How can I update the VAT Treatment for my EU customers post Brexit?

Post-Brexit, EU-Non VAT Registered is not an applicable treatment, and customers with this VAT treatment must be updated to Overseas. Also, EU-VAT Registered is applicable only if you are trading goods between Northern Ireland and the EU, else the VAT treatment must be updated to Overseas. You can bulk-update the VAT treatments for your customers. Here’s how:

- Go to Sales > Customers

- Select the customers for whom the treatment is to be updated. You can use the Advanced Search option to filter the customers with EU treatments.

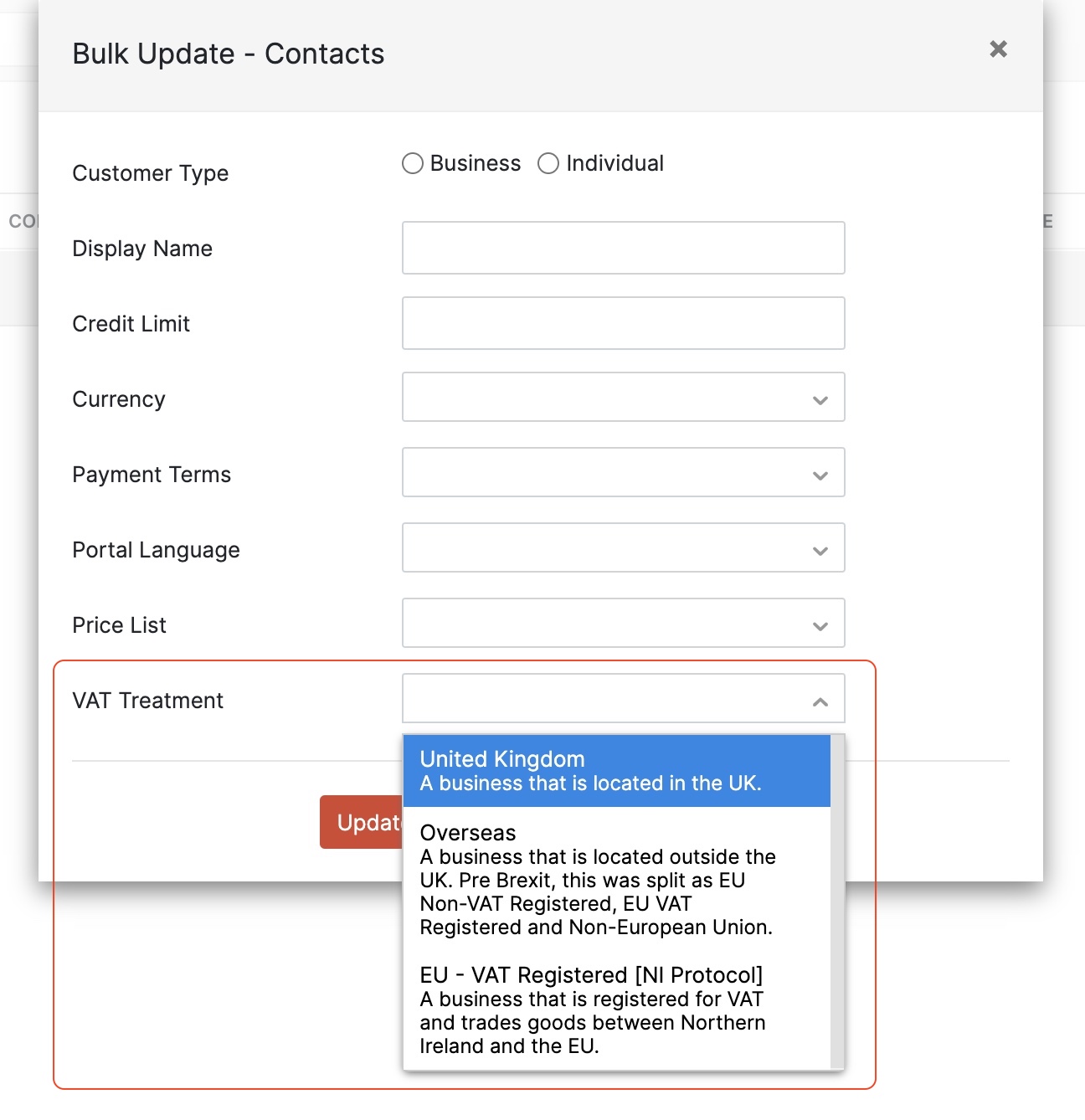

- Select the Bulk Update option

- In the Bulk Update pop-up, select the VAT Treatment as Overseas

- Click Update Fields.

The selected customers’ VAT treatment will be updated to Overseas.

Yes

Yes