance the integrity of your payroll data with finely-grained access controls. You can differentiate between multiple roles played by each department and eliminate unauthorized access. Collaborate with staffs securely, present the same interface but let payroll staff see only what they need to based on their roles.

Key features of payroll software

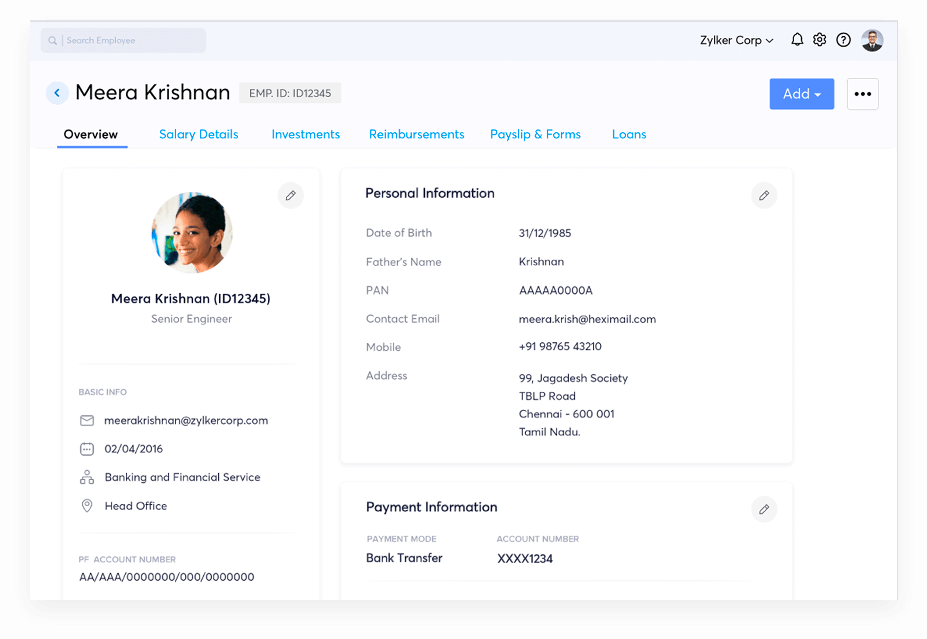

Simplified employee onboarding

As a HR you have tons of paperwork everyday. Your organization's payroll software should allow you to enroll employees onto payroll quickly, giving you the complete profile information of your employees from one place. This can include basic information, salary details, tax, and payment information.

Learn more about employee onboarding

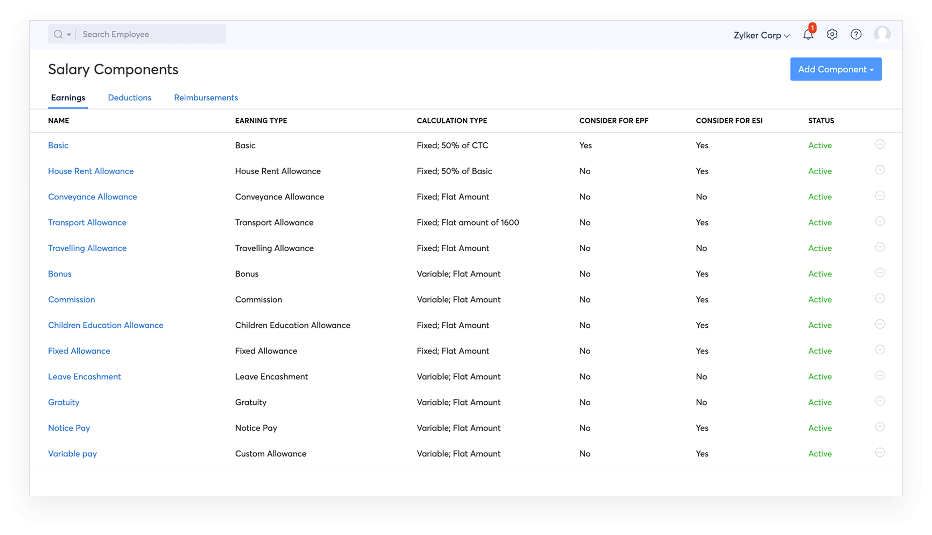

Custom salary components for employees

The hierarchy of your organization can range from top executives to interns. Good payroll software will allow you to customize earnings, allowances, deductions, reimbursements, and flexible benefit plans according to your organization's policy.

Learn more about salary components

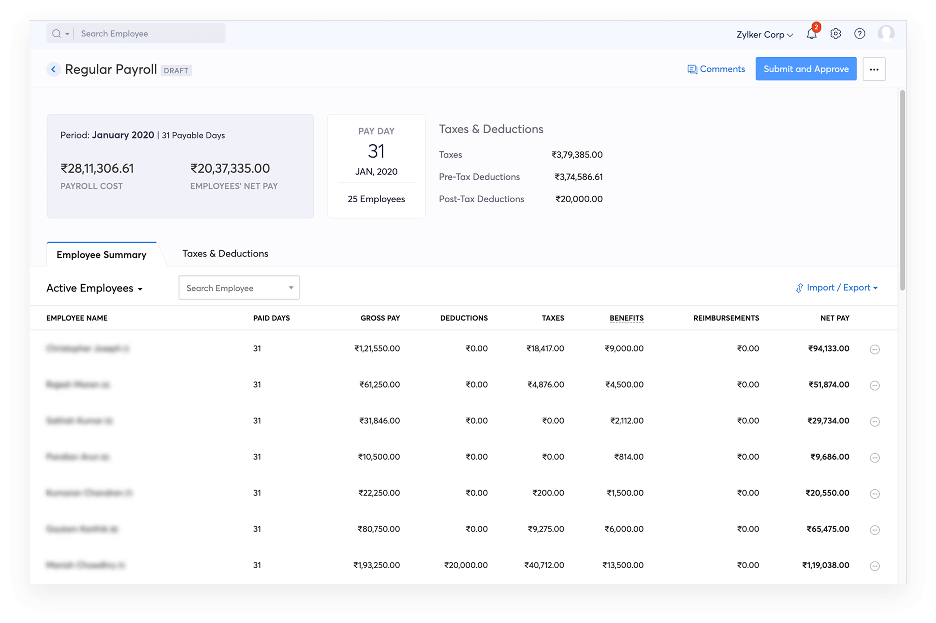

Single click payroll runs

Once you are all set to run your payroll, the software should complete a host of payroll processing activities in one click. This means, the salary computation should be automated, taxes are calculated as per the latest tax laws, payslips, salaries and payroll accounting entries should be taken care by default.

Learn more about payroll runs

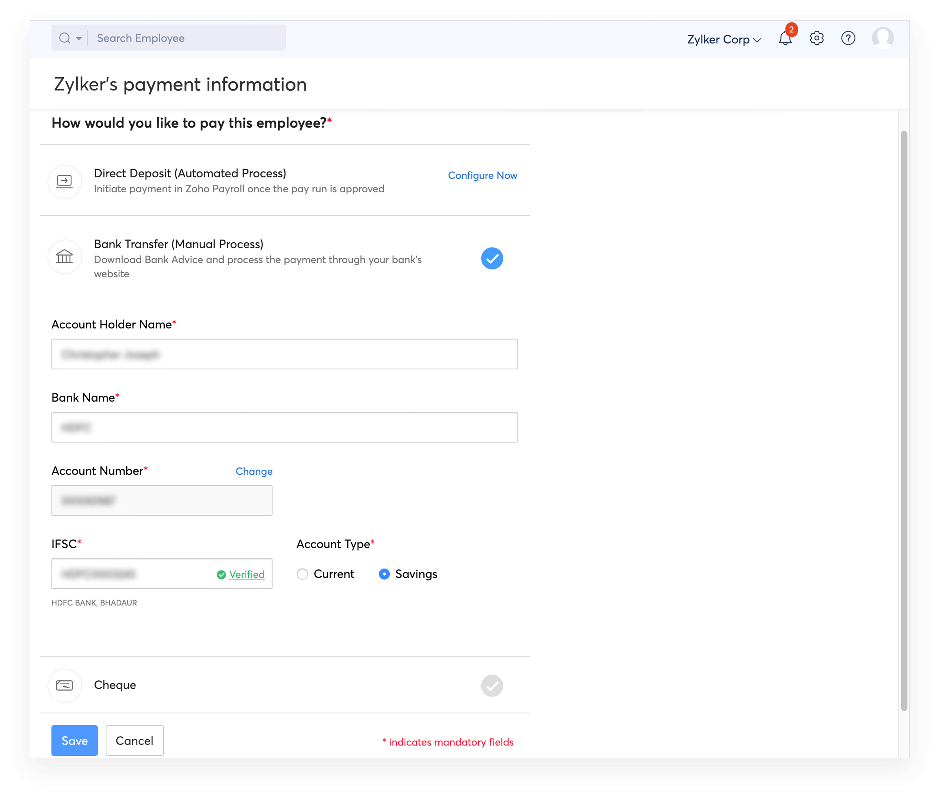

Online salary payments

Paying salaries on-time is a must for your organization. Payroll software that has active integrations with reputed banks can help you transfer salaries securely and on-time for all your employees. Some software even allow you to send salaries in advance to selective employees apart from your regular pay cycles which will help you cater to dynamic employee situations.

Learn more about salary payments

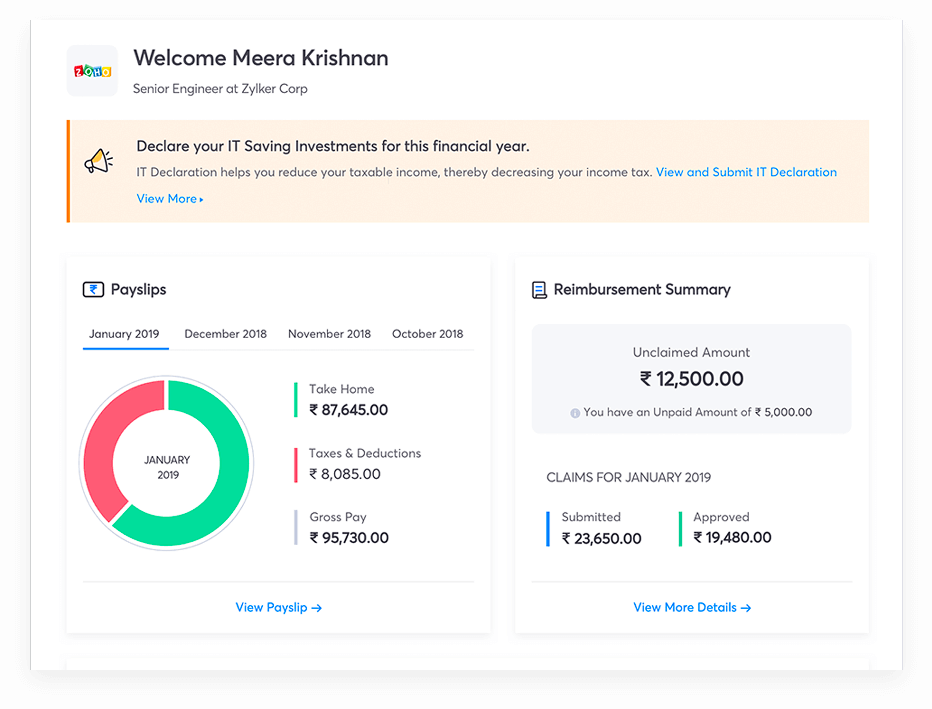

Employee self-service

This is a must for payroll software now, as these portals are inherently digital, allowing you to save plenty of work hours. Self service portals allow employees to download their payslip and tax worksheets, submit their investment declarations and proofs, claim reimbursements and receive timely notifications on deadlines.

Learn more about employee self-service

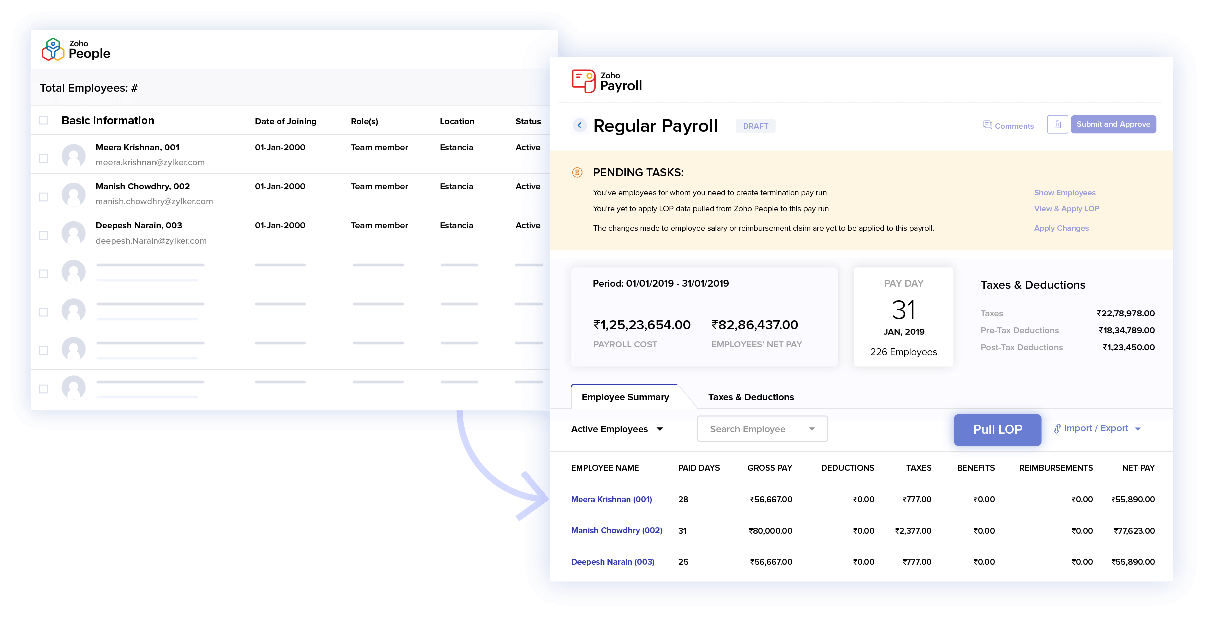

Leave and attendance management

Either with integrations to HRMS or with ability to accept spreadsheet inputs on leave and attendance data, your payroll software should allow you to manage your employees' leave and attendance data easily. By automatically fetching in leave data from a HRMS system, your payroll staffs can complete the work faster.

Learn more about attendance management

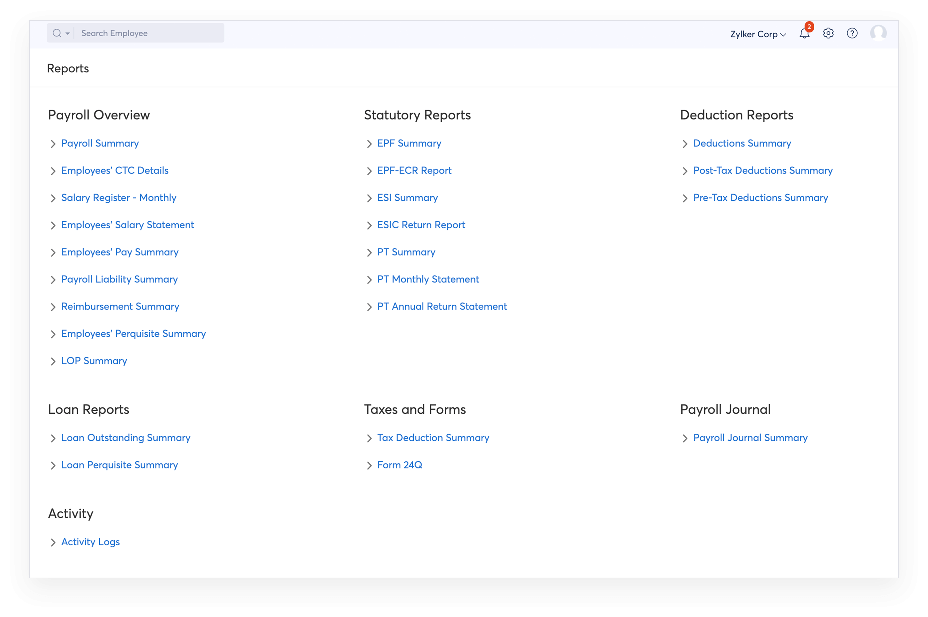

Pre-formatted tax reports

For your company to own a spotless tax compliance record, it is important for your payroll software to automatically generate reports on all the key statutories (PF, ESI, LWF, PT). These pre-formatted tax reports will help you complete the tax filing process quickly, saving you plenty of time in organizing the records. If you can share the reports with your auditors, it's even better.

Learn more about tax reports

Benefits of payroll software

- Timely salary payments

- Increased productivity

- Cost savings

- Spotless compliance records

Factors to consider while you are choosing your payroll software

Choosing an ideal payroll solution is a crucial investment for any business regardless of size. A complex and inefficient system will cost you time and money. Here are some of the most vital factors to look for when you are choosing payroll software.

-

Free trial

The payroll software you choose should allow you to test the waters first with a fully-featured free trial. You'll want to add a few employees quickly, create some salary structures, set a pay schedule and run a test pay run effortlessly before you make the choice.

-

Easy to use

The learning curve should be minimal to get used to the payroll software as HRs are short of time anyways. A clutter-free UI, contextual feature hints, and an intuitive user experience ensures that you'll know your way around the software super fast.

-

Scalable

When you think of payroll software, it should always be long-term. You cannot keep switching from different vendors every month or year. The migration efforts involved is too steep and exhaustive depending on the amount of data you have. The payroll software you choose should be aligned with your growth strategy, and should grow with you.

-

Accessible

Opt for a cloud-based payroll software which lets you access information from home or when you are travelling with just an internet connection, a web browser, and a suitable device like a mobile phone or tablet. This gives you the luxury of accessing your data from anywhere at any time. Mobile versions of cloud-based apps allow employees to follow your announcements and view their payslips instantly even when they’re not in the workplace.

-

Secure

Payroll involves storing some of your employees’ most sensitive information like their personal details, bank information, salary figures, and personal account numbers (PAN). Pick a well-known vendor that takes security seriously so you can safeguard your employee’s data. The vendor should be compliant with the International Security Standards, including a ISO/IEC 27001 security certificate, so you know they follow top-notch protocols.

-

Support

This one's a no brainer. You are dealing with pay checks every month and the support team should be able to lend you a hand when you are in need. Approach the vendor and understand if they have an excellent support system in place. Examine how easy it is to get in touch with them either through email or chat or phone calls and choose vendors who are well-known for providing quality support.