Finance Free Apps

-

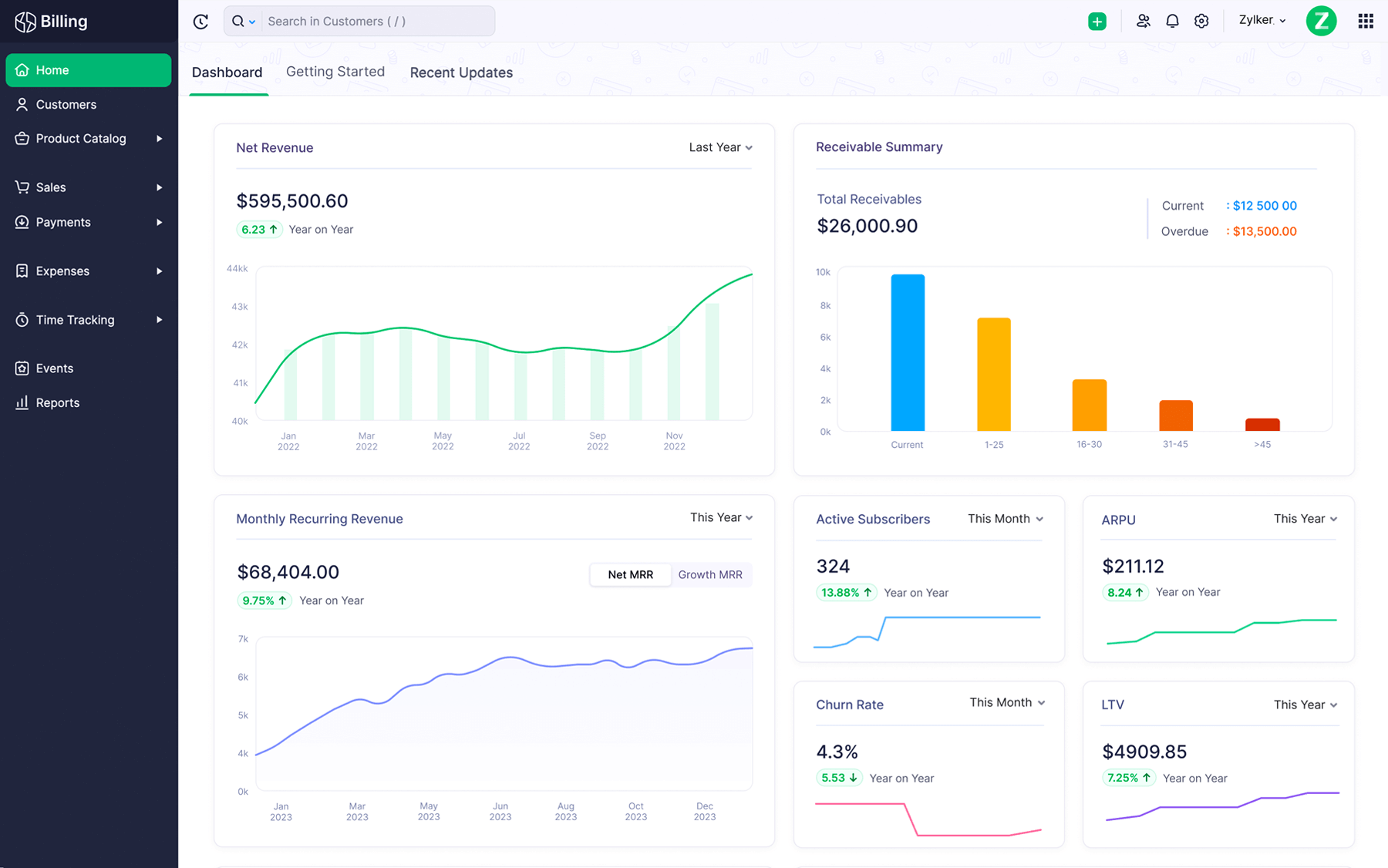

Billing

-

Finance & Payroll

- HMRC Furlough Claim Calculator

- Income Tax Calculator

- Paycheck Calculator

- India GST Calculator

- UK VAT Calculator

- UK Flat Rate Calculator

- Corporation Tax Calculator

- Financial Report Templates

- Free Project Cost Quote Calculator

- Form W-9 Generator

- Payslip Generator

- NPS Calculator

- EPS Pension Calculator

- Gratuity Calculator

- Statutory Bonus Calculator

- HRA Exemption Calculator

-

Inventory

-

Expense

-

-

Spread the word

-