Navigate Zoho Payroll

For any business, one of the most essential components involves a proper management of their payroll. Companies must make sure employees get paid on time, have proper salary compensation, receive payslips, and perform other activities related to their payroll. More importantly, the payroll of a company must comply with the country’s government legislations.

With Zoho Payroll, you can manage all your payroll activities in the most seamless way. Zoho Payroll is a cloud based payroll management system which automatically calculates salaries, taxes and deductions, sends payslips out every month and performs all other payroll activities.

Also, Zoho Payroll lets your employees view their payslips and other information through the dedicated online self-service portal in a web browser or by using our iOS or Android apps.

Accessing Zoho Payroll

Zoho Payroll, like all other applications in the Zoho Finance Suite, is a cloud based application. You don’t have to download and install software to access Zoho Payroll. All you need is,

- a supported web browser;

- a working internet connection; and

- Information about your business.

Getting to Know Zoho Payroll

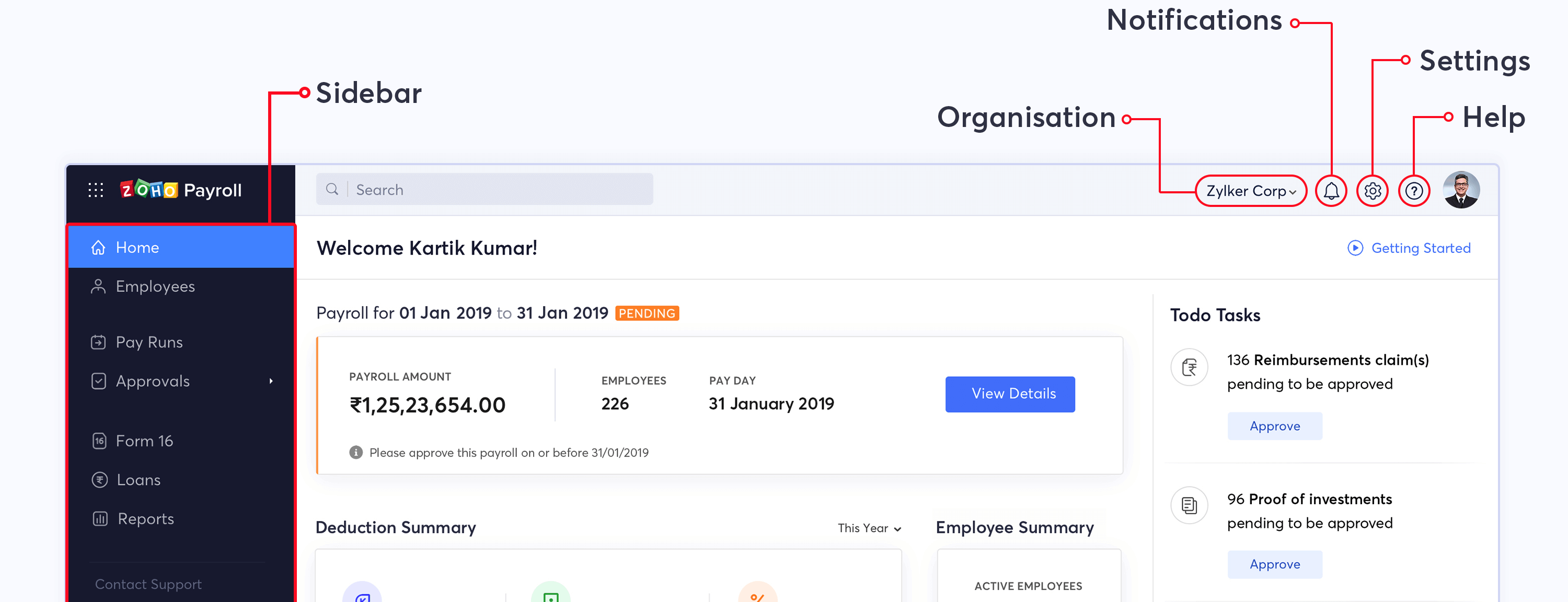

- Home: Get an overview of your entire payroll and the activities would need to perform related to your payroll such as uploading prior payroll data or finishing incomplete employee profiles. You can also view reminders about the upcoming Pay Runs and pending approvals, and also key statistics about your organisation like Net Pay, Net Deductions and the number of active employees.

- Sidebar: Switch between different modules of the product. Using the sidebar, you can manage employees using the Employees module, process your monthly payroll from the Pay Runs module and handle all your reimbursement claims and POI approvals from the Approvals module.

- Settings: Configure and customise Zoho Payroll for your business.

- Help & Support: Get access to our help resources or contact our support team.

- Notifications: Notifies you on all the ongoing payroll activities and also updates you on the new features that have been added to the product.

- Organisation: Manage and switch between multiple organisations in Zoho Payroll.

Supported Browsers

Zoho Payroll is a web based application. It is designed and developed to provide the best user experience. It supports the latest version of the following browsers:

- Chrome

- Firefox

- Safari

- Edge

Zoho Payroll's support is always there to lend a hand. A well-deserved five-star rating!

Zoho Payroll's support is always there to lend a hand. A well-deserved five-star rating!