VAT

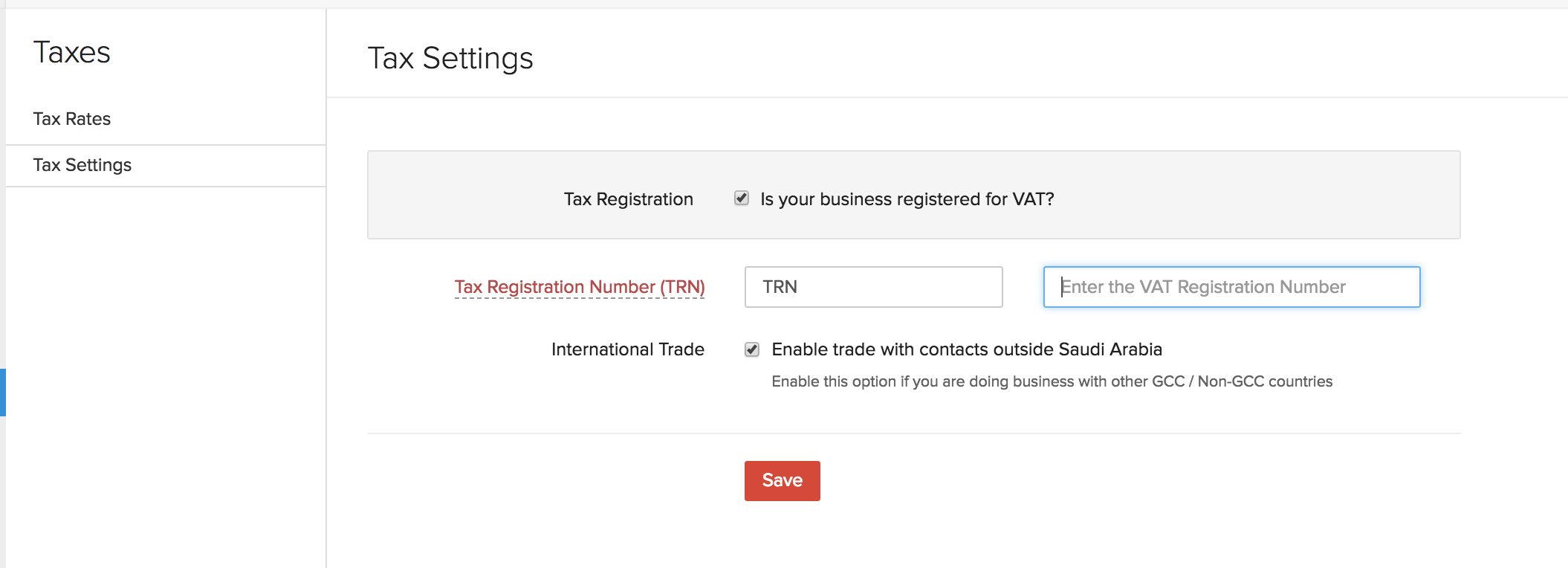

Value-Added Tax is a tax levied at the point of sale on the use of goods and services. If your company is registered for VAT, please configure your TRN number under Settings > Taxes > Tax Settings section.

Note: If you are liable to do business outside your registered country, you will have to enable the option to trade with contacts outside Saudi Arabia.

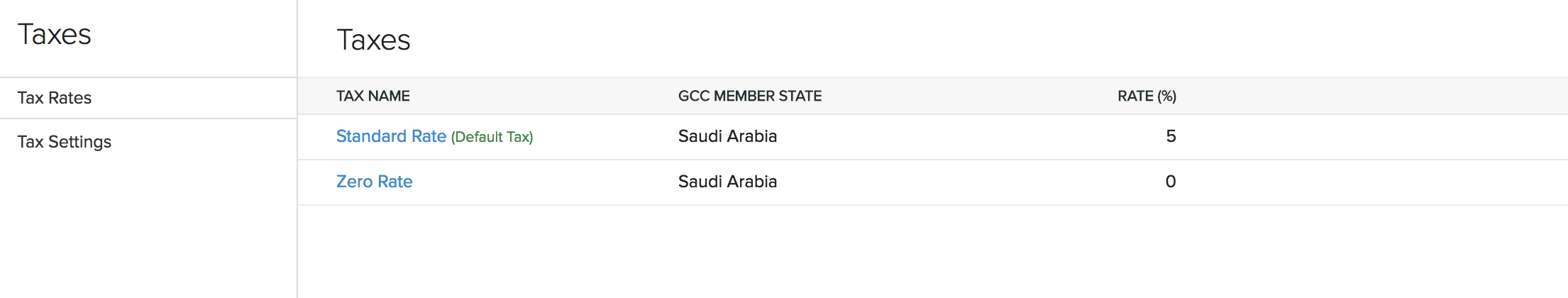

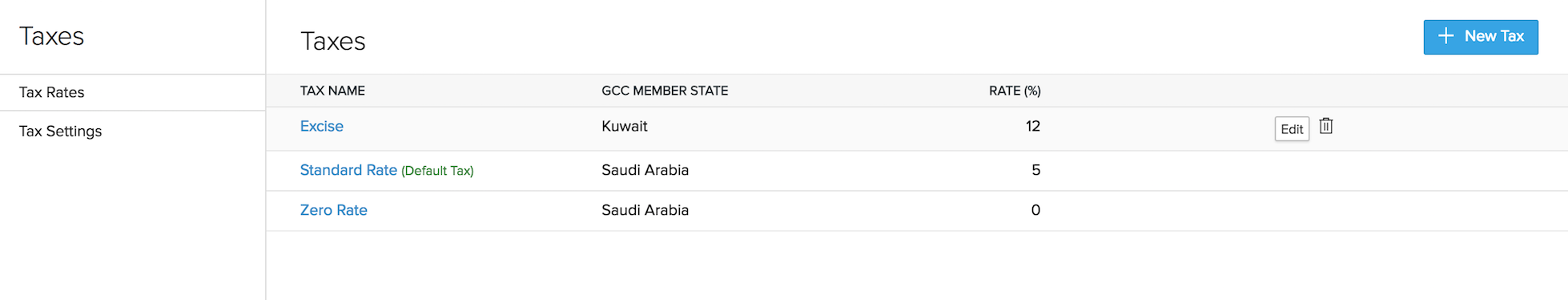

Once this is done, you can move over to the Tax Rates section which displays the various taxes configured for your business. By default, you will find two tax rates: five-percent and zero-percent configured.

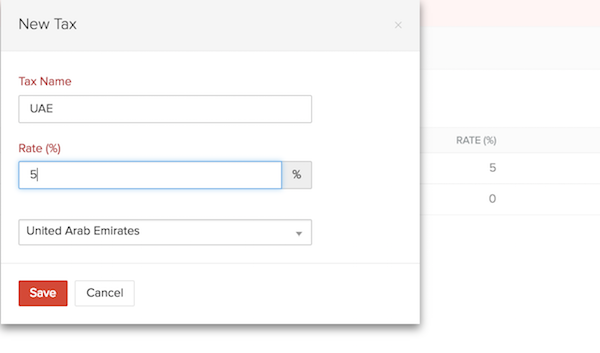

Adding new VAT rate

If you have the need to create new tax rates for businesses outside United Arab Emirates, you can do so by clicking on the New Tax button .

- Enter the Tax Name

- Key in the tax percent

- Select the Country for which it is applicable.

- Click on Save.

Editing a VAT Rate

To edit a VAT Rate,

- Navigate to Gear icon > Taxes > Tax Rates.

- Hover over the VAT Rate you’d want to edit and click on the edit icon that appears.

- Edit the details and click on Save.

Deleting a VAT Rate

To delete a VAT Rate,

- Navigate to gear icon > Taxes > Tax Rates.

- Hover over the VAT Rate you’d want to edit and click on the trash icon that appears.

Yes

Yes Thank you for your feedback!

Thank you for your feedback!