e-Invoicing compliant accounting software for Saudi Arabia

Zoho Books is now a ZATCA approved Phase 2 e-invoicing compliant solution. Get e-invoicing (Fatoorah) ready for your tax invoices in no time.

With you from the start: The e-invoicing timeline

Transition phase

The Zakat, Tax, and Customs Authority (ZATCA) in Saudi Arabia, through Phase I of e-invoicing, had mandated that all businesses must issue only e-invoices using compatible systems from 4th December 2021.

Integration phase

The e-invoicing platforms must be integrated with ZATCA's Fatoora portal, marking the completion of Phase II of e-invoicing. This phase involves transmitting e-invoices to ZATCA to ensure full compliance.

Deadlines

Phase II is rolled out in waves based on annual revenue subject to VAT. ZATCA will notify taxpayers at least six months in advance. Businesses with revenue over 10 million SAR must be Phase II ready by 28th February 2025.Click here for all deadlines.

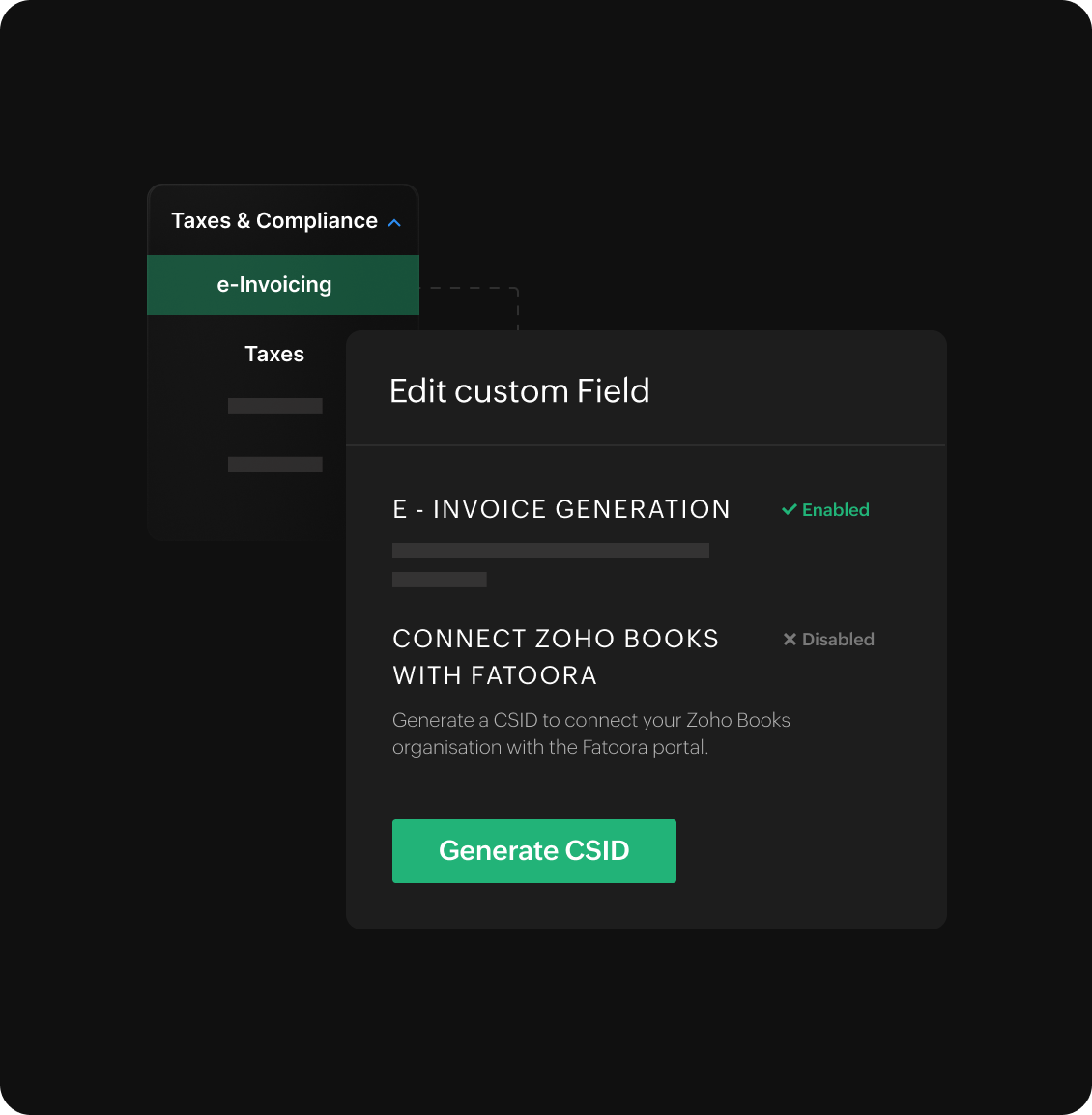

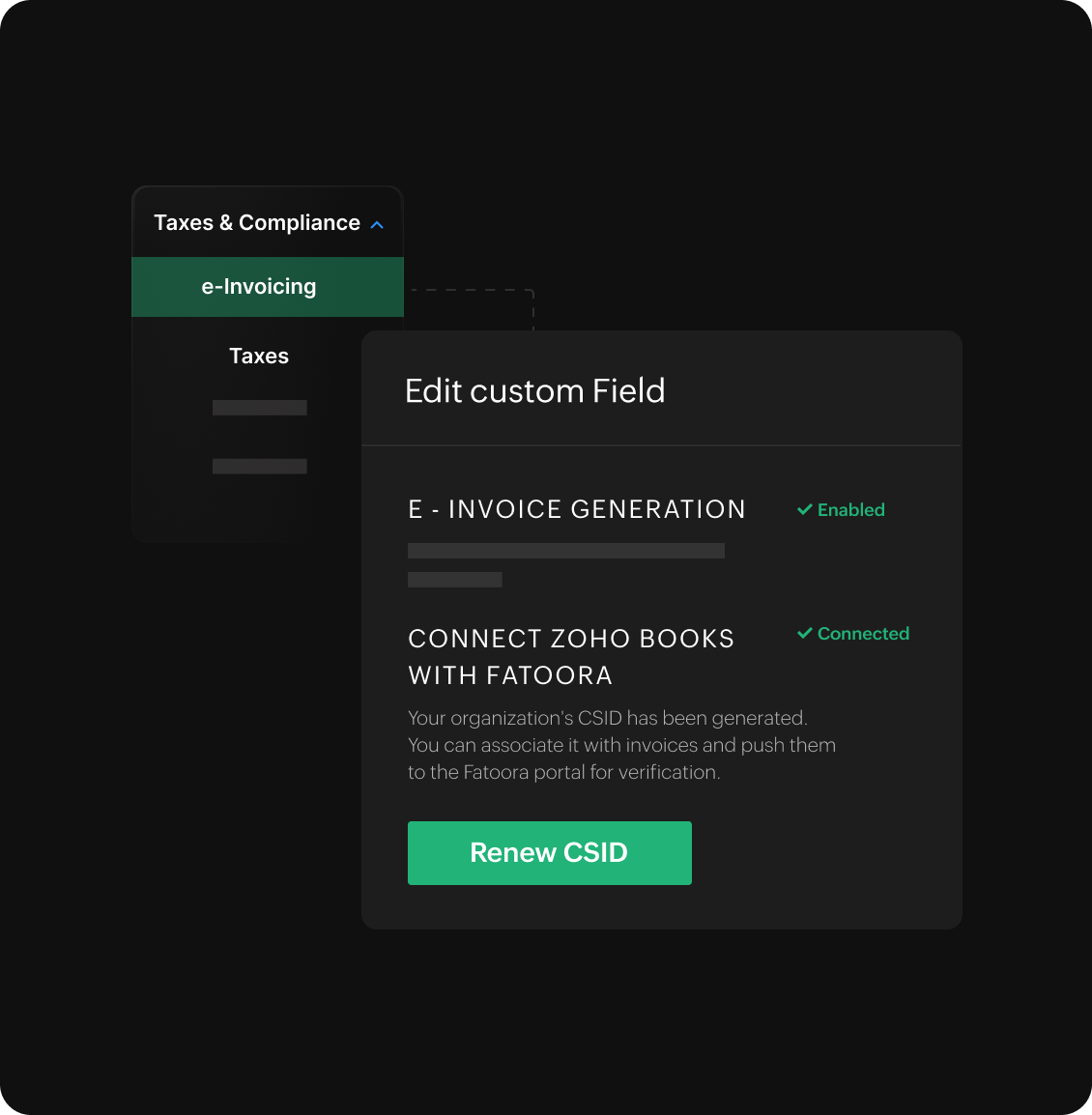

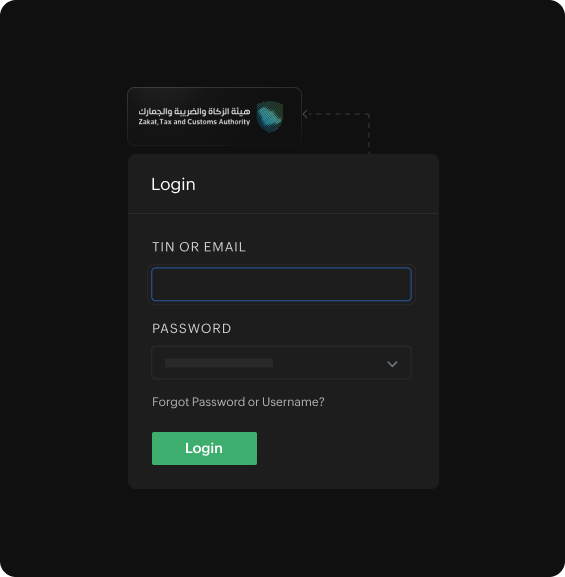

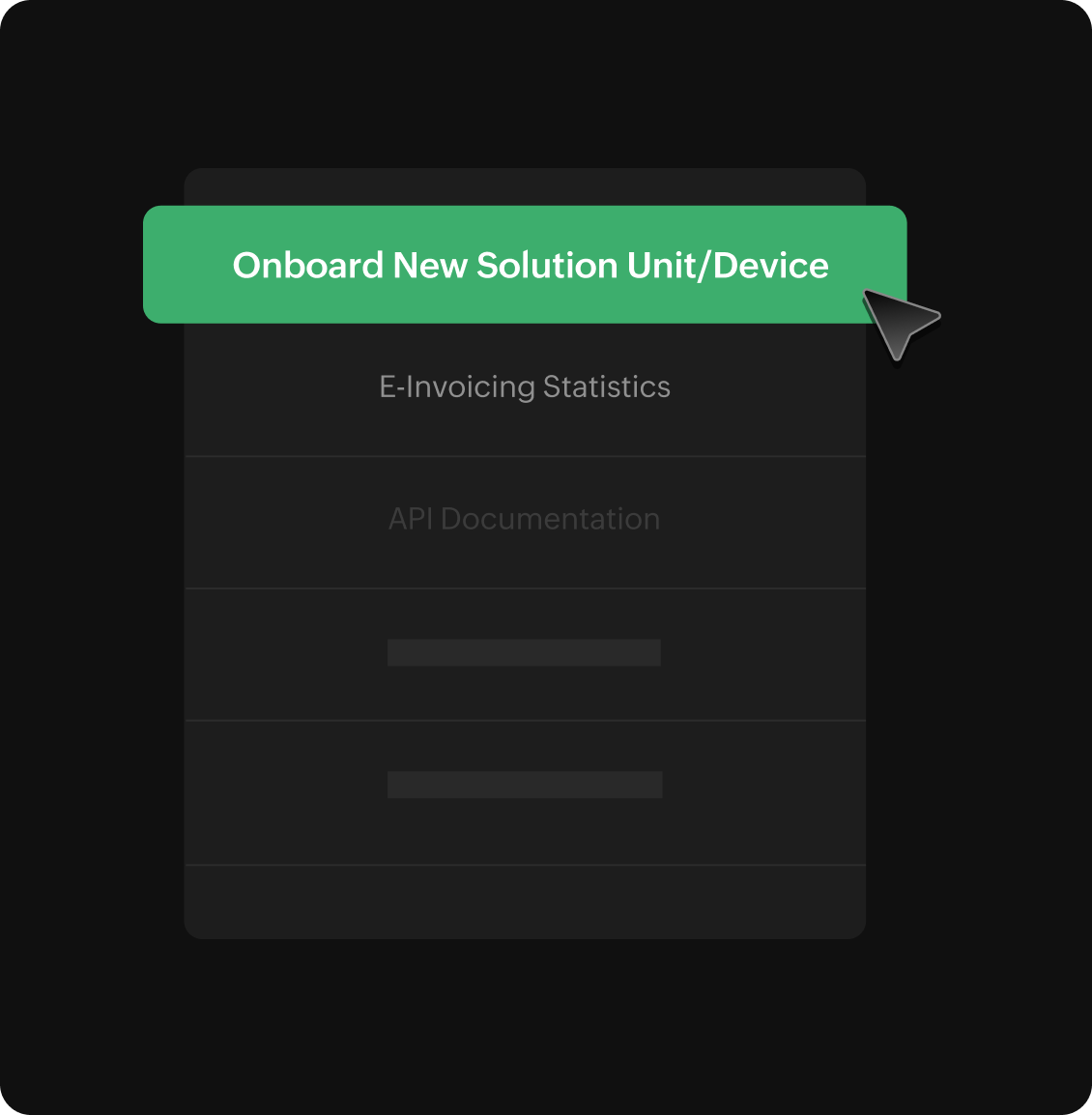

Simple steps to get started

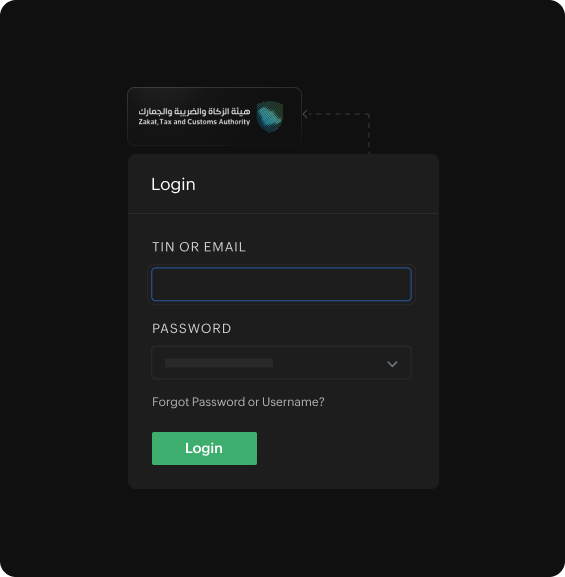

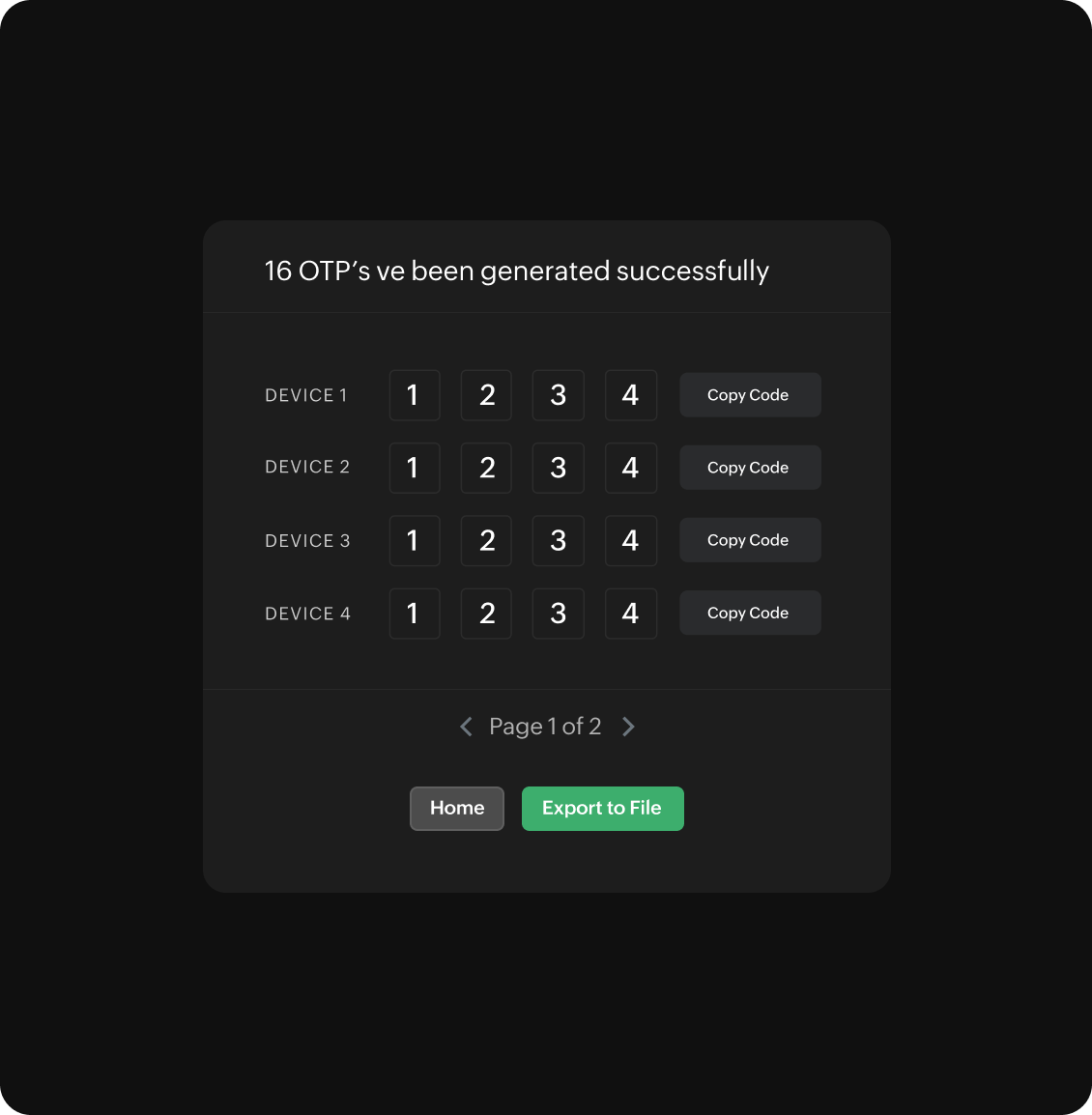

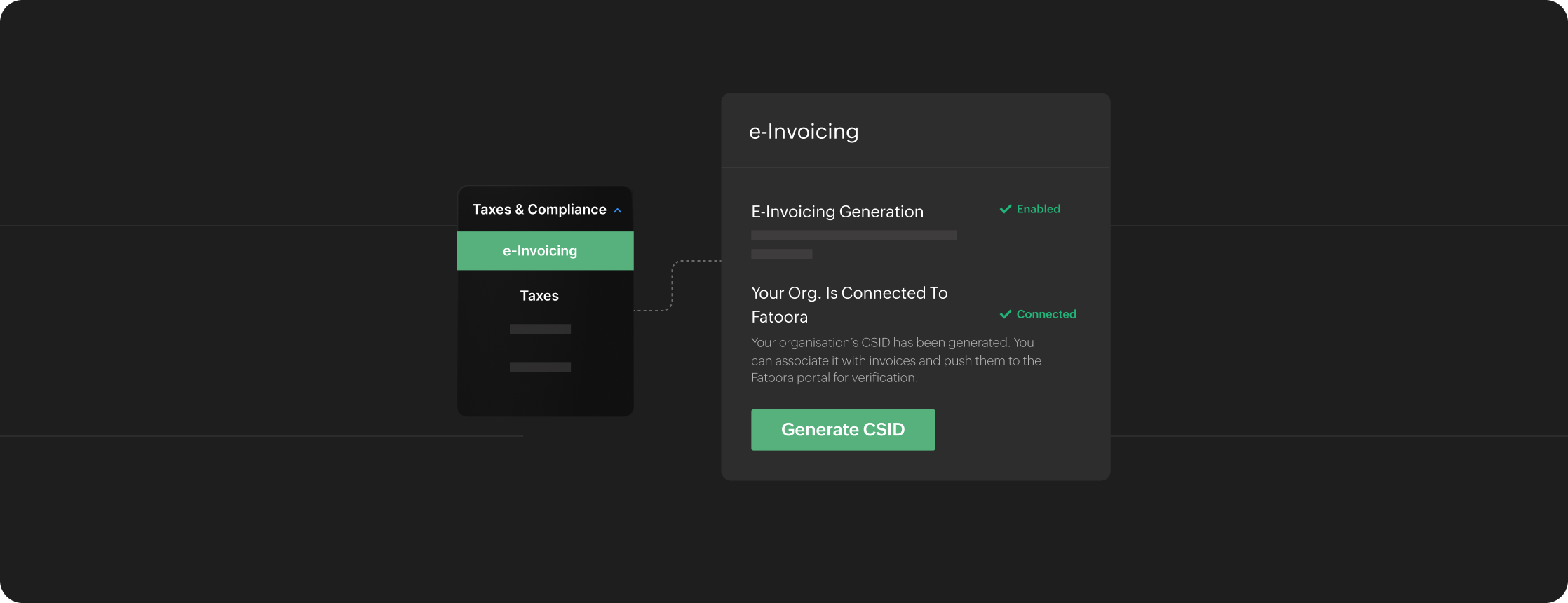

Login to the Fatoora portal

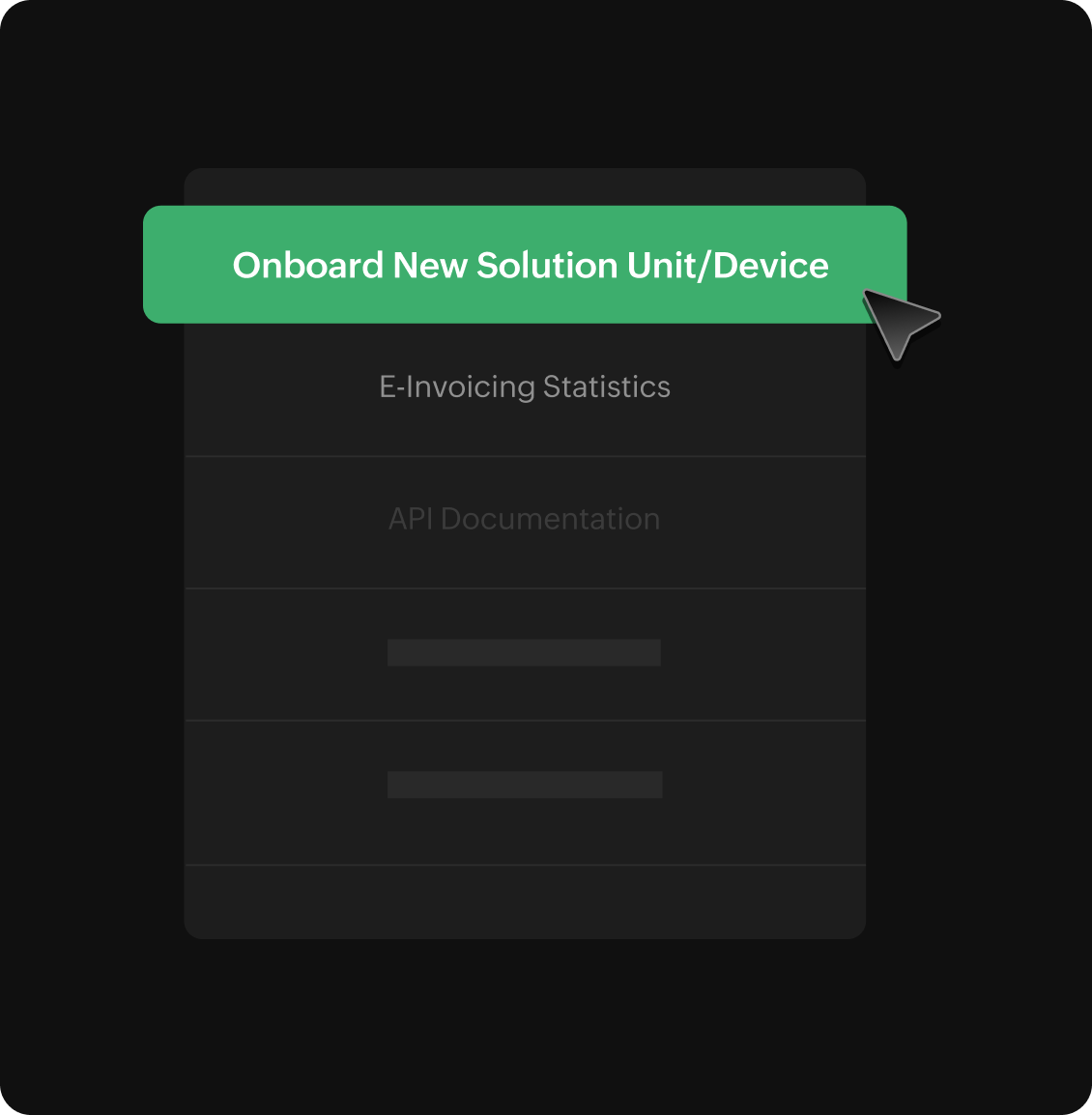

Click "Onboard new solution unit/device" and enter no.of devices

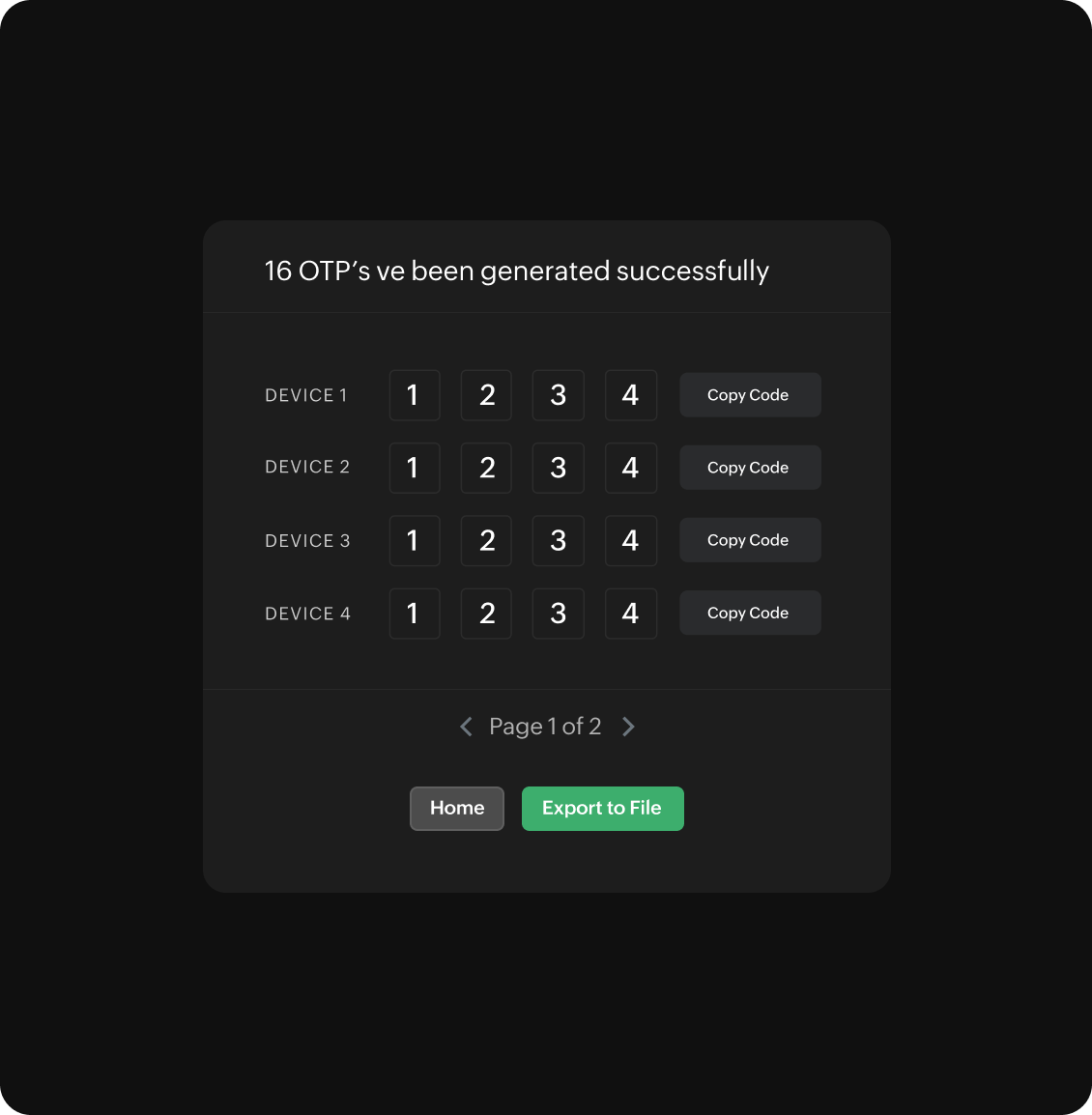

Export/copy OTP generated in the portal

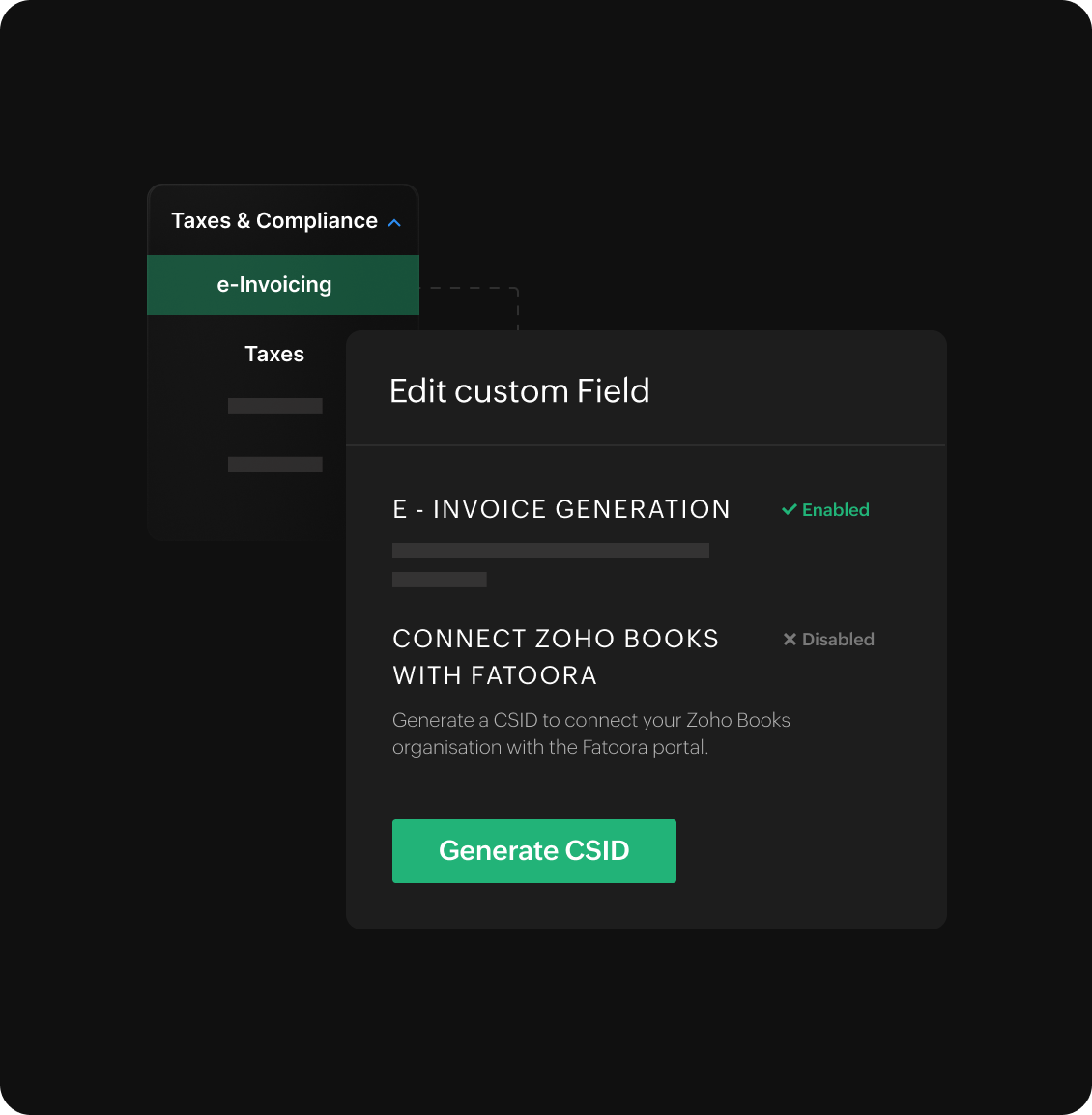

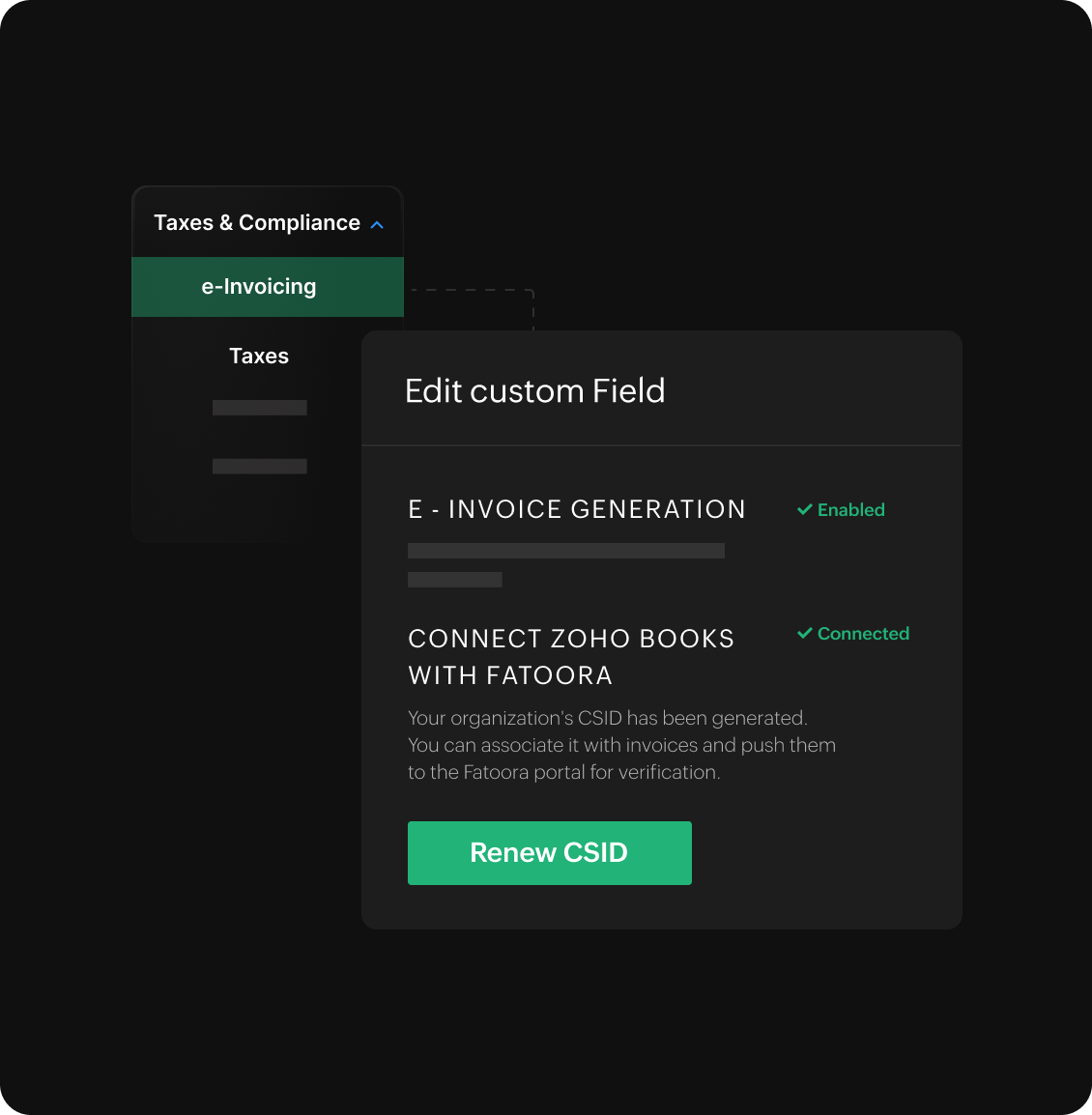

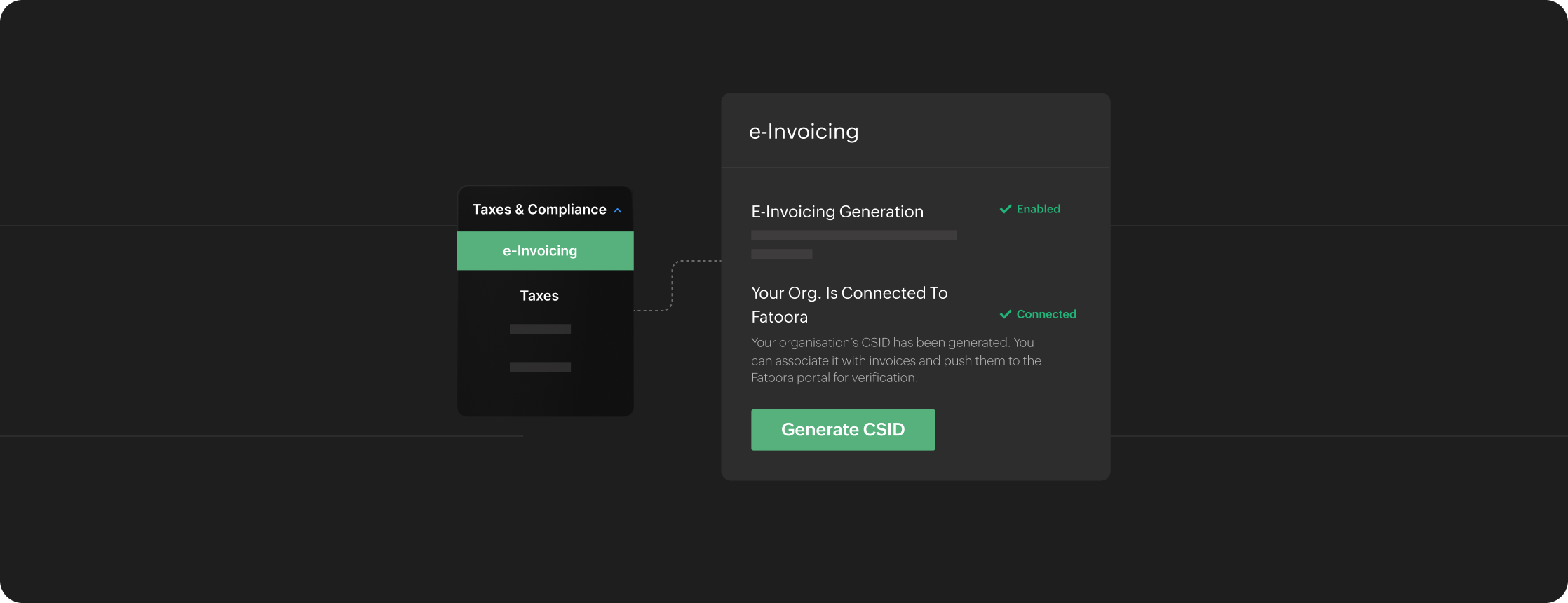

Use the OTP to generate CSID in Zoho Books

E-invoicing will now be enabled in Zoho Books

Achieving compliance with ease

Bilingual invoices

Push B2B and B2C invoices in Arabic or bilingually, including English, in adherence to ZATCA's e-invoicing rules.

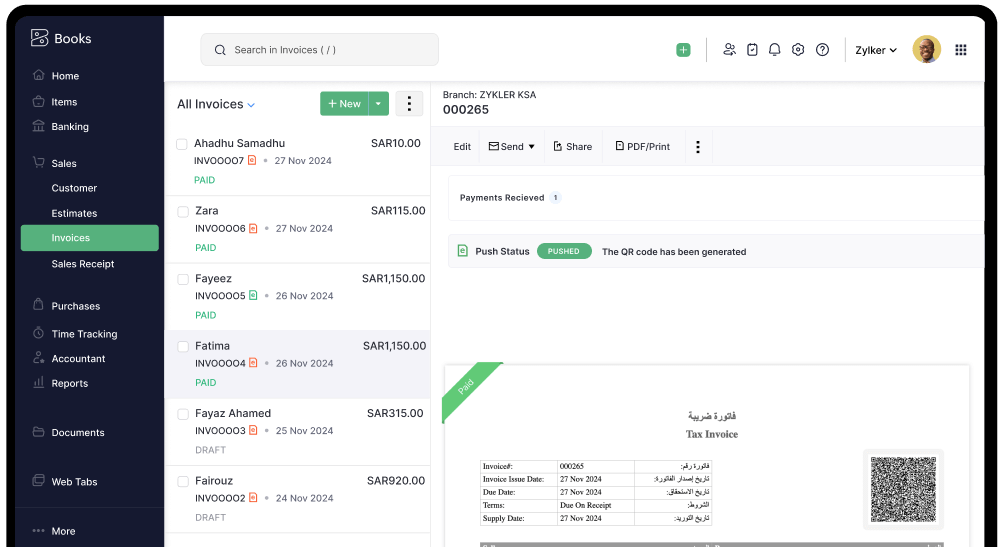

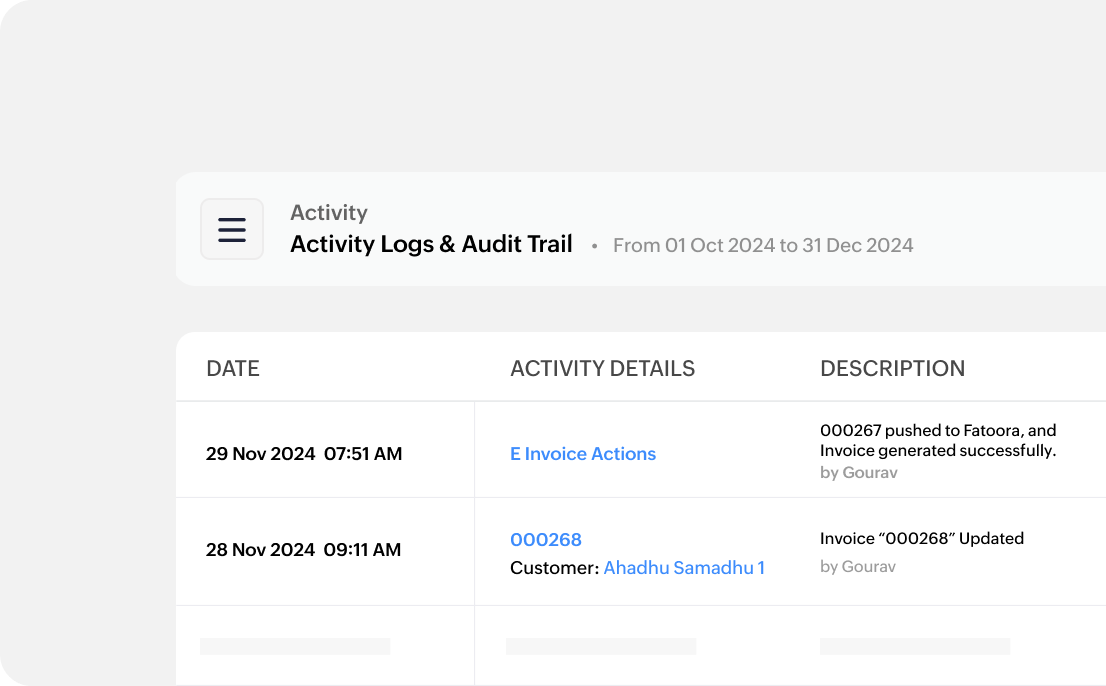

Track the status of e-invoices

Track and monitor the status of your invoice and any corrections made.

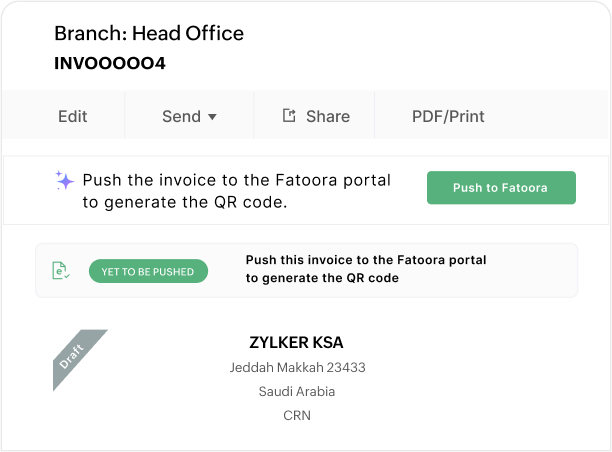

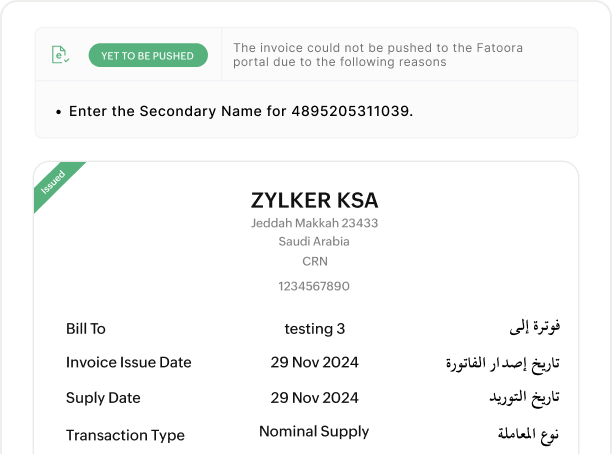

Auto-validate invoice data

Ensures accurate invoices with all required fields, including the QR code as per ZATCA regulations. Identifies any violations or incorrect data entries.

Protects transactions

Zoho Books complies with ZATCA's mandates by restricting anonymous access and preventing users from altering or deleting transactions. Role-based access limits users to their assigned modules, while uneditable activity logs and audit trails track all transaction history.

Zoho Books: Your perfect companion on the e-invoicing journey

Actions

Easy to setup

Zoho Books is VAT-compliant and e-invoicing ready. You can sign up for Zoho Books and start sending and managing e-invoices right away in just a few simple steps.

Module

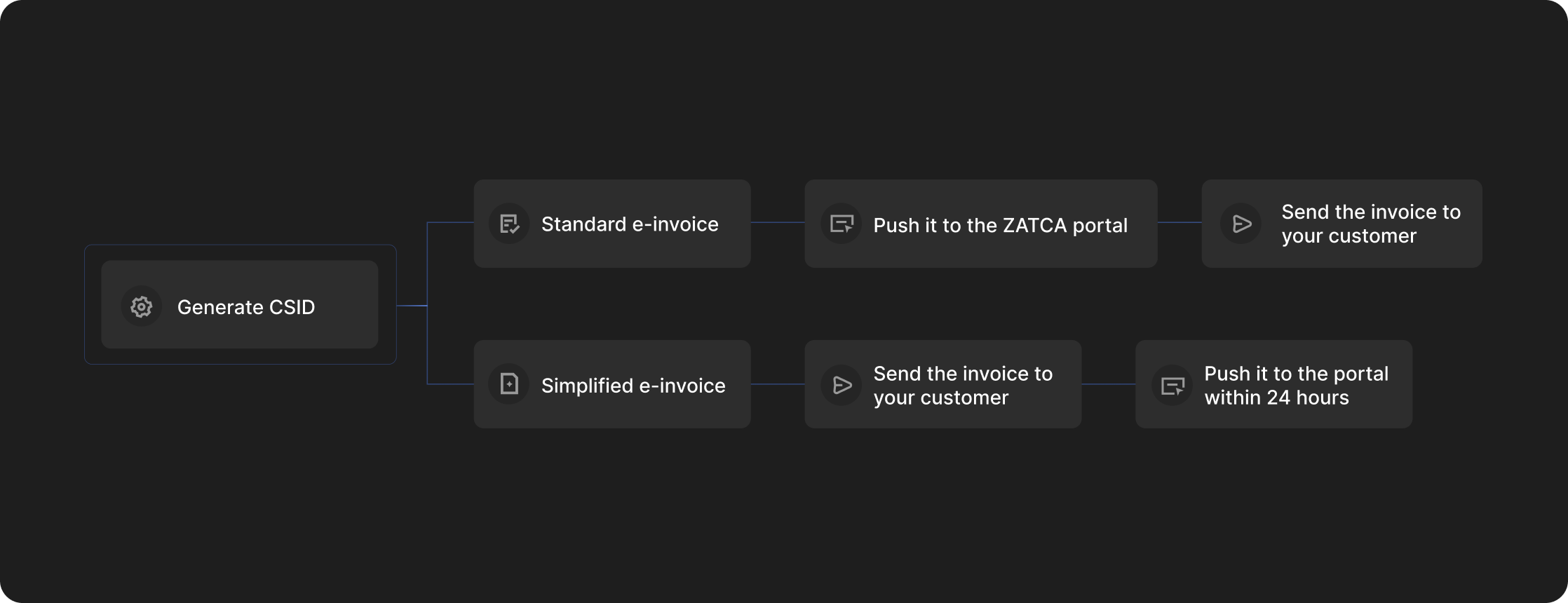

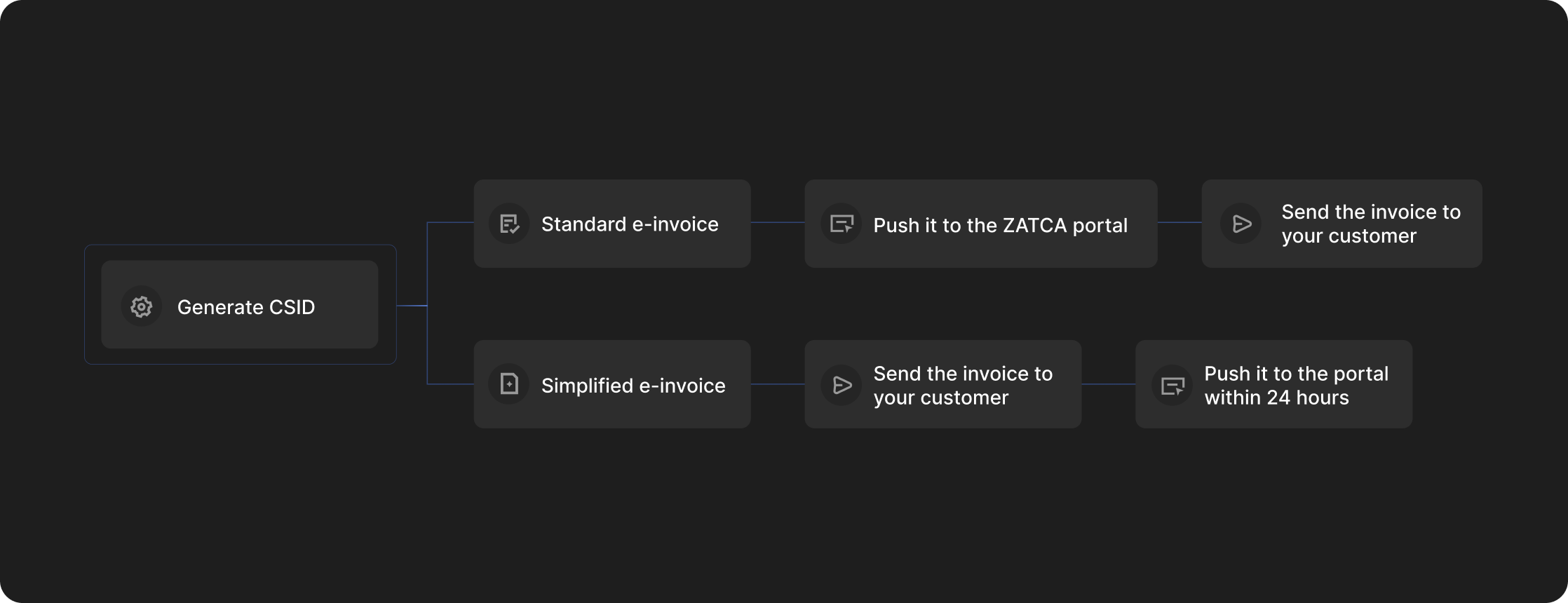

Push transactions to ZATCA

Generate and push all e-invoices to ZATCA's Fatoora platform and stay e-invoicing compliant at all times.

Webtabs

Data centre in Saudi Arabia

User data is exclusively stored in local data centers, aligning with regional privacy requirements.

Features that make Zoho Books comprehensive

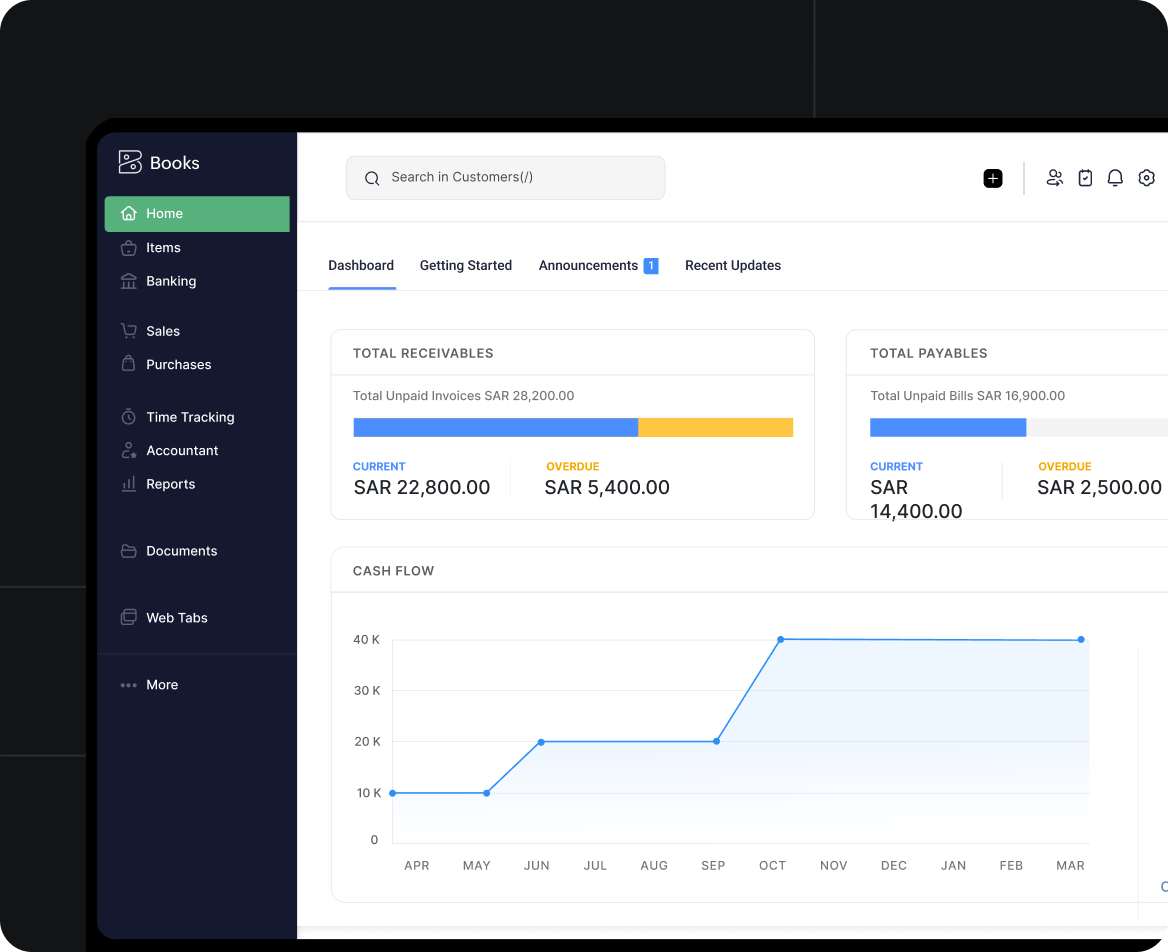

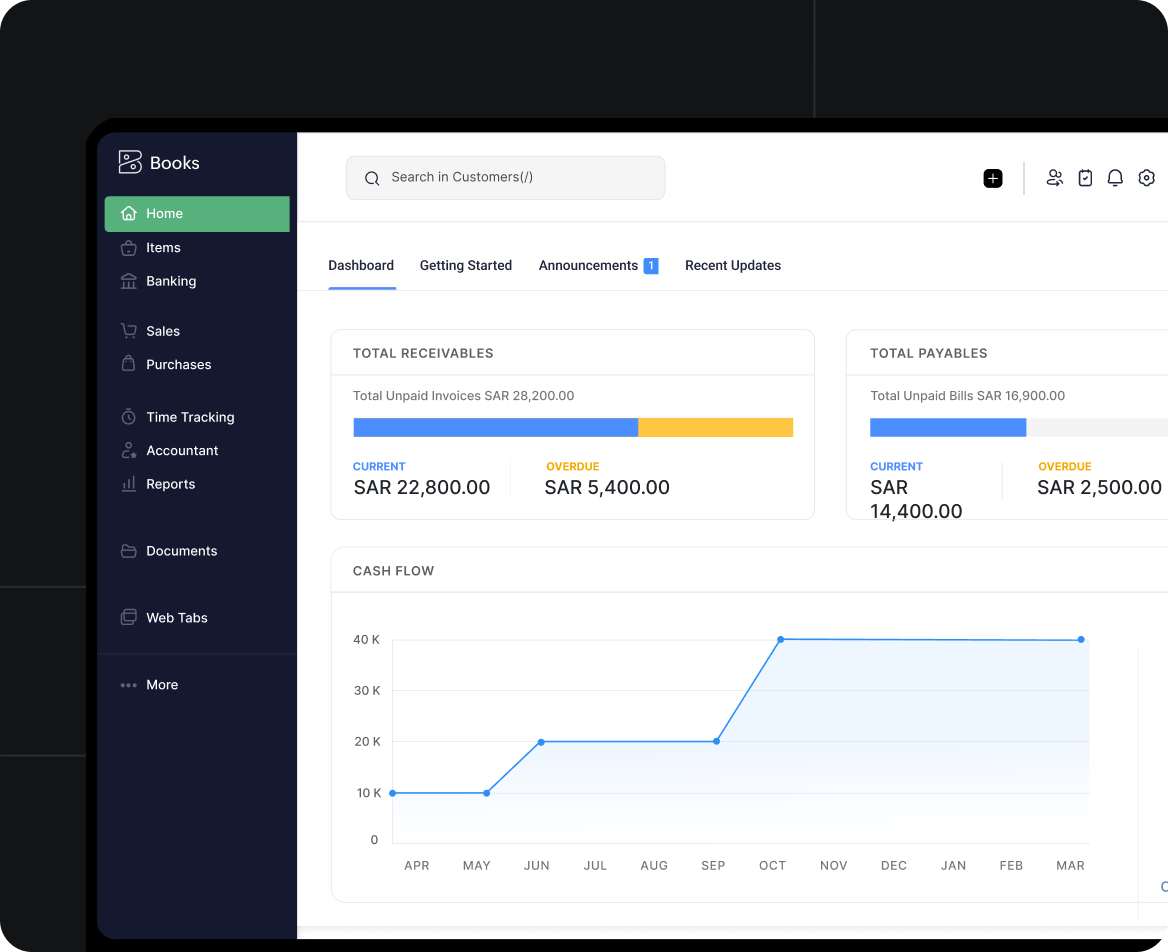

Go from quotes to invoices and payments in a few clicks

Record expenses, create vendor bills, and stay on top of your payables

Ensure error-free transactions with transaction approval

Get automatic bank feeds and reconcile accounts with minimal effort

Create 70+ financial reports and understand your business finances better

FAQ section

-

What is Fatoora?

Fatoora is Saudi Arabia's electronic invoicing system which mandatesall businesses to send e-invoices instead of manual invoices, and the Phase II of Fatoora requires that these invoices be submitted to ZATCA's Fatoora platform. Please refer the above page for the eInvoicing timeline.

-

What is the difference between a tax invoice and a simplified tax invoice?

A tax invoice is commonly used for B2B transactions and a simplified tax invoice for B2C transactions.

-

Should every invoice have a QR code?

All B2B and B2C invoices are mandated to have QR as per ZATCA's e-invoicing regulations.

-

Should I push the old invoices to the Fatoora portal?

For Phase 2 of Saudi Arabia's e-invoicing, there is no specific requirement to retroactively push old invoices to the Fatoora portal unless they are part of ongoing transactions or required for tax compliance. The focus should be on ensuring that all future invoices are compliant with the new system and reported in real-time

-

Which plan of Zoho Books offers e-invoicing capability?

The e-invoicing capability will be available from the STANDARD plan of Zoho Books. Refer to the plans and pricing for more details.

-

Can we push credit notes and debit notes through Zoho Books?

IRN will be generated for credit notes and debit notes as well, allowing you to push them to the e-invoicing portal.