Dashboard and Home Page

The Home page is the first thing you’ll see when you log into your Zoho Payroll account. It gives you a complete overview of all the payroll activities of your organisation.

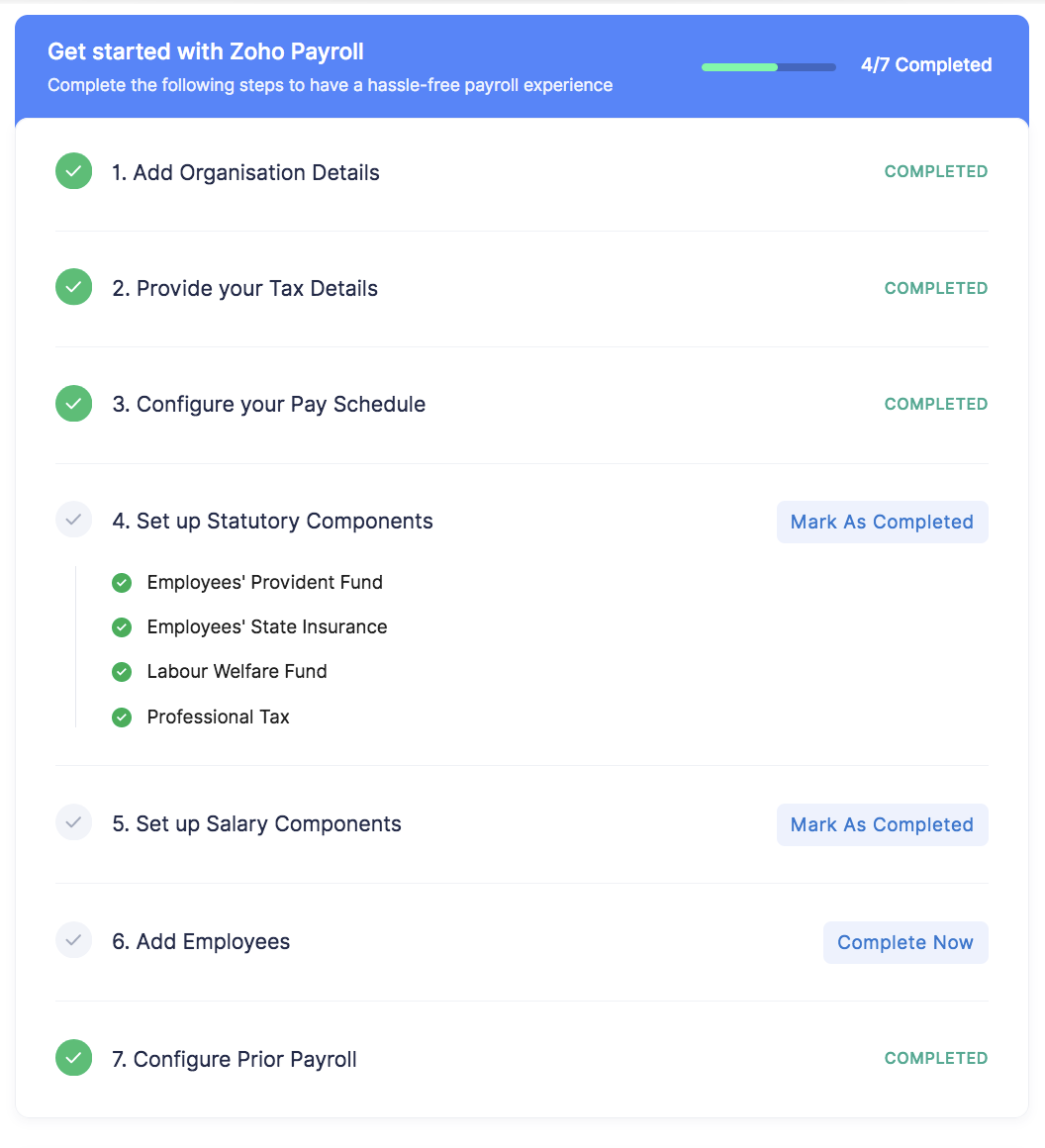

As soon as you set up your organisation, you will find a checklist of the steps you have to complete before you can run your first payroll.

The Home page has the following sections:

Process Pay Runs

Deduction Summary

Employee Summary

Payroll Cost Summary

To Do Tasks

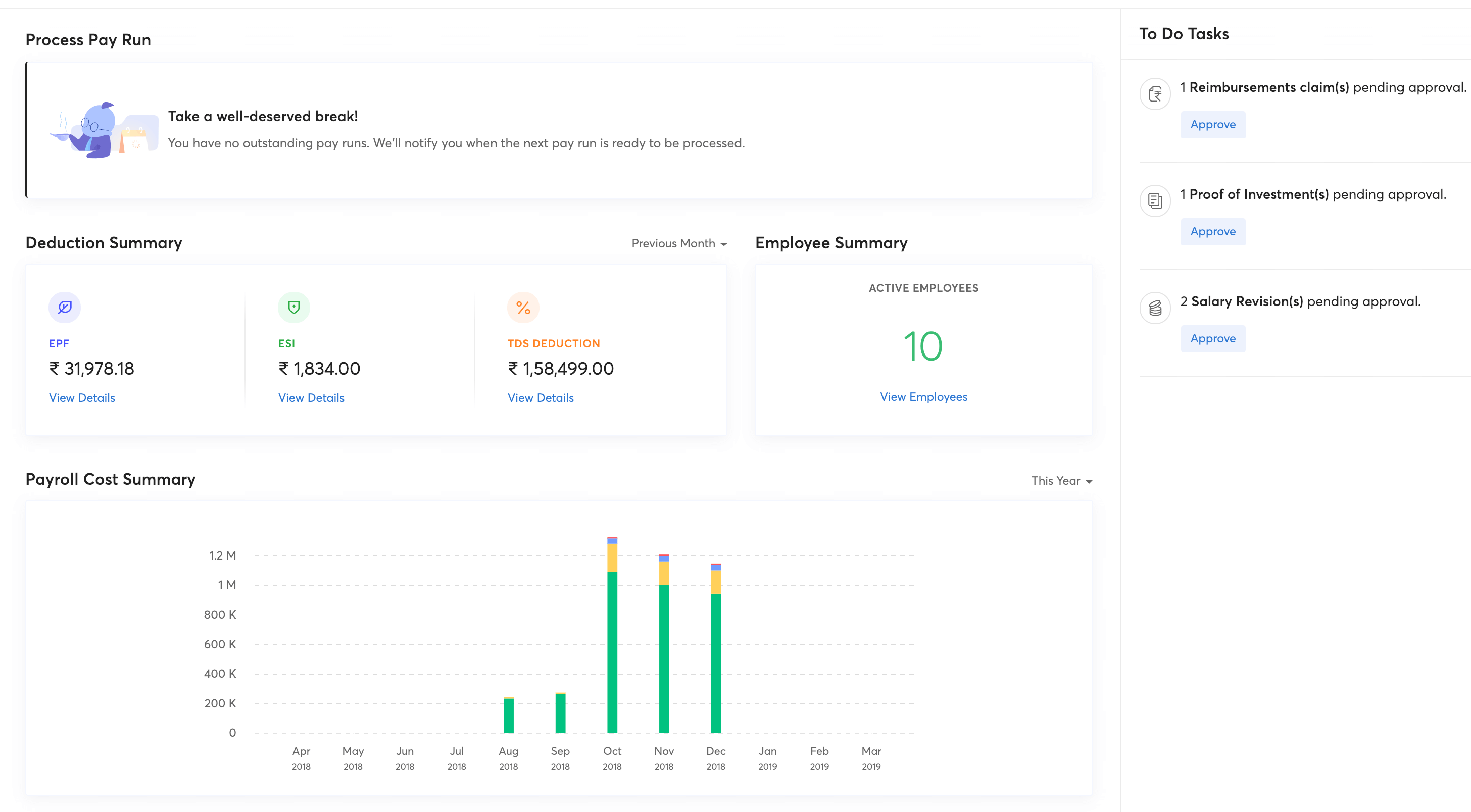

Process Pay Runs

The Pay Runs section shows you the details of any current or upcoming pay runs which need immediate action.

To Do Tasks

View all your pending reimbursement claim, salary revision and proof of investment approvals here. This way, you can keep track of your pending approvals from the Home screen.

Benefits and Deductions Summary

This section gives you information about Employee Provident Fund (EPF), Employee State Insurance (ESI), and TDS (Tax Deducted at Source) Deductions for the most recent month, which you are liable to pay to the Government. You can click the Benefit and we’ll redirect you to the respective report.

Employee Summary

View the number of active employees in your organisation. If any of your employees have incomplete setup, they will be shown here.

Payroll Cost Summary

Payroll Cost Summary helps you analyze the money spent running payroll for your organization. These graphs are generated based on the payrolls that you’ve run. It consists of the following graphs:

- Net Pay - The actual amount you paid your employees.

- Taxes - The amount paid to the Income tax department.

- Benefits - The amount contributed towards benefits like the National Pension Scheme (NPS), Voluntary Provident Fund (VPF), TDS deductions etc. which you are liable to pay as tax to the Government.

- Deductions - The amount deducted from the employees from their salaries after the tax deduction.

You can change the time frame and view the Payroll Cost Summary of This Year, This Quarter, Previous Year and Previous Quarter.

Zoho Payroll's support is always there to lend a hand. A well-deserved five-star rating!

Zoho Payroll's support is always there to lend a hand. A well-deserved five-star rating!