- HOME

- Taxes and compliance

- Employees' State Insurance (ESI) meaning, contribution & benefits

Employees' State Insurance (ESI) meaning, contribution & benefits

ESI, or Employees' State Insurance, is a socio-economic welfare scheme that aims to provide financial assistance to employees who are unable to work due to unforeseen situations.

This scheme covers sickness, maternity leave, temporary or permanent physical disablement, unemployment, and death due to employment injury or disease. ESI also extends medical care benefits for workers and their dependents.

The ESI Act was the first major legislation in India to allocate social security for workers. The scheme is managed by the Employees' State Insurance Corporation (ESIC) and is administered by the Ministry of Labour and Employment of the Government of India. Since it was first introduced in 1948, it has been one of the most important payroll statutory compliance in the country.

Who is eligible for ESI?

The ESI Act applies to all factories employing 10 or more people. In 2001, the government extended the provisions of the ESI Act to other establishments, including:

- Shops

- Hotels and restaurants

- Cinemas (including preview theatres)

- Road motor transport undertakings

- Newspaper establishments

- Educational and medical institutions

- Insurance businesses

- Non-banking financial companies

- Warehousing establishments

- Port trust and airport authorities

The minimum number of employees an establishment must have for registration under the Act varies in different states.

| Minimum number of employees required for ESI scheme | |

| States requiring minimum of 10 employees | States requiring minimum of 20 employees |

| Andhra Pradesh | Andaman and Nicobar |

| Bihar | Assam |

| Chhattisgarh | Chandigarh |

| Delhi | Dadra and Nagar Haveli |

| Gujarat | Daman and Diu |

| Haryana | Goa |

| Jharkhand | Himachal Pradesh |

| Karnataka | Jammu and Kashmir |

| Kerala | Lakshadweep |

| Odisha | Madhya Pradesh |

| Pondicherry | Maharashtra |

| Punjab | Meghalaya |

| Rajasthan | Nagaland |

| Tripura | Tamil Nadu |

| Uttarakhand | Uttar Pradesh |

| West Bengal | |

Note: At present, the ESI scheme is not available in Manipur, Sikkim, Arunachal Pradesh, and Mizoram.

According to the Act, employees of registered organizations earning less than ₹21,000 are entitled to ESI benefits. Under the Act, persons with a disability earning up to ₹25,000 can also claim ESI benefits.

How does the ESI scheme work?

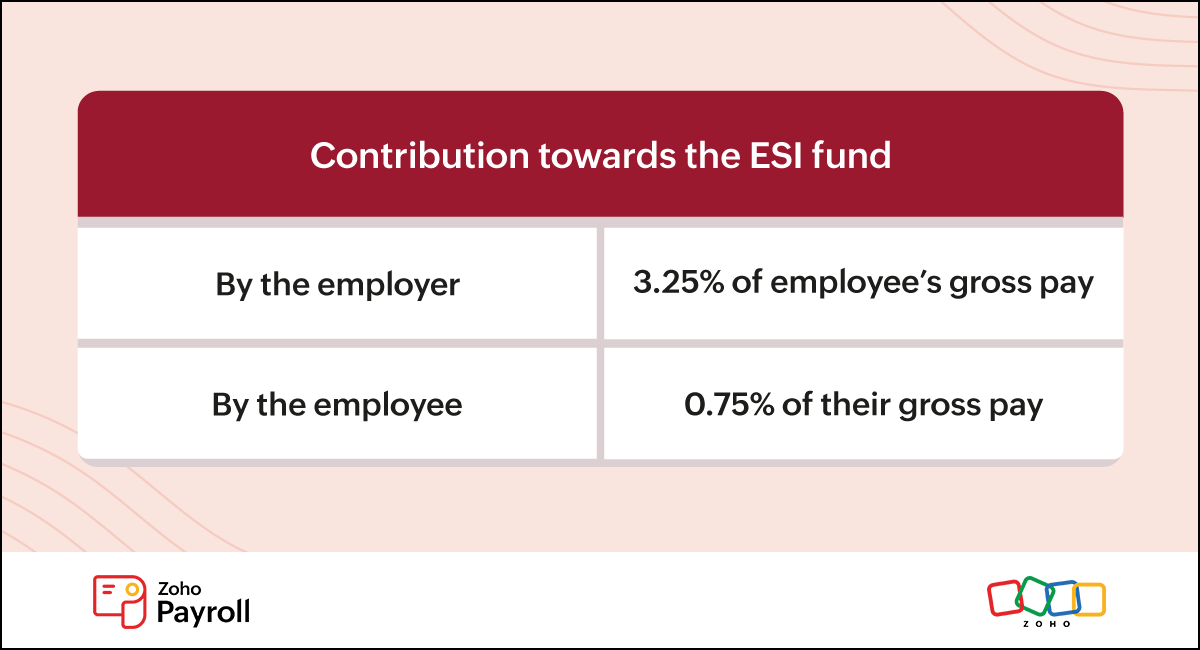

The employer and the employee need to contribute a combined 4% of the employee's gross wage each month towards this self-financing scheme. Here's how the contribution rates are split between the employer and employee:

As per the Act, the financial year is divided into two contribution periods to make compliance easy for employers. The first contribution period is from 1st April to 30th September and the second contribution period is from 1st October to 31st March.

In scenarios where the employee's salary increases beyond the cut-off limit during the period, the deductions will continue until the given contribution period ends.

Let's look at an example. Suppose your employee was earning ₹18,000 in November, and after an appraisal in January, they began earning ₹22,000. ESI deductions would still continue for them through March for that particular year since the contribution period ends on 31st March.

Benefits offered through the ESI Act for employees

Anyone who is covered under the Act is entitled to receive cash and non-cash benefits.

- The cash benefits include unemployment allowance, sick pay, maternity pay, disablement payments, dependents coverage, and other expenses like funeral expenses and confinement expenses. There is also rehabilitation coverage that includes vocational, and physical rehabilitation.

- Non-cash benefits through the Act include medical care for workers and their dependents.

In special cases where an organization employs differently-abled employees, the Ministry of Social Justice & Empowerment will pay the employer's ESI contribution amount for three years.

Here is a brief overview of the various ESI benefits and the applicability of each benefit.

Medical benefits

Employees and their dependents are provided with full medical care for free. State governments bear one-eighth share of the cost and the rest of the expense is covered by the ESI fund. Employees and their dependents become eligible for this benefit from the day they join the insured establishment.

Sickness benefits

Employees will be paid 70% of their average daily wages for 91 days if the insured person falls sick and can't work. Insured people who have made payments toward the ESI fund for at least 78 days in the relevant contribution period can claim this benefit.

Extended sickness benefits

An additional sickness benefit is available to provide financial aid to insured persons suffering from any of the 34 specified long-term diseases such as tuberculosis, AIDS, etc. Employees are paid 80% of their average daily wages for 309 days if the insured person completes two years of employment and made ESI payments for at least 156 days.

Enhanced sickness benefits

Aimed at promoting small family norms, insured people undergoing sterilization procedures can claim this benefit. Employees will get 100% of their average daily wages for seven days for a vasectomy surgery and 14 days for a tubectomy operation.

Disablement benefits

This is a periodic payment to support employees suffering from disablements as a result of an on-the-job injury or occupational disease. For temporary disablement, 90% of an employee's average daily wages will be paid until the injury subsides, while benefits for permanent disablement are determined by the loss of earning capacity of the worker.

Dependents benefits

This is a monthly pension payable to dependents of employees who died due to employment injury or occupational disease. Dependents will get 90% of the deceased's average daily wages (divided amongst the dependents if more than one) in the ratio prescribed by the employee.

Maternity benefits

All insured female employees who have made contributions towards the ESI fund for a minimum of 70 days are eligible for 100% of their average daily wages for a period of 26 weeks in confinement, 6 weeks in case of a miscarriage, and 12 weeks for commissioning or adoption.

Confinement expenses

A cash benefit of ₹2,500 can be claimed by female employees, or insured person's expecting dependents on a per case basis.

Funeral expenses

Upon the death of an insured employee, the eldest surviving member of their family will be given a lump sum of ₹10,000 to cover funeral expenses.

Rehabilitation allowance

If an employee is disabled due to an employment injury, they're eligible for 100% of their average daily wages. This can be claimed until the employee is admitted to the hospital for fixation or repair or replacement of an artificial limb.

Unemployment allowance

The Rajiv Gandhi Sharmik Kalyan Yojana scheme under the ESI Act aims to provide monetary support to insured workers who lose their jobs. Employees who were laid off due to a business's closure or retrenchment, or because of permanent disablement are entitled to 50% of their average daily wages for the first 12 months and 40% of their daily wages for the next 12 months. This can only be claimed if they worked at the establishment for at least three years and contributed fully to the ESI fund prior to the loss of employment.

The ESI scheme comes with various perks that your employees can immensely benefit from. As an employer, you should stay compliant with the ESI Act at all times to ensure these benefits remain available.

Employer liabilities

Besides contributing monetarily to the ESI fund, employers have other duties to fully comply with the ESI Act.

On-time registration: As a first step, fill out Form 01 for registration under the ESI Act within 15 days from the date of applicability. Once that is done, you must submit the Declaration Form to cover all the employees who are on your payroll.

Collect and submit amount: It is your responsibility to collect and submit both the employer and the employee contributions as per the specified rates by the 15th of every month. The amount should be deposited in a bank authorized by the statutory body.

- File returns: You should submit your half-yearly returns using the Return of Contributions form (RC). For the contribution period from April to September, the due date to file returns is 12th of November. The October to March period's due date is 12th of May.

Maintain records: It is also your responsibility to maintain all records and registers, and to provide them for verification whenever needed. If there are any changes within the organization, like a change in employee count or business address, you should inform the respective ESIC authorities as soon as possible.

Learn how to register your organization, make payments, and file returns for ESI in our step-by-step guide.

A quick summary

Employees' state insurance is a self-funding scheme that provides socio-economic support to employees during emergency situations. This multi-faceted insurance is managed by the Employees' State Insurance Corporation.

Factories with more than 10 employees should voluntarily register for this scheme. Employees of registered organizations earning less than ₹21,000 are entitled to ESI benefits. Both the employer and the employee should contribute a combined 4% of the wages payable to employees each month towards the ESI fund. The employer has to make monthly payments to the statutory body and file half-yearly returns.

Streamline the ESI process with Zoho Payroll

We understand that it's challenging for employers to manage statutory dues and grow their business at the same time. Zoho Payroll, cloud-based payroll software, is here to make compliance easy.

With Zoho Payroll, you can:

- Enable automatic ESI contribution calculations for eligible employees in a few clicks

- Regularly deduct employees' contributions to the ESI fund before processing each month's payroll

- Extract ESI summary reports and ESIC return reports

- Protect exported reports with secure passwords

When you choose Zoho Payroll you are choosing automatic payroll compliance. Our payroll software puts your business on solid legal footing and helps you process statutory dues with more confidence.