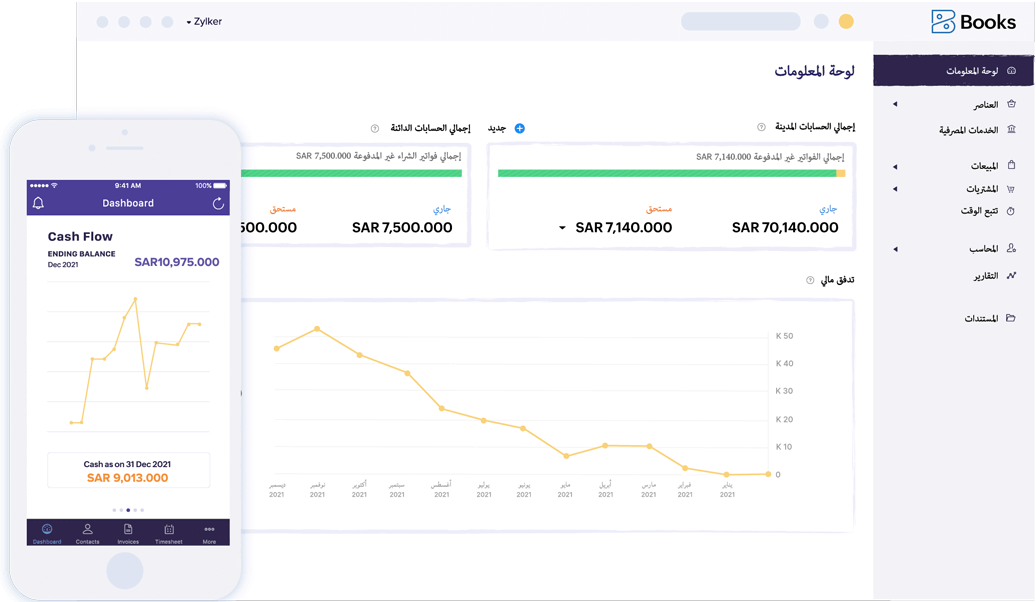

Why Zoho Books is the preferred accounting software of businesses

- Stay VAT compliant

Zoho Books makes VAT less taxing for small businesses. Knowing your VAT liability, and preparing your VAT returns and audit reports, is a piece of cake with Zoho Books.

- Work better together

Zoho Books makes working with your team simple. Role-based access lets you add your colleagues and your accountant to your organisation so they can log time, view reports, or manage your accounts, all without additional user fees.

- Save time with automation

Create unique workflows instead of spending time on tedious tasks. Zoho Books takes care of high-volume, error-prone processes from chasing customer payments to generating recurring invoices, giving you more time to focus on your business.

Features at a glance

Here's how Zoho Books keeps your business VAT compliant

- VAT in invoices

The invoices in Zoho Books capture all the details required to ensure VAT compliance, from the place of supply to the tax registration number, display all the details prescribed by ZATCA.

- VAT in items

Choose the appropriate VAT while creating an item and watch Zoho Books automatically populate the selected tax rate each time you create a transaction.

- VAT in contacts

We make it easy for you to comply with ZATCA mandates. Zoho Books lets you choose VAT preferences for your contacts, and automatically fetches the right tax rates when you create a new invoice.

- VAT in reports

Zoho Books calculates your VAT liability in a consolidated report that is ready to be exported and filed during tax season. Get detailed insight into your sales and purchase transactions and your claimable input VAT credit.

Simple and affordable pricing

Powering thousands of businesses

Moiz Sitabkhan, CEO of Conceptualize, needed a cloud-based accounting system to help him drive business forward in the VAT era. Watch how he realised that Zoho Books was the key to managing his financial growth.

iOS 16 ready >

iOS 16 ready >