Try Zoho Books for free

Trusted by businesses and CPAs worldwide

Spotlight

Engineered to

unlock business growth

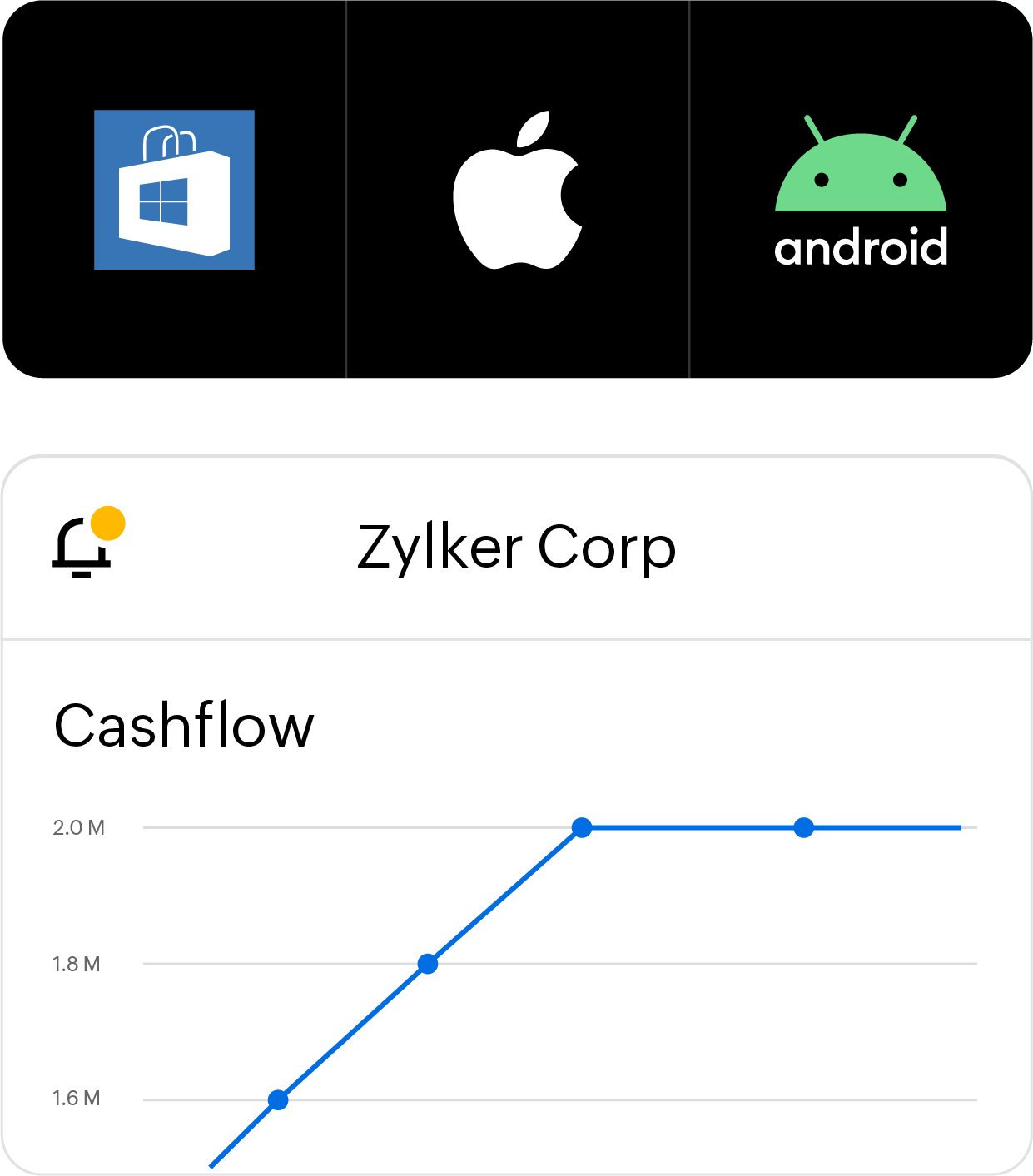

Accounting Across Devices

Whether you’re on the web, smartphone or desktop app, promptly send quotes right after meetings, track business expenses, log time, and view reports!

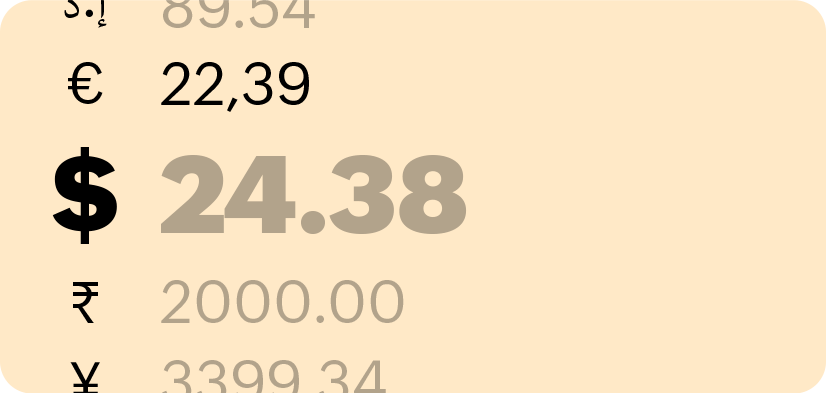

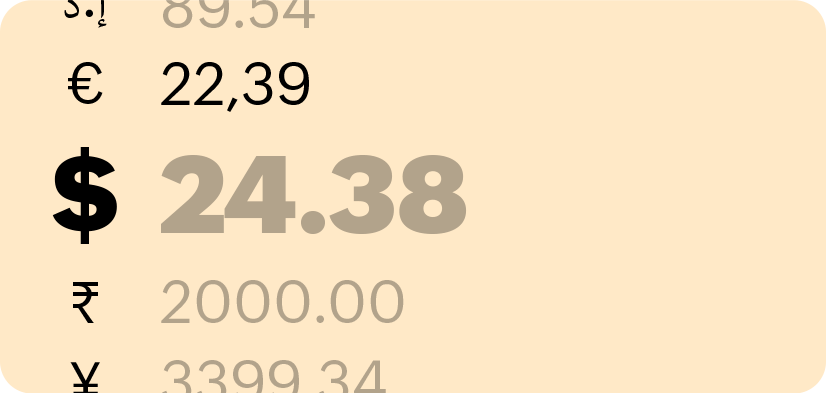

Sell globally

Manage foreign transactions with our multi-currency feature. Apply exchange rates automatically or manually.

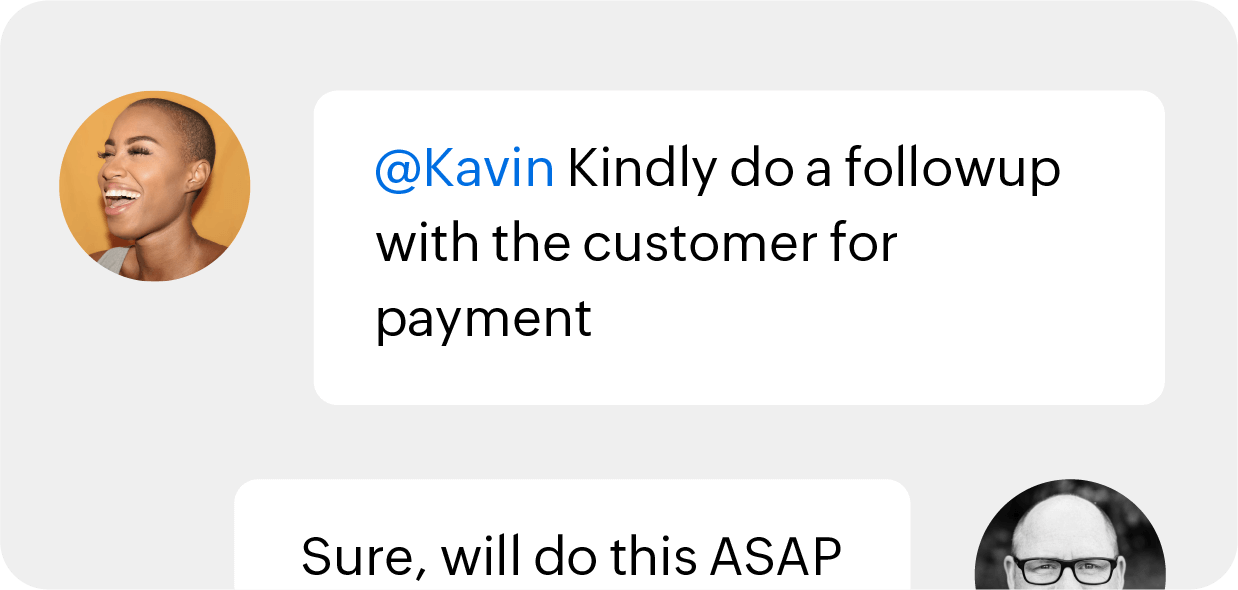

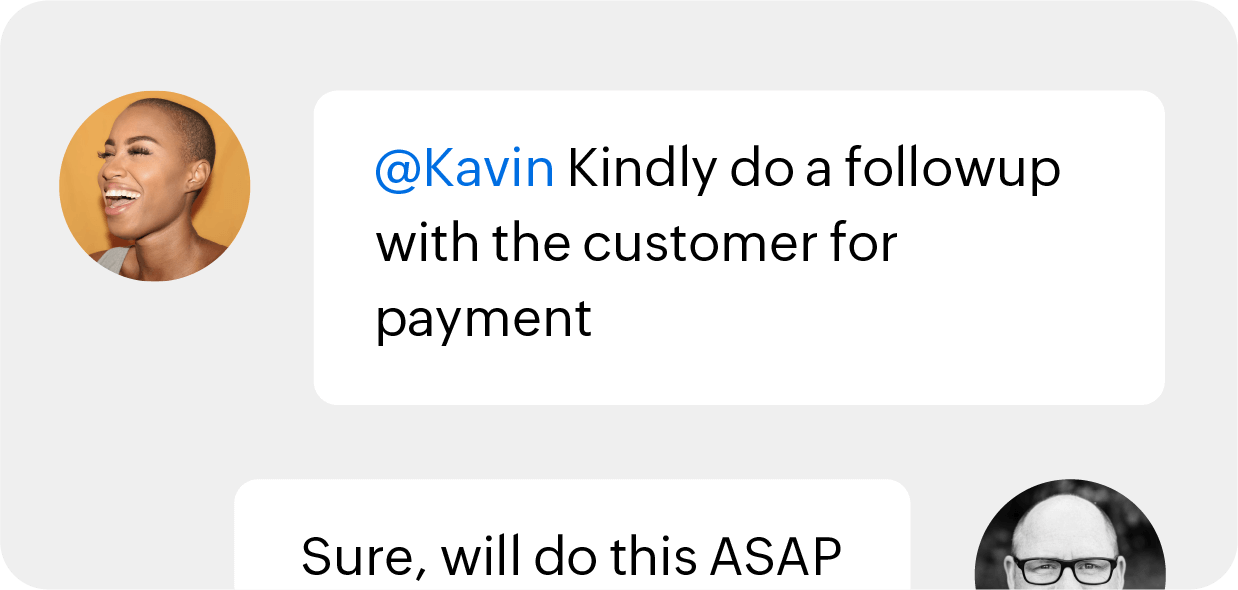

Collaboration

Work as a team, assign roles, permissions, and use customer and vendor portals for transparent, secure communication.

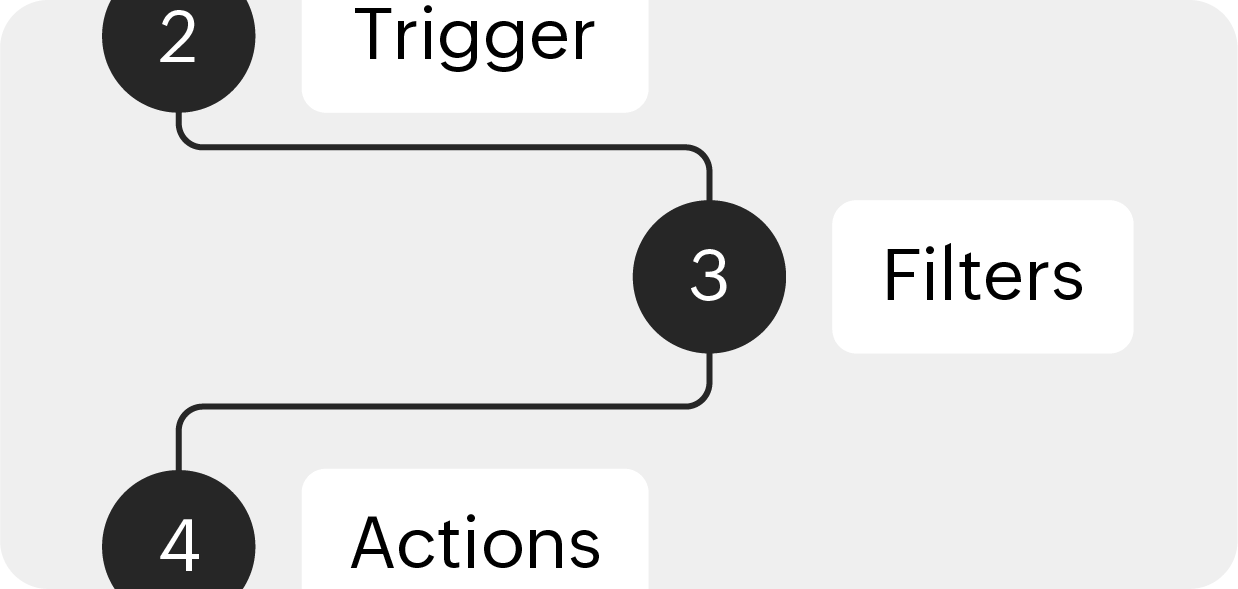

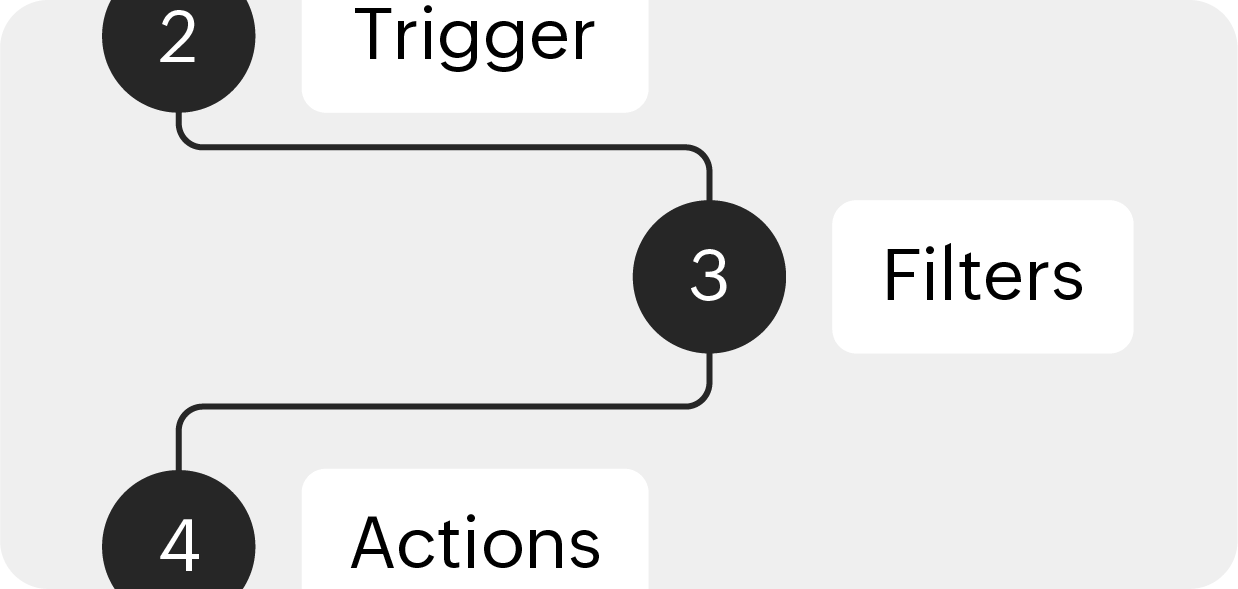

Automation

Trigger emails or notifications for reminders or alerts. Set recurring actions, schedules, and field updates.

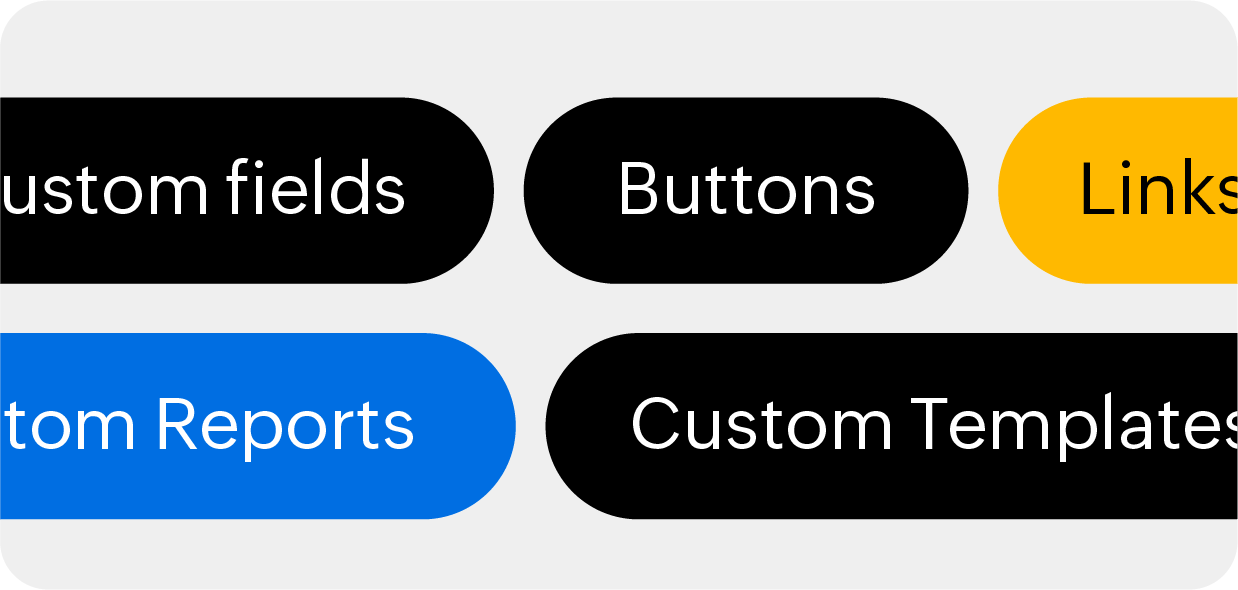

Customization

Customize Zoho Books to suit your business with custom templates and fields. Get custom reports, too!

Accounting Across Devices

Whether you’re on the web, smartphone or desktop app, promptly send quotes right after meetings, track business expenses, log time, and view reports!

Sell globally

Manage foreign transactions with our multi-currency feature. Apply exchange rates automatically or manually.

Collaboration

Work as a team, assign roles, permissions, and use customer and vendor portals for transparent, secure communication.

Automation

Trigger emails or notifications for reminders or alerts. Set recurring actions, schedules, and field updates.

Customization

Customize Zoho Books to suit your business with custom templates and fields. Get custom reports, too!

User favorites

Do it all,

and then some more!

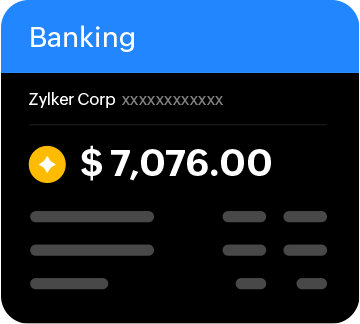

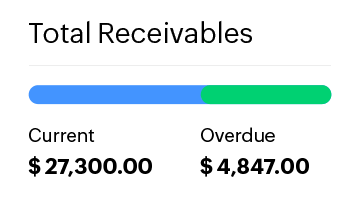

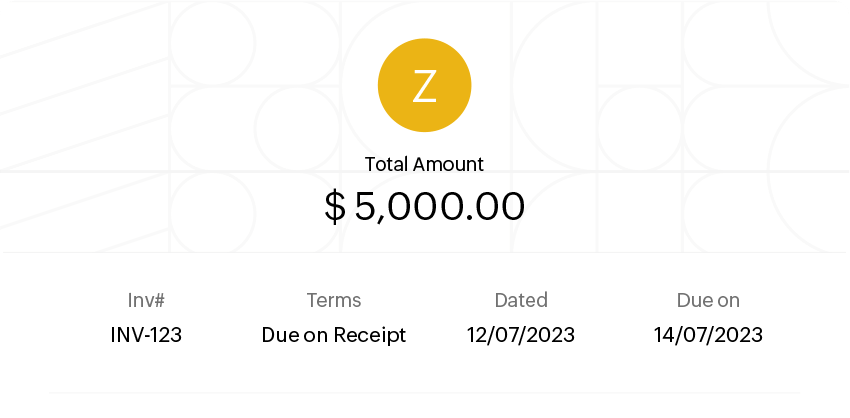

Receivables

Raise professional invoices and quotes in no time. Offer multiple payment options, automate invoices and reminders, and send online payment links.

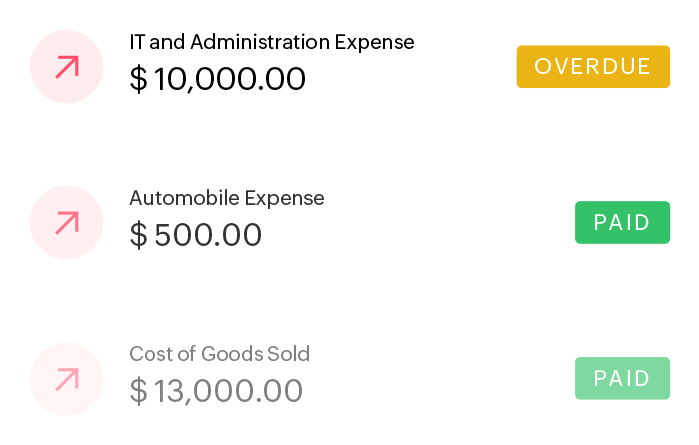

Payables

Track vendor bills and other expenses easily, add recurring expenses, and include client expenses on invoices.

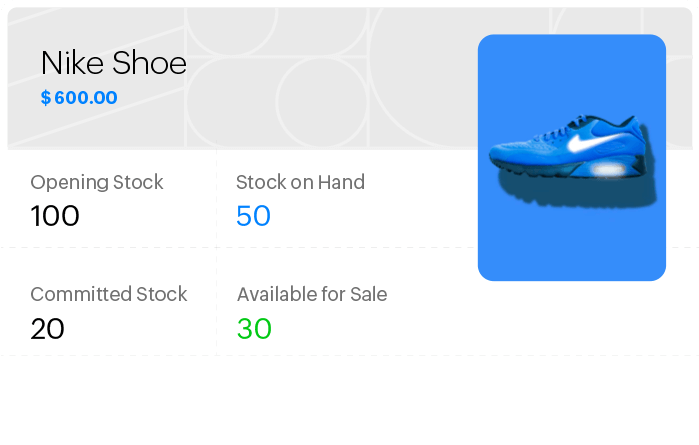

Inventory

Track your inventory. Update stock information automatically as you make purchases or sales. Set reorder points and reminders, too!

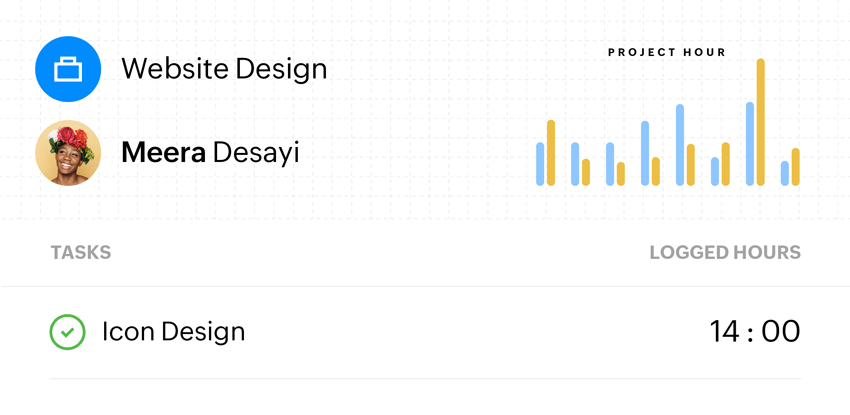

Projects

Send project quotes quickly, accommodate partial payments, and log time. Bill for resources, job completions, time spent, or expenses attached to a project.

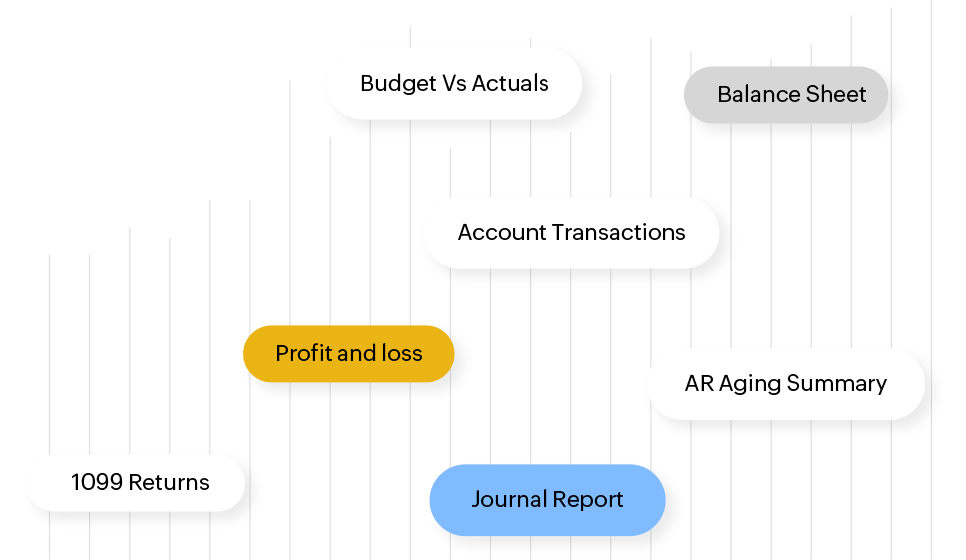

Reports

Get actionable insights on your cash flow, taxes, profit and loss, and more on demand. Opt to get select reports periodically sent to you and your team.

Transforming businesses

Inspiring

stories of success

Favourites

Customization

Time Tracking

Easy-to-use

Customization

Customer Service

Project Invoicing

Reporting

Zoho Ecosystem

Cost Advantage

Retainer Payments

Automatic Payment Reminders

Expense Tracking

Tailored for you

An accounting solution for

every need and every business

Integrations

Choose privacy.

Choose Zoho.

At Zoho, we take pride in our perpetual efforts to surpass all expectations in providing security and privacy to our customers in this increasingly connected world.

Free trial

Start with a 14-day free trial to experience effortless accounting.

Request a demo

Schedule a personal demo with a Zoho Books product expert

Getting started with Zoho Books