Strict compliance with tax laws

Zoho Payroll processes income tax, PF, LWF, PT, and ESI automatically, and stays compliant with all applicable tax laws.

Read how Zoho Payroll complies with laws

The ultimate practice management software for modern accounting and bookkeeping firms.

A comprehensive resource for understanding the goods and service tax

Find valuable insights into finance and accounting

The ultimate practice management software for modern accounting and bookkeeping firms.

A comprehensive resource for understanding the goods and service tax

Find valuable insights into finance and accounting

Process employee payruns, stay tax compliant, and get everything accounted for. Accomplish payroll processing and accounting in the same package with Zoho Books and Zoho Payroll.

Zoho Payroll processes income tax, PF, LWF, PT, and ESI automatically, and stays compliant with all applicable tax laws.

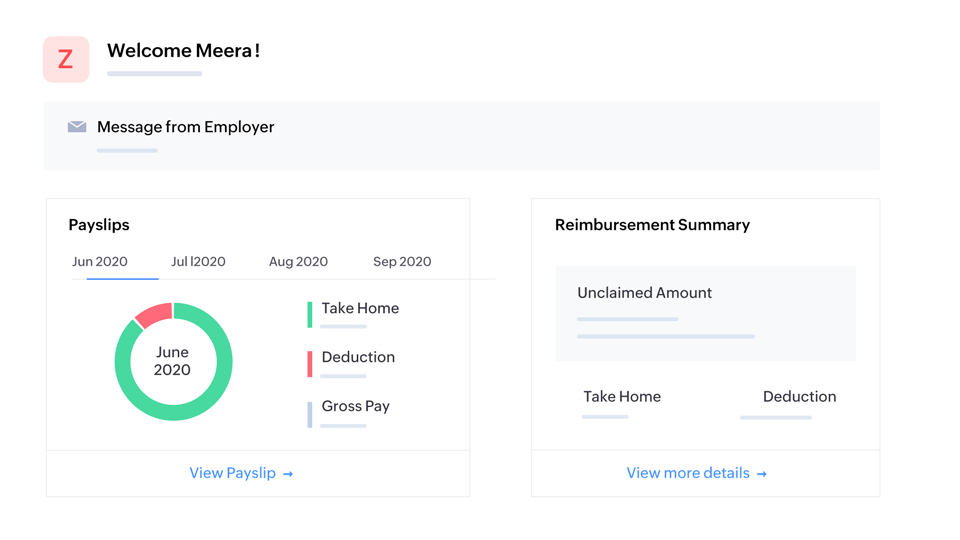

Read how Zoho Payroll complies with lawsZoho Payroll's self-service portal for employees allows them to submit their IT declaration and reimbursement claims online, and facilitates easy collaboration with payroll staff.

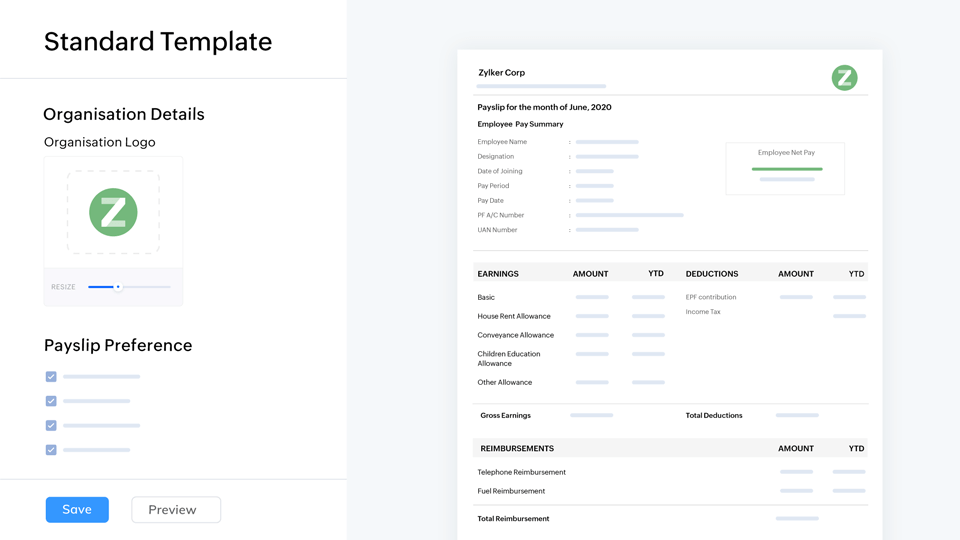

Know more about the self-service portalZoho Payroll offers a collection of customisable payslip templates that reflect your brand while providing a detailed breakdown of salary components to your employees.

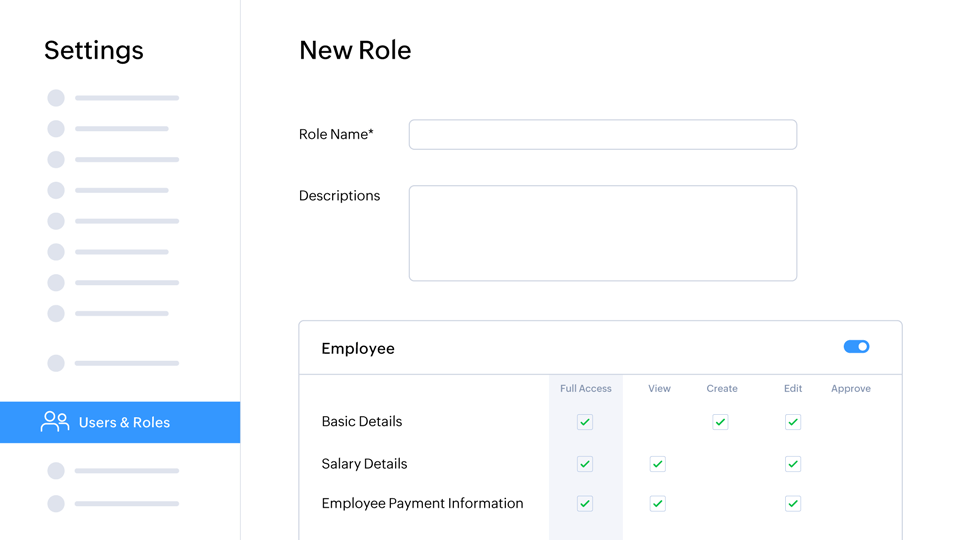

Check out different payslip templatesZoho Payroll gives you a firm hold on admin privileges. User roles and role-based access let you maintain control over all operations right from inviting qualified staff to process payruns to generating payroll reports.

See how you can administer payroll betterAll payroll related expenses and tax liabilities are automatically recorded in the correct Expense and Liability accounts in Zoho Books. This lets you skip the manual task of posting accounting entries every pay cycle, and eliminates the risk of errors related to manual entry.

Setting up your bank accounts and matching payroll transactions to bank feeds is easier done than said. You can set up bank accounts used for disbursing salaries, choose how wage payments are posted, and match corresponding transactions to the bank feeds.

All payroll transactions are sorted neatly into the corresponding expense and liability accounts in Zoho Books' chart of accounts to help with easy tracking and reporting. You can also create individual accounts and customise them to accommodate gross wages, salaries, payroll taxes, other earnings, and make it easier to know where what is.

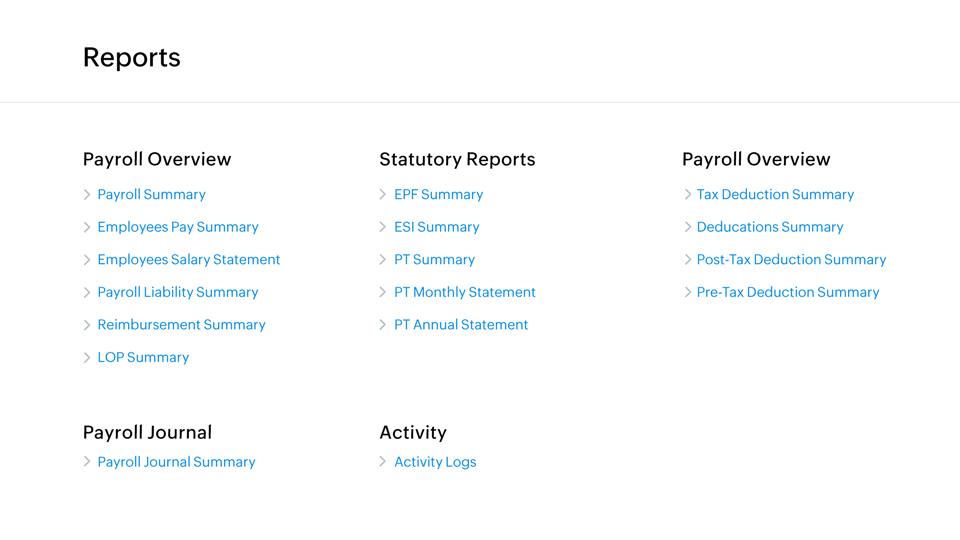

Gain full view of both accounting and payroll data, and draw informed conclusions through automatically generated reports. Zoho Books makes sure that your payroll transactions are reflected in the cash flow and income statements to help you understand how cash moves in and out, and keep an eye on your net profit with ease.

We've used Zoho Books for five years and now help our clients migrate from Tally. The software offers excellent financial visibility and is incredibly user-friendly, even for non-commerce professionals. The automatic bank feed import feature saves us considerable time, allowing easy transaction categorization. I highly recommend trying Zoho Books to feel the difference.

Zoho Books provides world-class services at a low price. We have seen a 30% increase in efficiency after moving to Zoho Books. It has transformed the way we work. If I were to recommend Zoho Books to a friend, I would tell them not to think twice and just go for it.

Contact Us On

Mon - Fri ( 9:00AM to 7:00PM )

18005726671

Mail Us

support.india@zohobooks.comFeatured App

Zoho Commerce

Learn MoreProduct Help & Resources

Comparison