Taxes

Value-added tax (VAT) is a tax on goods and services that is added at each stage of the supply chain where value is added, from initial production to the point of sale. In Zoho Inventory, you can add taxes to the transactions based on the government regulations. This section will give you an overview about how you can configure and add tax rates in Zoho Inventory.

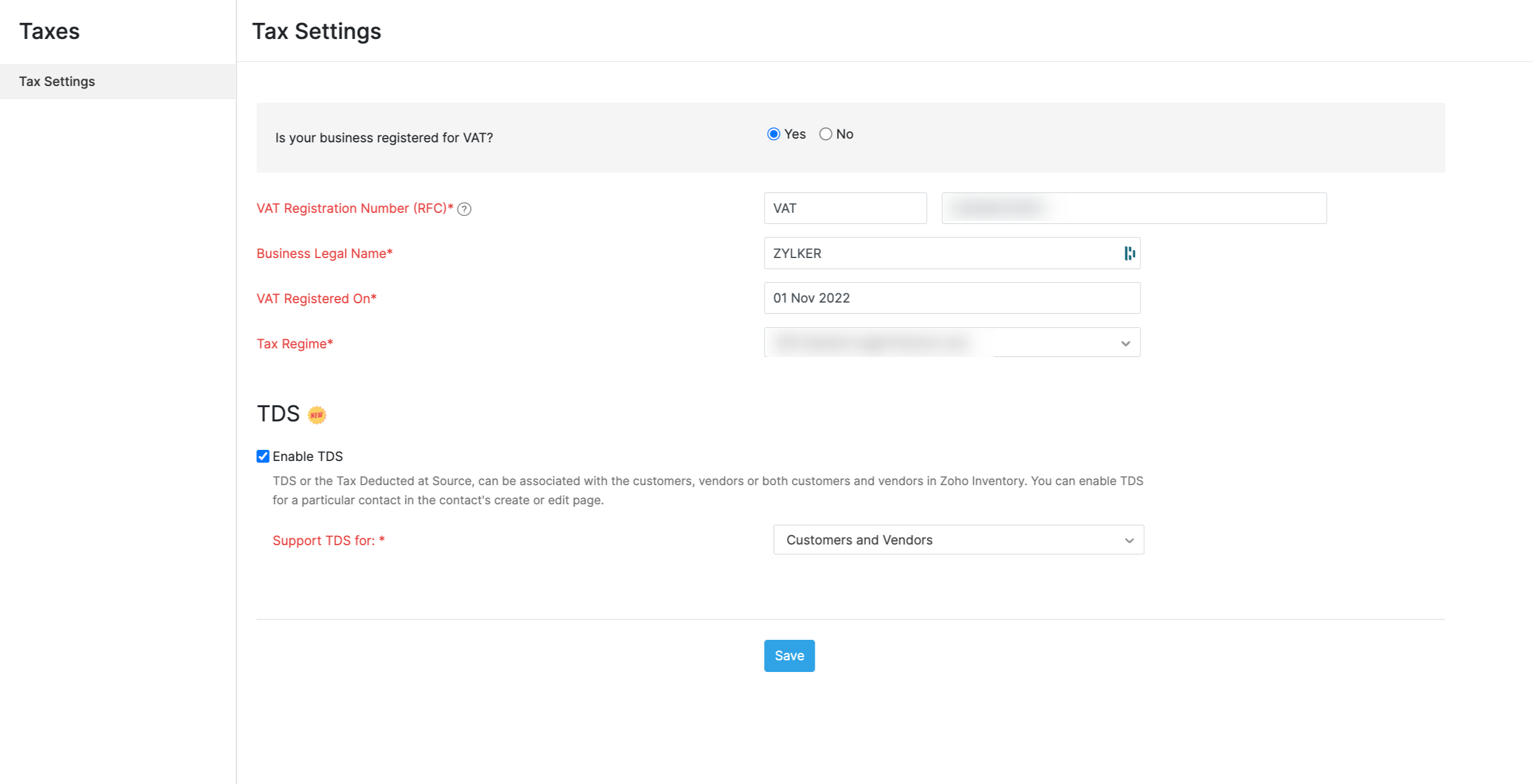

Configure Tax Settings

You’ll first have to enable and set up taxes for your organisation in Zoho Inventory:

- Go to Settings and navigate to Taxes.

- Click Tax Settings.

- Check Yes against Is your business registered for VAT?

- Enter the VAT Registration Number.

- Enter your Business Legal name.

- Select the VAT Registered On date and the Tax Regime.

- Check the Enable TDS box if you want to associate TDS in your organisation.

- Select if you want TDS to be associated with Customers, Vendors, or Customers and Vendors from the TDS Support For dropdown.

- Click Save.

VAT Rates

You can create the tax rates that are applicable for your business based on the goods and services that your business deals with.

By default, the following VAT rates are available once you enable taxes in Zoho Inventory:

- Standard Rate (16%)

- Reduced Rate (8%)

- Zero Rate

Add VAT Rate

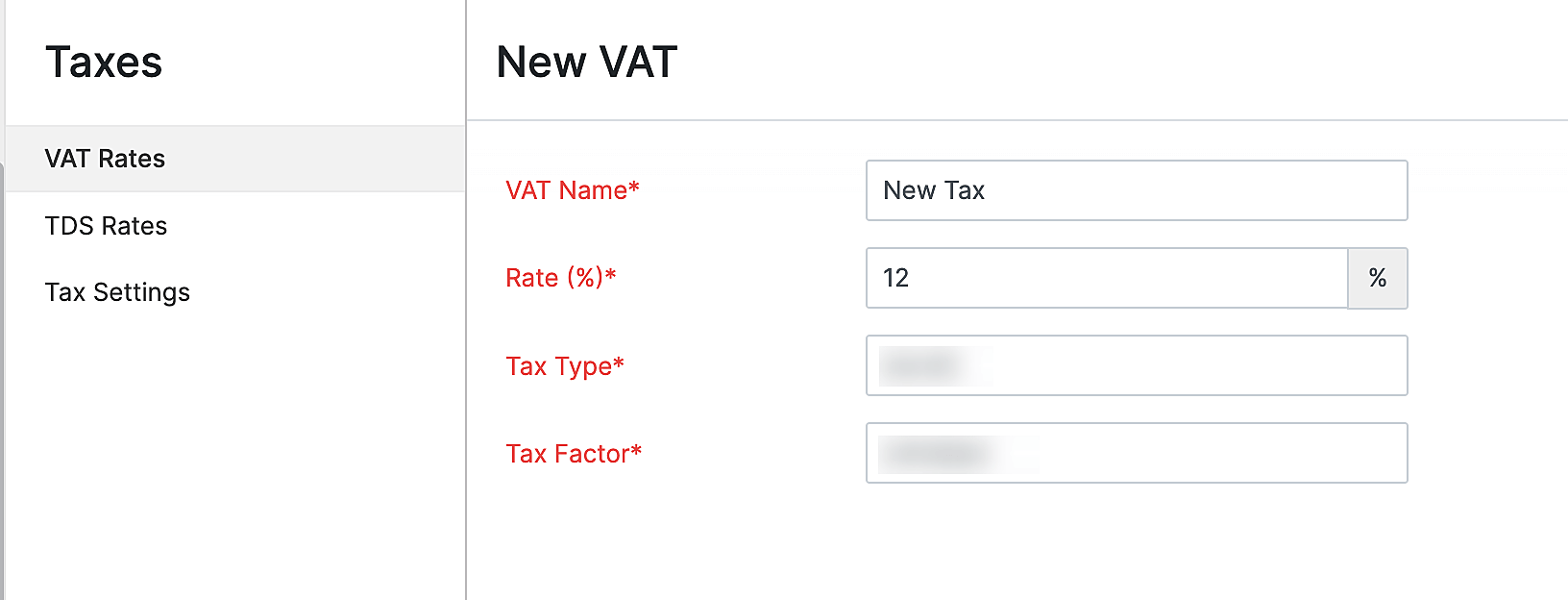

There might be cases where you might have to create VAT rates in Zoho Inventory based on your business requirements. To create a new tax rate:

- Go to Settings and navigate to Taxes.

- Click VAT Rates.

- Click the + New VAT button on the top right corner of the page.

- Fill in the VAT Name, Rate (%), Tax Type, and Tax Factor at which it’s levied.

- Click Save.

After you create a new VAT rate:

- You can associate it to an item as the default tax rate for that item. So, the next time you include this item in a transaction, the default tax rate will auto-populated.

- You can manually apply the VAT rate to line items while creating a transaction.

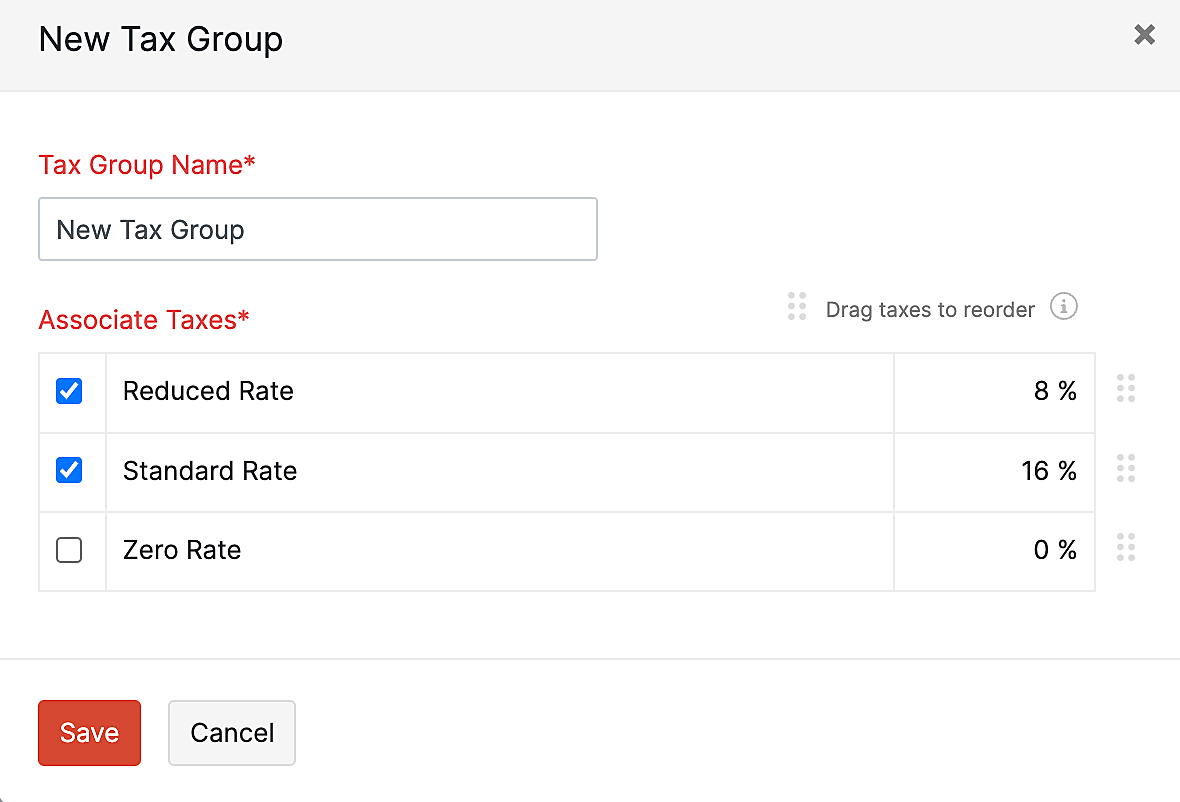

Tax Groups

You can group taxes together and apply them to your transactions.

The total tax rate of a tax group will be the sum of all the tax rates which are grouped under it.

Prerequisite:Before you create a tax group, ensure that you have created two or more tax rates in Zoho Inventory.

To create a new tax group:

- Go to Settings and navigate to Taxes.

- Click VAT Rates.

- Click the + New Tax Group button in the top right corner of the page.

- Enter the name of the tax group, and select the taxes you want to associate with this tax group.

- Click Save.

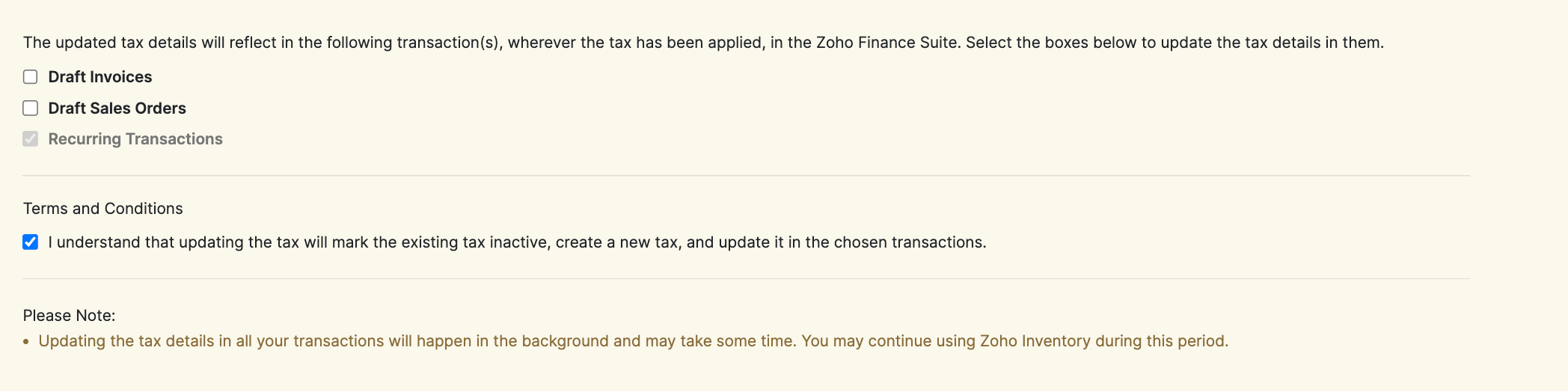

Edit VAT Rate

You can make changes to any tax rate that you have added in Zoho Inventory. Here’s how:

- Go to Settings and navigate to Taxes.

- Click VAT Rates.

- Hover over the tax and click Edit.

- After making the necessary changes, click Save.

- If this tax has already been applied in some transactions, you will be asked to accept the terms and conditions confirming that you wish to update the new tax rate in those transactions as well.

Warning: If you edit a tax rate that has been applied in an active recurring profile, the tax rate in the recurring profile will be updated as well.

Delete VAT Rate

If you no longer need a tax rate that you created, you can delete it in Zoho Inventory. Here’s how:

- Go to Settings and navigate to Taxes.

- Click VAT Rates.

- Hover over the desired tax and click the Delete icon.

- Click OK to confirm.