- HOME

- Payroll operations

- What is payroll? Definitive guide to payroll in India

What is payroll? Definitive guide to payroll in India

Unless you are an accountant or you are us, you probably might not be too excited about the topics on payroll. Primarily because it is usually thought of as a boring or complicated process. However, as a business owner, you need to understand the intricacies involved in payroll because not only it is one of your top expenses every month, but getting payroll wrong has serious consequences. We are writing this for more than 60 million small business owners in India, breaking down the entire process to help you get payroll right, and also to show you how simple it actually is.

In this guide, you will learn the basics of what payroll is, why is it important, how it's done in India, how does a successful payroll process looks like, and more. Let's start with the basics first.

What is payroll?

In simple terms, payroll can be defined as the process of paying a company's employees. It includes collecting the list of employees to be paid, tracking the hours worked, calculating the employee's pay, distributing the salary on time, and recording the payroll expense.

In order to get these done, there's tons of background work involved because payroll is more than just about calculating paychecks. It's an intricate set of process which requires different teams to work in tandem. But all these complexities can be managed effortlessly by the standardization of processes, selecting the right service delivery model, and using modern technology to manage payroll operations.

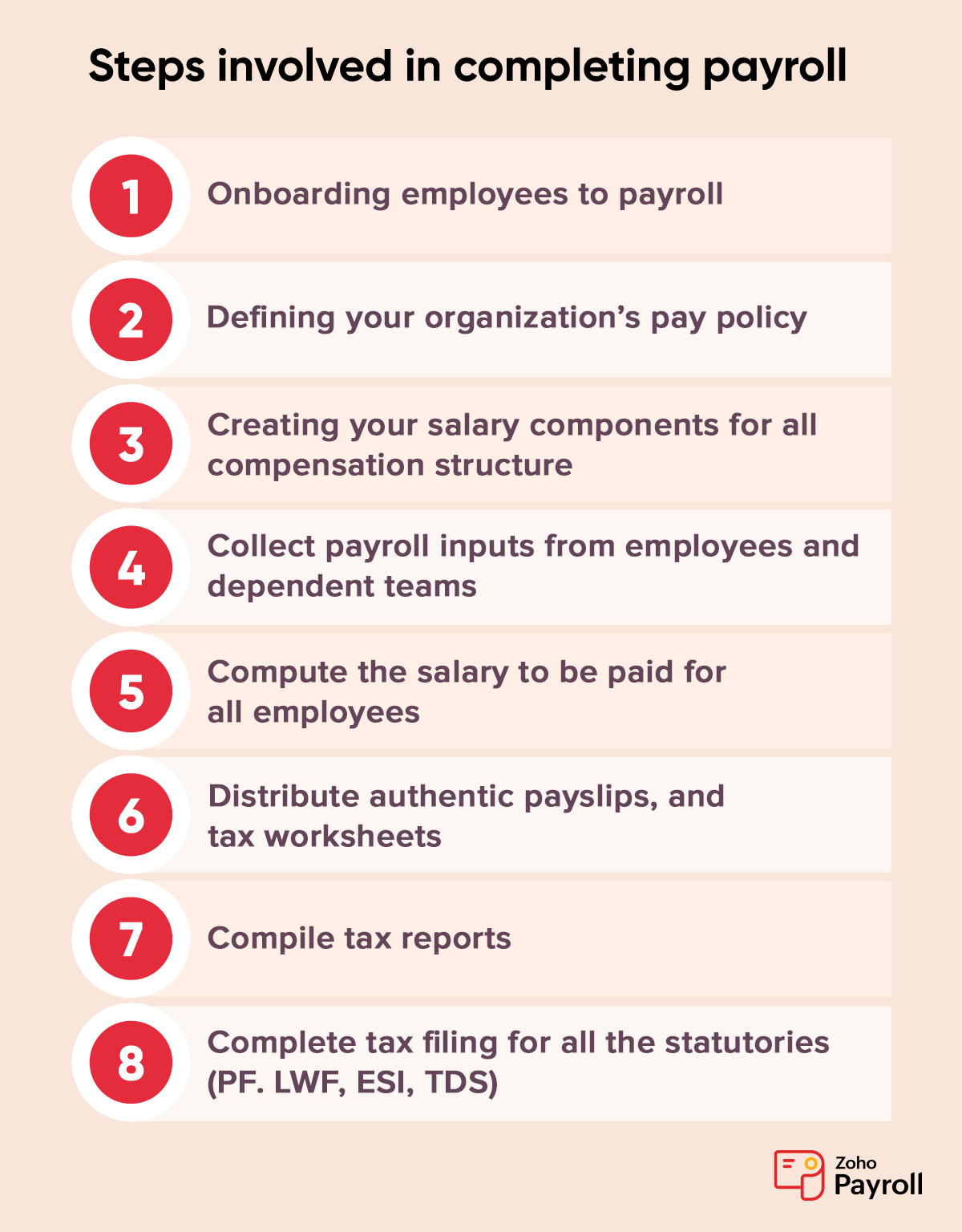

As a business function, here's a high-level overview of the series of steps involved in completing payroll successfully from scratch.

What is the need for businesses to do payroll?

Keeping a record of the salaries paid to employees is an instant thought that comes to mind. But there's more at stake for businesses. Payroll has a serious impact on the net income of an organization. It is also a business function that is subject to several laws and regulations. Because of the legal and ethical factors involving payroll, it is very crucial for businesses to do payroll and keep a spotless record of its payroll.

In cases where they are unable to maintain a clean record, some of the common notions that spread within the employees about your business include financial instability of the company, poor and untrustworthy management.

What are the challenges involved in processing payroll?

Payroll management or administration can be a mundane task, but it's not easy to get it right. The challenges can include:

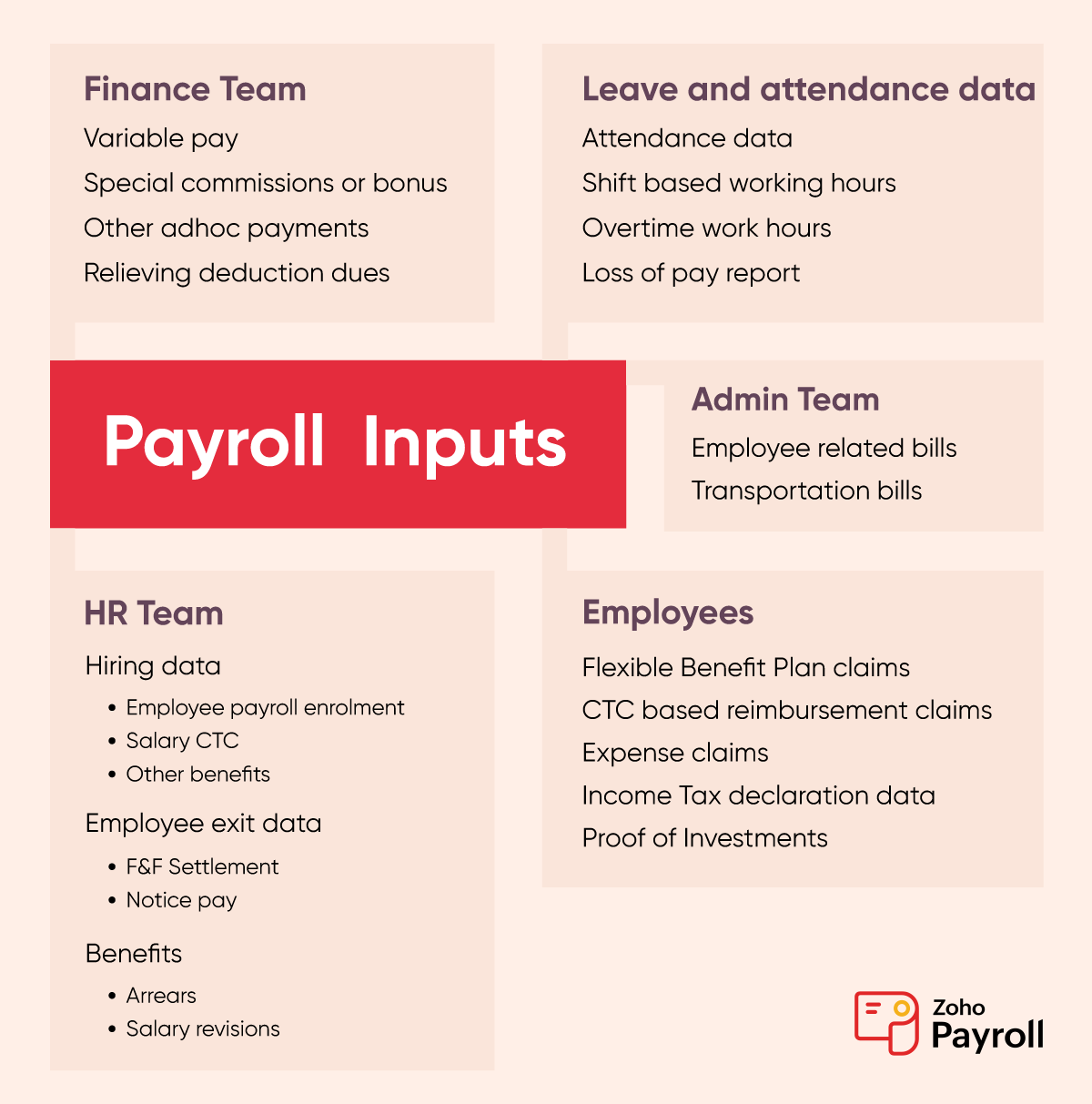

Coordinating multiple teams

- Payroll staffs spend countless hours collecting information from the HR, Finance, Expense, and Attendance management teams. Even employees submit information like bills for reimbursement claims and tax-saving records.

- It takes a lot of dashing around to get all of this information on time, every month, and if you’re a small business owner trying to do it all alone, it is nothing short of overwhelming.

Staying compliant with payroll laws

For businesses in India, all the statutory computations including PF, ESI, PT, LWF, IT, Shops and Establishments have to be taken into consideration. Any issue with tax remittance or miscalculation of any of these components could leave your business at a serious disadvantage.

Caring for employees' morale

- Employees expect to get paid on time for their time and work. A small paycheck misstep can affect their trust in you, and might be what makes them decide to leave.

- In a survey conducted by SD Worx, a leading global payroll service provider, 44% of the surveyed employees considered leaving their employers because of incorrect payments.

Depending on legacy methods

- You might feel more at home using a paper-and-pen approach for calculating work hours because it's what you are used to it before, but this approach puts you in the danger zone. Papers can be misplaced, torn, or even thrown away. They also open the door to inaccurate calculations and eat up a lot of your time.

- The immediate alternative, a spreadsheet-based payroll system, can bail you out in some ways but it doesn't really solve your problems. Spreadsheets are familiar and seem easy, but they take a lot of expertise to use well. You'll need to hire employees who understand advanced concepts like pivot tables, concatenate functions, split fields, and v-lookup, and who can audit your formulas regularly to ensure that the calculations are working correctly every time. You're dependent on your staff's knowledge to keep the system running smoothly.

Blue-print of a successful payroll practice

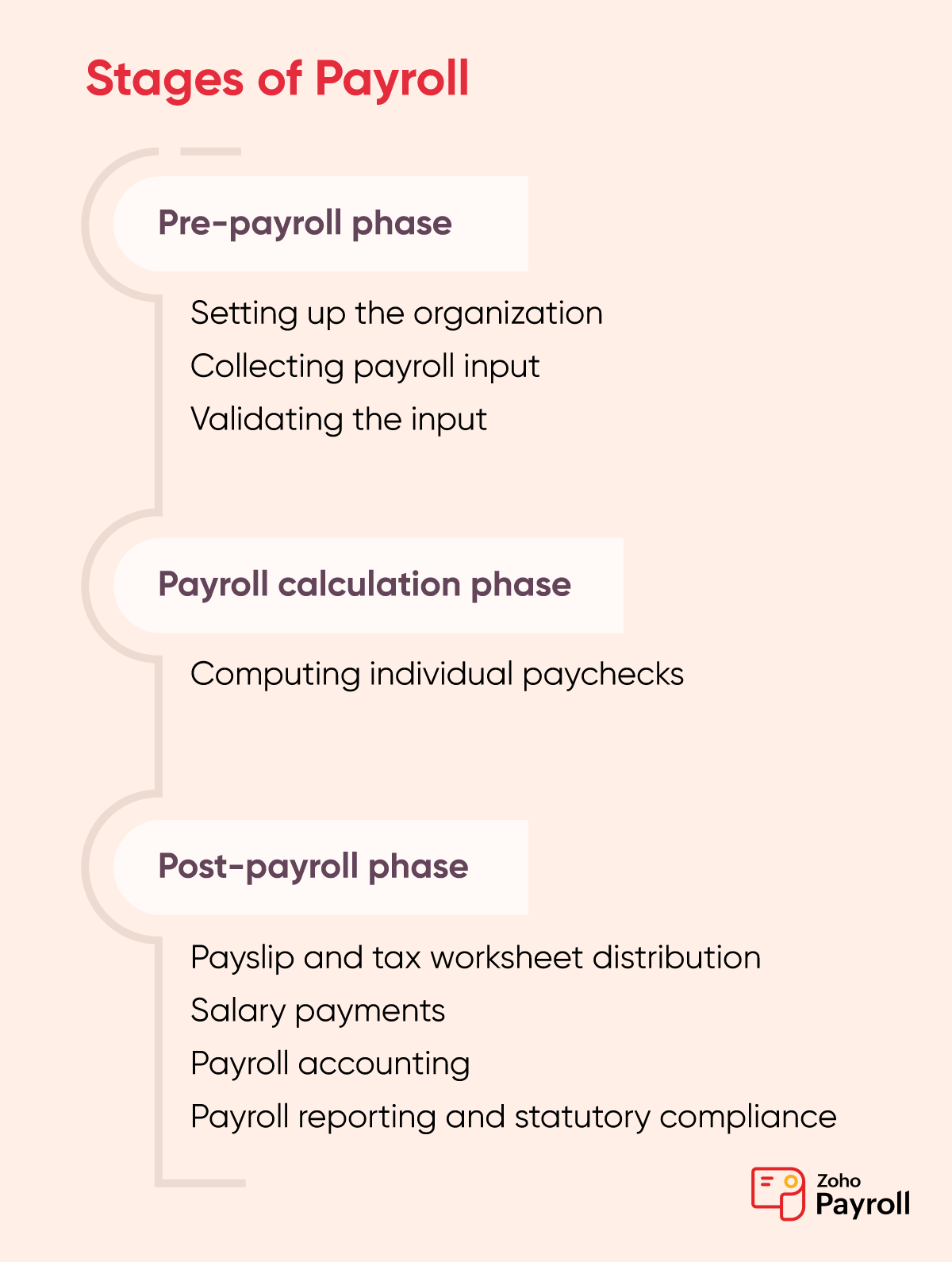

At the start of this guide, we spoke about how you can effortlessly take care of payroll by standardizing the practices. Since it involves numerous activities among multiple teams, the payroll staff needs to be on top of their game every single day monitoring the employee count, changes to statutory policies, new deduction rules, and more. To simplify the entire process for you, let's classify it into three large stages.

Pre-payroll phase

Setting up the organization

Every day, thousands of new businesses sprout all over the world. Each business has its own philosophy, approach to employee engagement, and work culture. The first step in standardizing payroll input is to set clear organizational policies, including:

Business profile

Ensure that you have a registered business number associated with your PAN and TAN. Payroll forms rely on registered numbers to send tax forms, payslips, and more.

Work location

If your business has multiple work locations across India, it's important to define a policy for each region.

Leave policy

Every employee is entitled to take leaves in various categories, like sick leave, casual leave, vacation leave, and privileged leave. Setting a leave policy is of paramount importance, as you'll need to consider it when calculating paychecks.

Attendance policy

- Integration with biometric devices and timesheets also has a direct influence on the employees' pay.

- Define organization policies that compute attendance for regular hours, shift hours, half-day permissions, and on-duty requests. Integration with biometric devices and timesheets helps you to gather employees' attendance data.

Statutory components

Adherence to Indian payroll laws is necessary to keep your business on a legal footing. You have to decide what you will offer your employees from the standard list of statutory components including PF, LWF, ESI, PT, IT, and Shops and Establishment Act.

Salary components

Design with salary components that can embrace diverse compensation structures. Select the right earnings, allowances, deductions, reimbursements, and flexible benefit plans according to your organization's policy.

Pay schedule

Decide on your organization's payday and pay schedule so employees can know when they'll be paid and plan their finances accordingly.

Employee information

Gather mandatory information like employees' DOJ, designation, and department.

Payroll calculation phase

Depending on how you process payroll, this phase depends on how you do the calculation part. If you are someone who works with a system, then the data collected in the pre-payroll phase is now fed into the payroll system to calculate every employee's paycheck. The outcome of this process will be the actual salary of each employee after considering all the withholdings, taxes, and deductions.

Post-payroll phase

Salary payments

Paying salaries to your employees forms the major part of the post-payroll process. Once the payroll calculation is completed, you can send the bank advice to your corporate bank for salary disbursement. But you can skip right over this process if you opt for payroll software that has an in-built direct deposit feature.

Payroll accounting

Salaries paid to your employees are one of the biggest expenses for your organization. As part of maintaining your organization's accounts, you should ensure that employees' salaries are recorded.

Payroll reporting and compliance

Statutory deductions like EPF, ESI, and TDS are automatically deducted at the time of processing payroll. The organization then has to remit the withdrawn amounts to the respective government agencies. The due date for each deduction is different. After the dues are recorded with the government, businesses can file their return forms (for example, for filing the PF return, an ECR is generated and filed).

How cloud-based payroll software can uncomplicate payroll

While the above mentioned structured approach can introduce some much-needed organization to your payroll process, adding the right technology can help you to reduce your dependency on spreadsheets or eliminate it altogether. With good payroll software, mundane tasks can be automated, and complex ones can be simplified.

Increased efficiency

- Typically, payroll staff spend countless hours collecting payroll inputs, but having an integrated payroll system helps to streamline the process. Software that includes employee self-service portals allows business owners to delegate routine documentation tasks to employees, reducing the time burden even further.

- Payroll staff are always pressed for time, and disorganized spreadsheet-based data makes things even worse for them. Payroll software organizes your data and provides a cleaner user interface, which makes life much better for your payroll staff.

In-built compliance

Staying up to date with all the changes in payroll laws is an area where payroll software really excels. Readily available reports make it easier for employers to pay their taxes and handle employees' statutory component deductions including Provident Fund (PF), Labour Welfare Fund (LWF), Professional Tax (PT), Employee State Insurance (ESI), and Tax Deduction at Source (TDS) based on their pay scale, mandated percentage, and work location.

Increased accuracy

- Payroll software eliminates the possibility of missing out on payroll inputs. For instance, tax-saving declarations and reimbursement bills are always included.

- Payroll computations are fully automated, eliminating the need to calculate paychecks manually or check the formulas in a spreadsheet.

Effortlessly scalable

Growth is inevitable for any business that's running successfully. A system that grows with you as you expand saves you the time of looking for alternatives as you outgrow previous solutions.

Secure employee self-service

Are you still dependent upon paper for collecting reimbursement bills, IT declarations, and POI data? Have you ever missed a reimbursement bill submitted by an employee and messed up their payroll calculation as a result? A self-service portal with in-built payroll validation helps you skip the chaos.

Powerful administration tools

Payroll is a crucial part of your finance operations, but exposing your financial data to all your payroll staff is a strict no. Payroll software that comes with finely-grained administration privileges helps you assign the right permissions to each employee.

Increased collaboration with other apps

- An integrated HRMS system brings in crucial HR data for processing payroll automatically. It saves payroll staff from sifting through leave and attendance records, employees submitted reimbursement bills and more.

- Tallying accounts can require many hours. A payroll system with the ability to automate your accounting process keeps your accounts organized, and saves you having to struggle through the numbers after every pay run.

Decreased cost

Infrastructure procurement and maintenance make up a huge part of your organization's bills. Cloud-based payroll software eliminates the need for specialized infrastructure, resulting in savings for your organization.

Decreased liability

As an employer, it's your responsibility to get payroll right. By enlisting payroll software to ensure that your calculations are spot on, you can reduce both your workload and your risk of liability.

The way forward

Messy payroll processing is a thing of the past. We'll leave you some valuable tips on what to look for when you go choosing payroll software to streamline your payroll operations.

Core payroll features

- Automatic payroll and payslip distribution

- Statutory compliance

- Customizable salary components

- Online salary payments

- Employee self-service portal

- Payroll reports

- Leave and attendance handling

- Full and final settlements

- Spreadsheets data import

Security features

- User roles and permissions

- Cloud security

- Data privacy standards

Usability features

- User-experience

- Accessibility

About Zoho Payroll: Refreshingly simple payroll software

As part of an extensive suite of 55+ products, with more than 100 million users worldwide, Zoho Payroll is our cloud-based payroll processing software designed to transform the way you've done payroll over the years. Tailored to fit the Indian statutory system with a refreshingly simple UI, Zoho Payroll is the de-facto choice for many businesses to streamline their payroll operations end-to-end.