DIOT Report

The DIOT report (Declaration of Operations with Third Parties) is used to declare the purchase transactions to the Mexican tax authorities, which is Servicio de Administración Tributaria (SAT) or also known as the Tax Administration Service. The DIOT report must be submitted every month your business makes a purchase transaction.

In Zoho Inventory, you can generate the DIOT report and download it in the TXT format to submit it to SAT.

To generate the DIOT report:

- Go to the Reports module on the left sidebar.

- Go to DIOT Report under Taxes.

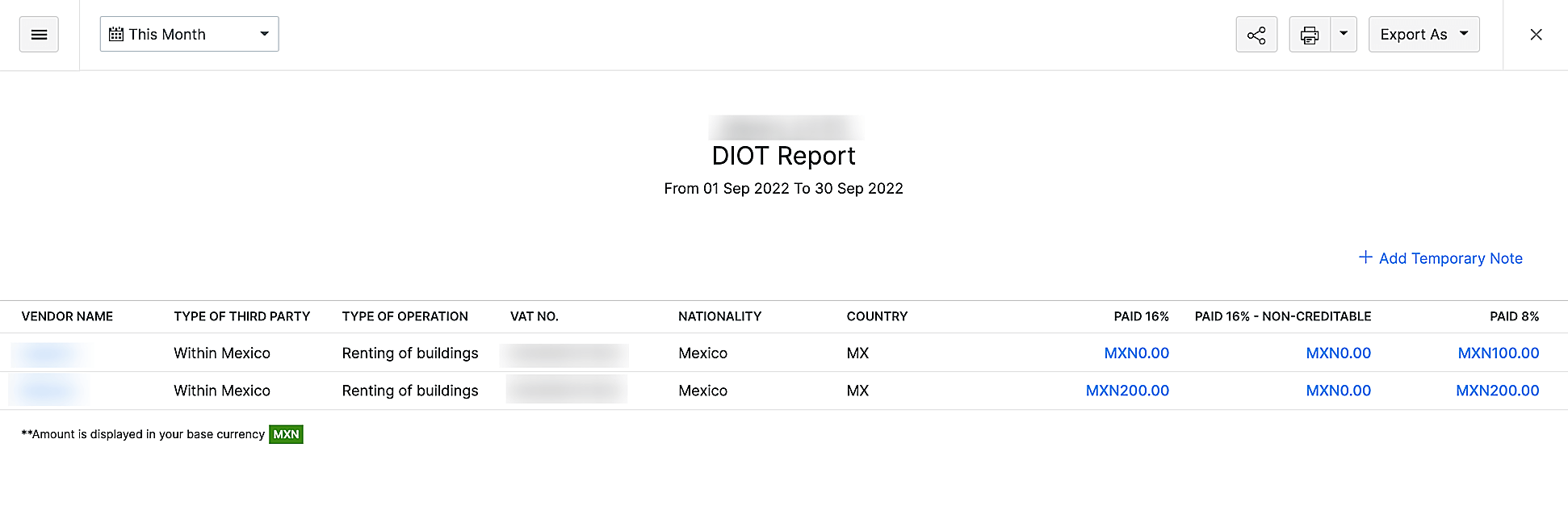

In the report, you’ll be able to view all the purchase transactions that you’ve created in Zoho Inventory. It will contain all the information you need to submit it to SAT as explained below.

| Field Name | Description |

|---|---|

| Vendor Name | The name of the vendor from whom you’ve purchased goods or services. |

| Type of Third-party | The type of vendor from whom you’ve purchased. |

| Type of Operation | The type of goods or operation that was purchased. |

| VAT No. | The vendor’s VAT number. |

| Nationality | The nationality of the vendor. |

| Country | The country from where the purchase was made. |

| Paid 16% | The goods and services purchased at 16% rate and are eligible for input tax credit. |

| Paid 16% - Non-creditable | The goods and services purchased at 16% rate and are not eligible for input tax credit. |

| Paid 8% | The goods and services purchased at 8% and are eligible for input tax credit. |

| Paid 8% - Non-creditable | The goods and services purchased at 8% and are not eligible for input tax credit. |

| Importation 16% | The goods imported from overseas vendors with VAT at 16%. |

| Paid 0% | The goods and services purchased at 0% VAT rate. |

| Vat Exempt | Purchases with no tax associated to it. |

| Vat Withheld | Purchases with TDS applied in it. |

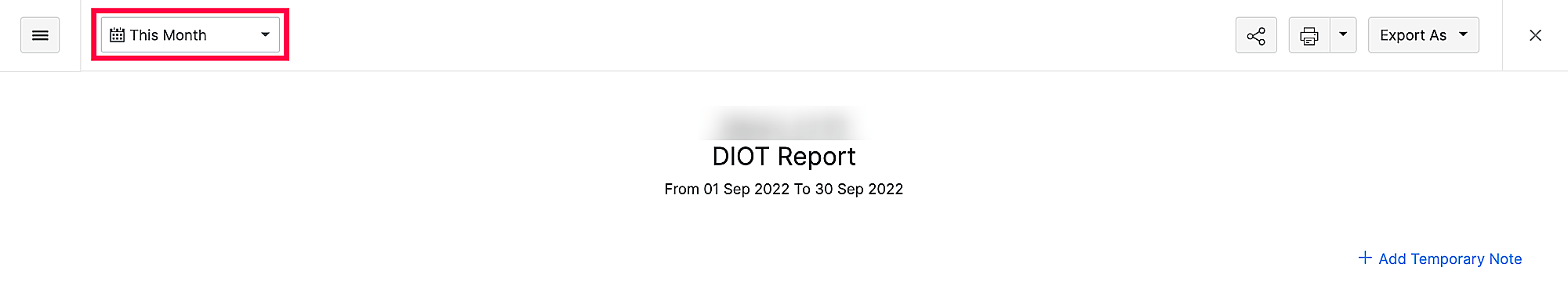

Pro Tip: You can customize the period for which you want to generate the report by selecting the period from the dropdown on the top left corner of the page.

Download DIOT Report

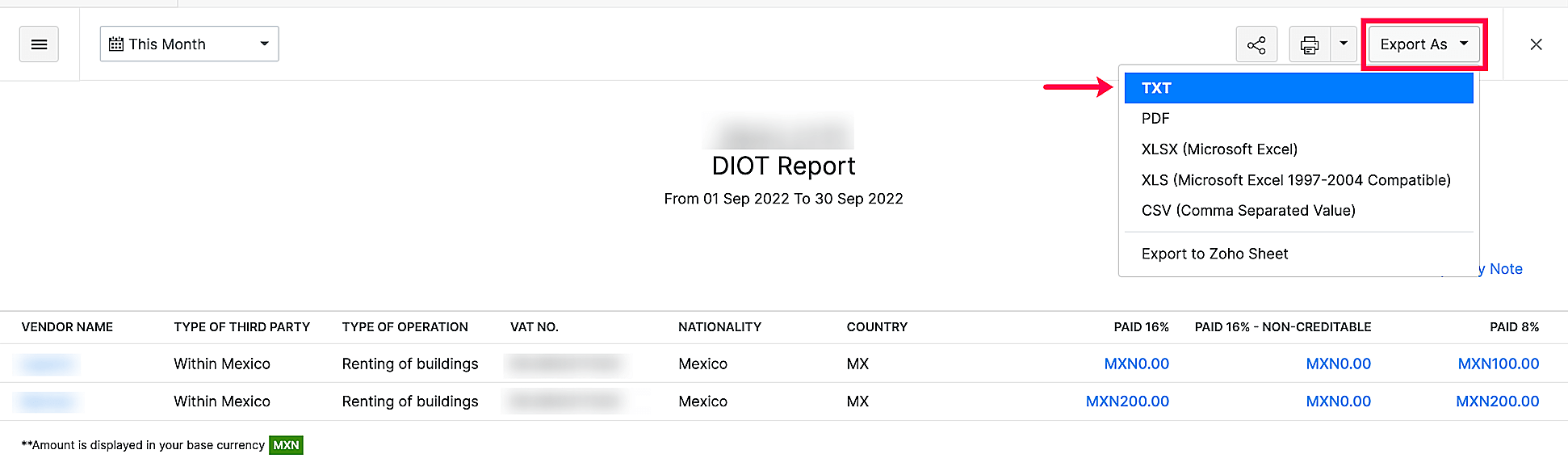

As per the SAT regulations, you’ll have to submit the DIOT report in the TXT format to SAT. To do this, you can download the report from Zoho Inventory in the TXT format. Here’s how:

- Click the Export As button on the top right corner of the page.

- Select TXT from the dropdown.

The report will be downloaded in the TXT format. You can now submit this report to SAT. Also, you can export the report in PDF, XLSX, XLS and CSV formats, or export it to Zoho Sheet.