Tax Deducted at Source

TDS (Tax Deducted at Source) is a mechanism where the tax is withheld at the source. In this mechanism, the payee will deduct tax and then make the rest of the payment to the receiver. You can enable it for customers and vendors in Zoho Inventory. You can also create transactions with TDS for the customers that you’ve enabled TDS for. When TDS is enabled in Zoho Inventory and applied to a transaction, it’ll calculate the tax based on the percentage selected and display the total amount of the transaction accordingly.

Enable TDS

Before you can create transactions with TDS, you’ll have to first enable TDS and create TDS rates in Zoho Inventory.

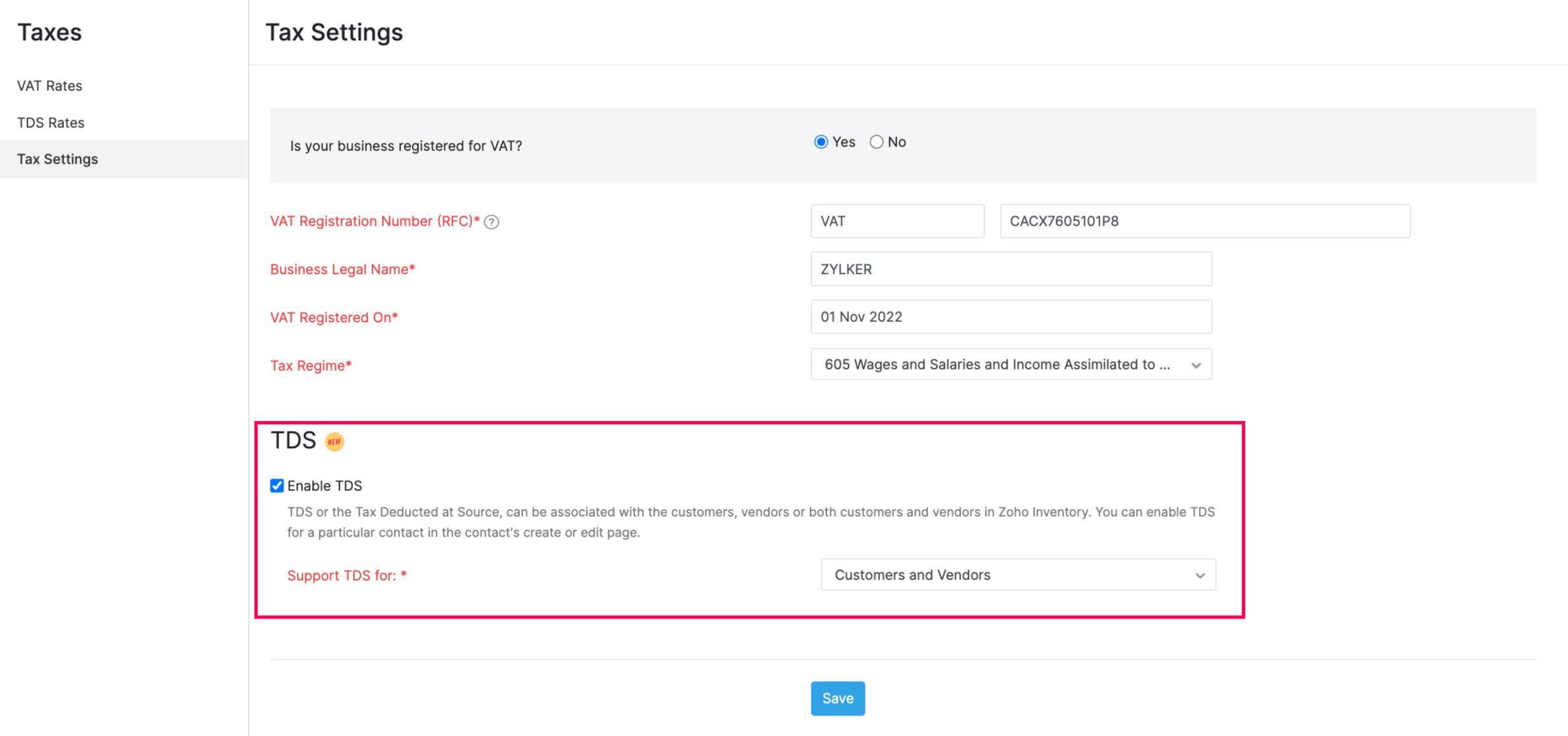

To enable TDS:

- Click the Gear icon on the top right corner of your page and select Taxes. You will see the Tax Settings page.

- Check the Enable TDS box.

- Next, select Customers, Vendors, or Customers and Vendors from the Support TDS For dropdown. Based on the option you select here, you will be able to enable TDS in customers, vendors, or both and apply TDS while creating transactions for them.

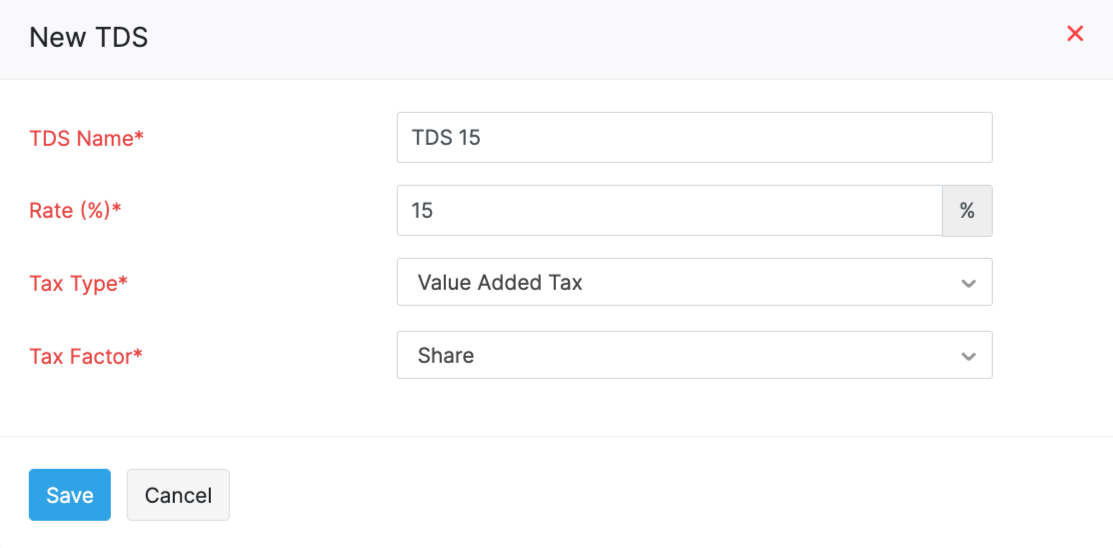

Add TDS Rate

Once you’ve enabled TDS in Zoho Inventory, you can add TDS rates. Here’s how:

- Click the Gear icon in the top right corner and select Taxes.

- Go to the TDS Rates section.

- Click the + New TDS Rate button on the top right corner of the page.

- Enter the TDS Name and TDS Rate.

- Select the TDS Type and TDS Factor from the respective dropdowns.

- Select your Tracking Preferences, i.e., the accounts under which you wish to track the TDS for sales and purchases.

- Click Save.

Pro Tip: You can also create TDS groups by clicking the + New TDS Group button on the top right corner of the page and selecting the required TDS rates to group them as one.

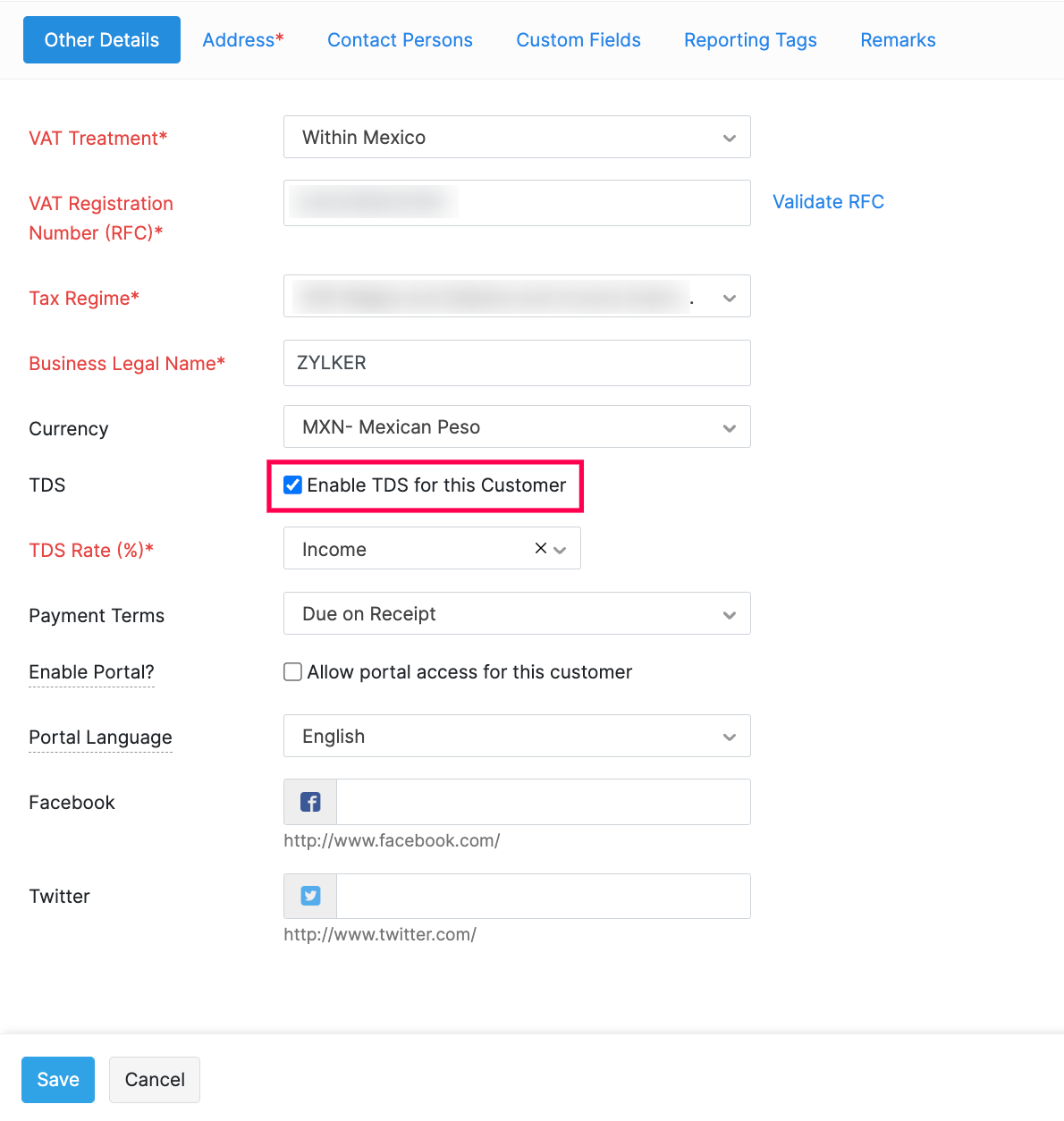

TDS in Customers/Vendors

Once you’ve enabled TDS in settings, you’ll have to enable it for the customers or vendors that you want to create transactions with TDS. Based on the preference you’ve selected while enabling TDS in Tax Settings, the TDS option will be available for customers, vendors, or for both customers and vendors.

To enable it for a customer or a vendor:

- Go to Sales > Customer for customers and Purchases > Vendors for vendors.

- Create a new contact or edit an existing one.

- Check the Enable TDS for this Customer/Vendor box.

- Enter or update the other necessary details and click Save.

Now when you create transactions for the customer or the vendor for whom TDS is enabled, you’ll be able to associate TDS at the line item level.

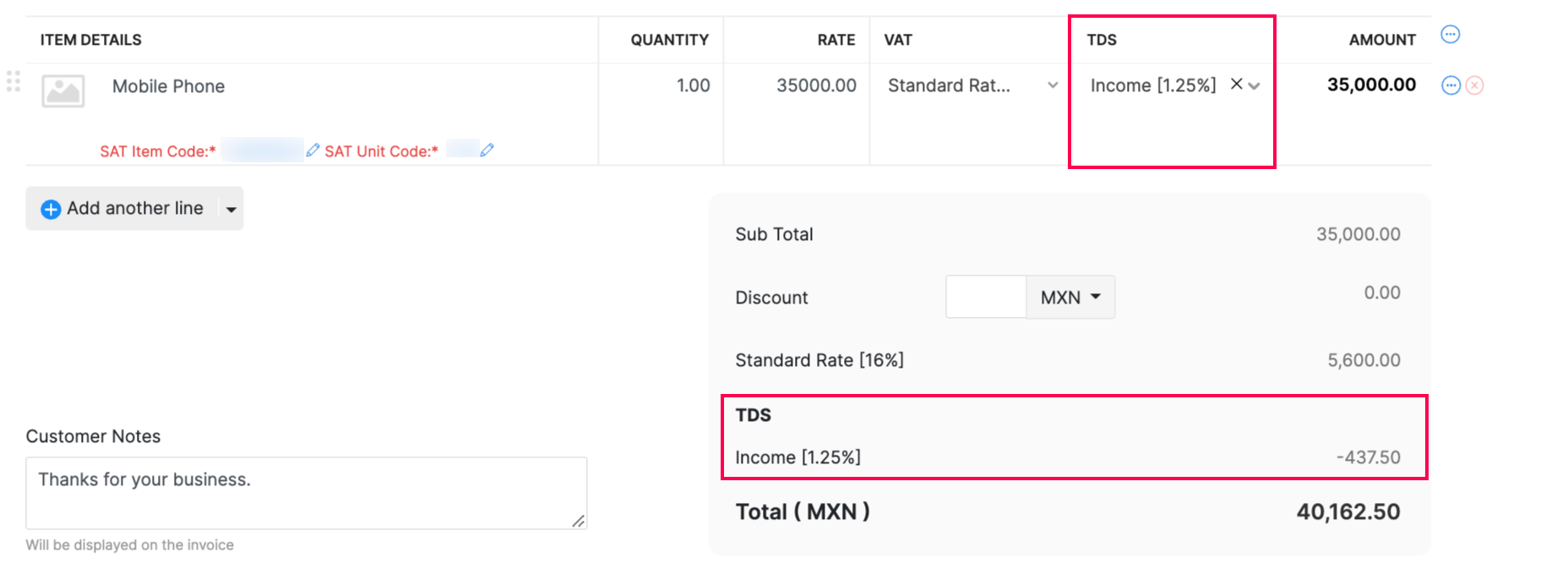

TDS in Transactions

You can associate TDS for each item in a transaction in Zoho Inventory. Here’s how:

- Go to the module from which you want to create a transaction.

- Add the items.

- Select a TDS rate for each item in the TDS column.

- Click Save.

The TDS for all the items will be calculated and displayed in the total section of the transaction.