- HOME

- Payroll administration

- LOP full form and calculation in salary

LOP full form and calculation in salary

Managing employee leave can become tricky as your team grows, but handling it properly ensures everyone's time is being tracked and accounted for. There are certain mandatory employee leaves you need to provide, and some that impact your payroll processing, such as loss of pay or LOP leave.

LOP is unpaid leave an employee takes when they do not have enough paid leave to cover their absence or when they take it without prior approval. Tracking LOP leave ensures your employees' salaries are accurately calculated, and your payroll process is also foolproof.

In this article, you will learn what LOP days are, LOP rules, and the LOP reversal process to help you craft a comprehensive leave policy for your organization.

LOP full form and meaning

LOP stands for loss of pay. It refers to the deduction made on an employee's salary if they take leave without prior approval or sufficient leave balance. For example, if an employee is entitled to 20 paid leaves annually but takes 21 days off, a day's salary will be deducted from their pay.

When is a leave marked as LOP leave?

Any additional leave taken by an employee after exhausting their allotted leave balance is marked as LOP. Some companies also mark LOP when an employee takes leave during the probation period when they have not yet accumulated leave or when they're serving a notice period and are not entitled to paid leave.

In some cases, LOP can also occur when an employee takes leave without their manager's approval, or when they take sick leave and fail to produce a medical certificate.

Loss of pay rules

Indian labor laws do not specifically address LOP, however, companies must have clear policies in place for leave management. Some general rules that you need to keep in mind are:

- Mention the number of leaves an employee is entitled to in the employment contract or the job offer letter.

- Deduct the appropriate amount of salary for the days the employee took LOP leave.

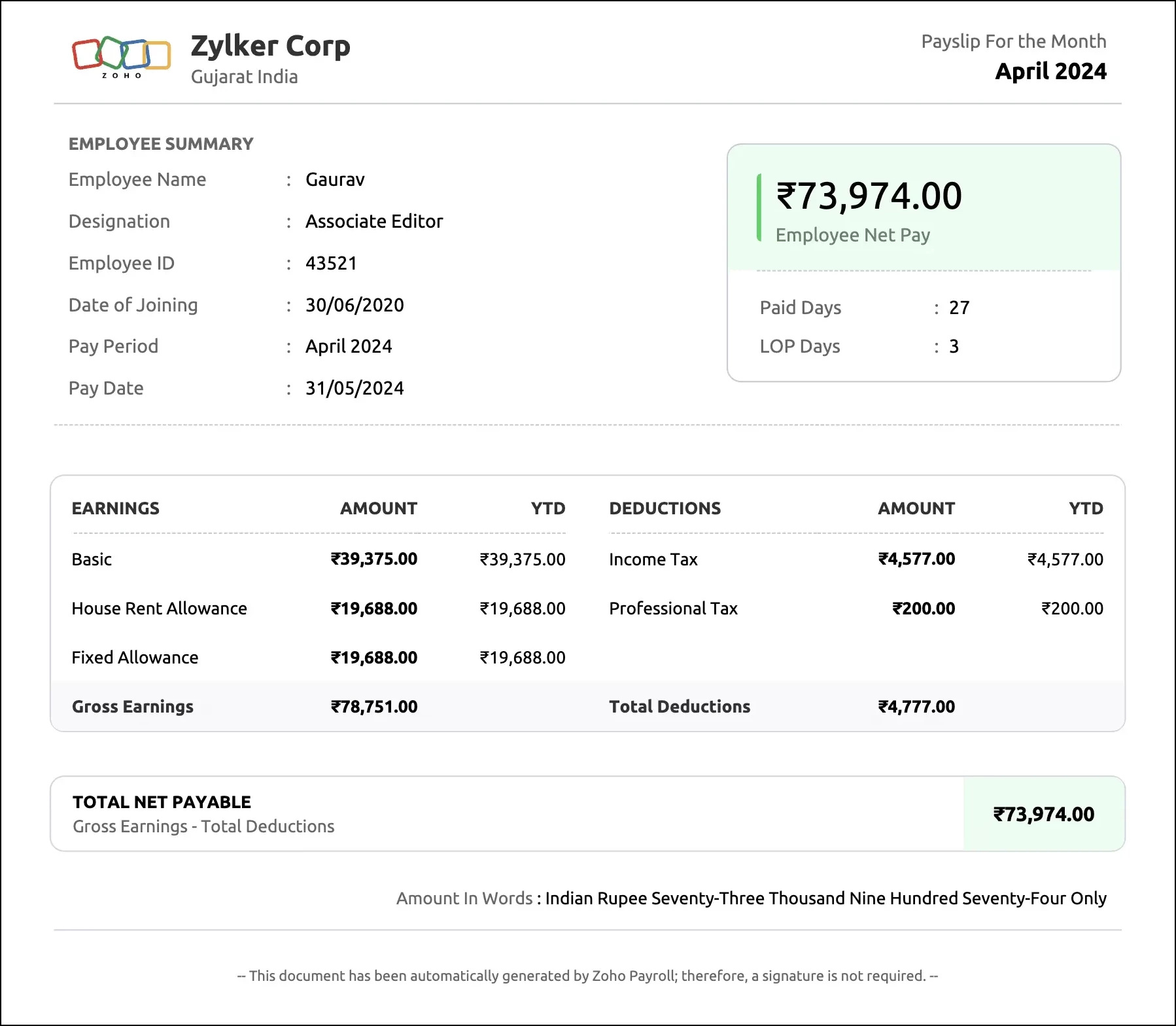

- Specify the number of LOP days an employee has taken in a month on the salary slip or payslip.

- Do not carry forward or encash the unused LOP leave if you have a limit on the number of LOP leaves an employee can take in a year.

Loss of pay calculation in a salary

LOP can be calculated by deducting the employee's daily wage for the number of days they took LOP leave. The formula to be used is straightforward:

LOP = (Employee's monthly salary/Number of working days in the month) X Number of LOP days

Assume, Rishi, an employee earns a monthly salary of ₹48,000 by working in a company where there are 24 working days in a month. If Rishi take two days of LOP leave in a month, the amount to be deducted from his salary will be:

LOP = (48,000/24) X 2

LOP = 2,000 X 2 = 4,000

Therefore, Rishi's LOP deduction for the month would be ₹4,000.

This amount would be subtracted from his monthly salary and the remainder, which is, ₹44,000, would be paid to him.

Note: Some companies consider the actual days in a month for salary calculations. In such cases, calculate LOP by dividing an employee's salary with the actual days in the month and multiplying it with the LOP days used.

How does LOP affect employee benefits?

Benefits like EPF, ESI, and gratuity depend on the employees' monthly salary. When there's an LOP deduction, these benefits will also be impacted.

1. Employees' Provident Fund: EPF contributions are calculated as a percentage of an employee's monthly salary. When an employee takes LOP leave, resulting in a reduction in their salary, their EPF contribution will also decrease. This reduction can affect the employee's long-term savings under the EPF scheme.

For example, assume Gaurav earns a monthly basic pay of ₹25,000 and he contributes ₹3,000 (12% of basic pay) towards EPF. If he takes four LOP days in a month, his basic pay would be reduced to ₹21,667 and his EPF contribution would get reduced to ₹2,600.

2. Gratuity: This reward is calculated based on the employee's last drawn salary and their tenure with the company. The lump sum will get reduced if the salary after taking LOP leave is considered the last drawn salary for gratuity.

💡 Calculate gratuity for long-serving employees with the free gratuity calculator tool.

3. Employees' State Insurance (ESI): Every month, applicable employees and their employers contribute 4% of the employee's gross pay towards ESI to cover medical and financial benefits. Since LOP leave results in a decrease in the employee's gross salary, there will also be a reduction in ESI contributions.

Sample salary slip with LOP days

After processing payroll for your employees, you must provide them with a salary slip or payslip containing a breakdown of their salary and the deductions made. Including LOP days on the salary slip will help your employees understand the impact of their leave on their earnings and ensure payroll calculations are accurate.

What is LOP reversal and how is it done?

LOP reversal is the process of rectifying deductions made from an employee's salary due to unapproved leave or errors in payroll processing.

For instance, assume an employee takes sick leave but fails to submit a medical certificate on time, or the leave is retrospectively approved post-deduction. In such cases, LOP reversal allows you to compensate for the deductions made.

The process typically involves the following steps:

- The employee submits an LOP reversal request along with supporting documents.

- The payroll admin or HR reviews and approves the request.

- The LOP deduction is then reversed in the subsequent pay run.

Pro-tip: With payroll software such as Zoho Payroll, you can automatically track your employees' LOP leave and process LOP reversal with a few clicks.

Frequently asked questions

What is LWP leave?

LWP stands for leave without pay. Similar to LOP, it refers to unpaid leave taken by an employee when they have exhausted their available leave balance. The terms LWP and LOP are often used interchangeably.

Is there a limit to the number of LOP days an employee can take in a year?

The limit to the number of LOP days varies depending on the organization's policies. Some companies impose a maximum limit of five LOP days in a year, while others allow employees to take LOP leave as needed, within reason.