Salary Withhold

There may be instances where you need to withhold your employee’s salary and disburse it in the following month or later. Zoho Payroll supports withholding of employees' pay for a certain period using the Salary Withhold option in the Pay Runs module.

When can your employee’s salary be withheld?

Salary withhold can be applied when you have:

- New employees who’ve joined at the end of a month.

- Employees who are serving the notice period.

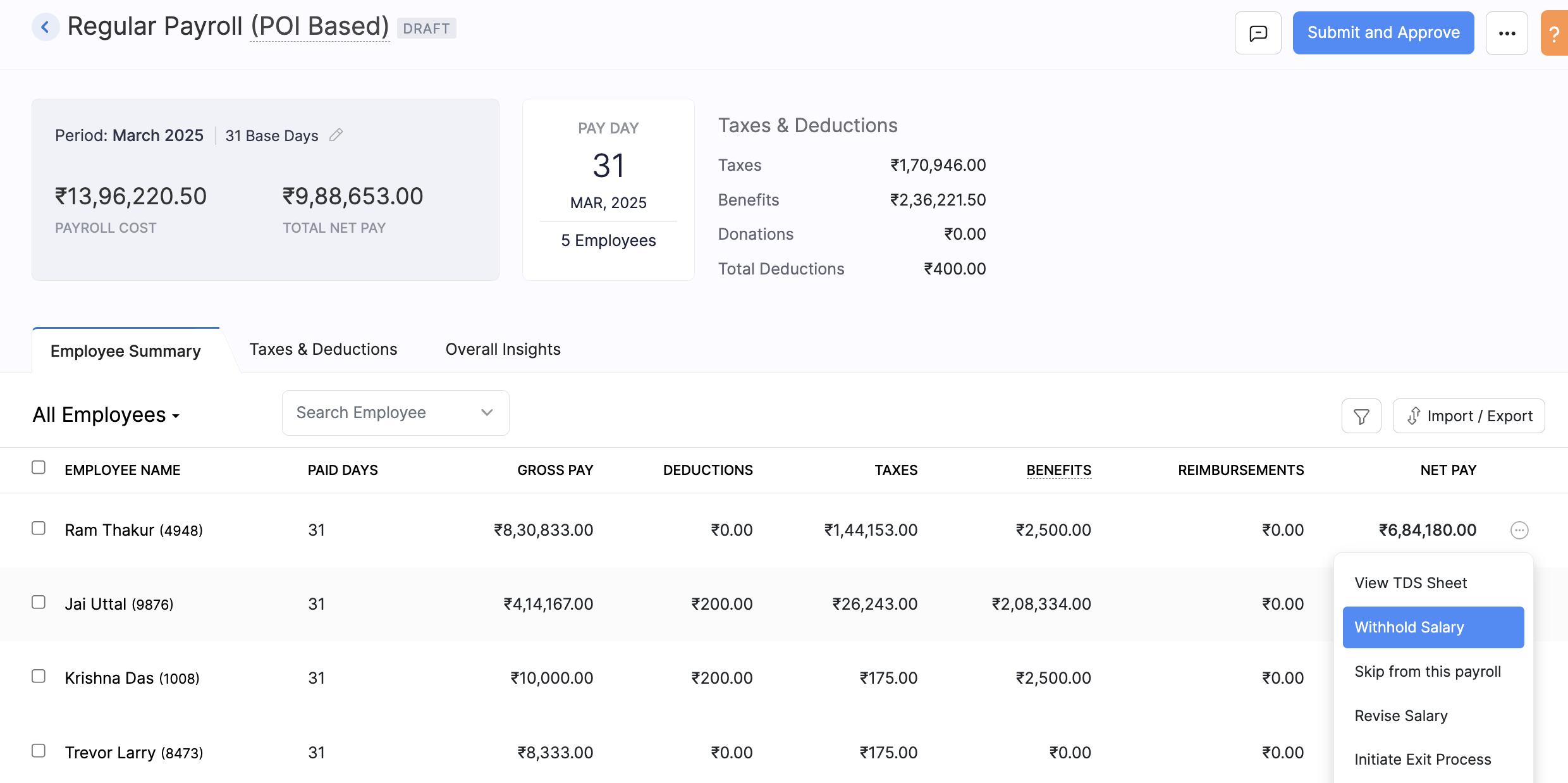

Withholding Salary

Here’s how you can withhold and release an employee’s salary in Zoho Payroll:

- Go to the Pay Runs module.

- Click Create Pay Run.

- In the pay run draft, click the Overflow icon (…) next to the employee’s name and click Withhold Salary.

- Enter the reason for withholding the salary and click Proceed.

- Once you’ve added all the inputs, click the Submit and Approve button in the top-right corner of the page.

- If you have enabled Zoho Books integration, you can choose to post the journal entry for the payroll transaction in Zoho Books. The transaction will be recorded under the account you had configured while setting up the integration.

- After the pay run is approved, you can record payment on or after the payday.

The withheld salary can be released in the subsequent pay runs.

Note: All the statutory components such as EPF, ESI, etc., will be calculated and deducted from the employee’s salary. Only the Net Pay will be withheld when you apply salary withhold.

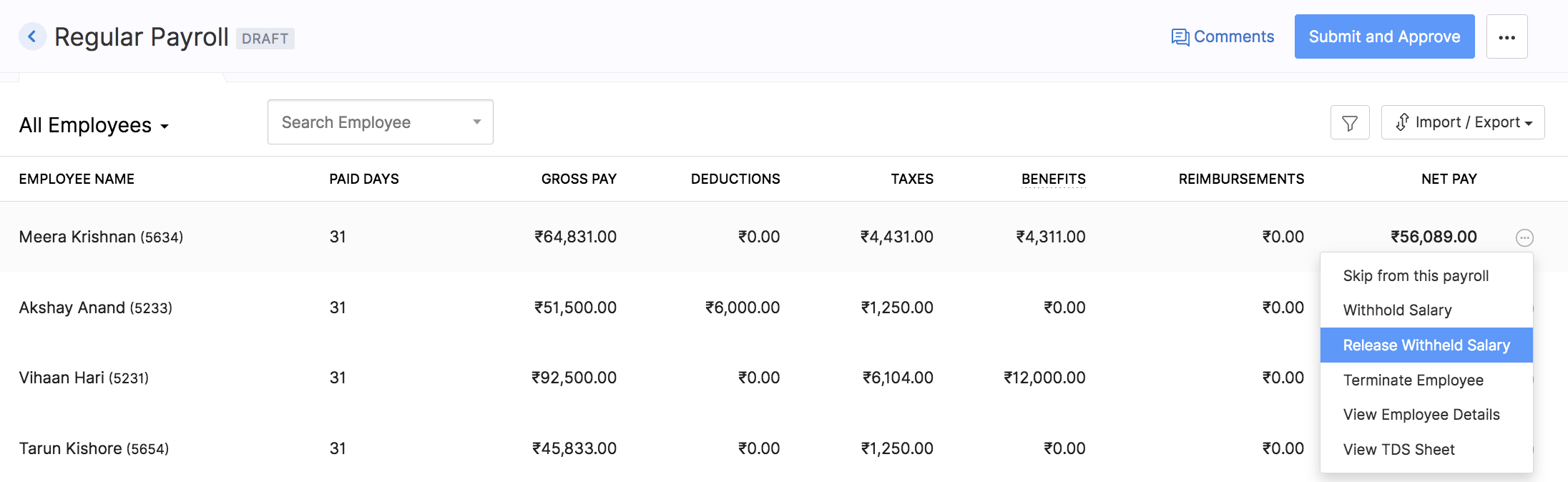

Releasing Withheld Salary

Let’s say you want to release the withheld salary along with the following month’s salary. Here’s how you can do it:

- Go to the Pay Runs module.

- Click Create Pay Run.

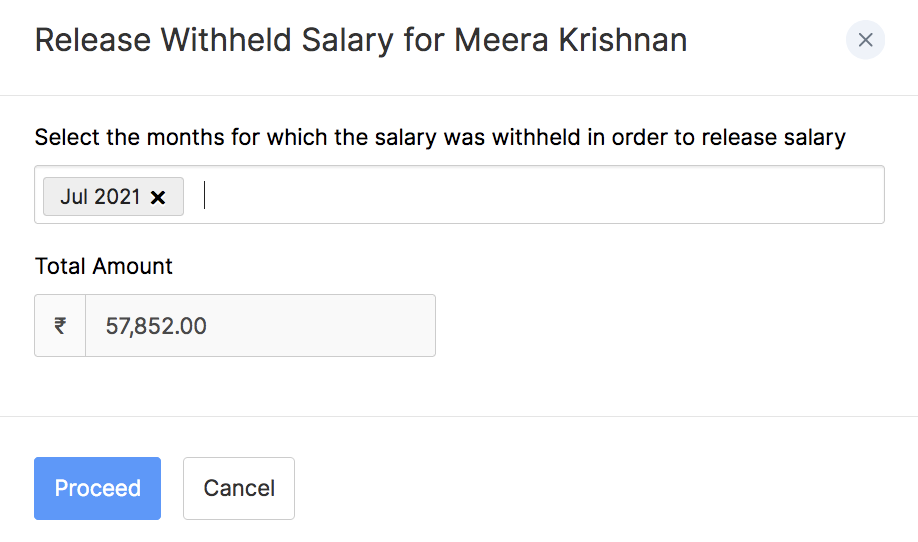

- In the pay run draft, click the Overflow icon (…) next to the employee’s name and click Release Withheld Salary.

- You will be prompted to select the month(s) for which the salary needs to be released. Once you’ve selected the month(s), the total payable amount will be displayed.

- Click Proceed.

The withheld net pay will be released and added to the current month’s net pay.

Note: You cannot release a previously withheld salary if the current month’s salary is put on hold.

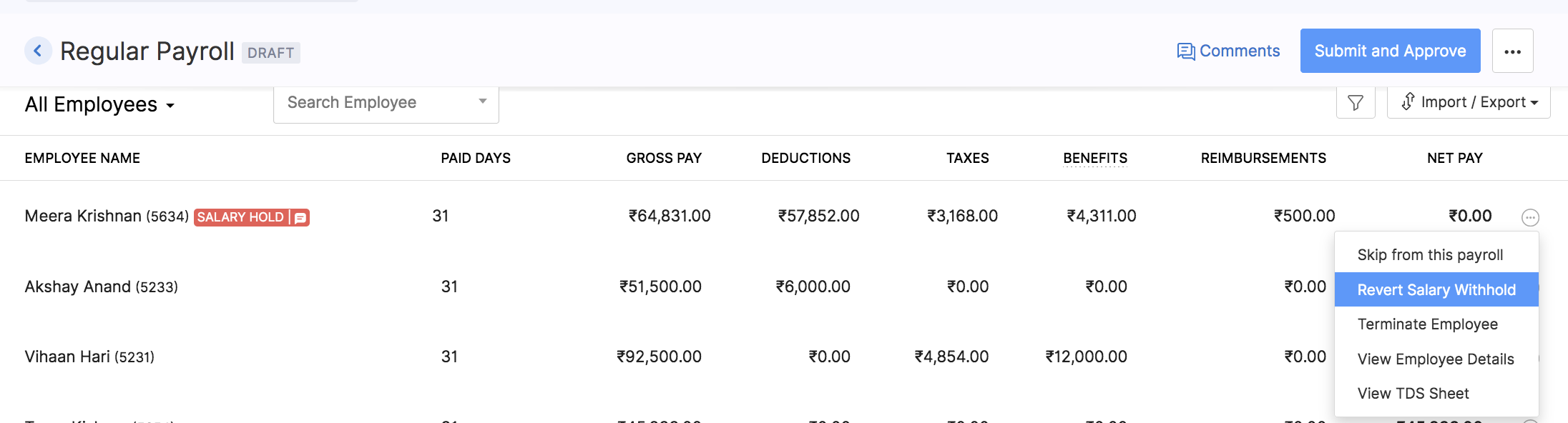

Reverting Salary Withhold

If you want to process a withheld salary in the same pay run, you will have to revert the salary withheld. Here’s how:

- Go to the Pay Runs module.

- Click View Details to view the pay run draft.

- Click the Overflow icon (…) next to the employee’s name and click Revert Salary Withhold.

- You will be prompted to confirm your actions. Click Yes to confirm.

The employee’s salary will be processed in the current month’s pay run.