How Customers Pay

Zoho Payments supports a wide range of payment methods to simplify the payment experience. Customers have the flexibility to pay using the enabled payment methods and can easily switch to an alternative in case of any downtime or issues.

If you’re using Zoho Payments as a standalone solution, your customers can pay you using:

- Payment Links: Customers can use the shared link to complete the transaction.

- Embedded Widget: Customers can make the payment from the widget embedded on your website.

If Zoho Payments is enabled in Zoho Finance apps (Zoho Invoice, Zoho Checkout, Zoho Commerce, Zoho Billing, Zoho Books, or Zoho Inventory), your customers can proceed to pay via:

- Invoices (one‑time or recurring), shared in emails, links, or the customer portal.

- Payment links sent directly to them.

- Payment pages accessed via your site, QR code, or link.

- Hosted payment pages where customers can complete their payments without leaving your site.

- Online store checkout using Zoho Payments as the gateway.

From there, they can select any of the enabled payment methods, enter their details, and complete the payment. You can refer to the section below to know how each method works in detail.

| Related Help Documentation | ||||

|---|---|---|---|---|

| Zoho Books | Zoho Invoice | Zoho Billing | Zoho Checkout | Zoho Inventory |

How Each Payment Method Works

While making a payment, your customers must enter their phone number for tracking and choose from the available payment methods to complete the transaction. Here’s how each method works:

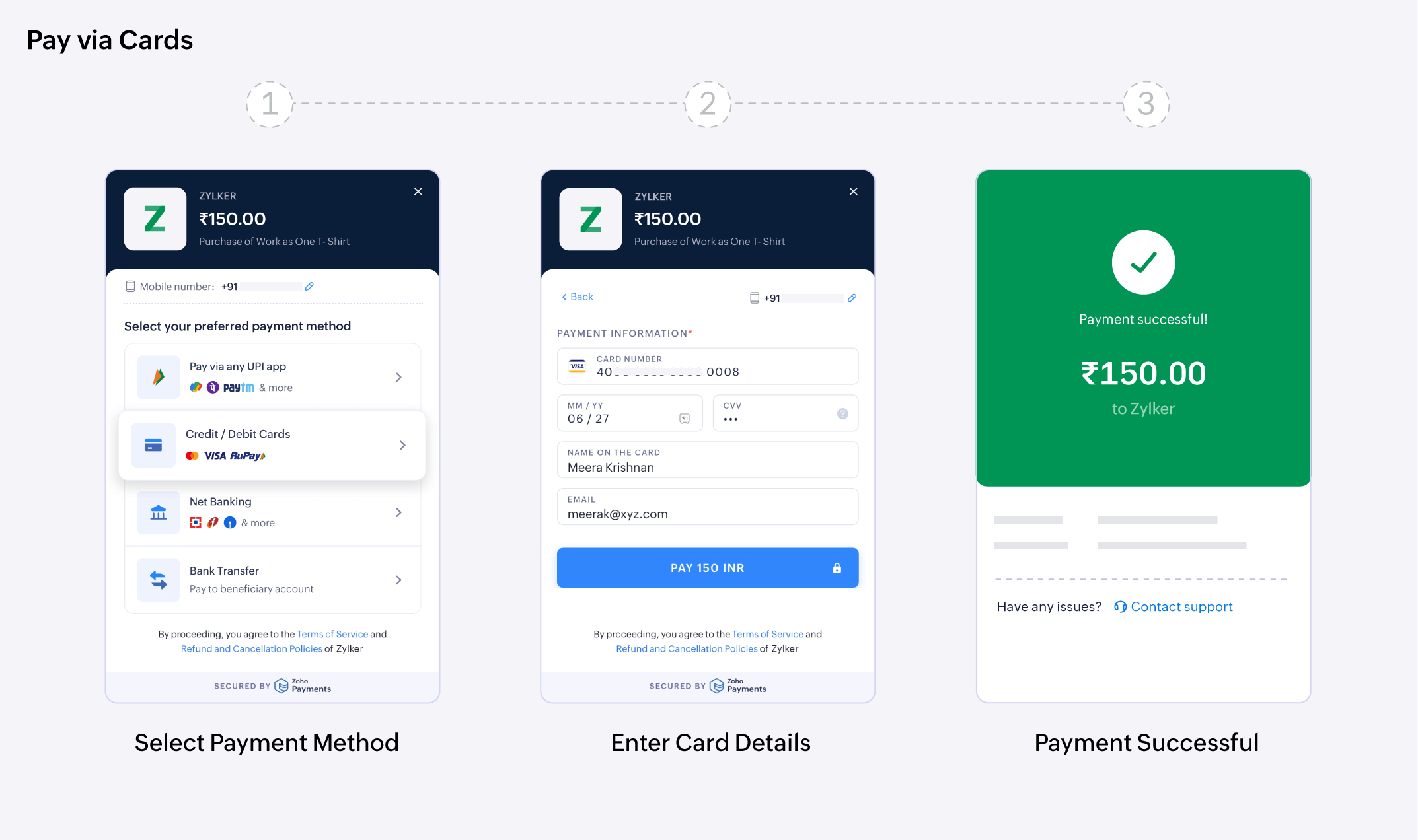

Cards

Customers can complete transactions using their credit, debit, or prepaid cards. To make a card payment, your customer will have to:

- Select the Credit/Debit Card option.

- Enter their Card Number, Expiry, CVV, Cardholder Name, and Email.

- Click Pay to complete the payment.

- Authorise the payment using the OTP sent by their issuing bank.

Once paid, the amount is instantly transferred from the customer’s bank account to your merchant account.

UPI

Unified Payments Interface (UPI) is a real-time payment system that allows customers to transfer money instantly between bank accounts using their mobile phones (such as Google Pay, PhonePe, or Paytm). Once the payment is initiated, there are different ways a customer can pay:

- Scan and Pay via QR

- Pay via UPI ID

- UPI Intent

- UPI Payments via RuPay Credit Cards

- UPI Credit Lines

- UPI AutoPay

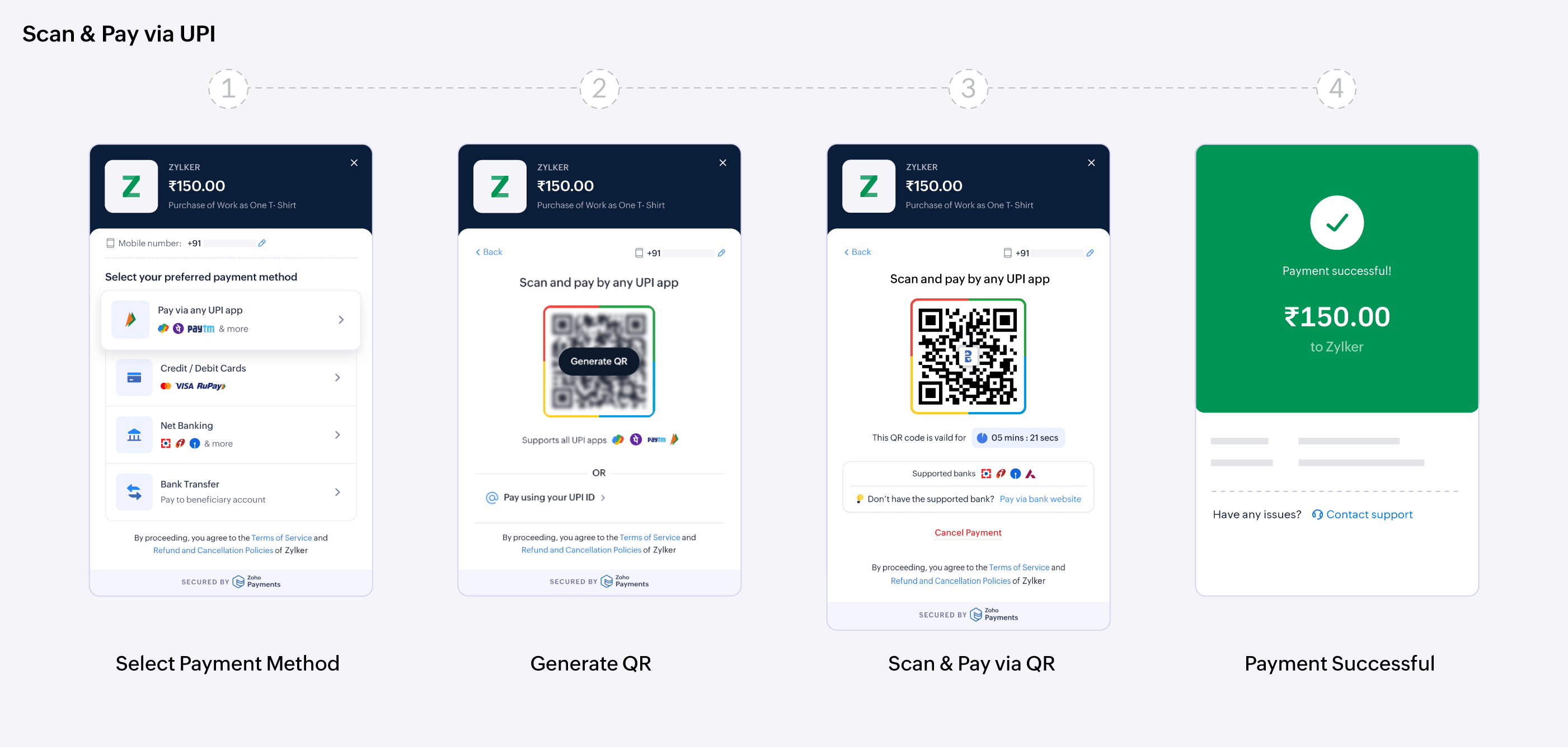

Scan and Pay via QR

A QR code is a unique scannable code generated for a transaction, enabling customers to make payments through UPI.

To make a payment via UPI, your customer will have to:

- Open their preferred UPI app.

- Scan the QR code displayed on the Zoho Payments checkout page.

- Enter their UPI PIN to complete the payment.

Once paid, the amount is instantly transferred from the customer’s bank account to your Zoho Payments account.

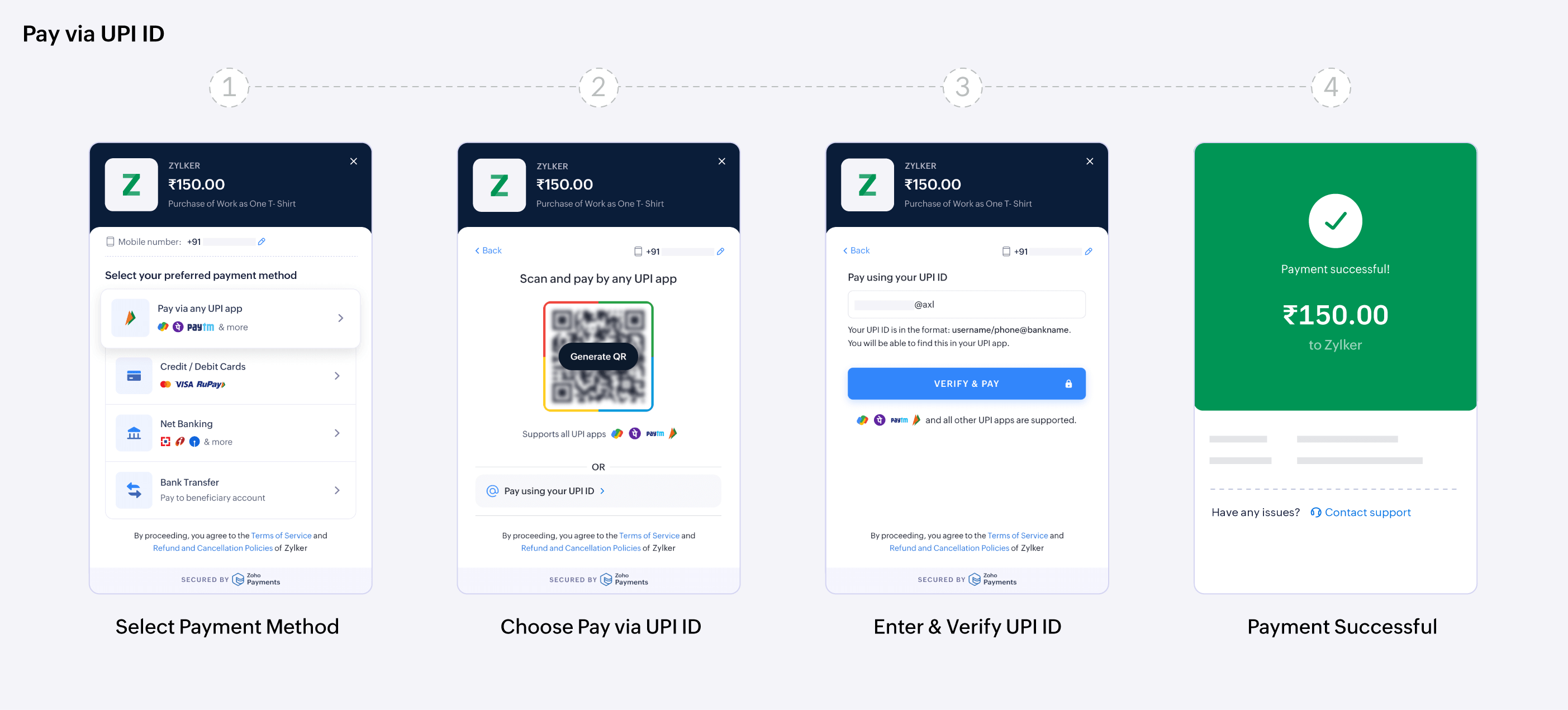

Pay via UPI ID

A UPI ID is a unique identifier linked to your customer’s bank account. It allows them to send and receive money securely through UPI-enabled apps without sharing sensitive bank details.

Note: As per NPCI guidelines, Zoho Payments will deprecate the Pay via UPI ID option for one-time payments by February 28, 2026. This option will continue to be supported for recurring payments via UPI mandates and for transactions initiated on iOS devices until NPCI deprecates it.

To make a payment via UPI ID, your customer will have to:

- Enter their UPI ID and click Verify & Pay.

- Open the UPI app linked to the entered UPI ID.

- Enter their UPI PIN to complete the payment.

Once the payment is authorised, the amount is transferred from the customer’s bank account to your merchant account.

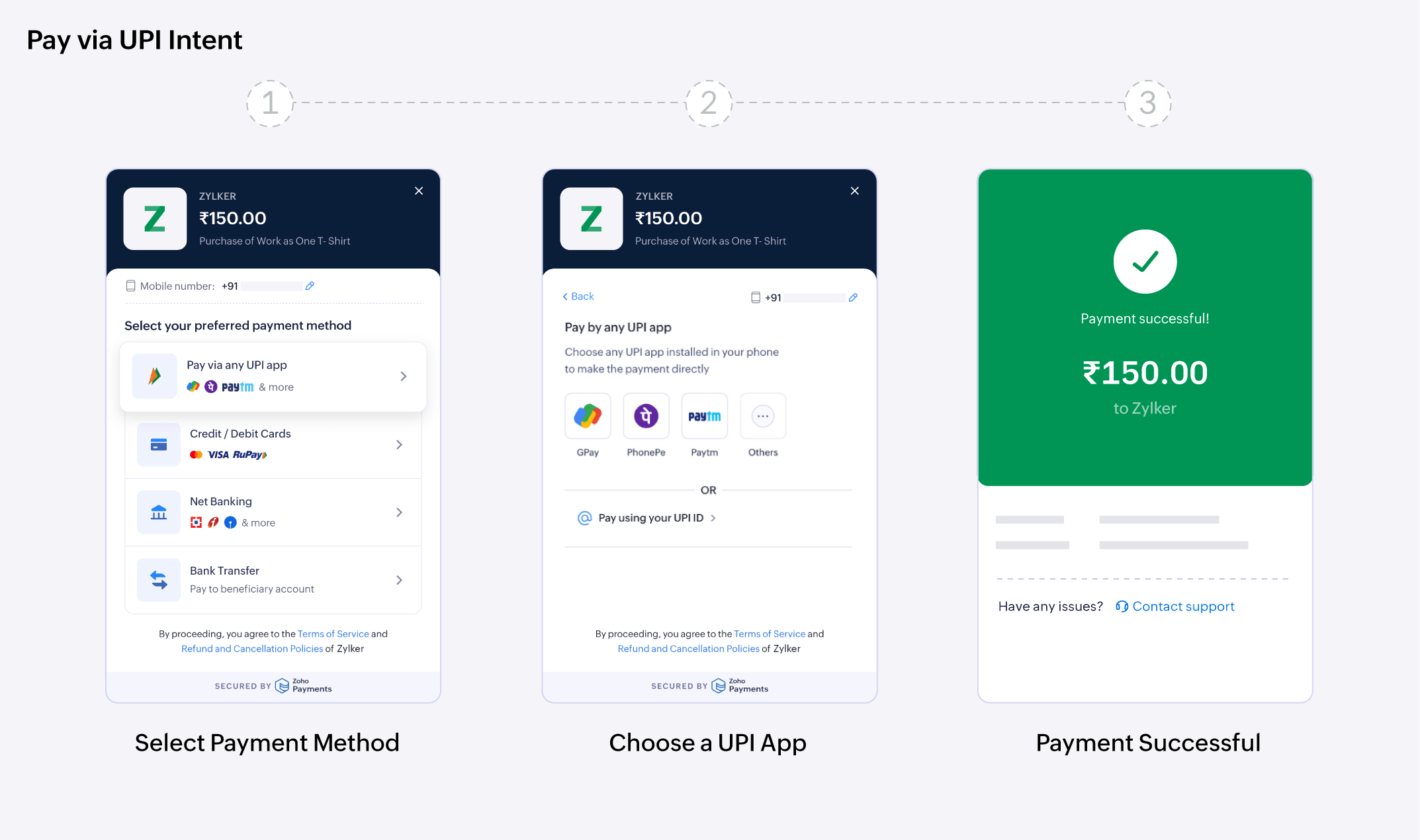

UPI Intent

UPI Intent is a payment method that allows apps or websites to initiate a payment request directly through a UPI-enabled app installed on a customer’s mobile. Instead of manually entering UPI details or scanning a QR code, the customer is redirected to their preferred UPI app (such as Google Pay, PhonePe, or Paytm) with the payment details pre-filled, where they can authorise and complete the payment securely.

To make a payment via UPI Intent, your customer will have to:

- Select their preferred UPI app from the checkout widget.

- Review the payment details pre-filled in the UPI app.

- Authorise the payment by entering their UPI PIN.

Once the payment is authorised, the amount is transferred from the customer’s bank account to your merchant account.

UPI Payments via RuPay Credit Cards

Traditionally, UPI transactions are linked to savings or current bank accounts, where the payment amount is immediately deducted.

With RuPay credit cards, customers can conveniently make payments through UPI while availing credit benefits such as reward points and delayed bill payments based on their billing cycle. This feature is supported on major UPI apps, and once you enable it in Zoho Payments, your customers can start using it to make payments.

To make a payment via RuPay credit card, your customer will have to:

- Select their preferred UPI payment method (Scan QR, or UPI ID or UPI Intent).

- Choose their linked RuPay Credit Card to complete the payment.

- Authorise the transaction by entering their UPI PIN.

Once authorised, the amount will be charged to their RuPay Credit Card and settled according to their billing cycle.

UPI Credit Lines

UPI Credit Line allows users to make payments through UPI using a pre-approved credit limit from their bank. Instead of deducting money directly from a savings account, the payment is made from this credit line. It offers the convenience of UPI with the flexibility of borrowing. Users can scan, pay, and repay later based on the credit terms set by the bank.

To make a payment via UPI credit line, your customer will have to:

- Select their preferred UPI payment method (Scan QR, UPI ID, or UPI Intent).

- Choose the UPI Credit Line option as the payment source.

- Authorise the transaction by entering their UPI PIN.

Once authorised, the amount will be deducted from their pre-approved credit limit and can be repaid according to the bank’s credit terms.

UPI AutoPay

UPI AutoPay enables businesses to collect recurring payments securely by setting up mandates through UPI. Customers can approve the mandate once, and payments are deducted from their linked accounts.

To enable UPI AutoPay, your customer will have to:

- Open the recurring invoice or payment request.

- Select UPI and enable the option to link the UPI details for future recurring payments.

- Choose their preferred UPI payment method (Scan QR, UPI ID, or UPI Intent).

- Authorise the transaction by entering their UPI PIN.

Once the customer authorises the mandate request, autopay is set up for the recurring payment. This allows future payments to be deducted automatically, with no further action needed from the customer.

Note: This feature is available on request. To enable it for your customers, contact us.

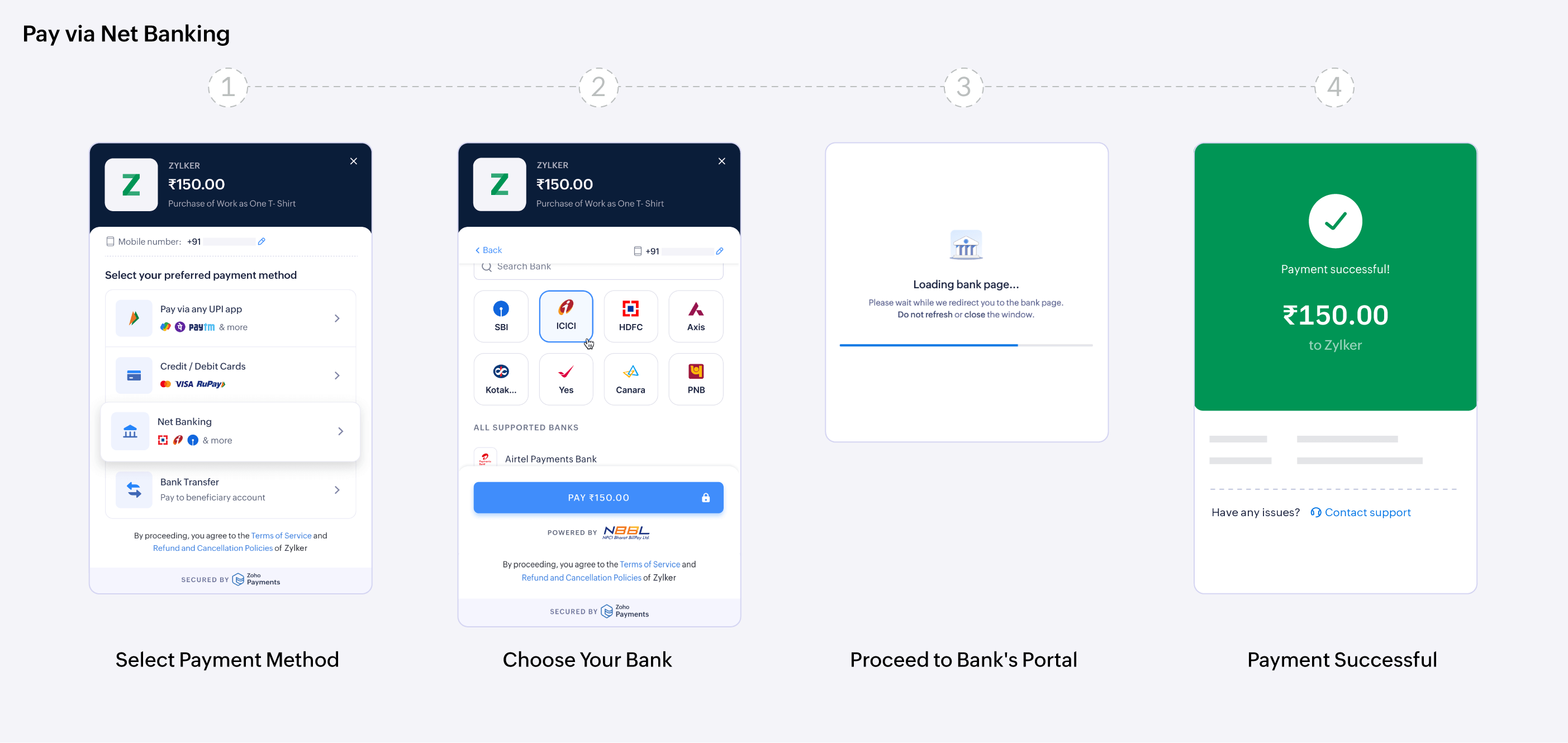

Net Banking

Net Banking allows customers to pay directly from their bank accounts. Net Banking 2.0, also known as Banking Connect, lets them pay via QR code or through their mobile banking app for selected banks. Here’s the list of banks supported in Zoho Payments.

- Pay via Bank Website: Customers will be redirected to their bank’s website to complete the payment manually.

- Pay via Net Banking QR code: Customers can generate a QR code and complete the payment by scanning it using their mobile banking app.

- Pay via Mobile Banking App: Customers can complete the payment directly from their mobile phones by selecting their preferred mobile banking app.

Note: Banking Connect is available only if the customer’s bank offers this feature and their mobile banking app is compatible with it.

Once the payment is completed, the funds are transferred to your merchant account, depending on the bank’s processing time.

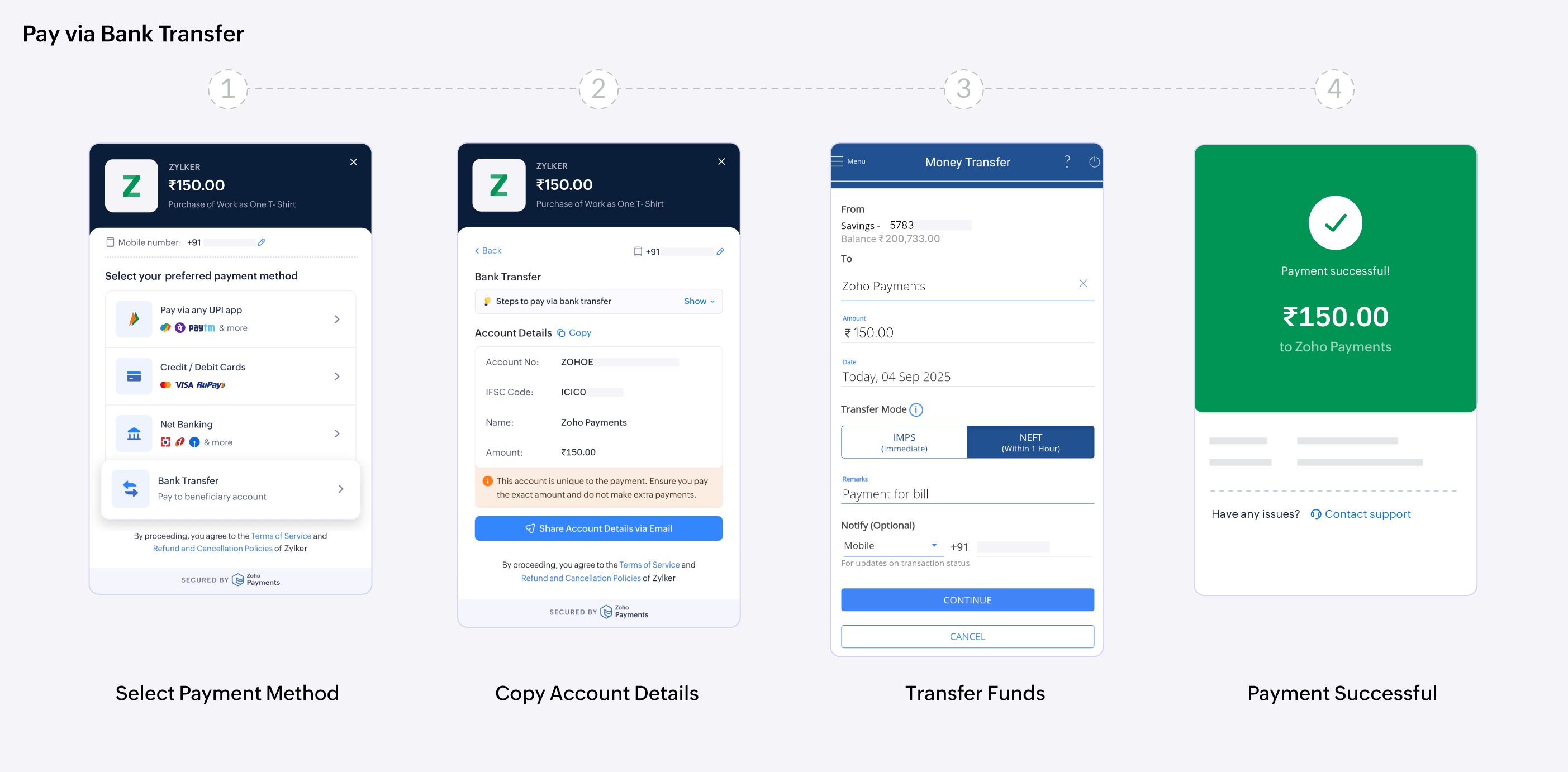

Bank Transfers

Customers can transfer funds directly via NEFT, RTGS, or IMPS from their bank account to the provided Zoho Payments account. This allows them to complete the payment at their convenience, using their banking portal or mobile app.

Note: Ensure your customer pays the exact amount and avoids extra payments, as this account is unique to their payment.

To make a bank transfer, your customer will have to:

- Select Bank Transfer as the payment method during checkout.

- Copy or Email the unique account details, including the bank account number and IFSC.

- Log in to their online banking portal using their credentials.

- Select their preferred transaction type (NEFT, RTGS, or IMPS).

- Use the account details to complete the payment.

Once the payment is completed, the funds are transferred to your configured account, depending on the bank’s processing time.

Notes:

- This feature is available upon request. Contact support@zohopayments.com to get it enabled.

- Zoho Payments does not support refunds for bank transfers. Any refunds must be issued offline using your preferred payment method.