Menu

-

FeaturesSee all featuresCore FeaturesComplianceEffortless Accounting

- Pricing

-

SolutionBy Size

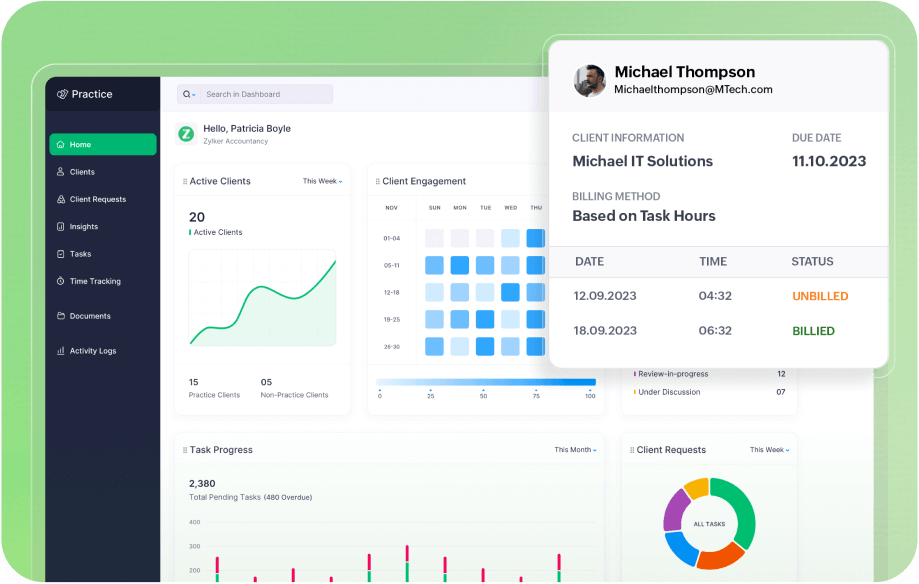

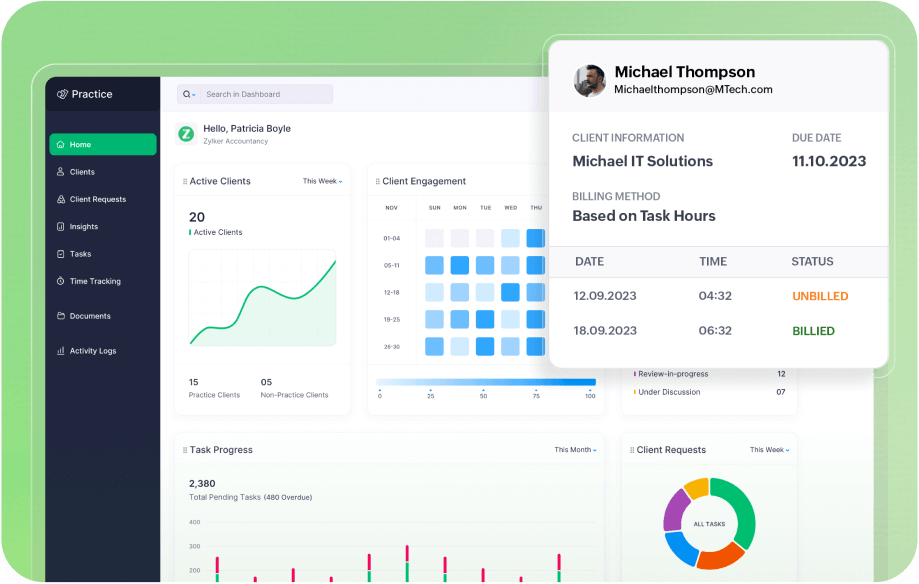

Introducing Zoho Practice

The ultimate practice management software for modern accounting and bookkeeping firms.

- Customers

- Partner with us

-

Resources

Tax Resources

A comprehensive resource for understanding the goods and service tax

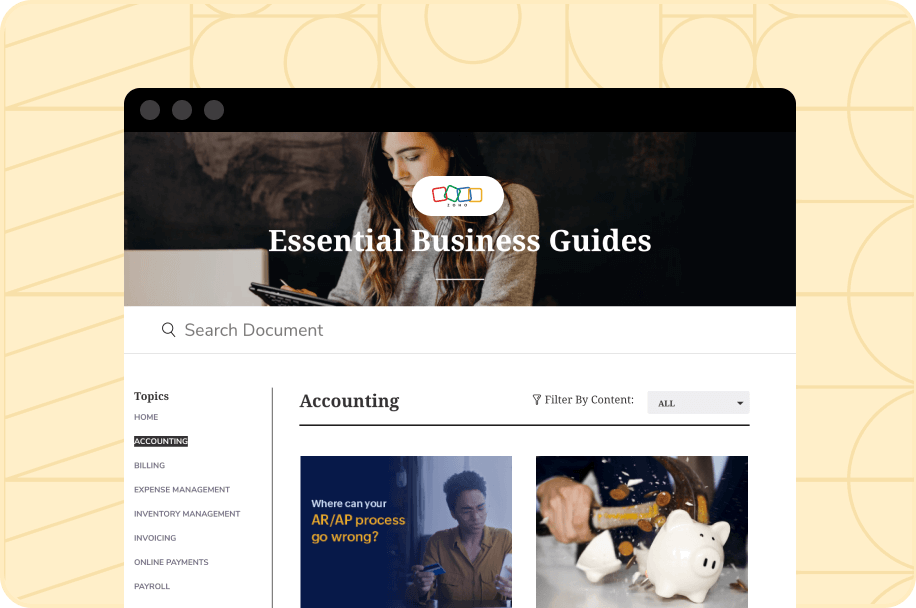

Business Guides

Find valuable insights into finance and accounting

- Available on IOS

- Available on Android

-

FeaturesSee all featuresCore FeaturesComplianceEffortless Accounting

- Pricing

-

SolutionBy Size

Introducing Zoho Practice

The ultimate practice management software for modern accounting and bookkeeping firms.

- Customers

- Partner with us

-

Resources

Tax Resources

A comprehensive resource for understanding the goods and service tax

Business Guides

Find valuable insights into finance and accounting

- Available on IOS

- Available on Android