NPS Calculator

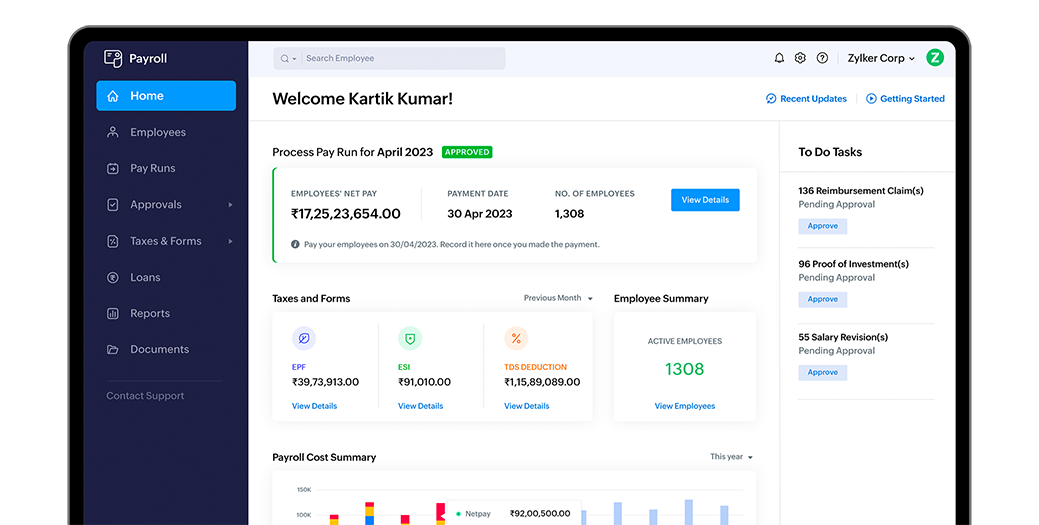

by Zoho PayrollWhat is NPS?

NPS stands for National Pension Scheme. As the name suggests, it is a scheme via which Indians can secure their finances post-retirement. It aims to help you grow your corpus via small monthly investments that won't burn a hole in your pocket. Anyone between the ages of 18 and 60 can invest in the NPS given that they comply with the KYC guidelines.

A -Total corpus amount at maturity

P - Principal sum

r -Rate of interest per annum

n -Number of times interest is compounded per year

t -Time (in years)

Major advantages of using the NPS calculator

Our NPS Calculator can assist you in the following ways:

-

It tells you what you can expect on the fund's maturity so that you can plan your post-retirement life accordingly.

-

You don't have to power through endless numbers manually and formulae to know how much money you'll get when you can compute it at a single click.

-

Know how much you'll save up on taxes under Section 80 CCD and accordingly plan your tax-savings investment portfolio.

How can you calculate pension amount with this tool?

Zoho Payroll's free NPS calculator shows you the provisional lump sum and pension amount you get at retirement based on your monthly contributions, annuity purchased, and expected rate of return.

Just enter the required data in the relevant fields. Our free NPS calculator will tell you how much you can expect after retirement.

Investment per month:

The monthly investment amount you contribute towards your NPS.

Expected return:

This is the estimated return you expect to achieve with your NPS investment. It varies based on your investment choice, market conditions, and the performance of the assets.

Age at the time of investment and retirement:

Enter the age at which you started investing for NPS and the age at which you plan on retiring.

Annuity:

Annuity in NPS refers to the pension you will receive every month from the Annuity Service Providers (ASP) after your NPS reaches maturity.

Annuity percentage:

This is the percentage of pension wealth you would like to reinvest to purchase an annuity.

You can reinvest a minimum of 40% to a maximum of 100% of the corpus to purchase an annuity. Any amount remaining can be withdrawn as a lump sum at the time of retirement.

Users who are subscribed to tier 2 of NPS, can withdraw funds without any restrictions.

Let us see an example.

Albert, a 25 year old employee, decides to contribute Rs. 3000 every month towards his NPS account. He keeps contributing for the next 35 years, expecting a return of 10% p.a. On his 60th birthday, his total investment will be Rs. 12,60,000, his interest earned will be Rs. 1,02,24,830 and his lump sum value will be Rs. 68,90,898.

In addition to the lump sum amount, Albert decides to buy an annuity at 40% p.a. This is what his pension account figures will look like:

12,60,000

You invested

+

1,02,24,830

Interest earned

=

1,14,84,830

Maturity amount

Lump sum value

₹68,90,898

Annuity value

₹45,93,932

Monthly pension