Australia GST

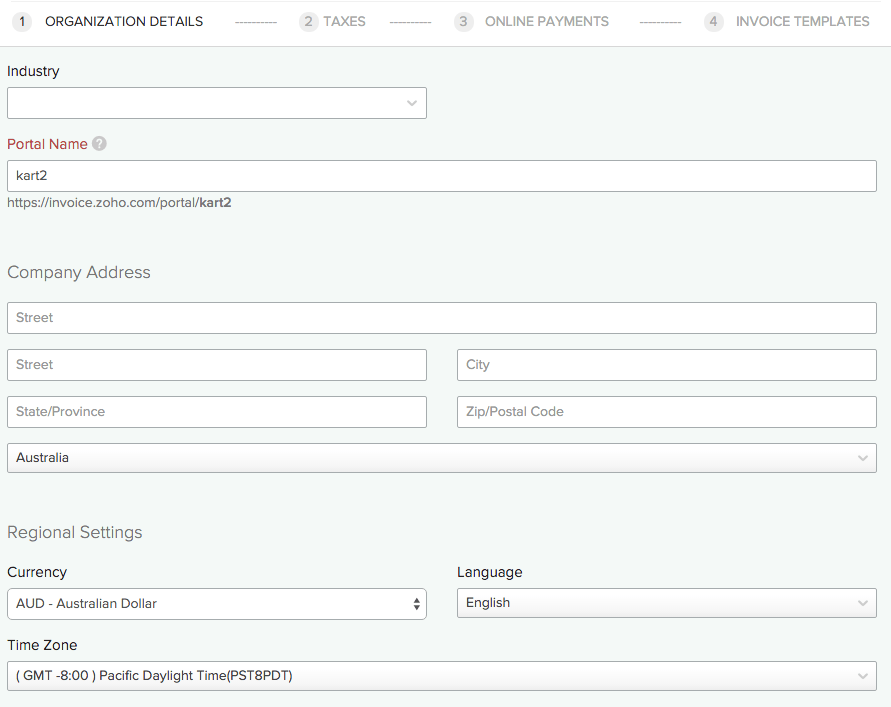

Create a new organization in Zoho Invoice and choose Australia as the country.

General Information: GST: Goods and Services Tax is a value added tax of 10% that is applied on the sale of goods and services in Australia.

IN THIS PAGE…

Tax

Tax Information in Contacts & Items

Invoices

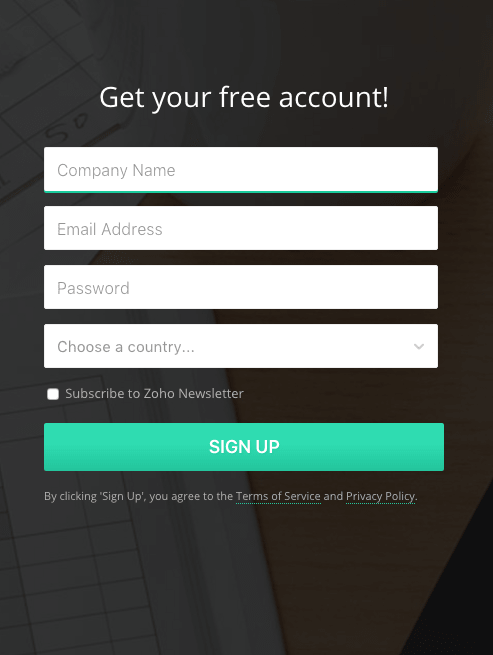

Creating an Australian Organization

- If you are signing up as a new user, select Australia while choosing the Country from the drop-down.

- If you already use Zoho Invoice, create a new organization and select the Country as Australia.

Insight: You can also set your taxes in the Quick Setup that follows. You will learn how to setup taxes that will be applicable for your business in Step 2.

Tax

Create a New Tax

- Click on

and select Taxes.

and select Taxes. - Select the checkbox next to “Is your business registered for GST?". Fill up the information the fields that are displayed including Australian Business Number, Reporting Period, Generate First Tax Return From and Tax Basis.

- Finally click on Save.

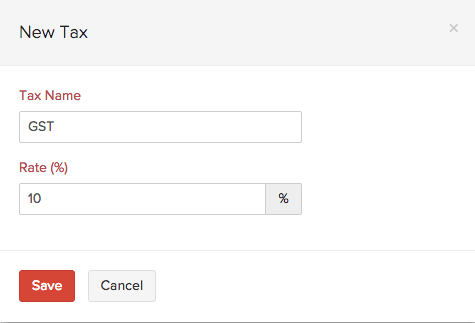

- In the screen that follows, click on +New Tax, placed on the top-right corner of the taxes window.

- In the new window that appears, enter the Tax Name and Rate(%).

Click on Save to save the tax.

Create a New Tax Group

- Click on

and select Taxes.

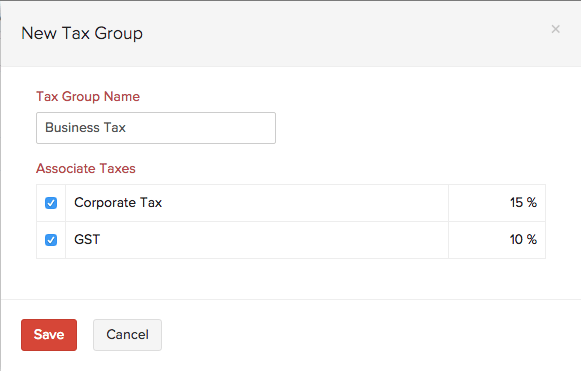

and select Taxes. - Click on + New Tax Group option under new tax drop down, placed on top-right corner of the taxes window.

- Before you add a tax group, you need to have taxes already added.

- Enter the name of the tax group and select the taxes that needs to be added.

Click on Save the tax group.

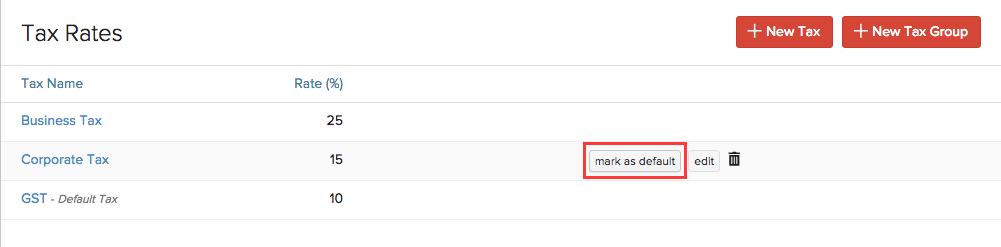

Default Tax

The Default Tax will be used in transactions when tax preference (Taxable/Tax Exempt) is not set for the involved customers. The first tax you create will be marked as the Default Tax initially. However, you can mark a different sales tax as default as well.

Default Tax can be useful for the following scenarios.

- When customers are imported into Zoho Invoice, their tax preference is not set. When these customers are involved in transactions, the Default Tax will be applied in those transactions.

- The tax preference will also not be set for customers who were created before tax was enabled. Here again, the Default Tax will be used in transactions where these customers are involved.

Insight: Default Tax is not automatically associated with a customer. It is only used when tax preference (Taxable/Tax Exempt) is not set for the involved customers.

To mark a different tax as default, hover your mouse over the tax you wish to select as default. You will find the mark as default button appearing next to the tax. Select it to make the tax a default tax.

Tax Information in Contacts & Items

Contacts

Associate a tax for a contact

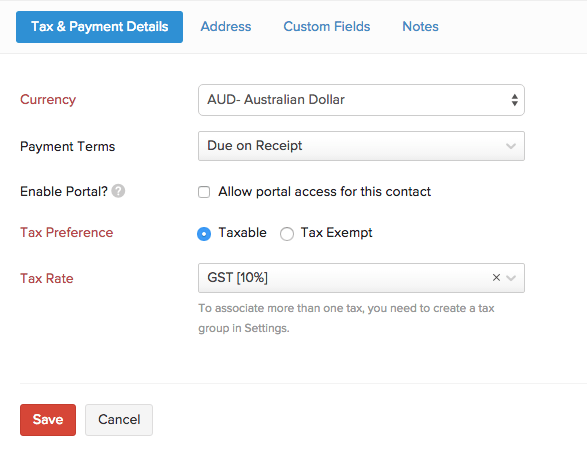

You can associate taxes to contacts either while creating or editing them.

- Go to Contacts module and select + New to create a contact.

- After filling the customer details, under the Tax & Payment Details section, select Taxable for Tax Preference.

- For the Tax Rate, select the appropriate tax from the drop-down which has already been created. You can also create a new tax by selecting + New Tax in the drop-down.

- Click on Save.

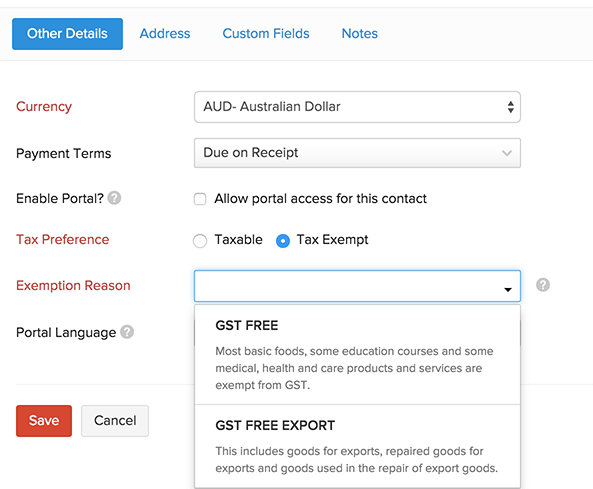

Making a Contact Non-Taxable

- Select Tax Exempt under Tax Preference.

- Select the Exemption Reason from the drop-down.

- Click on Save.

Insight:

- GST FREE: The price of the product or service you sell to a contact will not include GST.

- GST FREE EXPORT: The price of the product will not include the GST if you intend to export and sell your items outside Australia.

Click here to learn more about it.

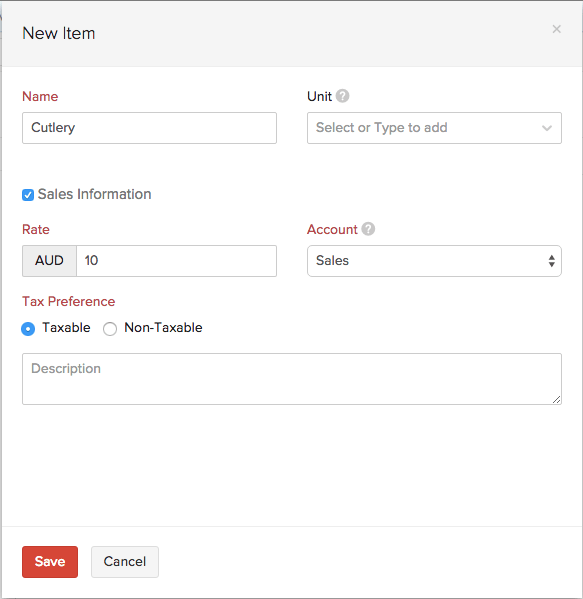

Items

- While creating an item, you can choose to make it taxable or non-taxable.

- After entering the relevant details, select the Taxable check box and save it. This will make the item taxable.

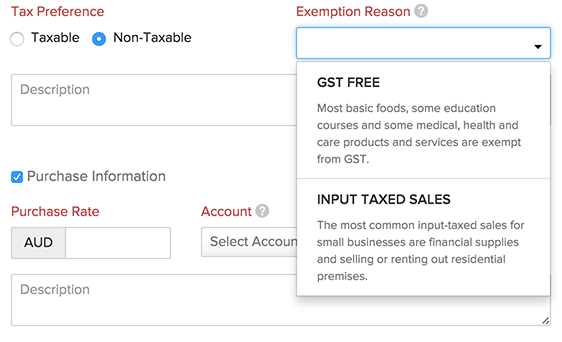

- If you wish to make the non-taxable, select the Non-Taxable option. You will be prompted to select an Exemption Reason, which you can select from the drop down.

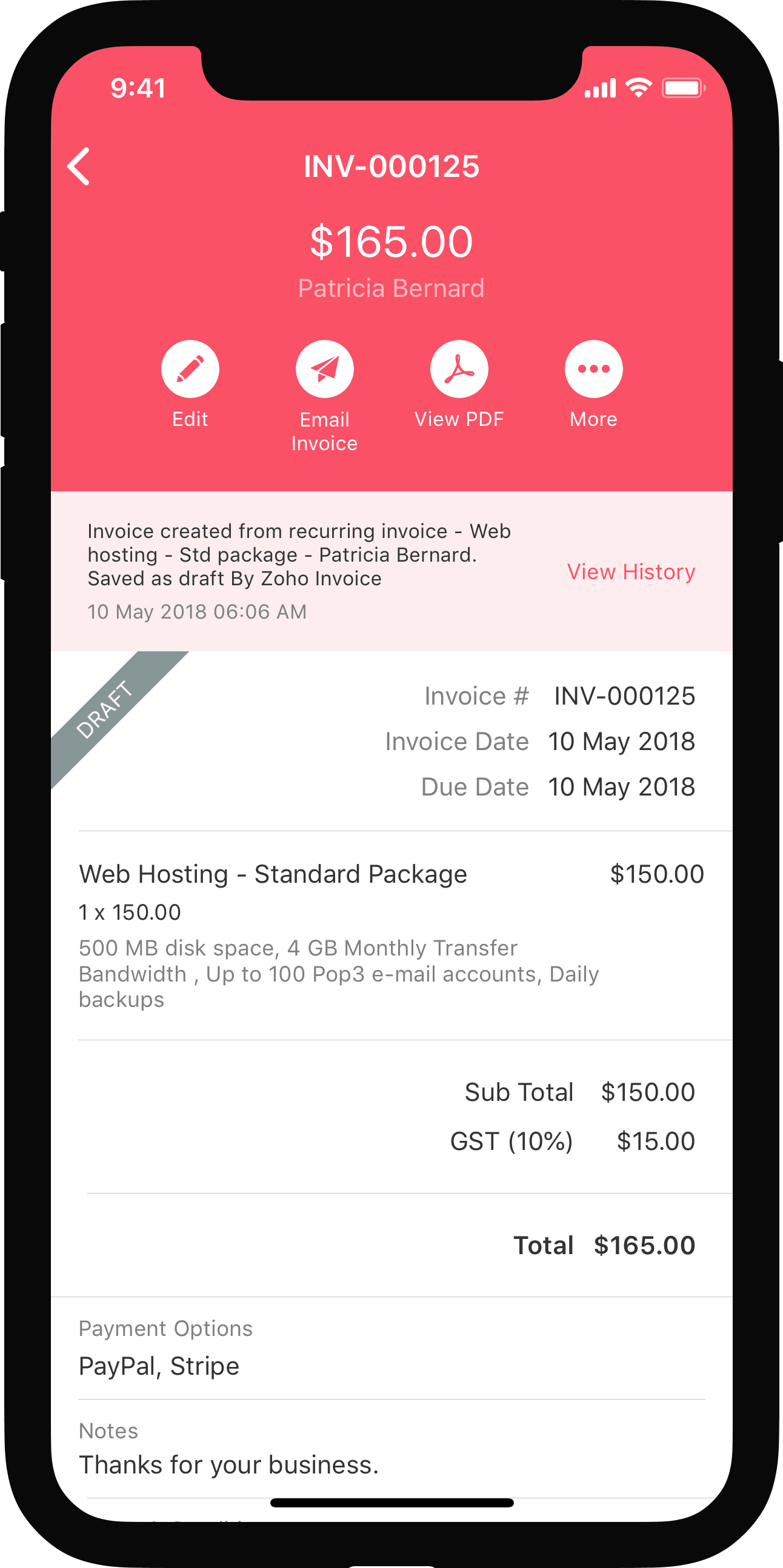

Invoices

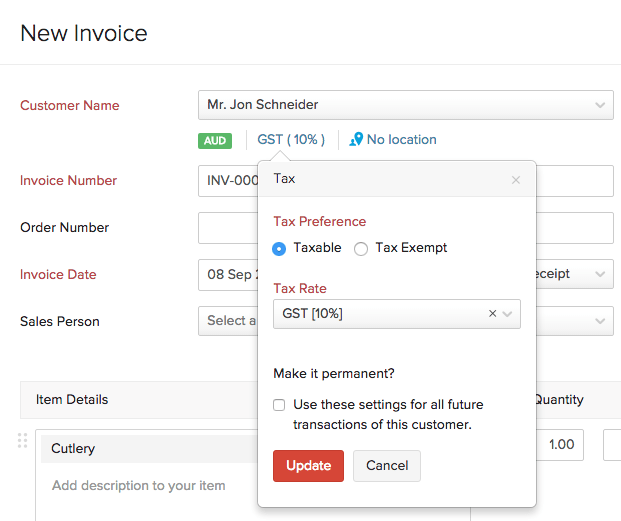

Tax Information in Invoices

- While creating an invoice, the tax information can be seen just below the Customer Name field.

- Here, you can change the tax preference for the particular invoice i.e: you can also make the invoice non-taxable by selecting the Tax Exempt option. Selecting the Make it permanent? option, the tax preferences for the contact will get updated.

Insight: INPUT TAXED SALES: The price of goods and services do not include GST.Click here to learn more about it.

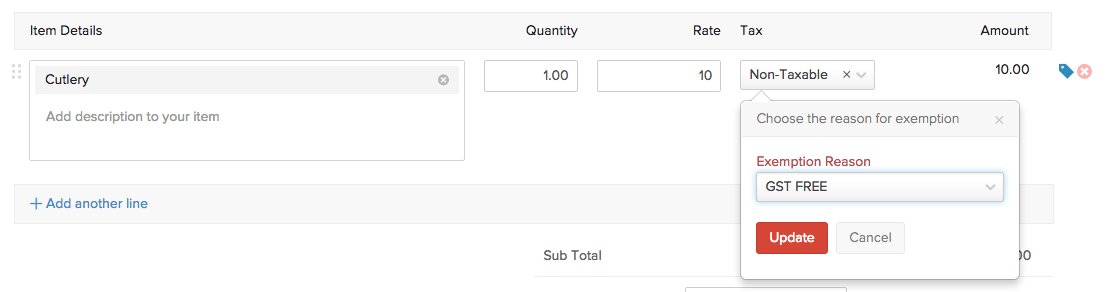

Making an Item Non-Taxable

- If you are adding an item under item details while creating an invoice, and if you wish to make it non-taxable, select Non-Taxable option from the Tax drop down.

- In the next window that appears, choose the Exemption Reason.

- Click Update.

Showing Tax Registration Number in Sales Transactions

- Click on

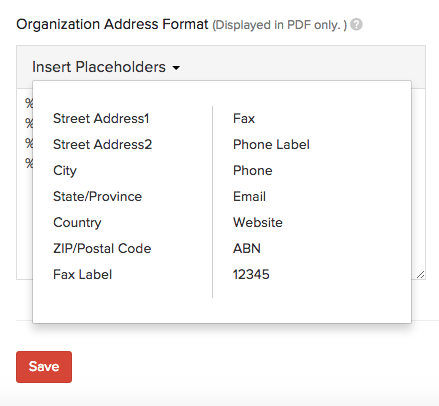

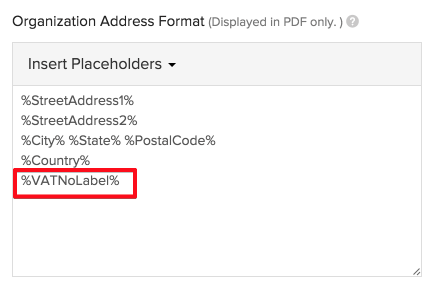

and navigate to More Settings -> Preferences -> General.

and navigate to More Settings -> Preferences -> General. - Scroll down to the Organization Address Format section.

- In the Insert Placeholder drop down, you will find ABN which stands for ‘Australian Business Number’.

- Insert the placeholder in the address format.

- Click on Save.

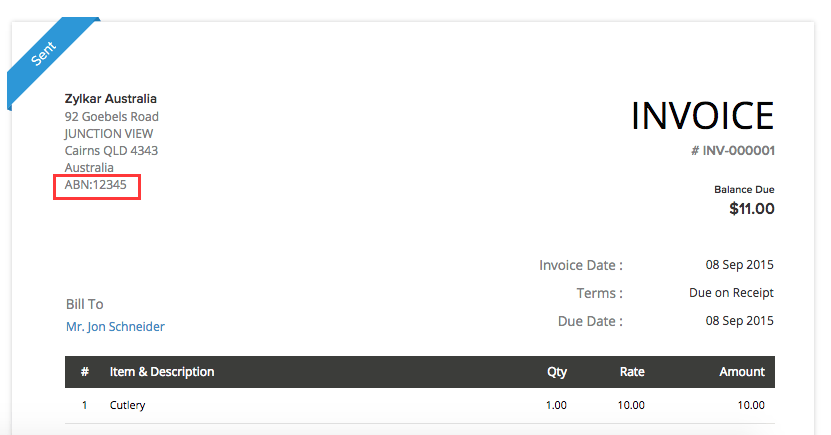

- Now create a sales transaction, and you can find the Tax Registration No. with the organization address.

Taxes in Purchases

You can also choose to make purchase transactions such as Expenses as Taxable or Non Taxable. While creating such transactions, select a tax from the drop-down to make the transaction taxable or select Non-Taxable to make the transaction exempt from tax.

Terminologies

| Name | Description |

|---|---|

| Tax Name | It refers to the name you’d like to assign to a particular tax. Ex: GST in Australia is 10%. |

| Rate | Refers to the tax rate pertaining to a province in percentage. Ex: GST in Australia is 10% |

| Exemption Reason | Users have to select why a customer / transaction / item is exempt from sales tax. Ex: GST FREE, GST FREE EXPORT and INPUT TAXED SALES. |

Yes

Yes

Thank you for your feedback!

Thank you for your feedback!