- HOME

- Payroll administration

- What is salary slip or payslip? Its format and components

What is salary slip or payslip? Its format and components

What is a salary slip?

A salary slip, also known as a payslip, is a document provided by employers to their employees detailing the breakdown of their salary for a specific pay period. It includes salary components such as basic pay, allowances, deductions, and net pay. They serve as a record of payment for employees and help employers maintain transparency in their payroll processes.

When are salary slips distributed?

Typically, salary slips are distributed at the end of each pay period, once the salary payments are made. In India, companies usually distribute payslips on the last working day or the first working day of every month.

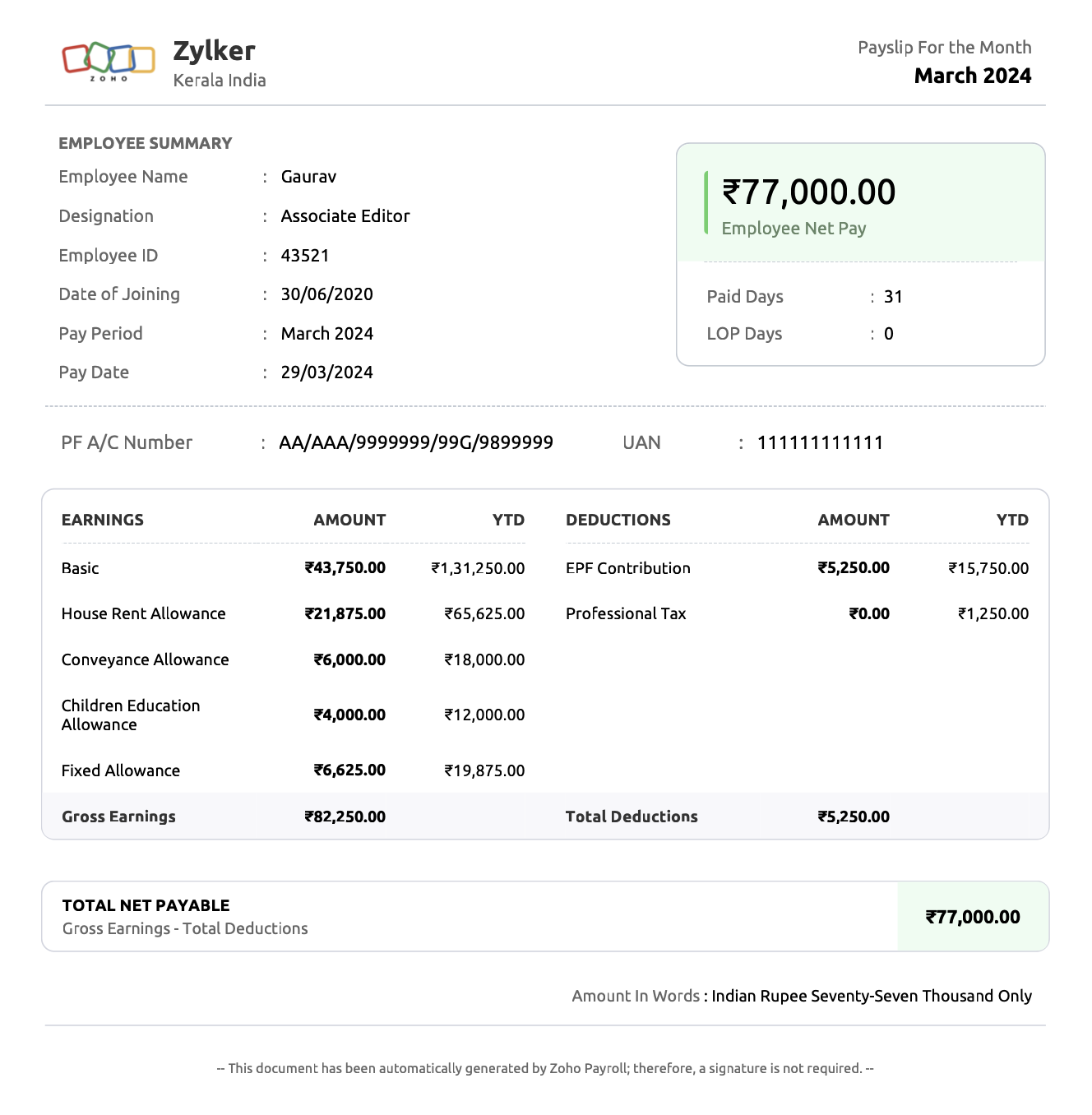

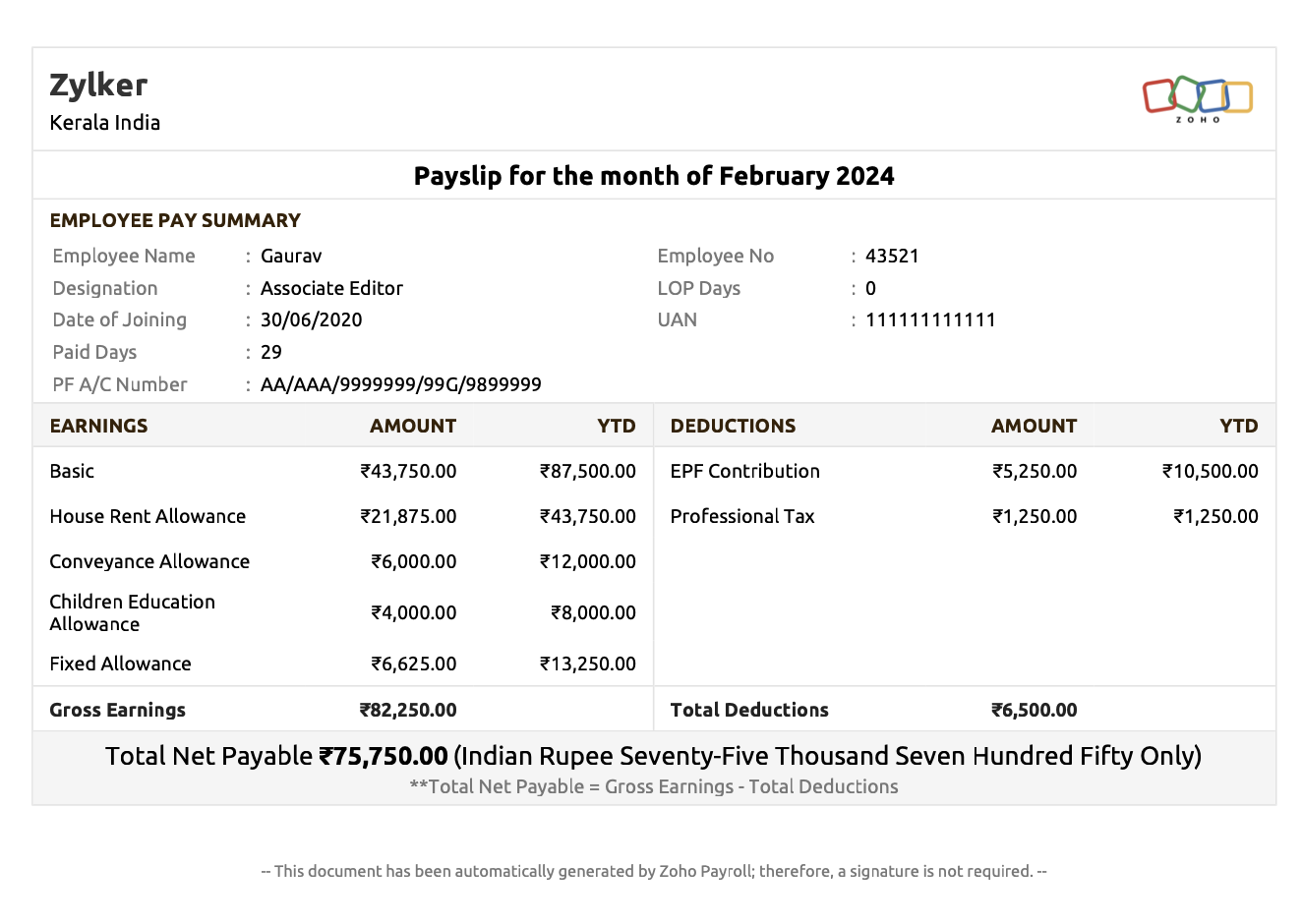

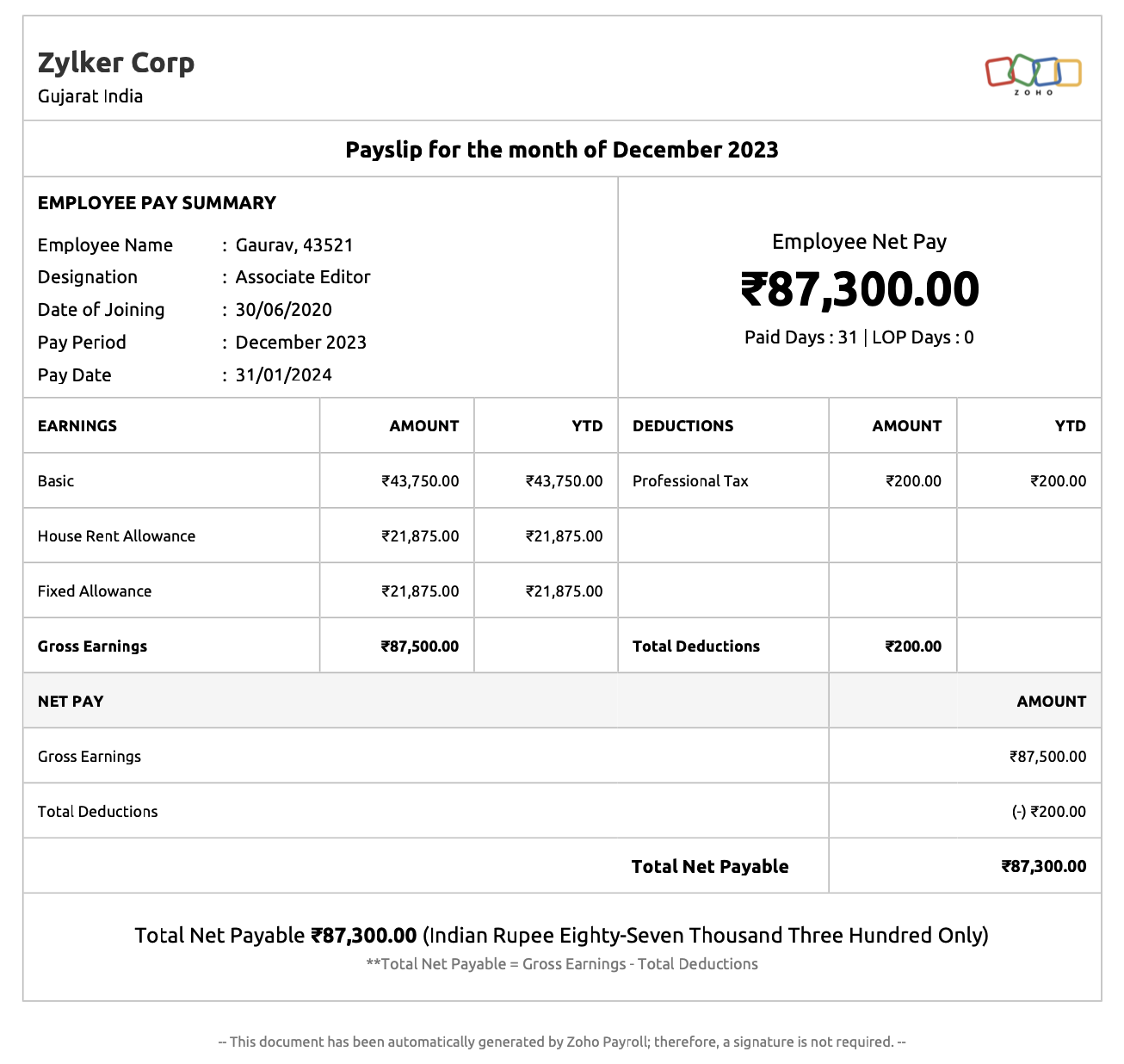

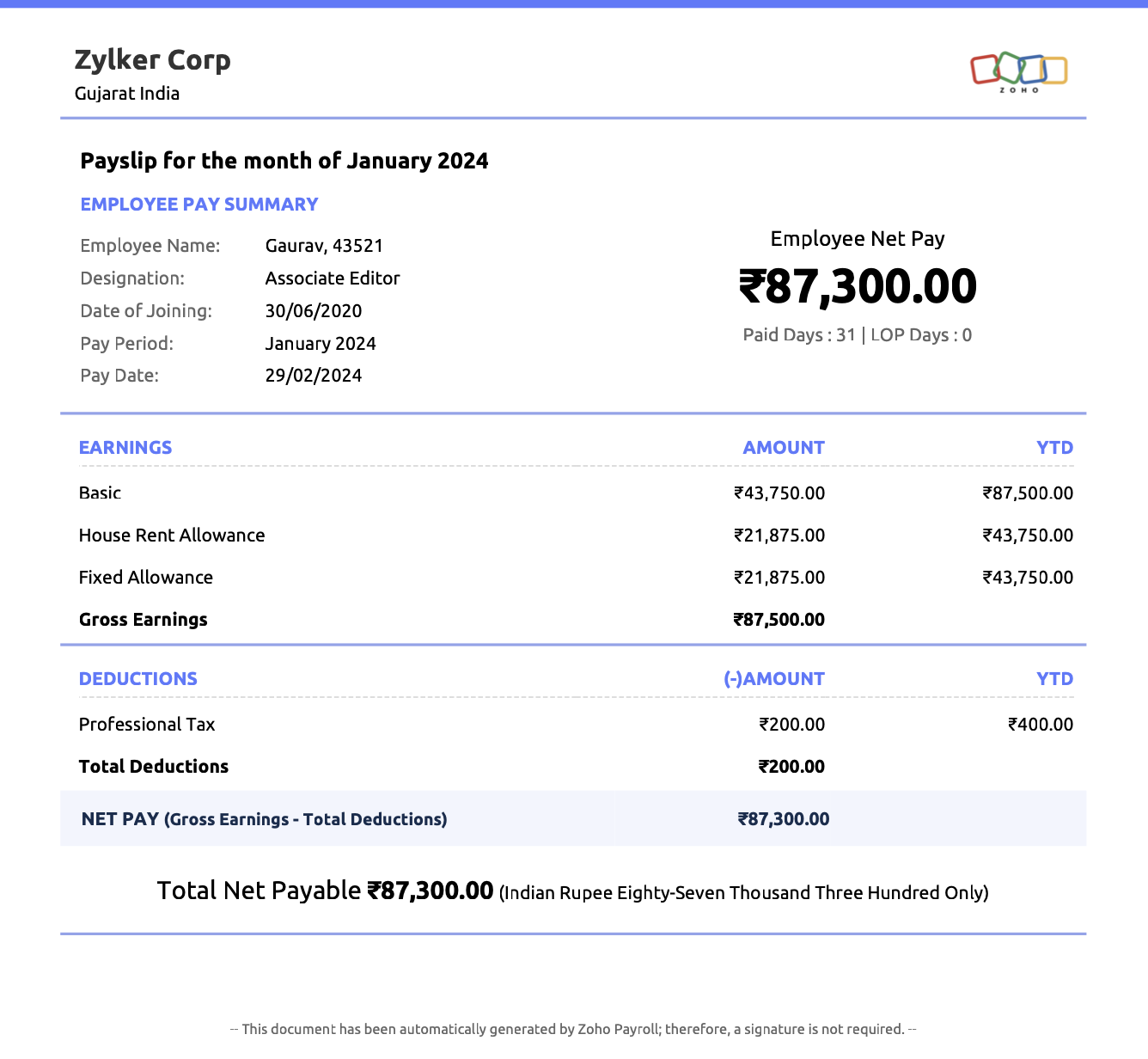

Salary slip format

A salary slip format is a standardised layout used by organizations to provide salary information to their employees. It includes the employee's earnings, deductions, taxes, and net pay, presented in a structured manner.

Salary slip format for word

Download the sample salary slip format for word

Pro tip: Create top-notch payslips using Zoho's free payslip generator tool.

Components of a salary slip

The format of a salary slip may vary depending on the organization's structure and practices. However, there are standard salary components that payslips must include.

Earnings

Basic pay:This is the fixed portion of an employee's compensation, constituting the foundation upon which other allowances and benefits are built. Typically, basic pay accounts for 50% of the total CTC, while allowances and benefits are calculated as a percentage of the basic pay.

Dearness Allowance (DA): DA is an inflation-linked allowance aimed at mitigating the impact of rising prices on employees' purchasing power. It is mostly provided to the government and public sector employees.

House Rent Allowance (HRA): HRA is offered to employees to meet their rental expenses for accommodation. The amount of HRA varies based on the employee's basic pay and their city of residence.

Conveyance allowance: It is granted to cover the expenses incurred by employees for commuting to and from work.

Other allowances: Apart from the above mentioned allowances, salary slips may also include overtime allowance, special allowance, leave travel allowance, and other allowances received by the employees as part of their compensation. These allowances serve to recognize and reward employees for their contributions to the organisation.

Deductions

Tax Deducted at Source (TDS): TDS is the amount deducted by the employer from the employee's salary as per the income tax slab the employee falls under. The employer is responsible for deducting TDS and depositing it with the government on behalf of the employee every month.

Professional tax: Professional tax is a state-level tax levied on individuals earning an income through their profession or employment. The amount of professional tax varies across states and is deducted from the employee's salary as per the applicable rates.

Employees' Provident Fund (EPF): EPF is a mandatory retirement savings scheme wherein both the employee and employer contribute a percentage of the employee's salary every month towards the provident fund.

Labour Welfare Fund (LWF): LWF is a statutory deduction aimed at promoting the welfare of labourers. Applicable employees and their employers contribute towards this fund based on the regulations set by the state government.

Employees' State Insurance (ESI): ESI is a social security and health insurance scheme designed to provide financial protection to employees and their families in case of medical emergencies. Both employers and employees contribute to the ESI fund based on the employee's salary.

7 essential elements to include on a payslip

- Employee information: Name, employee ID or number, Permanent Account Number (PAN) and designation.

- Employer information: Company name, address, Tax Deduction and Collection Account Number (TAN) and contact details.

- Pay period: Clearly state the period for which the payment is being made (e.g., March, 2024).

- Net pay: Indicate the total amount the employee will receive after all deductions have been made.

- Gross pay: Provide the total earnings before deductions.

- Tax information: Include details about tax calculations, including the taxable income, applicable tax rate, and amount deducted.

- YTD (Year-to-Date) totals: Display year-to-date earnings and deductions to give employees a comprehensive view of their financial transactions over the year.

The importance of salary slips

For employers, payslips act as legal documents for tax and compliance purposes. For employees, they offer clarity regarding earnings and deductions, aiding in financial planning and tax filing.

Importance of payslips for employers

- Statutory compliance: Payslips help employers comply with labour laws and regulations related to minimum wages, overtime, and employee benefits. Accurate documentation of earnings and deductions mitigates the risk of legal disputes or non-compliance penalties.

- Budgeting and financial planning: Employers use salary slips to track payroll expenses and budget for future expenditures. Understanding the cost of employee salaries and benefits enables better financial planning and resource allocation.

- Employee performance evaluation: Employers can use salary slips to analyse trends in earnings, bonuses, and incentives to assess employee performance and identify areas for improvement.

- Audit and documentation: Payslips provide a detailed record of payroll transactions and support financial transparency and accountability.

Importance of payslips for employees

- Proof of income: Salary slips stand as official documents that verify one's employment and income, making them crucial during legal proceedings or financial transactions.

- Loan applications: They are often required when applying for loans or credit cards. Lenders use them to assess an individual's financial stability and repayment capacity.

- Visa applications: When applying for visas or immigration, some countries may ask for a payslip as evidence of a steady source of income and employment status.

- Salary certificates: Salary slips can be used to obtain salary certificates, which may be required for various purposes, such as applying for scholarships or joining professional associations.

How to download payslips

Many organisations provide employees with the convenience of accessing and downloading their payslips through dedicated employee self-service portals. Employees can log in, navigate to the payslip section, and effortlessly download their payslips through these portals.

Frequently asked questions

What is the difference between a salary statement and a salary slip?

A salary statement is a formal document issued by an employer to an employee upon request for specific purposes. Unlike a salary slip, which provides a breakdown of earnings and deductions for a particular month, a salary statement offers a broader overview of the individual's income over a defined period, often for purposes such as loan applications, visa processing, or income verification.

What is YTD in a payslip?

YTD (Year-to-Date) in a payslip refers to the cumulative earnings or deductions from the beginning of the fiscal year to the present date.

How to make a salary slip?

Crafting a salary slip requires meticulous attention to detail and adherence to statutory regulations. Many organisations use payroll software to generate accurate payslips and distribute them electronically. Alternatively, they can be created using free online payslip generator tools.