- HOME

- Taxes and compliance

- Labour Welfare Fund (LWF): Meaning, contribution & payment

Labour Welfare Fund (LWF): Meaning, contribution & payment

The government of India has implemented various statutory frameworks to provide welfare schemes to workers. One such payroll statutory component that offers socio-economic benefits to employees is the Labour Welfare Fund (LWF).

The LWF scheme is managed by the state governments, and 16 states have enacted the Labour Welfare Fund Act thus far.

LWF full form and meaning

The full form of LWF is Labour Welfare Fund. LWF is a payroll statutory managed by the state governments in India. Introduced under the provisions of the Industrial Disputes Act of 1947, this scheme aims to improve labourers' working conditions and standards of living. It does so by providing medical care, housing, education, nutritious food, and recreational facilities to eligible employees and their dependents.

The state government collects LWF contributions from applicable employees and their employers and provide social security benefits to employees who are in need. The contribution rates vary from one state to another and the deduction cycle can be monthly, half-yearly, or yearly depending on each state's regulations.

Applicability of the Labour Welfare Fund

Each state has its own regulations and some states do not even collect LWF. This chart will give you an overview of the states that collect and don't collect LWF.

What an employer must do to comply with LWF

Under the Labour Welfare Fund scheme, employers of an organisation are responsible for the following:

Registering their establishment under the Act, if their state legislature has enacted one.

Contributing their share towards the fund.

Collecting LWF dues from the workers.

Remitting payments to the government based on the deduction frequency, before the submission deadline.

Filing tax returns using the correct form.

How the LWF scheme works in different states

Since the Labour Welfare Fund is under the purview of the state governments, the deduction cycles vary in each state.

Here's a detailed list of the state-specific LWF contribution rates, applicable employees, the deduction frequency, deadline date for making the payment.

Andhra Pradesh

Applicable employees: All employees except those who are employed in a managerial capacity and part-time position.

| Employee contribution | Employer contribution |

| Rs. 30 | Rs. 70 |

| Deduction frequency | Deduction date | Submission deadline | Compliance form |

| Annual | 31st December | 31st January | Form F |

Chandigarh

Applicable employees: All employees earning up to Rs. 15,000 per month.

| Employee contribution | Employer contribution |

| Rs. 5 | Rs. 20 |

| Deduction frequency | Deduction date | Submission deadline* | Compliance form |

| Monthly | Last day of each month | 15th October and 15th April | NA |

Chhattisgarh

Applicable employees: All employees except those working in a managerial or administrative capacity or employed in a supervisory capacity earning more than Rs. 10,000 per month.

| Employee contribution | Employer contribution |

| Rs. 15 | Rs. 45 |

| Deduction frequency | Deduction date* | Submission deadline* | Compliance form |

| Half-yearly | 30th June and 31st December | 15th July and 15th January | Form A |

Delhi

Applicable employees: All employees except those working in a managerial or supervisory capacity earning more than Rs. 2,500 per month.

| Employee contribution | Employer contribution |

| Rs. 0.75 | Rs. 2.25 |

| Deduction frequency | Deduction date* | Submission deadline* | Compliance form |

| Half-yearly | 30th June and 31st December | 15th July and 15th January | Form A |

Goa

Applicable employees: All employees except those working in a managerial or supervisory capacity earning more than Rs. 1,600 per month.

| Employee contribution | Employer contribution |

| Rs. 60 | Rs. 180 |

| Deduction frequency | Deduction date* | Submission deadline* | Compliance form |

| Half-yearly | 30th June and 31st December | 15th July and 15th January | Form B |

Gujarat

Applicable employees: All employees except those working in a managerial or supervisory capacity earning more than Rs. 3,500.

| Employee contribution | Employer contribution |

| Rs. 6 | Rs. 12 |

| Deduction frequency | Deduction date* | Submission deadline* | Compliance form |

| Half-yearly | 30th June and 31st December | 15th July and 15th January | Form A-1 |

Haryana

Applicable employees: All employees employed directly by the principal employer, including contractors. Each employee shall contribute an amount equal to 0.2% of their salary or Rs. 25 to the fund every month. The employer will contribute twice as much as the employee does.

| Employee contribution | Employer contribution |

| Rs. 31 | Rs. 62 |

| Deduction frequency | Deduction date | Submission deadline* | Compliance form |

| Monthly | Last date of each month | 15th October and 15th April | NA |

Karnataka

Applicable employees: All employees who are employed for salary to do any work, skilled or unskilled, manual or clerical, in an organization.

| Employee contribution | Employer contribution |

| Rs. 20 | Rs. 40 |

| Deduction frequency | Deduction date | Submission deadline | Compliance form |

| Yearly | 31st December | 15th January | Form D |

Kerala

Applicable employees: All employees under the purview of the Kerala Shops and Commercial Establishments Act, 1960.

| Employee contribution | Employer contribution |

| Rs. 20 | Rs. 20 |

| Deduction frequency | Deduction date | Submission deadline | Compliance form |

| Monthly | Last date of each month | 5th of every month | NA |

Madhya Pradesh

Applicable employees: All employees except those working in a managerial or supervisory capacity earning more than Rs. 10,000 every month.

| Employee contribution | Employer contribution |

| Rs. 10 | Rs. 30 |

| Deduction frequency | Deduction date* | Submission deadline* | Compliance form |

| Half-yearly | 30th June and 31st December | 15th July and 15th January | NA |

Maharashtra

Applicable employees category 1: All employees except those working in a managerial or supervisory capacity earning up to Rs. 3,000 per month.

| Employee contribution | Employer contribution |

| Rs. 6 | Rs. 18 |

| Deduction frequency | Deduction date* | Submission deadline* | Compliance form |

| Half-yearly | 30th June and 31st December | 15th July and 15th January | Form A-1 cum return |

Applicable employees category 2: All employees except those working in a managerial or supervisory capacity earning more than Rs. 3,000 per month.

| Employee contribution | Employer contribution |

| Rs. 12 | Rs. 36 |

| Deduction frequency | Deduction date* | Submission deadline* | Compliance form |

| Half-yearly | 30th June and 31st December | 15th July and 15th January | NA |

Odisha

Applicable employees: All employees except those working in a managerial or supervisory capacity within an organization.

| Employee contribution | Employer contribution |

| Rs. 10 | Rs. 20 |

| Deduction frequency | Deduction date* | Submission deadline* | Compliance form |

| Half-yearly | 30th June and 31st December | 15th July and 15th January | NA |

Punjab

Applicable employees: Any person who is employed for hire or reward to do any work, skilled or unskilled, manual or clerical, in an establishment.

| Employee contribution | Employer contribution |

| Rs. 5 | Rs. 20 |

| Deduction frequency | Deduction date | Submission deadline* | Compliance form |

| Monthly | Last day of every month | 15th April and 15th October | NA |

Tamil Nadu

Applicable employees: All employees except those working in a managerial or supervisory capacity earning above Rs. 15,000 per month.

| Employee contribution | Employer contribution |

| Rs. 20 | Rs. 40 |

| Deduction frequency | Deduction date | Submission deadline | Compliance form |

| Yearly | 31st December | 31st January | Form A |

Telangana

Applicable employees: All employees except those working in a managerial or supervisory capacity earning up to Rs. 1,600 per month.

| Employee contribution | Employer contribution |

| Rs. 2 | Rs. 5 |

| Deduction frequency | Deduction date | Submission deadline | Compliance form |

| Yearly | 31st December | 31st January | NA |

West Bengal

Applicable employees: All employees except those working in a managerial or supervisory capacity earning more than Rs. 1,600.

| Employee contribution | Employer contribution |

| Rs. 3 | Rs. 15 |

| Deduction frequency | Deduction date* | Submission deadline | Compliance form |

| Half-Yearly | 30th June and 31st December | 15th July and 15th January | Form D |

*Deduction and submission is due every 6 months

How to register for the LWF scheme

You must register for the LWF scheme within 15 days of commencement of your organization. The registration process varies by state, but the information you need to submit is the same across all states. With that in mind, we'll focus on registering for the Labour Welfare Fund in Haryana as an example.

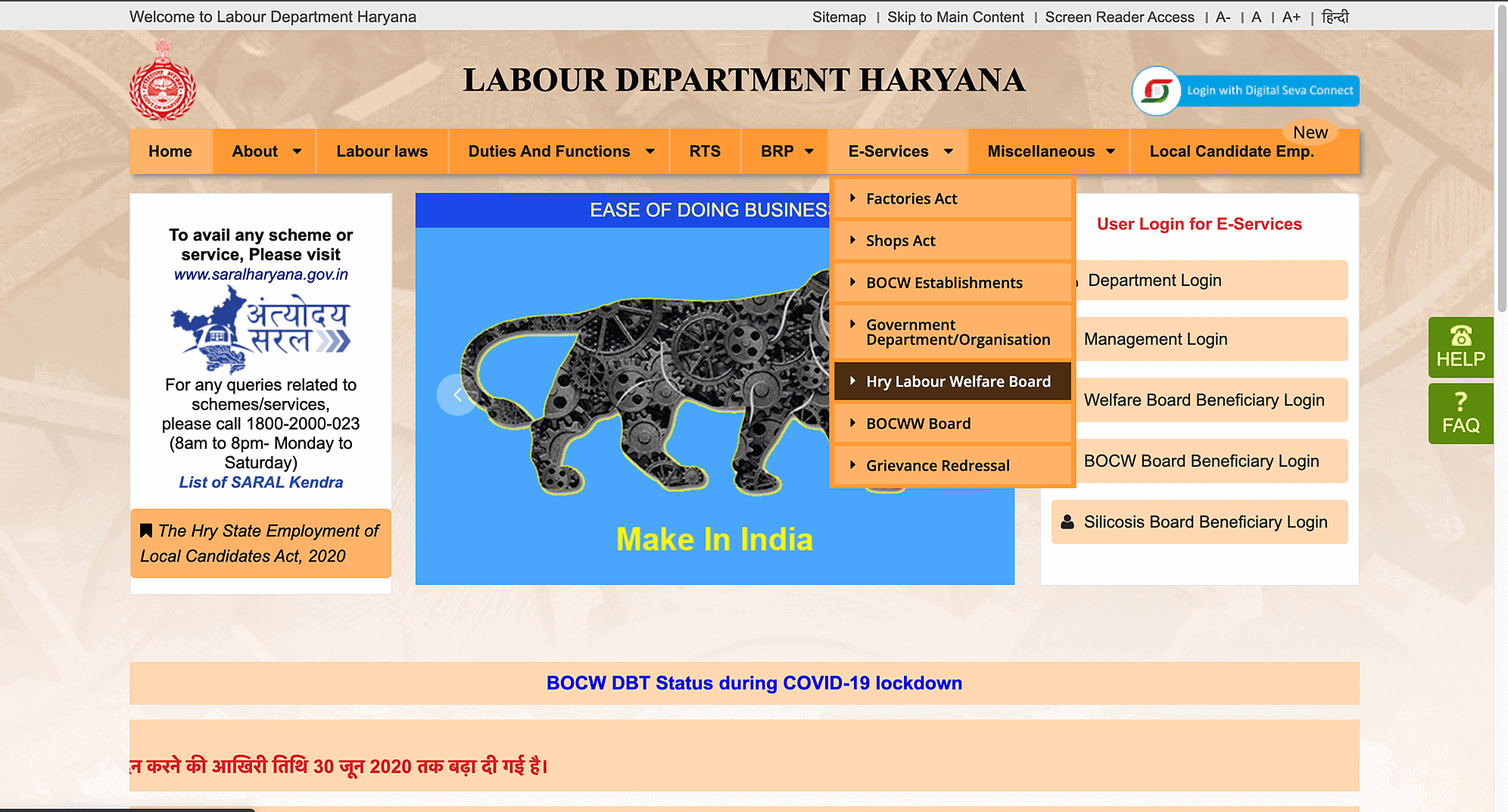

- Go to the Haryana's Labour Department website. Under E-Services, select Hry Labour Welfare Board.

- A new instructions page will open. Read the terms and conditions and click Submit.

- Select the type of establishment you run and enter your Aadhaar number and establishment's email ID. Click Submit.

- NOTE: If you're a worker from Haryana and want to register yourself for the scheme, you should select Welfare Worker from the list and proceed with registration.

- Fill in the Basic Information form and upload your passport-sized photo. Create a password and hit Submit.

- You will be taken to the Successfully Registered page and your login credentials will be displayed.

How to make LWF payments online

Each state uses a different website to process LWF payments online, but the standard procedure to make payments is the same:

- Go to the state-specific Labour Welfare Fund website.

- Select LWF Online Payment under E-seva or Online Services section.

- Log in using your company code or establishment ID and captcha.

- Once done, the below details will be displayed on the following screen:

- Company name

- Company address

- Contact details

- Select the payment category (whether you're paying your LWF contributions, settling unpaid accumulations, or court fines).

- Enter the number of employees in your payroll and the following details:

- Contribution month, year, establishment type, institution code, and owner's name.

- Once done, click Submit. You'll be taken to the online payment gateway.

- After successful payment, a confirmation challan will be sent to the registered email. Make a note of the challan details for future reference.

Penalty for non-compliance

The degree of penalty for not contributing, not registering your organization under the scheme, and obstructing inspection officers from performing their duties depends on each state's Labour Welfare Fund Act.

You'll receive a notice from the authorities if you fail to make LWF payments before the deadline. Usually, states levy a simple interest of 1% of the unpaid amount for the first three months of delay. For the subsequent months, the interest rate increase to 2-3%.

Individuals who wilfully hinder state officials from performing their duties are met with severe punishments. First-time offenders are charged either with imprisonment of up to three months, a fine of ₹500, or both. For second and subsequent offences, the imprisonment term can extend to six months, a fine of ₹1,000, or both.

What are the benefits of LWF?

The LWF offers perks both to workers and their employers. Here's a list of the major Labour Welfare Fund benefits for employees:

LWF benefits for employees

| Benefit category | Benefits available for employees |

| Education | Scholarships, stationeries, and uniforms for workers' dependents. |

| Medical |

|

| Food | Nutritious food for employees and their children. |

| Transport |

|

| Recreation | Access to activities like painting, playing sports, music, dance, etc. |

| Other benefits |

|

LWF benefits for employers

Increased productivity at work: Improved standards of living and working conditions will motivate employees to work efficiently.

Better employee retention: 96% of employees say that care and empathy from employers are driving factors for them to work. Implementing a well-structured LWF scheme will show you care about your workers.

Morale boost: Employees are the face of any company. When they have access to skill development courses and recreational activities, it boosts their confidence and reflects positively on the company.

A quick summary

The Labour Welfare Fund, or LWF, is a payroll statutory that ensures social security and improved working conditions for labourers. It offers medical care, educational support, transport, and recreational activities to the workers and their dependents. Both the employer and the employees contribute towards this fund.

Employers who have establishments in states where the LWF is implemented must register under the scheme and contribute towards the fund. The contribution rates and deduction cycles vary with each state. Non-payment or delayed payments can incur hefty fines and immeasurable loss of reputation for your company.

Frequently asked questions on LWF

What is LWF in salary?

LWF stands for Labour Welfare Fund. It is a statutory fund managed by the state governments in India. It is aimed at providing welfare benefits like healthcare, food, and financial assistance to eligible employees. The contribution towards the fund is typically shared between the employer and the employee.

What is the frequency of LWF deduction?

The frequency of LWF deduction varies from state to state in India. Generally, the deduction is made either monthly, half-yearly, or annually. For instance, in some states like Karnataka, the deduction is done once a year (before the 31st December), while in other states, it might be monthly or half-yearly basis.

What are the Labour Welfare Fund contribution rates?

The Labour Welfare Fund contribution rates also vary by state. The contribution is usually a nominal amount, with both the employer and the employee contributing a certain percentage or fixed sum. For example:

In Haryana, the employer contributes Rs. 62 per employee per month, and the employee contributes Rs. 31.

In Tamil Nadu, the employer contributes Rs. 40 per employee per month, and the employee contributes Rs. 20.

Implement LWF with Zoho Payroll

Staying compliant with payroll laws is crucial for running a successful company. There are many rules involved and a careless mistake could cost your firm tremendously. That's why we built Zoho Payroll—simple payroll software with completely automated statutory compliance.

Zoho Payroll allows you to automatically calculate employer and employee LWF contributions and deduction frequency based on your work location.

Deduct contributions from your employees' salary automatically before processing pay runs on Zoho Payroll.

Enable LWF for your organization with a click.

Contributions to the fund depend on employees' salary and state regulations. Enable or disable LWF at the employee level with Zoho Payroll.

- Keep your business accounting clean with real-time deduction summary and payroll cost summary graphs.

Read our new blog post to understand how payroll software can you help you simplify LWF process.

Comments(1)

The Article is very good. It has given me compelte guidance for my issue.