Australia GST

GST: Goods and Services Tax is a value added tax of 10% that is applied on the sale of goods and services in Australia.

- Registering for GST

- Creating a New Tax

- Editing a Tax

- Deleting a Tax

- Default Tax

- Associating a Tax for a Customer

- Making a Customer Tax Exempt

- Making a Plan Taxable/Non-Taxable

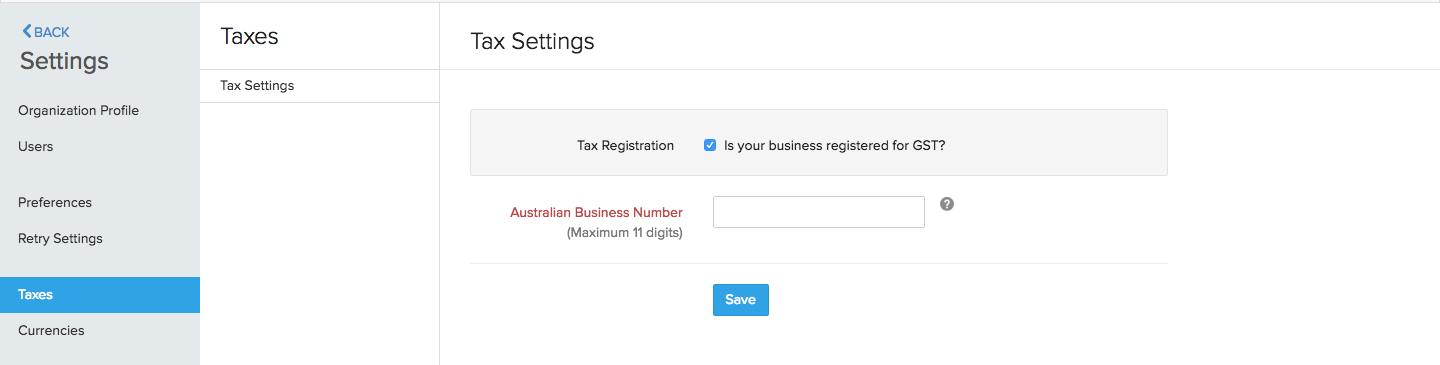

Registering for GST

To register your organization for GST in Zoho Subscriptions,

- Navigate to Gear icon > Taxes > Tax Settings.

- Select the checkbox next to “Is your business registered for GST?" and fill in the Australian Business Number requested.

- Finally, click on Save to register your organization for GST.

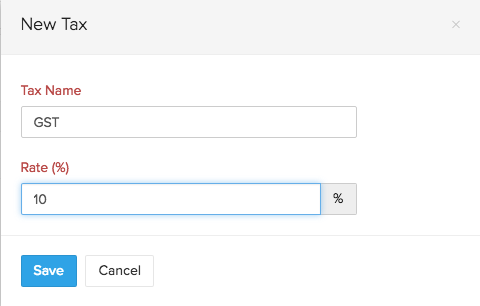

Creating a New Tax

To create a new tax,

- Navigate to Gear icon > Taxes.

- In the Taxes screen, click on + New Tax.

- Enter the required details and click on Save.

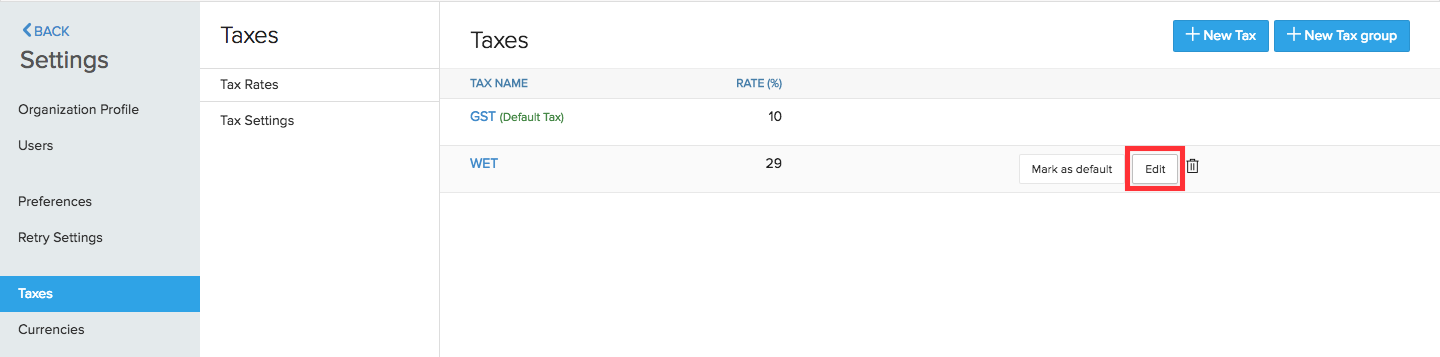

Editing a Tax

To edit a tax,

- Navigate to Gear icon > Taxes.

- Hover over the tax you’d want to edit and click on the Edit icon at the far end.

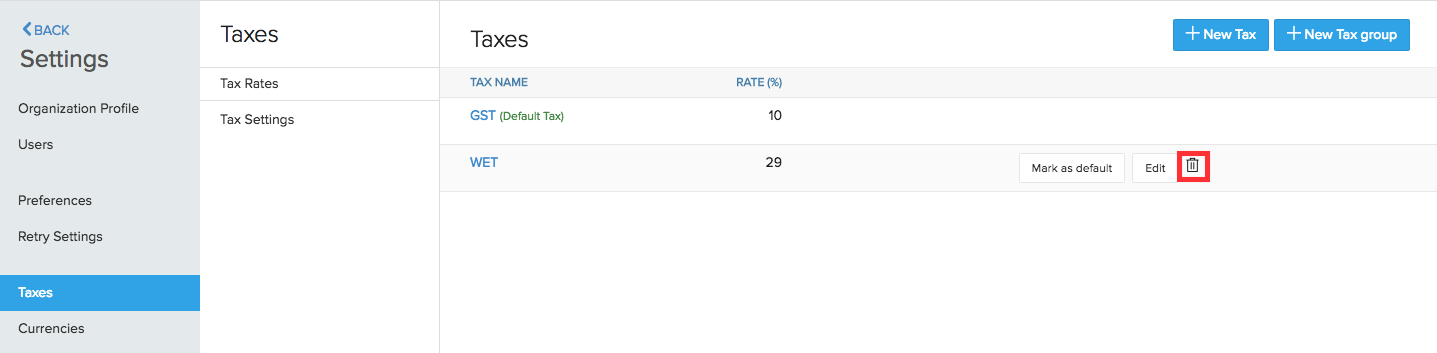

Deleting a Tax

To delete a tax,

- Navigate to Gear icon > Taxes.

- Hover over the tax you’d want to delete and click on the trash icon at the far end.

Default Tax

The Default Tax will be used in transactions when tax preference (Taxable/Tax Exempt) is not set for the involved customers. The first tax you create will be marked as the Default Tax initially. However, you can mark a different tax as default as well.

Default Tax can be useful for the following scenarios.

- When customers are imported into Zoho Subscriptions, their tax preference is not set. When these customers are involved in transactions, the Default Tax will be applied in those transactions.

- The tax preference will also not be set for customers who were created before tax was enabled. Here again, the Default Tax will be used in transactions where these customers are involved.

Default Tax is not automatically associated with a customer. It is only used when tax preference (Taxable/Tax Exempt) is not set for the involved customers.

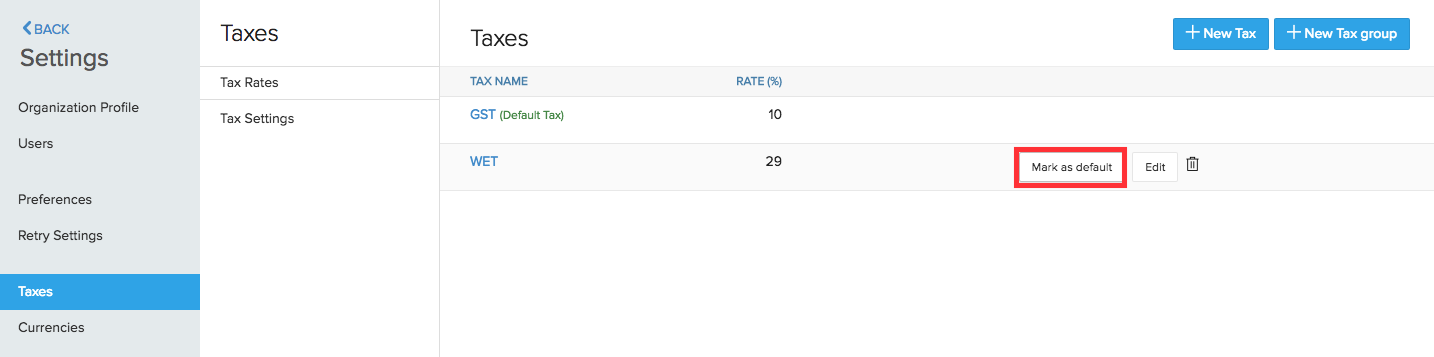

To mark a different tax as default,

- Navigate to Gear icon > Taxes.

- Hover over the tax you’d want to set as default and click on Mark as default button at the far end.

Associating a Tax for a Customer

To associate a tax for a customer,

- Go to the Customers tab.

- After filling in the customer details, scroll down to the Tax Preference label and ensure that Taxable is checked.

- Select the required tax rate for the customer from the drop down box adjacent to the Tax Rate label.

Making a Customer Tax Exempt

At times, you might have to create a subscriptions for a customer whose organization is exempted from tax (GST free/GST free export). You can make that particular customer non-taxable by following the below steps.

- Go to the Customers tab.

- After filling in the customer details, scroll down to the Tax Preference label and ensure that Tax Exempt is checked.

- Select the Exemption Reason and click on Save.

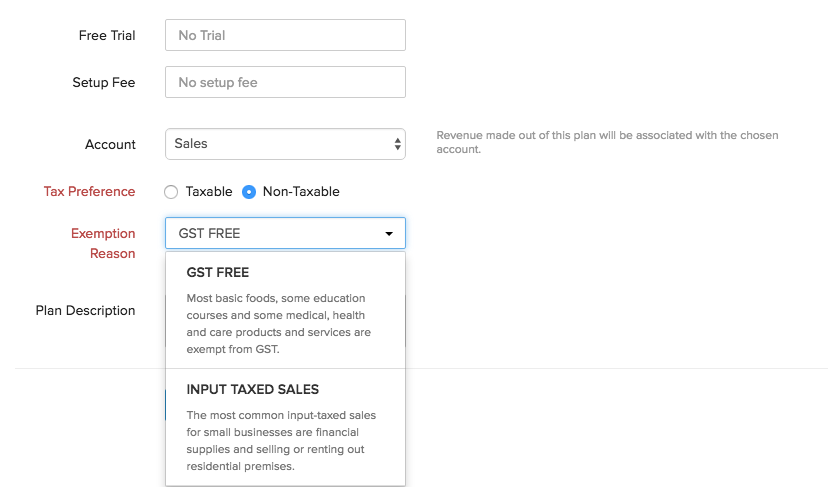

Making a Plan Taxable/Non-Taxable

- While creating a plan, you can choose to make it taxable or non-taxable.

- After entering the relevant details, select the Taxable check box and save it. This will make the plan taxable.

- If you wish to make the plan non-taxable, select the Non-Taxable option. You will be prompted to select an Exemption Reason, which you can select from the drop down.

Yes

Yes Thank you for your feedback!

Thank you for your feedback!