Keep your business on good legal footing with Zoho Payroll. Apply appropriate tax deductions, calculate mandatory government contributions, and generate tax-compliant payslips.

Keep your business on good legal footing with Zoho Payroll. Apply appropriate tax deductions, calculate mandatory government contributions, and generate tax-compliant payslips.

Stay confident in making accurate tax deductions at all times. Changing tax laws, customized pay runs, multiple salary components, and multiple employee pay grades are all easily accounted for in Zoho Payroll.

Declare your organization's and employees' PF contributions, and let Zoho Payroll generate payslips with accurate deductions every month, while keeping you compliant.

Keep the resources ready to help employees wade through unforeseen circumstances with regular contributions to Employee State Insurance.

Got employees working in different states? With Zoho Payroll, you can automatically deduct professional tax on the right schedule, whether it's every month, every six months, or every year.

Generate a digitally-signed Form 16 to help employees understand their tax liabilities for the financial year.

Enable TDS deductions for employees who fall into the income tax slabs. See monthly payslip breakdowns and year-to-date tax liabilities automatically.

Process LWF automatically for employees. Zoho Payroll calculates and makes the right contributions across all the states.

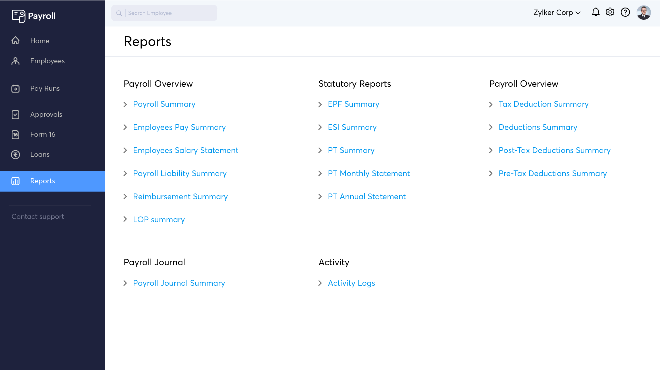

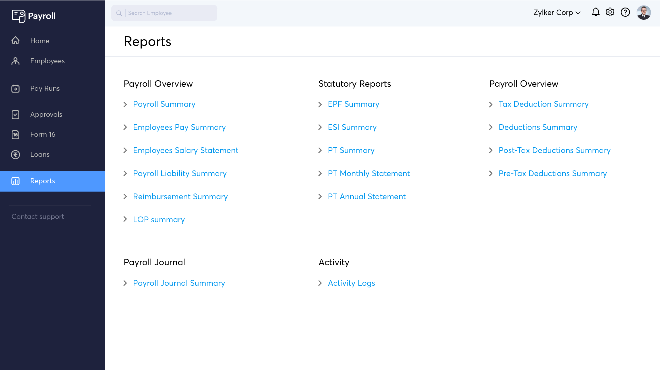

Maintain your clean statutory compliance record and generate reports for the tax authorities whenever called for. Zoho Payroll generates a summary of your EPF, ESI, and Professional Tax instantly.

Get insights into your payroll operations in seconds. Run specific reports, from employee salaries and reimbursements to overall payroll costs, in a single click.

Prepare your tax deduction summary report for periodic evaluation. Get a complete report on all your employees, their taxable income, and their income tax withheld.

Let your software account for your payroll expenses for you. Zoho Payroll automatically adds payroll journal entries and condenses them into a neat, organized summary.

Follow what's happening in your payroll department with detailed audit reports. From recent pay runs to updated employee records, you can review every action performed by your payroll staff.