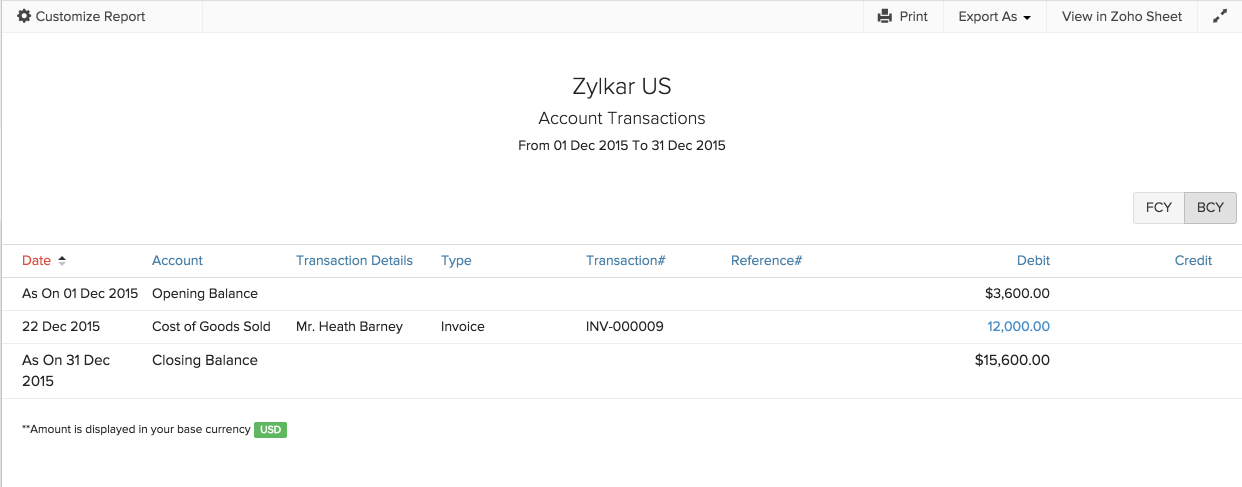

Why am I seeing income transactions while running the Account Transactions report for expense accounts?

This situation will occur if Inventory has been enabled for your organization. This causes all sales and purchase transactions(Invoices and Bills with Inventory items) to pass through an asset account called Inventory Asset. In the screenshot below, you can see an Invoice transaction with a Cost of Goods Sold account.

This is done because, when you purchase goods, until you sell them, it is considered as your asset. Hence those goods are stored under Inventory Asset. However, only when you raise an invoice and sell them to a customer, will it be considered as an expense.

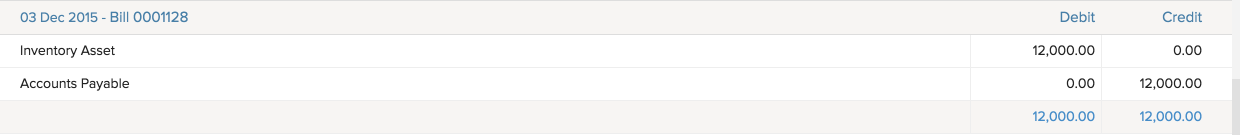

When you are purchasing items from your vendor, you will see in the Journal Report that,

- The Inventory Asset account is debited and,

- The Accounts Payable account is credited.

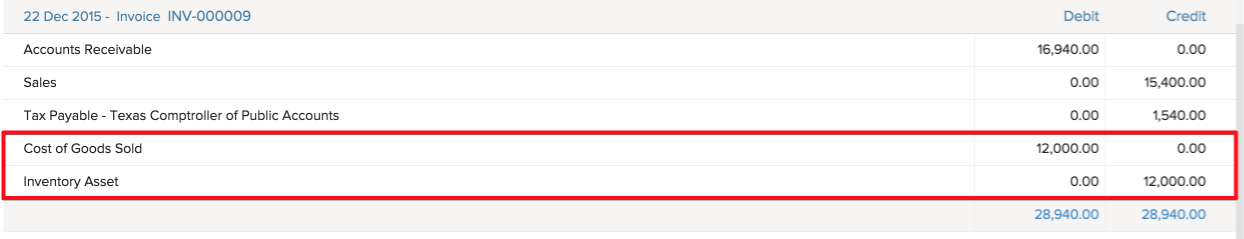

Similarly, when you are selling items that you had initially bought, you will see in the Journal Report that,

- The Cost of Goods Sold account is debited and,

- The Inventory Asset account is credited.

Yes

Yes