Prior Payroll

If you’ve started using Zoho Payroll in the middle of a financial year, it is of paramount importance that you import the details of all the pay runs that you’ve run this year. This helps us calculate accurate year-to-date values for Net Earnings and Tax Deduction at Source (TDS). This document will guide you through all the steps involved in importing your prior payroll data to Zoho Payroll.

Importing Prior Payroll

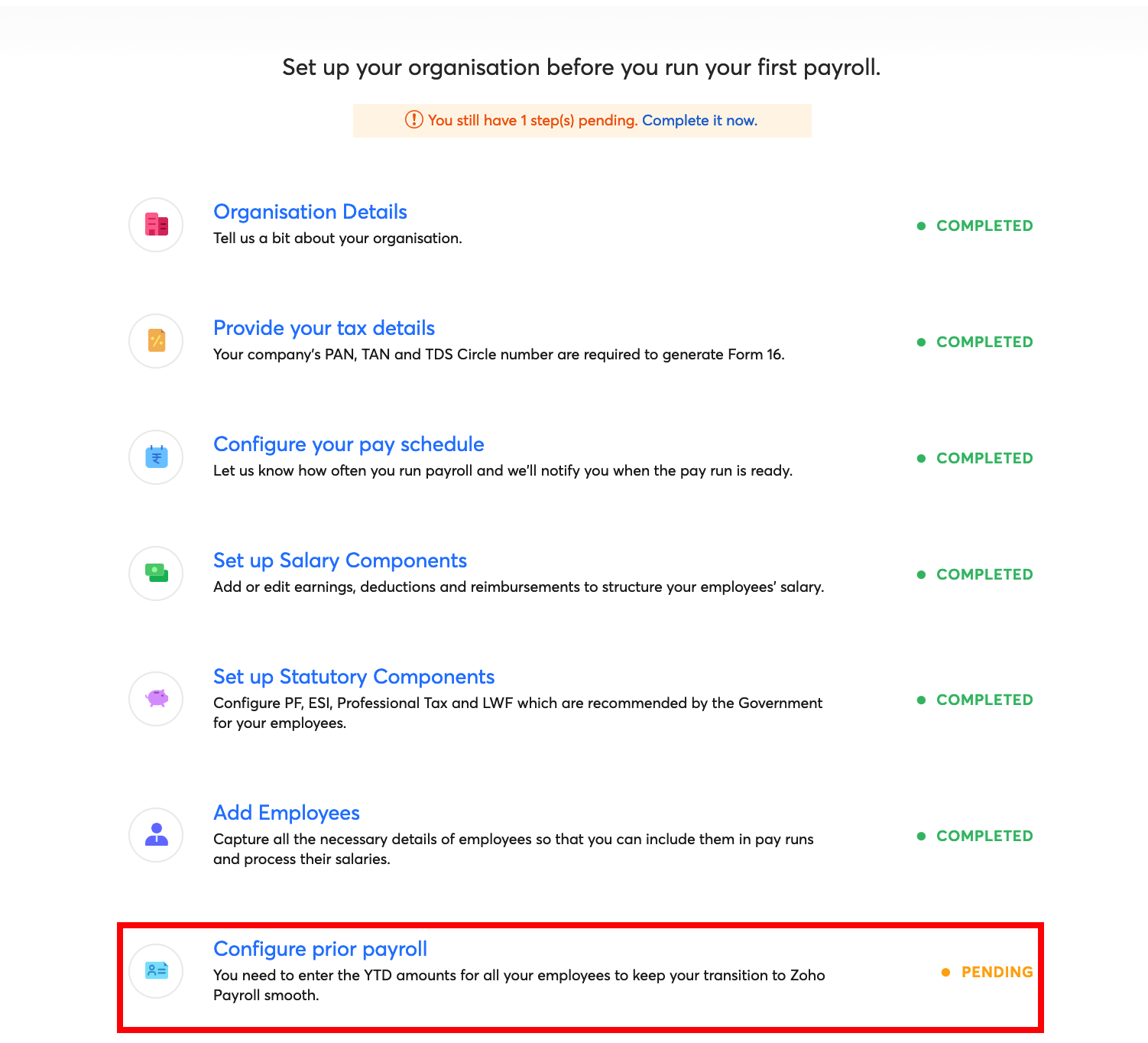

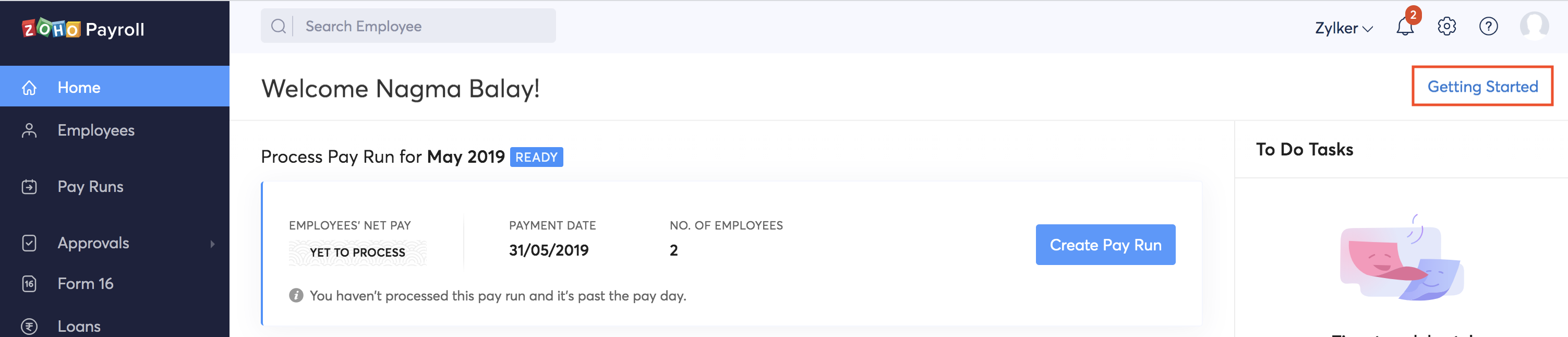

Once you’ve set up your organisation, you’ll be taken to the Getting Started page.

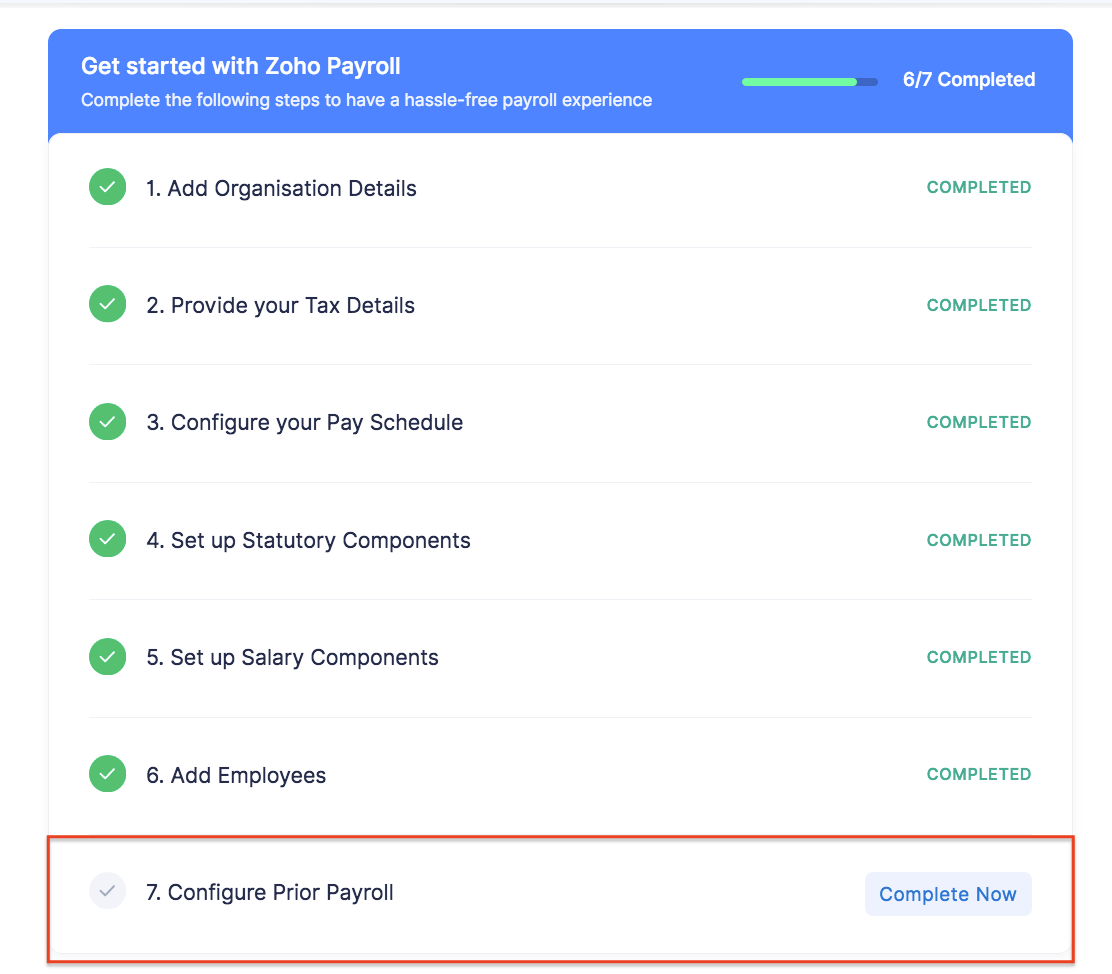

Here, you can view a list of tasks that you need to complete before you can start processing your monthly pay runs. Click Configure Prior Payroll.

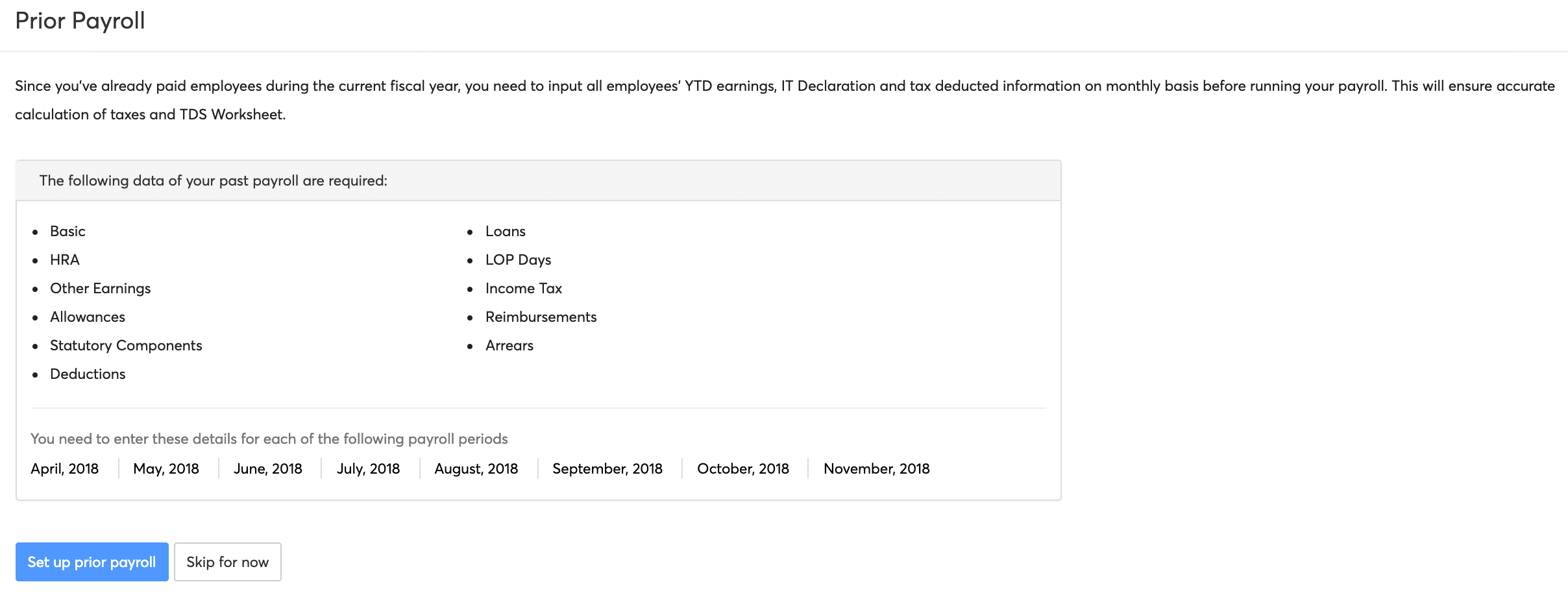

You’ll be taken to a screen where you can view all the different fields that you would have to include in your import file.

Click Set up prior payroll.

The setup consists of three steps:

- Employee Information

- Pay Information

- Summary

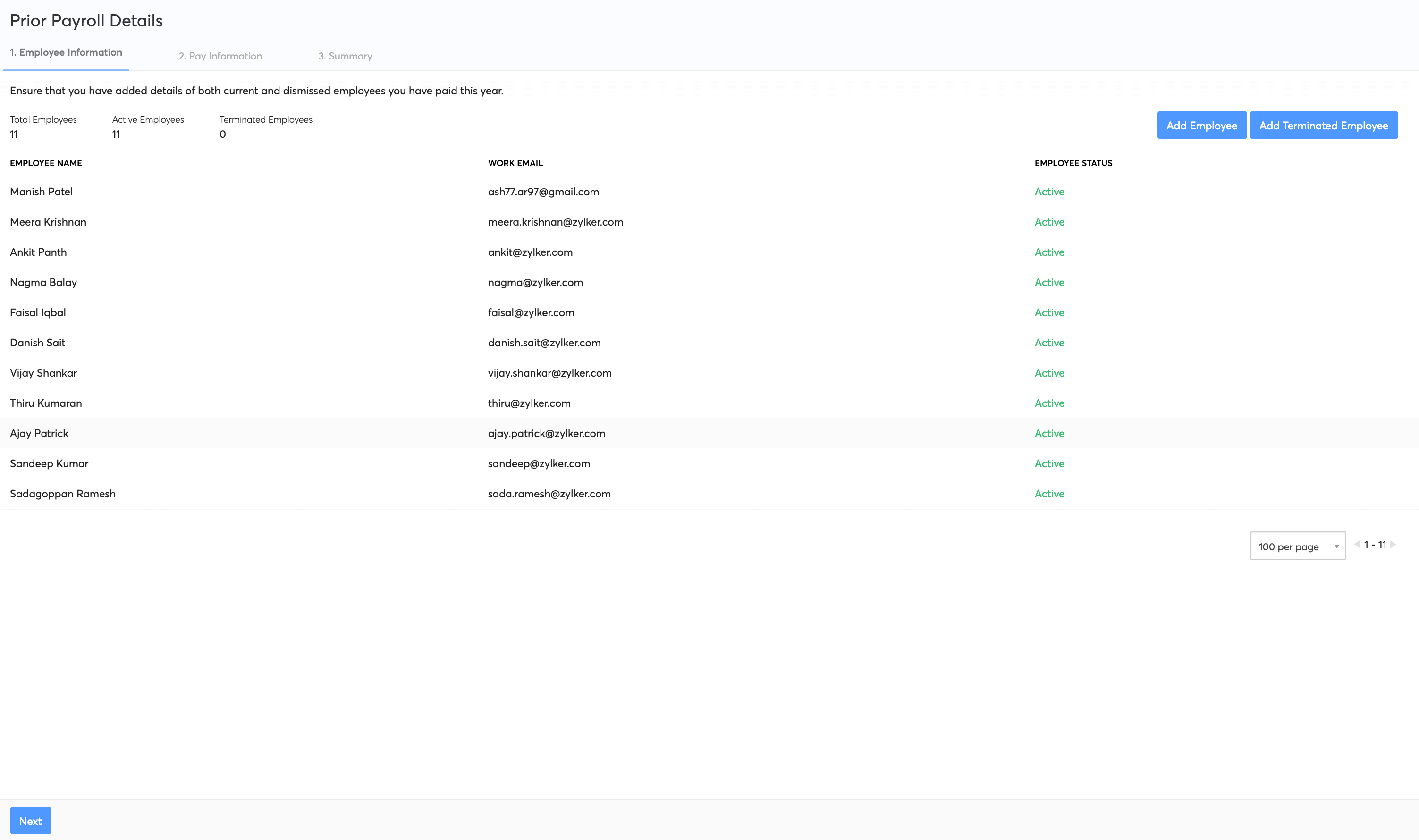

STEP 1: Employee Information

In this step, you can view all the employees that you’ve added to your organisation. You can also add active and terminated employees by clicking the respective buttons. Click here to learn more about adding employees. Make sure that you have added the details of all the employees that you have paid in this financial year, and click Next.

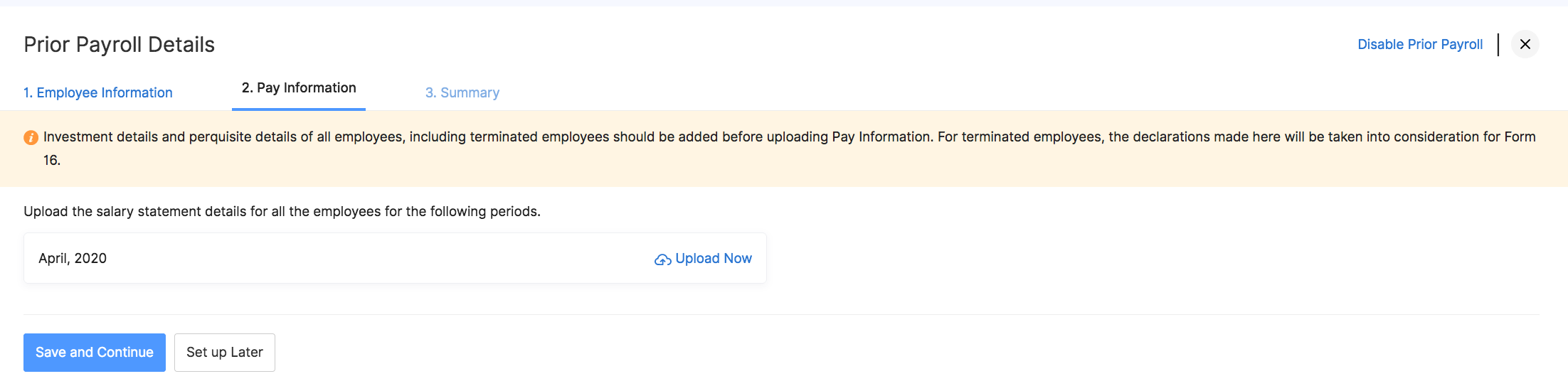

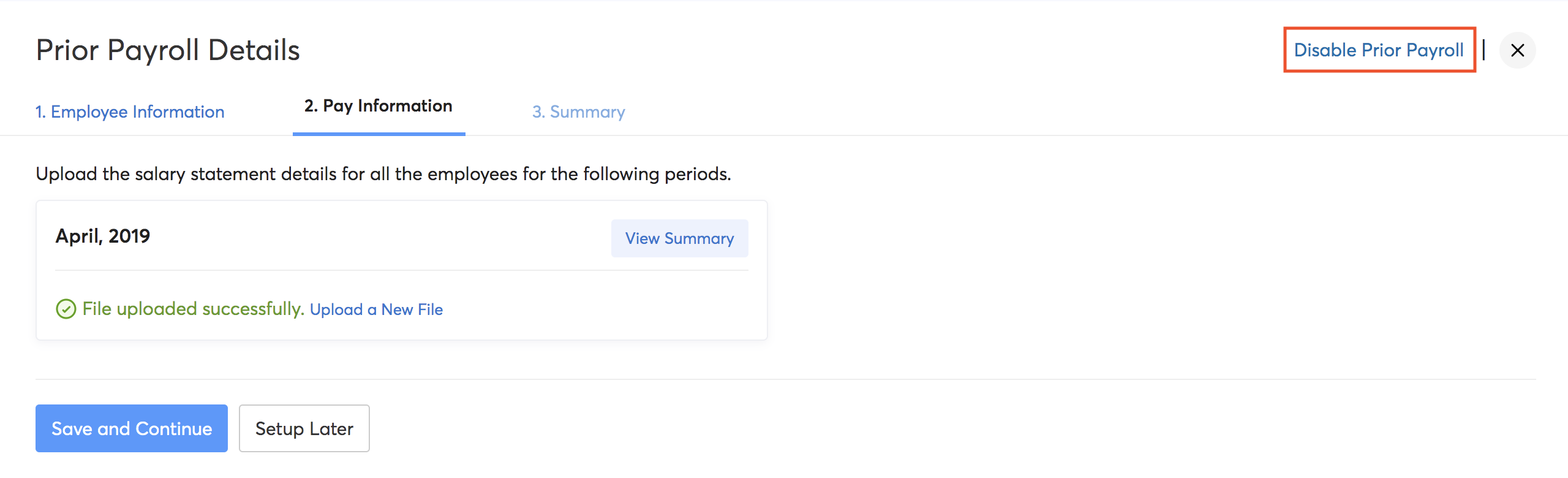

STEP 2: Pay Information

This is where you upload your past pay runs in the form of a CSV or XLS file. Click the Upload Now button next to the corresponding month to get started.

Your upload file should contain the employee ID of the employees along with the earnings, deductions, reimbursements, income tax and the employee and employer contributions towards the various statutory components. You can view the sample file to get an idea about the format in which the data needs to be populated in the import file.

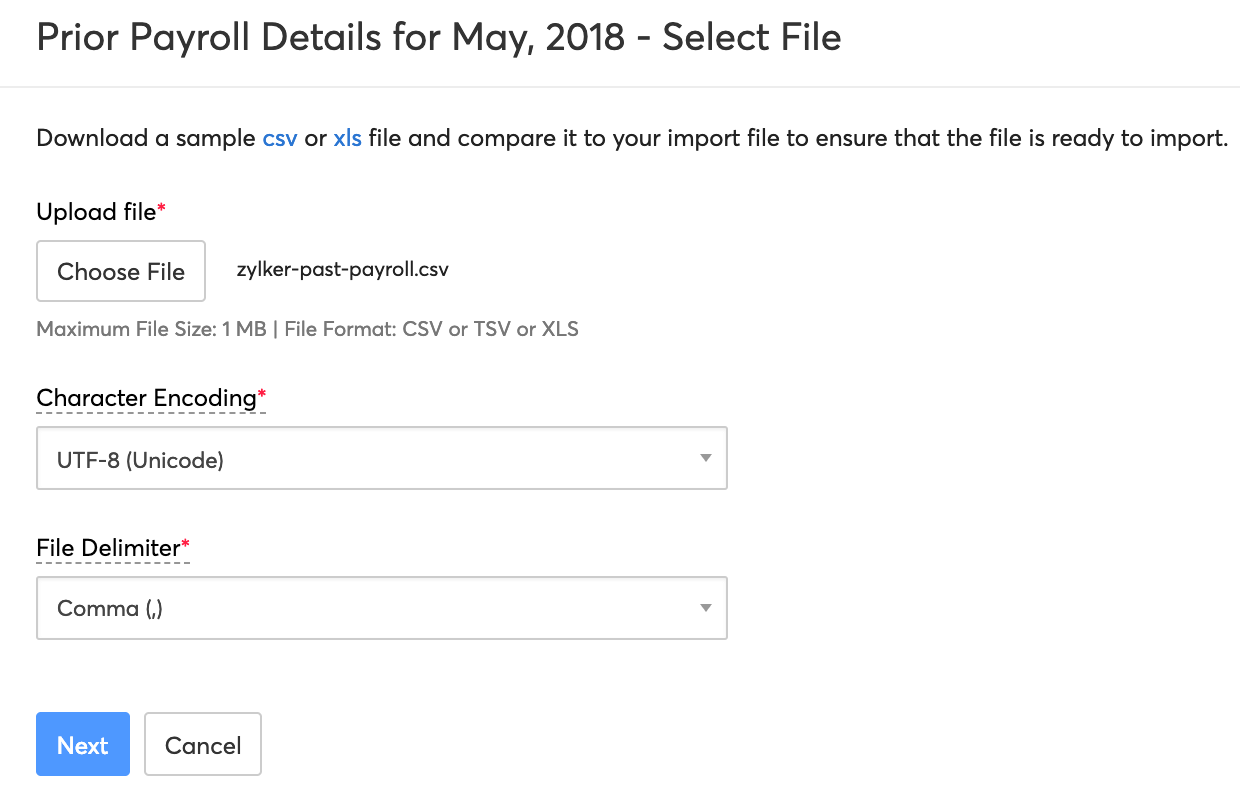

- Click the Choose File button and select the import file from your computer.

- Choose the appropriate Character Encoding from the dropdown menu to match the exported file format.

- Choose the File Delimiter from the dropdown menu according to the exported file.

- Click Next.

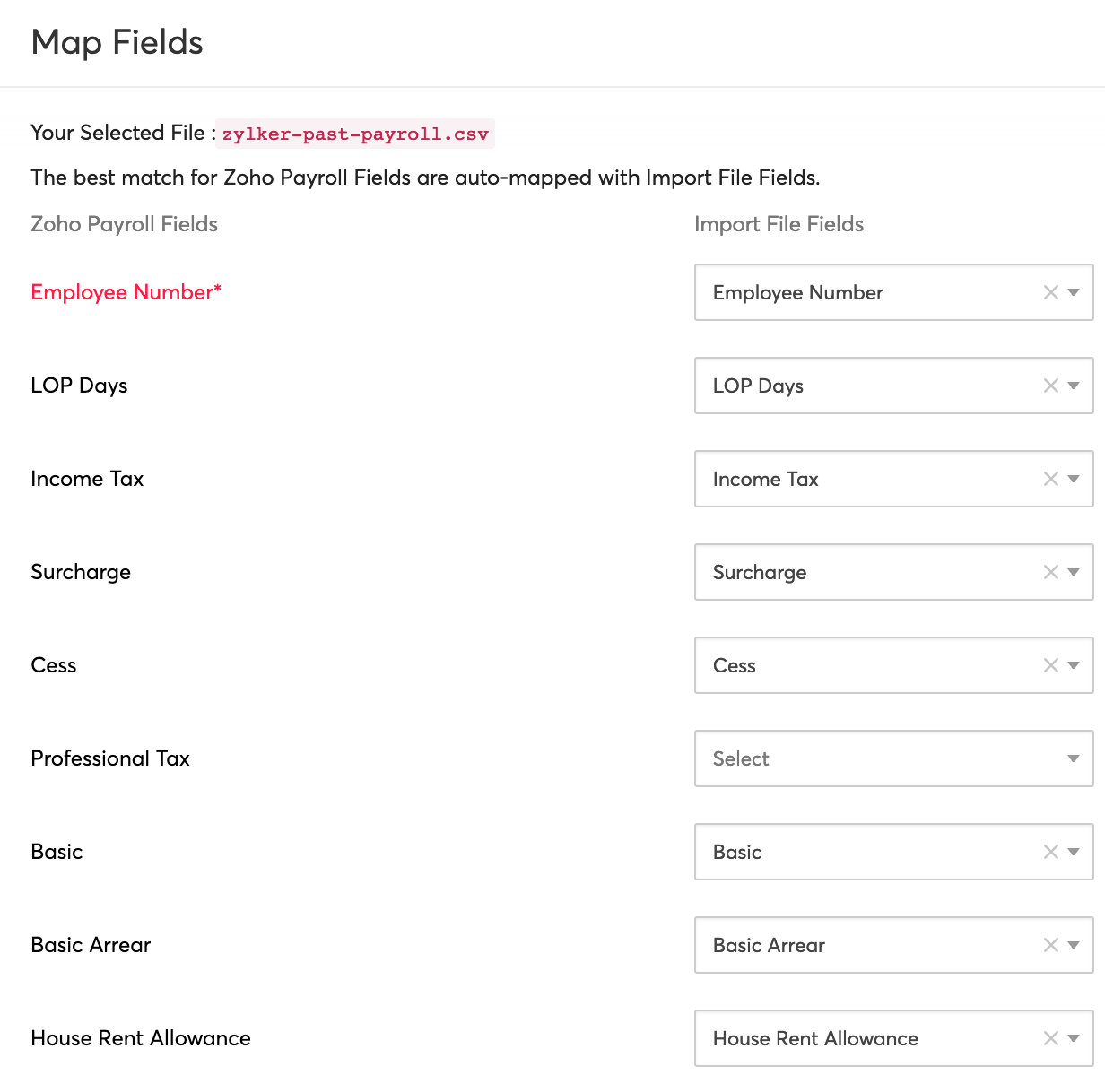

- Map the fields of the imported file to the fields in Zoho Payroll.

- Check Save these selections for use during future imports. to use the same mapping in future imports.

- Click Next.

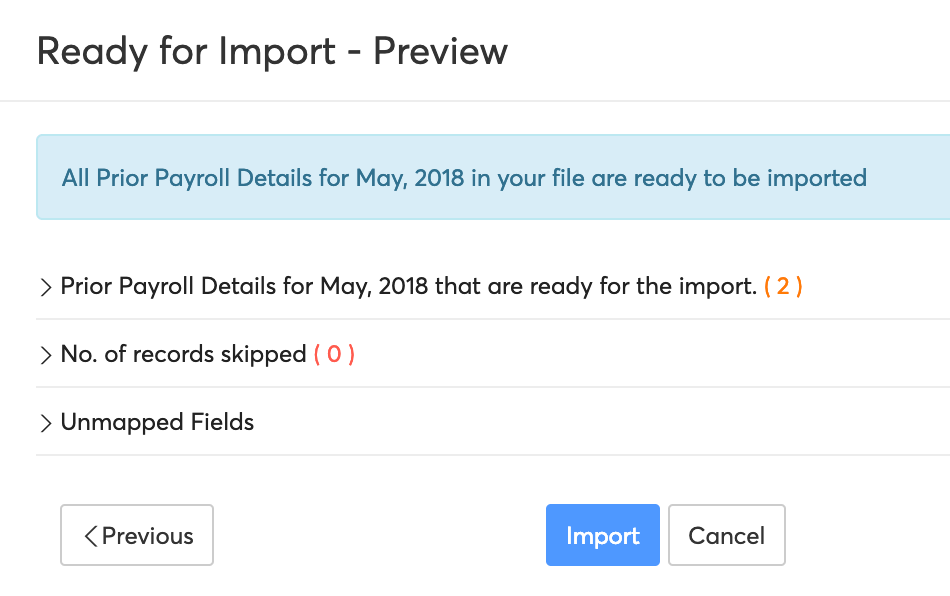

- A list of the ready-to-be-imported, skipped and unmapped fields is displayed for final verification.

- Click Import.

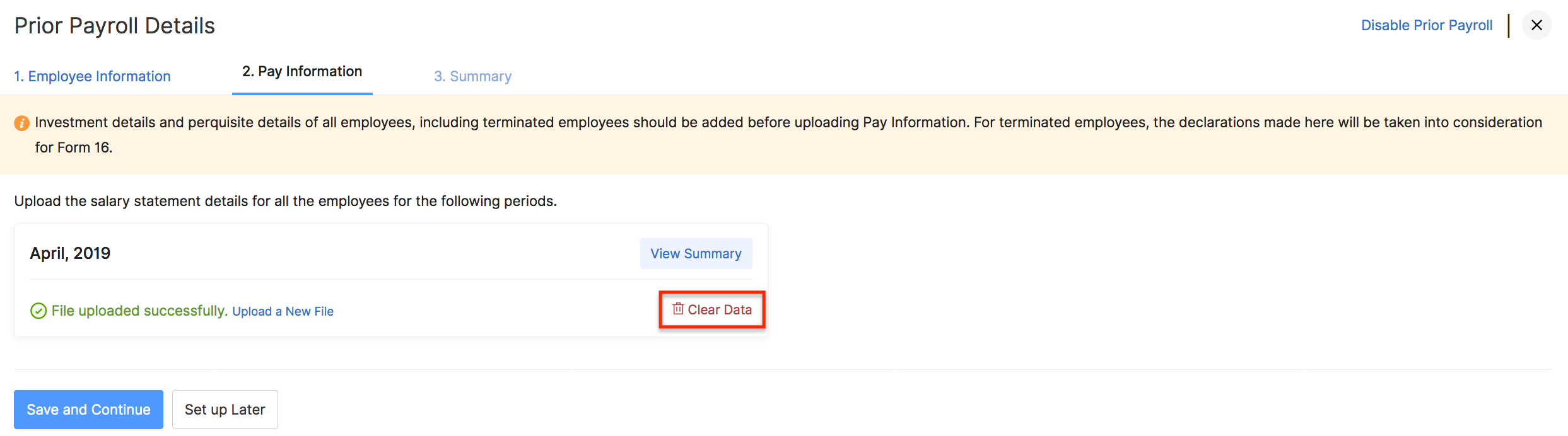

Note: Investment details and perquisite details of all employees, including terminated employees should be added before uploading Pay Information. For terminated employees, the declarations made here will be taken into consideration for Form 16. You can add the investment details in the respective employee profiles under Investment Details. Alternatively, you can also import the prior payroll details in the Employees module.

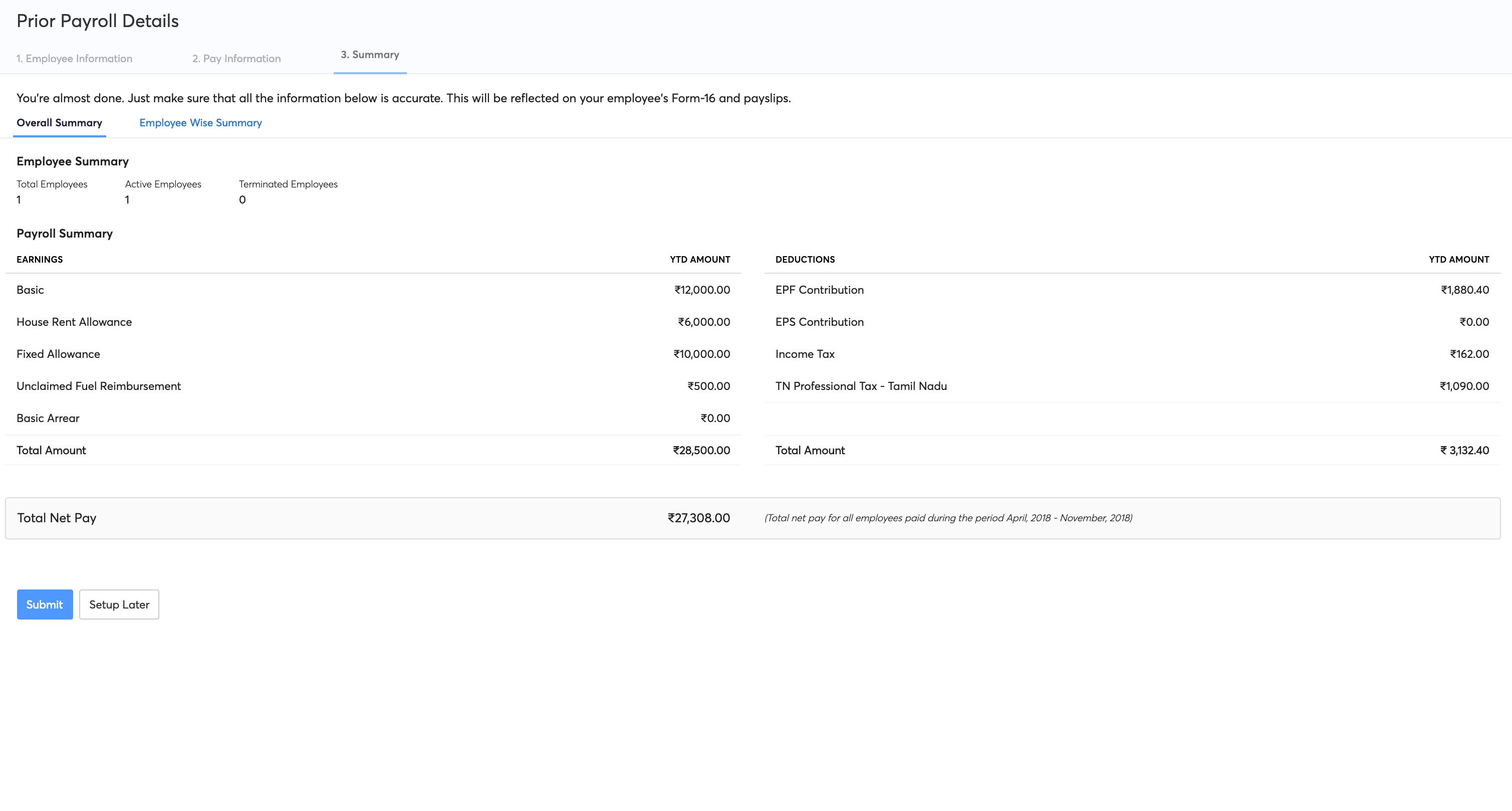

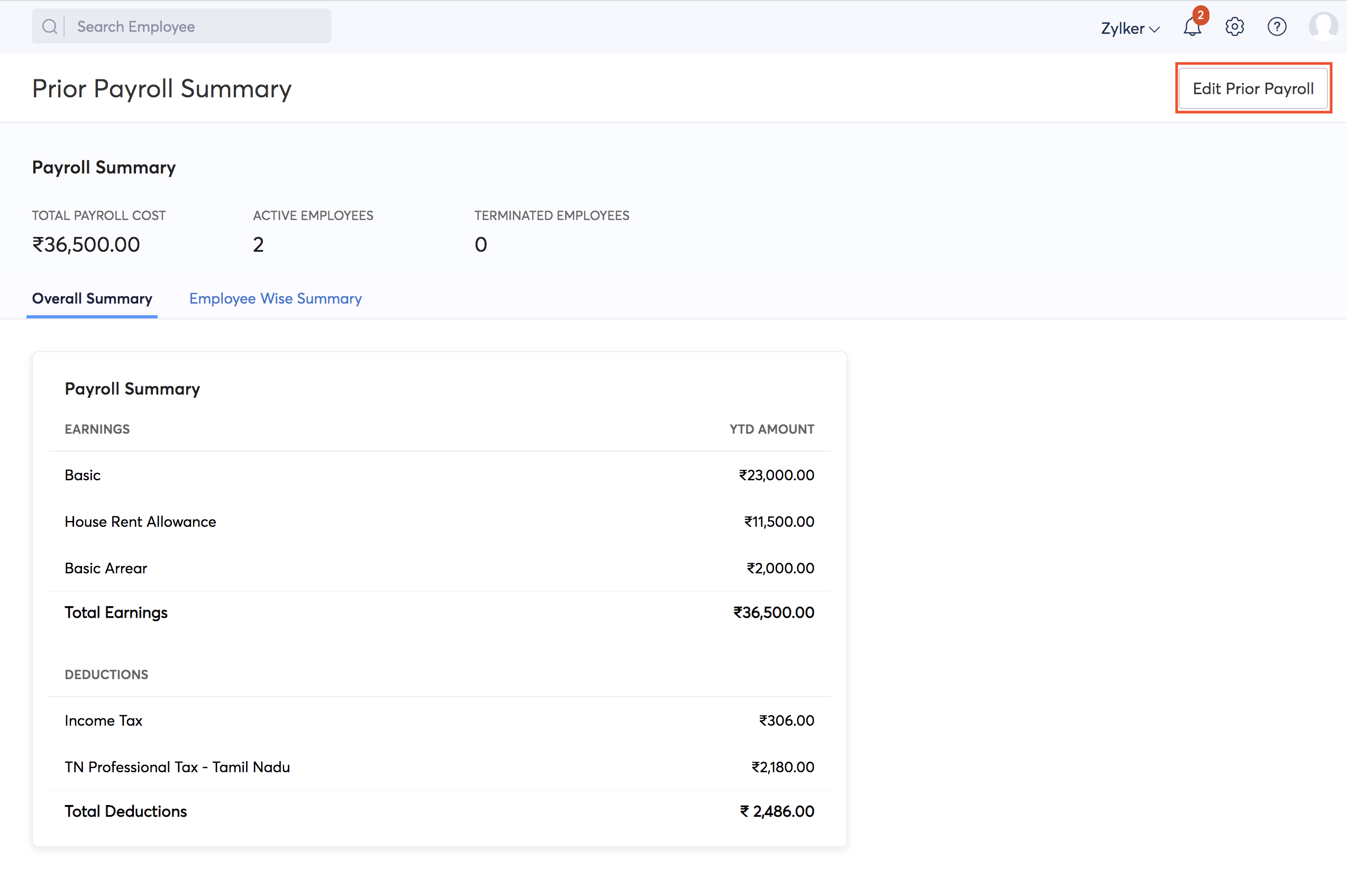

STEP 3: Summary

View a detailed Employee-wise and Overall Summary and click Submit.

This concludes the import process. You can now run your monthly pay runs and process payroll.

Editing/Disabling Prior Payroll

Prior payroll can be edited or disabled if you want to opt out of prior payroll after the organisation setup.

Prerequisites

- There should be no active pay run drafts.

- If you have processed any pay runs after completing the prior payroll setup, you will have to revert the pay runs and then disable the prior payroll.

To disable or edit prior payroll:

- Go to the Home module in the left sidebar.

- Click Getting Started on the top right corner.

- Select Configure Prior Payroll.

- Select Edit Prior Payroll. Here, you can make changes to the prior payroll data and save it.

- If you want to disable the prior payroll, hover over the month and click Clear Data.

- Next select Disable Prior Payroll on the top right corner.

- Select Yes to confirm that you want to disable prior payroll.

Enabling Prior Payroll

If you had chosen to not record prior payroll during setup and want to enable prior payroll later, go to the Home module > Getting Started > Configure Prior Payroll > Enable Prior Payroll.

Deleting Prior Payroll

If you’ve entered incorrect information in the prior payroll details or update prior payroll, you need to delete the existing information and add new details.

Prerequisites:

- There should be no active pay run drafts.

- If you have processed any pay runs after completing the prior payroll setup, you will have to revert the pay runs and then disable the prior payroll.

Then,

- Go to the Homepage in the side-bar.

- Click Getting Started on the top right corner.

- Click Configure Prior Payroll which will be marked as Completed.

- In the Prior Payroll Summary page, click Edit Payroll and, then Yes.

- In the Pay Information tab, hover over the specific month you want to delete and click Clear Data.

- Click Save and Continue and then, Yes.

- In the Summary page, click Submit and Yes, to confirm.

You can choose to upload new payroll details, or disable prior payroll completely.

Zoho Payroll's support is always there to lend a hand. A well-deserved five-star rating!

Zoho Payroll's support is always there to lend a hand. A well-deserved five-star rating!