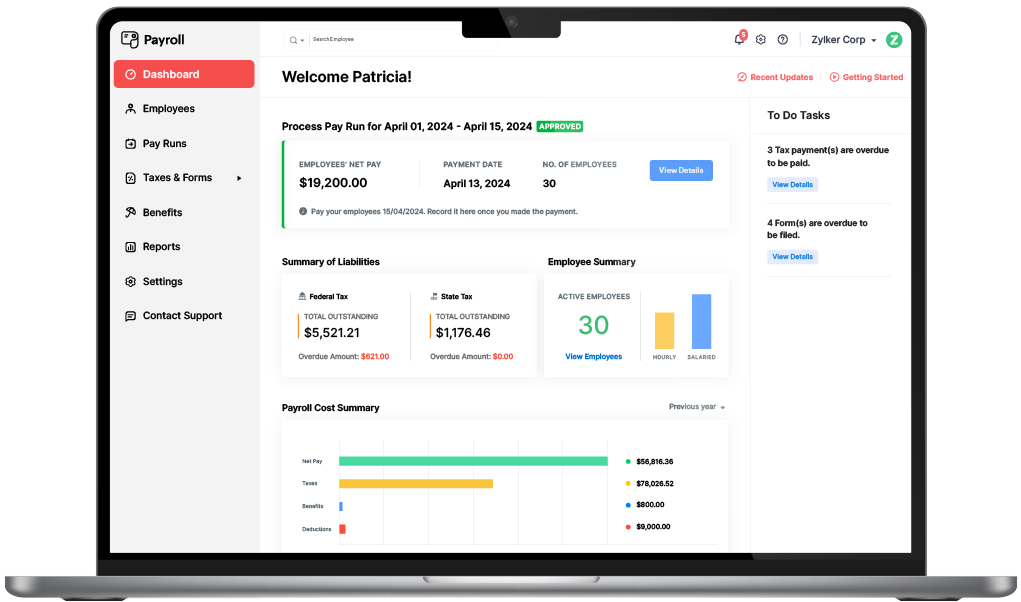

Run payroll like a pro for any state, report payroll spend accurately

Process payroll and pay salaries for hourly and salaried employees. File federal and state taxes automatically.

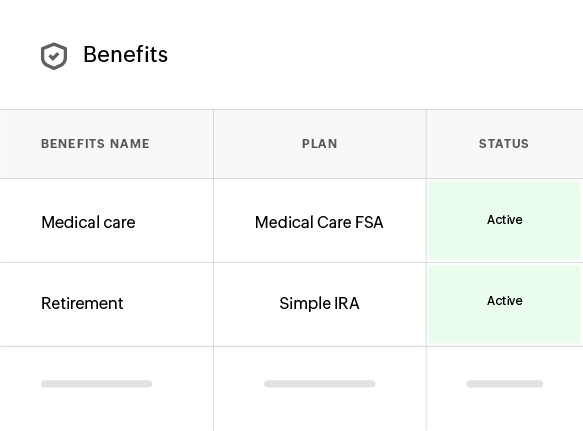

Benefits

Payroll made simple,

smart, and compliant

Seamless single-state, full-service payroll

Pay employees across all 50 states in the US, compliant with federal, state, and local tax laws.

Automated tax filing

Tax filing for federal, state, and local tax is completely automated. We ensure to keep you compliant so you don't have to.

Accurate payroll spend reports

Payroll, your biggest business spend is automatically accounted for in your spend reports.

All the forms you need

Forms I-9 and W-4 for onboarding and W-2 for employee tax statement. View your employer tax return forms after filing is completed.

Built for ease.

Built for accurate payroll

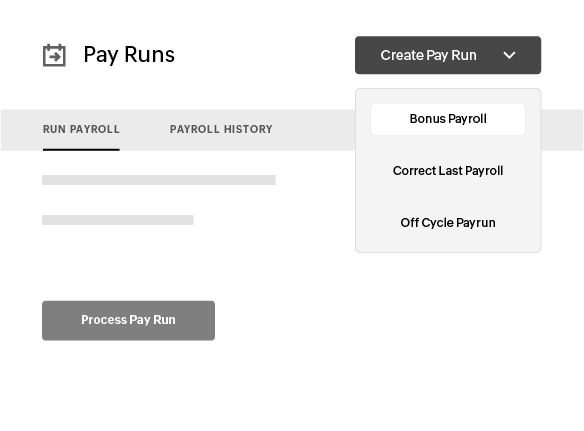

Well-designed UI that

feels familiar

Adapt the payroll features with an intuitively designed user interface. Get started with running payroll with the help of user guides and videos for all features.

Flexible customizations for your business

Configure auto email notifications, add custom fields to capture employee data, run ad hoc payroll, and many more custom actions.

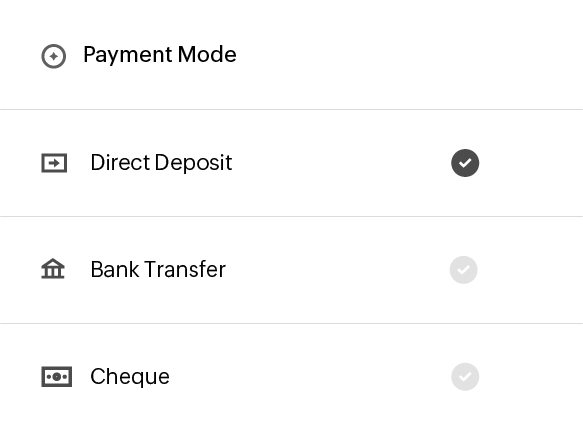

Online salary payments

In a single click, transfer salaries to employee bank accounts with online salary payments through ACH.

Manage employee benefits

Track all mandatory benefits deductions, such as healthcare, retirement, and paid time off (vacation and sick leave).

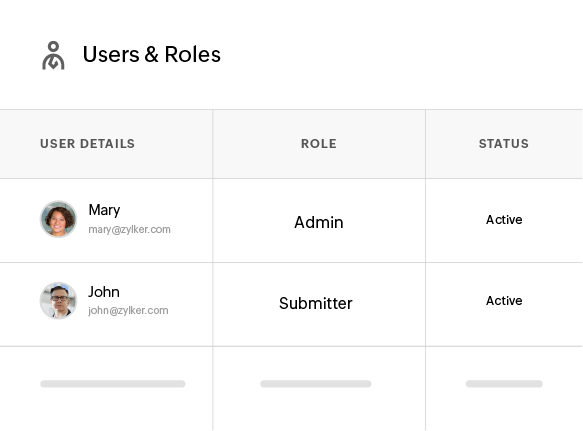

Make collaboration secure between your teams

Assign unique roles to each team working on payroll, but ensure seamless collaboration amongst all your staff with controlled access.

Make payroll information accessible to employees

Provide each employee with login credentials to access their self-service portal and view pay information.

-

Download pay stubs

-

Sign I-9s and W-4s

-

Access documents uploaded by their employer

-

View salary details

-

Download W-2s

-

Contact the payroll admin