- HOME

- Taxes and compliance

- Employees' Provident Fund (EPF) - A business owner's guide

Employees' Provident Fund (EPF) - A business owner's guide

To run a successful business in India, you need to adhere to the payroll laws laid out by the government. These laws govern how your employees are paid and ensure their social security. The Employees' Provident Fund (EPF) is one such mandatory statutory requirement that organisations must comply with.

According to the Employees' Provident Fund Organisation's report, a massive 8.7 million EPF accounts were created from April 2022 to September 2022—a huge rise from the 2018-2019 fiscal year which only saw 6.1 million accounts registered. Unfortunately, many reputed organisations have also increasingly failed to comply with the EPF laws in recent years, resulting in huge penalties. Organisations that want to do better have a great need for statutory know-how, but they often have to refer to multiple sources just to learn the fundamental concepts.

In this guide, we will cover everything you need to know about EPF as a business owner in a language that's easy to understand, so you can maintain business compliance and help your employees build a sizeable retirement chest.

What is the Employees' Provident Fund scheme?

The Employees' Provident Fund, or EPF, is a popular retirement savings scheme for salaried individuals in India. The major focus of the scheme is to provide social security for employees and facilitate them to save a fraction of their salaries for retirement.

The fund is built with contributions made by the employees and their employers each month. In addition to that, the scheme offers a fixed interest on the EPF accumulations. Employees can use the corpus once they retire, resign, or during times of need.

EPF was introduced in 1952 under the Employees' Provident Funds & Miscellaneous Provisions Act. The Act now includes the Employees' Pension Scheme (EPS), 1995 and the Employees' Deposit Linked Insurance (EDLI), 1976. The three schemes are managed by the Employees' Provident Organisation, or EPFO, a statutory body administered by the Ministry of Labour and Employment.

Latest EPF regulations

The Indian government announced an interest rate of 8.25% on EPF accumulations for the 2023-2024 fiscal year.

In a recent verdict, the Supreme Court of India has allowed EPS members to contribute 8.33% of their actual salaries rather than their pensionable salary which was capped at ₹ 15,000 per month. This will help employees increase their retirement savings.

How does EPF work?

All employees who are drawing a salary are eligible for EPF. There are certain instances where EPF is mandatory:

Your organisation has 20 or more employees.

Your employee earns less than ₹ 15,000 per month.

EPF wages

Employers and employees who are members of the scheme must contribute a fixed percentage every month towards the fund. The contribution amount depend on the employee's EPF wages. A person's EPF wage is the sum of their basic pay, dearness allowance, and other allowances, excluding house rent allowance. If a person's monthly basic pay exceeds ₹ 15,000 then only their basic pay is considered as EPF wages.

Here's how you can calculate EPF wages for people with varying salary packages.

| Salary and EPF calculation | |||

| Salary components | Package 1 | Package 2 | Package 3 |

| Basic pay (Always considered for EPF) | ₹ 25,000 | ₹ 18,000 | ₹ 12,000 |

| Transport allowance (Considered for EPF only when basic pay is lesser than ₹ 15,000) | ₹ 4,000 | ₹ 2,000 | ₹ 1,500 |

| Telephone allowance (Considered for EPF only when basic pay is lesser than ₹ 15,000) | ₹ 3,500 | ₹ 3,000 | ₹ 1,000 |

| EPF contribution | ₹ 3,000 (12% of ₹ 25,000) | ₹ 2,160 (12% of ₹ 18,000) | ₹ 1,740 (12% of ₹ 14,500) |

Table 1 - EPF calculation for employees with different salary structures.

EPF contribution rates

All employers and most of the employees contribute an equal share of 12% of EPF wages every month. There are certain cases where an employee has to contribute only 10% of their EPF wage, provided the company they work for falls under any of these categories:

Has less than 10 employees.

Is declared as a sick industrial company by the Board for Industrial and Financial Reconstruction.

Has accumulated losses equal to or exceeding its entire net worth at the end of the financial year.

Belongs to the jute, beedi, coir, or guar gum industry.

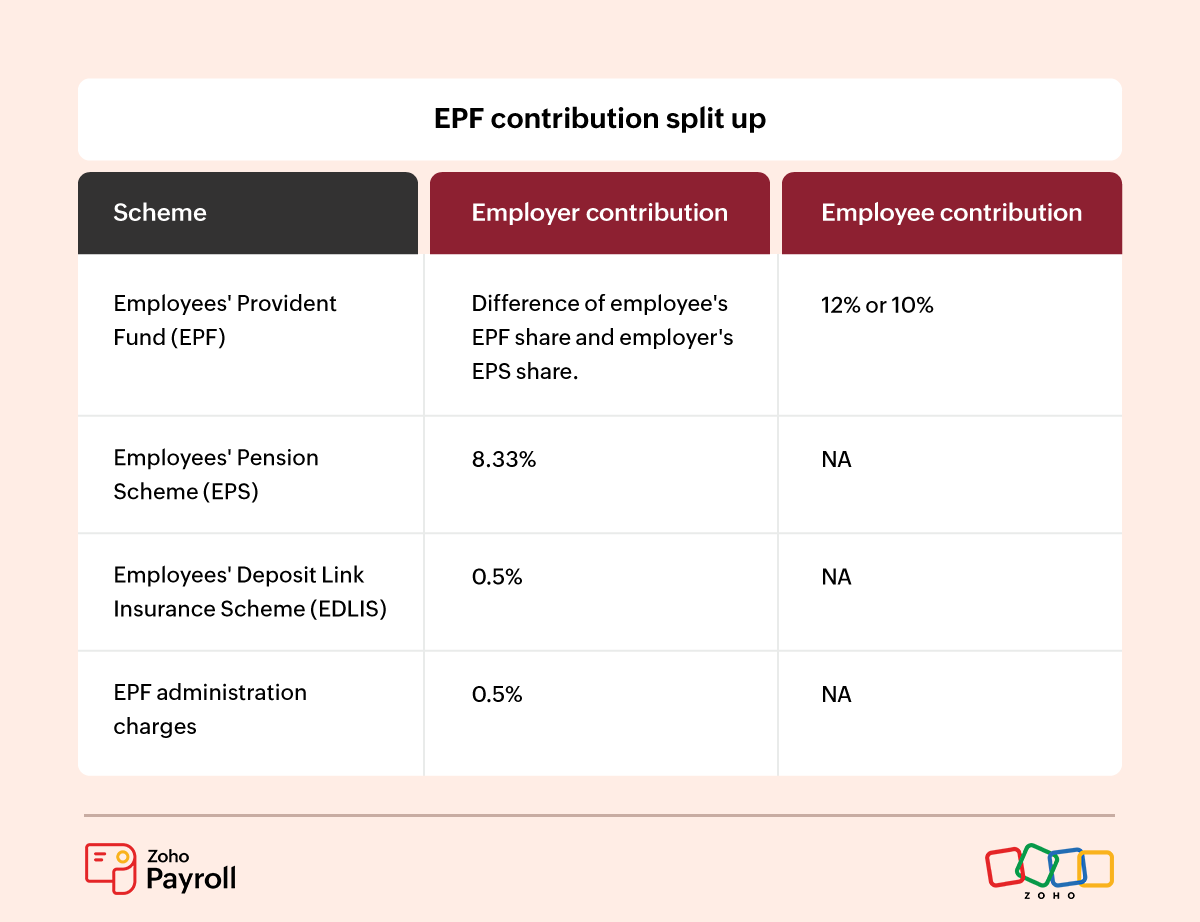

Employers are responsible for collecting contributions from the employees, and also contributing the employer's share each time payroll is processed. The employee's share goes entirely to the EPF, whereas the employer's contribution is split between the three schemes as mentioned in the table below.

Table 2 - Employee's and employer's EPF contribution rates based on employee's EPF wages.

Here's a brief of the different schemes for which your EPF contributions will go:

Employees' Pension Scheme: This is a social security scheme that provides a monthly pension to employees once they retire from work. Only the employer contributes 8.33% of the employee's EPF wage towards this scheme. The maximum wage limit for contribution is ₹ 15,000. Even if an employee earns more than that in a month, the maximum amount an employer must contribute is 8.33% of ₹ 15,000 which is ₹ 1,250.

Employees' Deposit Link Insurance Scheme: EDLI is an insurance cover provided by EPFO for employees of registered organisations. The employer must contribute 0.5% of the employee's EPF wage every month towards the policy. Contribution is to be paid on a maximum wage ceiling of ₹ 15,000 even if the EPF wages are higher than that. Hence, the employer's contribution can't exceed ₹ 75 in any given month.

How to calculate EPF contributions

The calculation of contributions is straightforward when your employee's EPF wages is less than ₹ 15,000, but the formula to calculate it will differ if their wages exceed the amount. Let's figure out how to calculate employers and employees EPF contribution through an example.

Anuya and Krish are two employees of an EPF-registered company and their monthly salary structure is as follows:

| Salary components | Krish | Anuya |

| Basic pay | ₹ 12,000 | ₹ 20,000 |

| Conveyance allowance | ₹ 2,000 | ₹ 4,000 |

| House rent allowance | ₹ 8,000 | ₹ 9,000 |

| Gross salary | ₹ 20,000 | ₹ 33,000 |

| EPF wages | ₹ 14,000 | ₹ 20,000 |

As per table 1, Krish's EPF wages will include basic pay and conveyance allowance because his basic pay is less than ₹ 15,000, whereas Anuya's basic pay is more than the limit and only that component will be considered for EPF. Their respective EPF wages are ₹ 14,000 and ₹ 20,000 and their monthly EPF contributions are as follows.

| Employees' contributions | |

|---|---|

| Krish | 12% of ₹ 14,000 = ₹ 1,680 |

| Anuya | 12% of ₹ 20,000 = ₹ 2,400 |

The monthly employer's contribution towards EPF can be calculated using this simple formula:

Employer's EPF contributions = Employee's EPF share - Employer's EPS share

The following table will help you understand how the employer's contribution is split between the three schemes under EPFO.

| Employer's contributions | For Krish | For Anuya |

| EPS (with a maximum wage ceiling of ₹ 15,000) | 8.33% of ₹ 14,000 = ₹ 1,166 | 8.33% of ₹ 15,000 = ₹ 1,250 |

| EPF (difference of employee's EPF share and employer's EPS share) | ₹ 1,680 - ₹ 1,166 = ₹ 514 | ₹ 2,400 - ₹ 1,250 = ₹ 1,150 |

| EDLI (with a maximum wage ceiling of ₹ 15,000) | 0.5% of ₹ 14,000 = ₹ 70 | 0.5% of ₹ 15,000 = ₹ 75 |

| EPF administration charges | 0.5% of ₹ 14,000 = ₹ 70 | 0.5% of ₹ 20,000 = ₹ 100 |

| Total employer contributions | ₹ 1,820 | ₹ 2,575 |

Contributions made by both parties can be rounded off to the nearest rupee. EPFO allows employees to contribute at a higher rate than the mandatory 12% if they wish to do so. In such a case, the employer is not obligated to match the employee's contribution.

How to get your business EPF ready

Understanding the contribution formulas clearly is crucial in getting your business compliant with EPF. After that, you need to follow various steps to implement the scheme effectively. We've split the whole process into four phases:

Registering under the scheme.

Getting your employees enrolled.

Collecting dues every month.

Paying EPF dues online.

Registering under the scheme

When should an employer register under the scheme?

Any establishment with 20 or more employees must register under the Act and provide benefits to their workforce. This includes both permanent and contract employees. The employer must obtain the registration certificate within one month of attaining the employee strength.

A registered establishment will continue to be under the purview of the Act even if the employee count falls below the required minimum. Employers with less than 20 employees can also voluntarily register for the scheme.

Documents required for registration

Depending on the type of business you run, you will be asked to submit different documents. However, there are some standard documents that are applicable for all businesses that you need to keep handy while registering. They are:

Name and address of the organisation.

PAN associated with the organisation.

Date of incorporation or registration of the company.

Details of the owner, designation, and contact details of directors and partners.

Legal status of the company—whether it's a private/partnership/publicly held firm or a society.

Basic details of employees—name, salary, and date of joining.

Total number of employees and the amount of wages disbursed each month.

Name and contact details of the organisation's tax deductor—the one who handles paying taxes on behalf of the company.

Business license information. This could be your certificate of registration or a incorporation certificates or memorandum of association.

How to register for EPF online

Employers can register for EPF by visiting the official website and following the below steps.

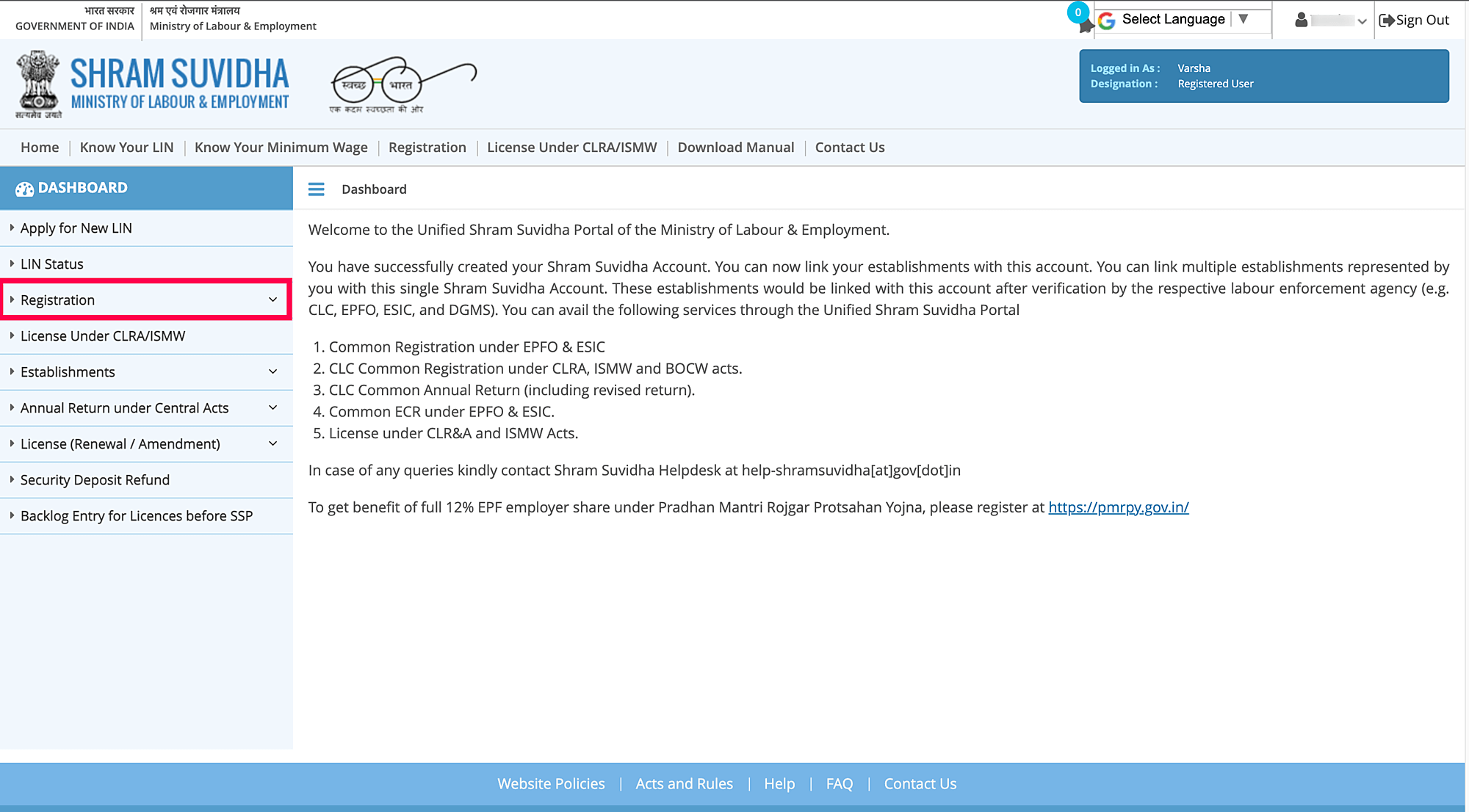

Go to the EPFO website and select Establishment Registration at the top right corner. You'll be taken to the login page of Shram Suvidha.

Sign up to the portal using your name, email address, and phone number.

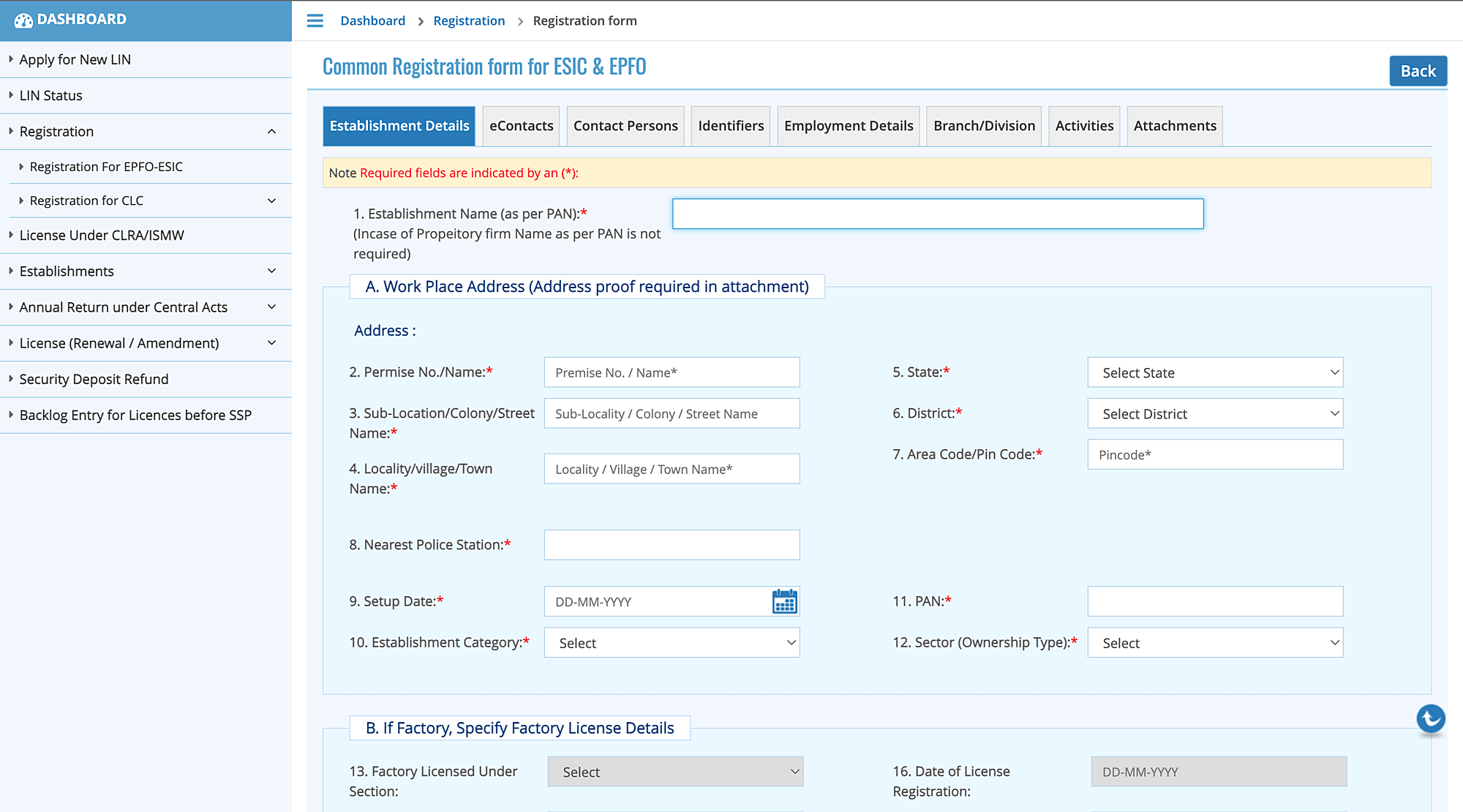

Once logged in, your screen will look like this. Click Registration on the dashboard.

Select Registration for EPFO-ESIC from the dropdown and click Apply for New Registration in the top-right corner of the screen.

On the next screen, you'll see two options—Registration for Employees' State Insurance Act, 1948 and Employees' Provident Fund and Miscellaneous Provision Act, 1952. If you'd like to register for both the schemes, select both and click Submit.

- Upon clicking Submit, you'll be taken to the Common Registration Form.

Fill in the necessary details under each section and attach the following documents in the Attachments section:

Proof of address of the establishment.

Date of setup proof.

Licence proof.

Specimen signature in the format prescribed.

Once you're done, go through the summary of the form and click Submit. You'll be asked to upload a Digital Signature Certificate on the next screen.

- After submission of the digital signature, you will receive an email from Shram Suvidha with a successful completion of registration message and your establishment's unique identity number.

Getting your employees enrolled

After completing the registration process, your next step will be to ensure all your employees have a Universal Account Number (UAN) allotted by the EPFO.

All the contributions made get accumulated in the respective employee's EPF account and this account is identified by UAN, which is a 12-digit unique number assigned to everyone who is a part of the fund. The process to getting your employees enrolled differs based on whether they're fresh graduates or lateral employees.

Prerequisites for new employees (fresh graduates)

Employees who are just starting out might not be members of EPF. For such candidates, it is your responsibility to get them enrolled and generate a UAN for them.

Log in to the employer's portal using your establishment's username and password.

Go to the Member tab and click Register Individual.

Check the Previous Employment field under the section as No.

Upload the employee's PAN, Aadhaar, and bank details in the fields and approve your entry under the Approval section.

A new UAN will be generated for your employee's EPF account.

Prerequisites for lateral employees

Employers can link new employees joining from different organisations using their existing UAN.

The process to add lateral members slightly differs from new employees. Here, you need to select Yes on the Previous Employment field under the Register Individual tab when adding a lateral employee.

Additionally, you must check whether the Know Your Customer (KYC) details has been updated against the employee's UAN. Aadhaar, PAN, driving licence, and ration card are some of the documents considered for KYC by EPF. If the employee has uploaded the document during their tenure at the previous organisation, you must verify the credentials and re-confirm the same when you're adding the new member through the portal. This will help with the auto-transfer of the employee's provident funds from the previous employer's member ID to present employer's ID.

Collecting dues every month

Once your business is registered and all your employees are enrolled, you should start collecting EPF dues every month and make payments on time.

Contributions from the employees should be deducted before processing pay runs. The employer must deposit the deducted amount along with their share before the 15th of the following month. For example, if you've deducted EPF contributions and paid your employees' salaries for November, you must make EPF payments before the 15th of December.

In order to make these payments to the EPFO, you need to generate a file called EPF-ECR (Electronic Challan cum Return). This challan contains employee-wise salary details and also provides a high-level summary of the contributions made by new employees, existing employees, and employees who have left the organisation during the month for which the payment is being made. Upon successful approval of the ECR, employers can make these payments online.

Making EPF payments

The government has made it mandatory for organisations to pay EPF online through the unified portal. The collected EPF dues should be remitted to the EPFO along with the ECR challan by the employer. Here are the steps to follow to make EPF payments online.

Log in to the unified EPFO portal.

Ensure that the pre-filled EPF details such as your organisation ID, name, address, and exemption status are shown correctly.

From the Payment drop down, select ECR/Return filing and click ECR Upload.

Select the corresponding month, salary paid date, and rate of contribution fields from the respective drop downs. Once done, upload the generated ECR text file.

The uploaded ECR file will be validated, and a Temporary Return Reference Number (TRRN) will be generated for the uploaded ECR.

Click Verify and then click Prepare Challan to generate an ECR summary sheet.

Validate the amount, enter any missed admin charges, and once you are done, click Generate Challan.

Verify the challan amount, then click Finalize, then Pay.

Select your payment mode as Online and complete your payments through any of the listed bank options.

Upon successful payment, a payment/transaction ID will be generated and an e-receipt will be generated. These details will be updated inside your EPFO portal.

EPFO will then confirm the payment made against the respective TRRN number.

Here's the tutorial with screenshots on how to process EPF payments.

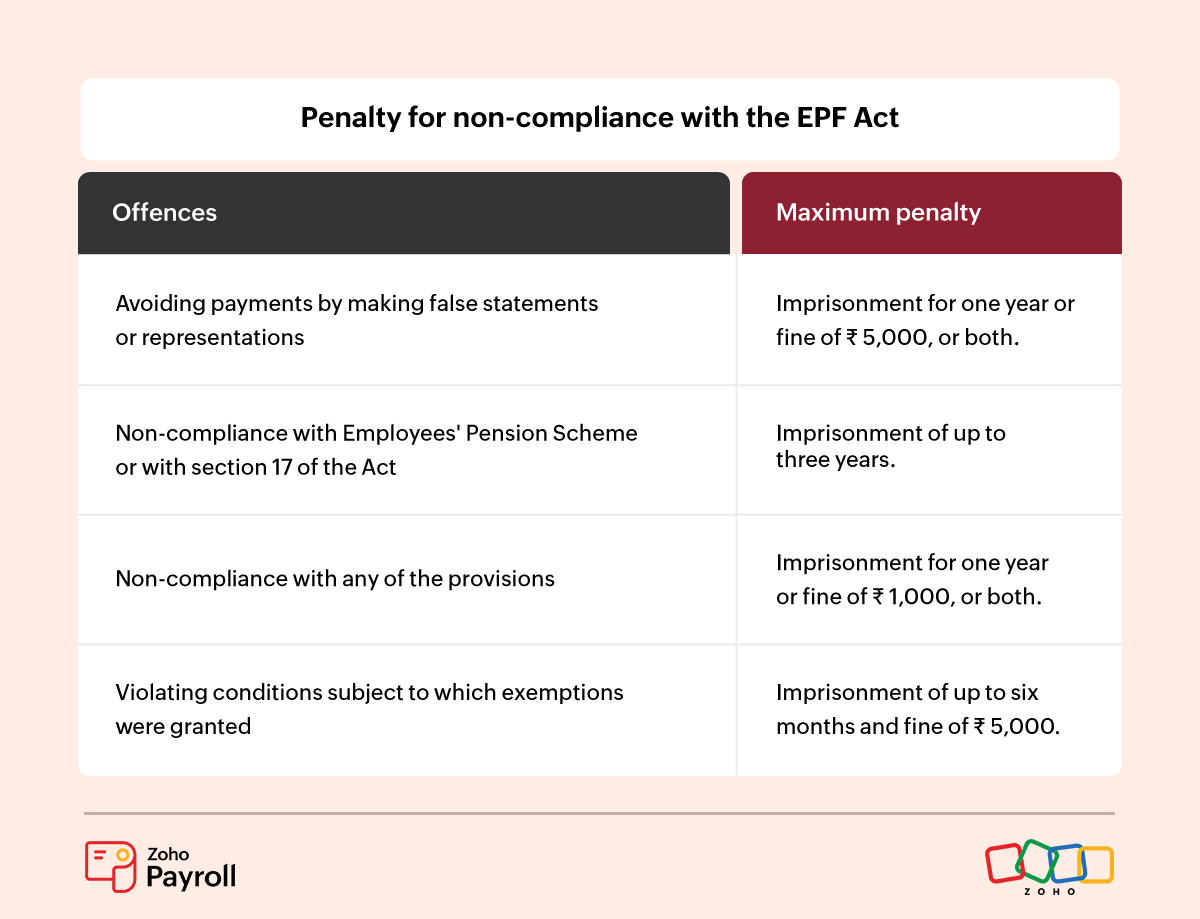

Penalty for non-compliance

Non-compliance with the EPF Act will incur penal provisions on the employer. The following table summarizes the various offences and the maximum penalty each would attract.

If an employer fails to make the EPF payments or any other charges as mandated by the Act, the officer authorized by the central government can impose damages on the employer. These damages will be calculated at a rate of 1% of the unpaid contribution for each month or part of a month that the payment is delayed.

If you're in default, the penalties keep accumulating until you settle the dues. You can pay the late fine online through the employer's portal.

Log in to the portal, go to the Payments tab and click ECR/Return filing. On the next page, click Challan Entry, choose the corresponding wage month from the dropdown and select Miscellaneous Challan under the challan type field. Verify the fine amount and pay the charges online.

Things to keep in mind

Registering your business under EPF is mandatory if your employees strength exceeds 20.

EPF is also compulsory for all employees who earn less than ₹ 15,000 per month.

You need to deduct contributions from your employees' salary before processing payroll every month.

The due date to make EPF payments is the 15th of each month.

Every time you hire a new employee you must check if they have an EPF account and add them as a member through the employer portal.