- HOME

- Marketing

- Developing a Powerful Brand Positioning Strategy

- Understanding Your Competitors' Brand Positioning

Understanding Your Competitors' Brand Positioning

- 13 Mins Read

- Posted on December 7, 2018

- Last Updated on October 8, 2024

- By Lauren

As we’ve been discussing, a skillful positioning strategy is one that strongly differentiates your brand from every other brand in your industry. And it should go without saying that there’s no standing out from the crowd if you have no idea what the crowd is offering. In the last section, we guided established businesses through the steps of discovering their market’s perception of their brand. But understanding your competitors’ brand position (including how they’re perceived by the market you share) is something you can—indeed, you should—undertake even if your business hasn’t opened its doors yet.

Let’s face it: Chances are high that the product or service you offer isn’t all that different from the one your competitors offer. Even your customers may not be able to articulate the difference between offerings. Your difference may come down to position, which has nothing to do with the product itself, and everything to do with how it’s presented and perceived.

In the last section, we offered a series of questions to ask while researching your brand perception. Many of these are worth asking of your competitors. And yet perception is only one side of the coin. The other side concerns how your competitors are trying to position themselves. (We’ll call this the difference between external perception and internal objectives.) You’ll want to know as much as you can about both. That includes answers to the following:

- Who are my direct, indirect, and future competitors?

- What do they claim about the products or services they offer? What data do they use to prove their claims? What features or benefits do they emphasize in their messaging?

- What are their marketing strategies? What channels do they use? Which of their strategies appears most successful?

- How do they represent their offering, their employees, and their business in general? What’s the tone their marketing materials take? Is their product portrayed as extravagant or utilitarian? Basic or professional? Traditional or disruptive innovator? What do their mission, vision, and values statements promise?

- Who is their customer persona? Why do their customers choose them?

- What do their customers say about them in business and product reviews? How does their market interact with them on social? How do my competitors respond?

- How is their customer service? What are their hiring practices and how would I describe the company culture they appear to be building?

- According to my market, what are my competitors’ strengths and weaknesses? According to my competitors, what are their own strengths? Are the answers to these two questions aligned?

You’ll answer all these questions with an eye, ultimately, to the gaps you can fill. What are your competitors not doing well that you could do better? What are they failing to do altogether that you could certainly do? You’ll want to carve out a place that hasn’t been carved out yet.

If you’re a new business, doing this kind of competitive research first will ensure that you’re not entering the market with a value proposition that’s already been adopted or a plan to position yourself in a place that’s already occupied, making you superfluous before you’ve even opened your doors. It’ll shed light on the position you can “own” (like Volvo “owns” safety) by identifying the mindshares already owned… and the ones no one has claimed yet.

If you’ve been in business for awhile, this process will help you refine your current strategy in light of your competitors’ positions, leverage your strengths and re-articulate your position in light of your competitors’ weaknesses, and cultivate a laser-like focus to start delivering on the “promise” you decide you want to be known for.

All that, rather than playing a guessing game.

Identifying Your Competitors

We’ve talked about distinguishing between direct and indirect competitors and building your competitor list elsewhere; so we won’t dig too deeply here. Remember that your competitor pool is made up of more than direct competitors (businesses that offer the same product or service to the same target market). Competition comes in many forms, some more subtle than others: If you own a gym, you may be competing not only with other fitness options, but also with consumers’ couches and Netflix accounts!

That said, from a positioning perspective, your most important indirect competitors are 1) businesses who don’t offer the same product or service, but meet the same need in an alternate way; and 2) businesses who do offer the same product or service, but to a different market segment.

While you’ll focus primarily on direct competitors for this exercise, pay attention to your competitor range. Indirect competitors could easily become direct competitors with a single addition to their product line or an extension of their target market. (Remember how Amazon entered the grocery segment when it bought Whole Foods?)

In brief, here’s how to discover your competitors:

- Study reports from market research firms—or do secondary market research yourself, and observe which businesses get mentioned in the resources you employ.

- Utilize keyword research to see which businesses come up in the search engine results when you type in keywords for your industry.

- Ask your customers, who probably researched your competition before choosing to work with your business. (Or ask former customers, who might be doing business with your competitors now; or ask members of your sales team, who probably hear prospects mention your competitors’ names regularly.)

- Use social media platforms to find out what businesses in your industry are getting recommended or reviewed, or what other businesses your customers follow.

- Check online forums (Quora, for example) to discover which products, services, and businesses in your industry users are recommending to each other.

Once you’ve exhausted these resources, choose 4-5 competitors whose names you keep seeing. You’ll be researching them from two different points of view:

1) the perspective of their market, searching primarily for what their market sees as their weaknesses

2) the perspective of the company, to decipher what their positioning strategy is based on the messages they’re sending

Gauging Your Competitors’ Market Perceptions

In this first phase of competitive research, you’ll be using the same techniques you used to uncover your market’s perception of you. How are your competitors talked about, categorized, and ranked by their customers? By their broader target market? By their industry as a whole? Strategies for answering these include:

Consumer surveys

Given every member of your target market shares a pain point (the one you’re out to solve), chances are high that they’ve done research on both you and your competitors… and they have an outside perspective on what sets you apart. “Surveying” your market can include interviewing them at industry events or having members of your sales or customer service teams occasionally probe callers for the reasons they chose you over your competitors… or why they’re leaving you for them.

If you have reservations about asking consumers directly about your competition, you can commission a research firm to conduct a market analysis that includes a survey of consumer attitudes about your competitors. These firms produce reports that include statistics such as your competitors’ market share or sales numbers, independent opinions on your competitors’ strengths and weaknesses, and more.

Social listening

Use the search features on Facebook, Instagram, Google+, LinkedIn, and other social platforms to see how consumers are talking about your competitors. Thanks to tools like Zoho Social, Hootsuite, and Mention, you can also set up alerts to get notified each time a consumer posts about, tags, or @mentions any of your competitors.

What does your competitors’ overall customer sentiment look like? Around what topics are their customers primarily engaging? At some point, you may start recognizing patterns in positive and negative mentions. The positive mentions will tell you where your competition is strongest; it may not be worth trying to compete with them in that space. The negative mentions, on the other hand, might reveal an opportunity for your brand.

Review sites and blog comments

While social media will likely be your biggest data-generator, don’t forget other user-generated content spaces. Reviews—by virtue of their very genre, which asks consumers to “evaluate”—can be a goldmine of information concerning consumer satisfaction or discontent. Blog comments may be less revealing in this sense, but can still yield valuable insights. Look for patterns in positive and negative reviews. Take notes.

Every bit of data you uncover here can be useful to you from a broader business perspective. But remember that, as a positioning exercise, your mantra should be “competitor weaknesses and industry gaps.” That’s what you’re looking for.

Gauging Your Competitors’ Brand Positioning Strategies

You should have a pretty strong sense, at this point, of how your target market feels about your competitors. Now there’s the other half of the coin, which is how your competitors are trying to position themselves… regardless of how well they’re succeeding.

Why do you need to know your competitors’ strategies and approaches if what ultimately matters is their market’s perception? Because even if they’re failing to communicate or meet their market now, their next campaign—or media story, or consumer-determined fad—could be the thing that catapults them into the industry spotlight. If your market suddenly recognizes them for that thing they’ve been promising, you don’t want to have been promising the same… unless, that is, you’re certain you could still win the market share.

Here’s where to turn for that reconnaissance work:

Social media

Yep, we’re back to social. You’ve observed consumer sentiment; now it’s time to see what the brands themselves are saying. Scour your competitors’ feeds. Which social platforms are they most active on, and what can you infer about their target market from this? (Snapchat and LinkedIn users, for example, make up very different demographics.) What kinds of stories are they sharing, and whom do those stories appeal to in terms of age, gender, social class, niche market? What tone do they take with their followers? Whom are they following and interacting with? What’s the subject matter of their posts? How (and how often) do they speak about their company in their posts? And what do the answers to these questions suggest about their positioning strategy?

Company websites

Assuming your competitors have paid as much attention to their websites as they ought to, virtually everything you’d want to know about their positioning strategies can be found here. Company homepages will alert you to what they think their most prized products are, the most significant features and benefits of their offering, and their visual identity. About Us pages will give you a sense of the broader story they’re telling about their business. Mission, vision, and values statements—along with value propositions and unique selling propositions—will reveal both the company’s self-image and the mindshare they’re trying to win.

Take a look at their product or services pages. The customer value they focus on—alongside their pricing—will expose their target market and the perception they want their market to have of them (budget, premium, etc). Finally, do a content analysis on their blog. What does their SEO look like; what does their content marketing strategy appear to be; what do their posts suggest about the kind of authority they hope to be seen as? And what does all this suggest your competitors think their strengths are?

Marketing and advertising materials

What imagery and language do they employ in their advertising? What’s the attitude, tone, or spirit their messaging evokes? What channels do they advertise in? What features or benefits do they emphasize in their ads? Reverse-engineer their messaging to understand what piece of the market they’re after. How much do they appear to be spending on their ads? (An ad agency can quantify this for you.) Are their ads responses to their competitors? (The answer to this may give you a sense of how they’ll respond to your future strategies.)

Sign up for their email list and consider the emails you receive from them. Look at their product brochures and read their press releases. How are they trying to set themselves apart? Are they claiming—subtly or conspicuously—to be innovators, low-budget suppliers, market leaders, etc? If you put all these marketing and advertising messages together, what’s the primary differentiating factor they’re articulating?

Employees and customer service

If your competitor has a brick-and-mortar store, visit it. If not, call their customer service or their sales reps with questions. If they have live chat on their website, use it. Ask questions as though you were a prospect. Find out for yourself the quality of their service, the tone of their brand, and the knowledge of their employees. If you call more than once, is the tone that you’re met with consistent? If they display employee bios on their website, take a look at what the makeup of their team suggests about company culture (Do they only hire PhDs or MBAs, or do they take an anti-institutional approach and hire people to learn on the job?). Extrapolate: What does company culture suggest about how that company wants to be known?

These aren’t the only strategies out there (using your competitors’ products or services will tell you a lot, and there are plenty of othercompetitor analysis tools out there to play with); but the above strategies should tell you plenty about how your competitors hope to be perceived.

Of course, now that you’ve done the research on their market’s perception, you know whether or not they’re succeeding.

Visual Aids for Competitive Brand Positioning

If you’ve done your due diligence, you’ve just spent at least a few afternoons researching your competitors’ positioning strategies and their markets’ interpretations of those strategies. Hopefully you’ve taken detailed notes… because it’s time to arrange that data. There’s nothing cutting-edge about the below strategies; but they’re certainly tried-and-true. And they’ll give you a visual snapshot of the data you’ve collected, so you can more easily determine your relative position.

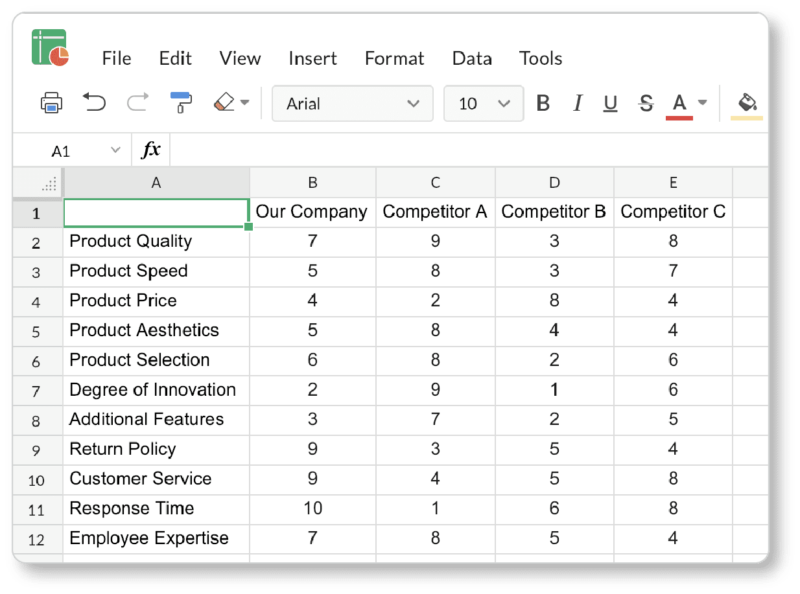

Competitor research spreadsheet and rating

This is exactly what it sounds like. Use Zoho Sheet, Excel, Google Sheets, or the ancient pen-and-paper method to create a spreadsheet for comparison. List your competitors and yourself along one axis, and the criteria by which consumers purchase along the other axis. Criteria might include product quality, product effectiveness, service uniqueness, price, innovation, aesthetics, durability, serviceability, ease of use, additional features, customer service, and so on.

Choose the criteria that come up again and again in consumer reviews, ratings, and mentions. You want to map what matters to your market; and you want your ratings to be objective and fact-based rather than guided by personal bias. Now, based on the data you’ve collected, rate each company according to each criterion on a scale of 1-10. The below is a rather crude example, but you get the idea:

Now, ask yourself:

- In which categories do I score higher/lower than average?

- In which categories are the biggest ratings gaps between myself and my competition?

- In which categories are scores low across the board? Are those criteria ones I could improve upon to differentiate my offering from the mediocrity?

- In which category is the ratings gap one in which I score highest? (And what would a brand positioning statement that focused on this criteria look like?)

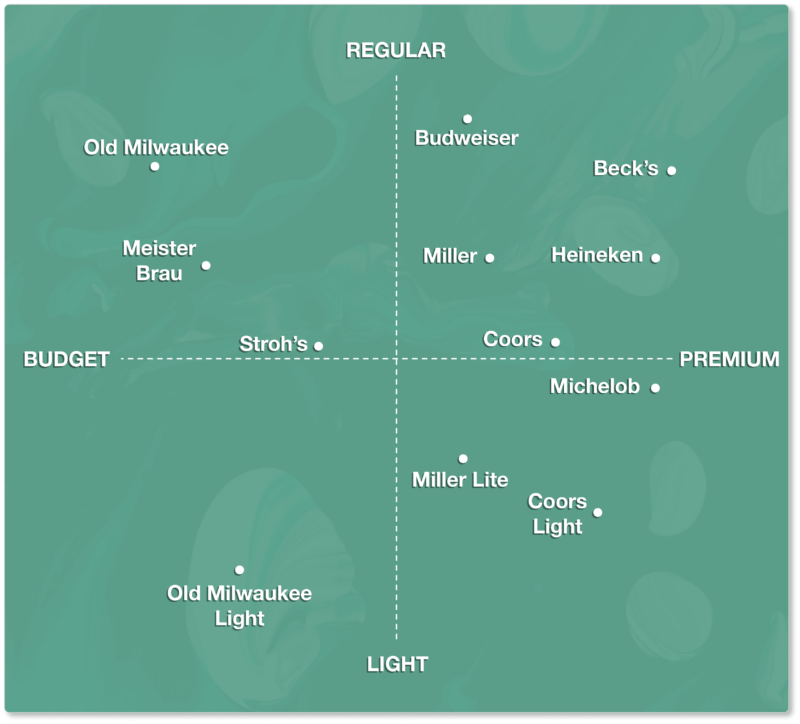

Perceptual brand mapping

According to the American Marketing Association, perceptual brand mapping is “the visual plotting of specific brands against axes, where each axis represents an attribute that is known to drive brand selection.” A perception map takes two of the criteria you listed on your spreadsheet and plots them in relation to each other, giving you a sense of the industry landscape according to two motivations for purchase. (One of the criteria is often price; these are called “price-benefit maps” and are based on the assumption that there’s an approximate relationship between price and quality.) Here are two examples of price-benefit maps:

Note that the second map is different from the first as it pertains to “benefit.” No one is arguing that “high quality” isn’t better than “low quality”; if you’re in the auto market, you don’t want to be in the quadrant Mini is in (low quality / high price).

On the other hand, there’s no “bad” quadrant on the beer map. If you were in this industry, you’d ask: Do I want to produce regular or light beer; and do I want to be seen as high-quality or as a budget option? With the map in front of you, you’d easily locate the less competitive or unoccupied spaces. (There are five times as many brands in the regular/premium quadrant as there are in the light/budget quadrant; a new business would be wise to position themselves in the latter.) So while these maps might seem like oversimplifications, they can help you see through the data fog.

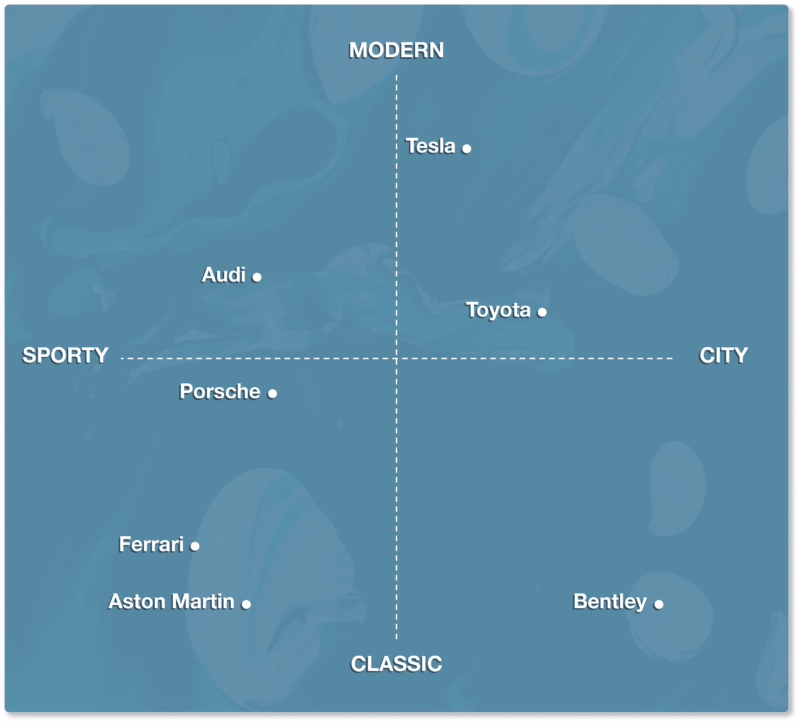

Price doesn’t always have to be one of the axes. What matters is that each axis considers criteria that your market deeply cares about. Since you can only consider two criteria at a time, you’ll make many versions of these maps: Have some fun with your criteria-pairing. Here’s another auto map, examining aesthetics (“modern” v. “classy”) and handling (“city” v. “sporty”):

Again, because this isn’t a price-quality map, none of these quadrants would make for unfavorable positioning. The point is to find the gaps, reducing the number of competitors you’re up against… though of course, before you jump wholeheartedly into one of those low-density quadrants, do your research to make sure it’s not empty for a reason (for instance that no one wants that combination of characteristics)!

Again, because this isn’t a price-quality map, none of these quadrants would make for unfavorable positioning. The point is to find the gaps, reducing the number of competitors you’re up against… though of course, before you jump wholeheartedly into one of those low-density quadrants, do your research to make sure it’s not empty for a reason (for instance that no one wants that combination of characteristics)!

Hopefully you can see how this is as useful for new businesses looking to “plot their first point” in the industry as it is for older businesses looking to plot their desired position and shift into new quadrants.

While there are other ways to visualize your relationship with your competitors and your present (or future) mindshare in your industry—individual SWOTs, for example—we’ve found these two strategies complement each other well. Perceptual mapping will alert you to the gaps or under-occupied spaces where two consumer criteria meet. And a spreadsheet-and-rating system will alert you to your relative strengths… so you know which of those under-occupied quadrants you can credibly move into.

And “credibly,” of course, is the key word there.

Now that you know your strengths and your industry’s gaps, it’s time to do the work of differentiation. In the next section, we offer a series of differentiation styles and positioning strategies, so you can solidify your singular value in relationship to your competition.