- HOME

- Payroll administration

- Leave encashment in India - Meaning, calculation & tax rules

Leave encashment in India - Meaning, calculation & tax rules

Leave is one of the important criteria that allows employees to achieve a strong work-life balance. Getting complete time-off from work helps employees recover from any stress and prevents burnout. Understanding this, companies around the globe have started providing ample leave to their employees.

Some employees enjoy this time-off, while others save up their leave and risk letting it go unused. If you're an HR or payroll professional, you likely receive many questions around unused leave and need to know everything about the topic. We've put together this article to help you understand the types of leave and the concept of leave encashment, including its calculation and taxation rules.

What is leave encashment?

Leave encashment refers to the amount received by an employee in exchange for unused paid leave provided by the organization.

Although leave is mandatory, leave encashment is not mandated by Indian labour laws. The employer decides whether the unused paid leave can be encashed or carried forward to the next year. A study suggests that nearly 10% of paid leave goes unused per year. Encashment of such leave will be beneficial for your employees, and in turn make your organization a better place to work.

Leave type that can be encashed

All salaried individuals are entitled to a certain amount of leave according to the labor laws. Let's take a look at some of the leave types you can offer your employees and whether they can be encashed.

Paid leave

Employees earn paid leave, also known as earned or privilege leave, after a specific number of working days. This leave is calculated on a pro-rata basis, and eligible employees receive between 12 to 20 days of earned leave per year.

This leave is typically used for personal reasons, such as festival holidays and vacations.

In cases where employees do not exhaust all their paid leave, organizations may allow them to either carry over or encash their unused leave. Companies that permit encashment can credit the equivalent amount at the beginning of the subsequent calendar year or upon the employee's resignation or retirement from service.

Learn more about privilege or paid leave here.

Casual leave

Casual leave is offered to accommodate any unforeseen circumstances. Companies provide their workers with seven to 12 casual leave requests per year. Generally, companies do not allow to carry forward or encash unused casual leave.

To learn more about this type of leave and its rules, read our latest article on casual leave.

Sick leave

Employees can avail sick leave or medical leave if they fall ill and cannot work.

This type of leave is mandated by law, and companies offer up to 14 days of sick leave per year. Most organizations do not allow encashment or carrying forward of unused sick leave to the next year.

Now that we understand only unused paid leave can be encashed, let’s learn how to craft a leave encashment policy for your company.

Leave encashment policy

Leave encashment rules vary from company to company. Business owners and payroll professionals can determine when they can provide the encashed amount to their employees.

If the employee is still working at the company, encashment of unused leave from the previous year can be credited during the first pay cycle of the following year. If the employee has retired or resigned from their position, the encashed amount can be credited along with the full and final settlement.

This brings us to the next question: As an employer, should you be deducting any tax on the encashed amount, or is it exempt from taxation?

Is the leave encashment amount taxable?

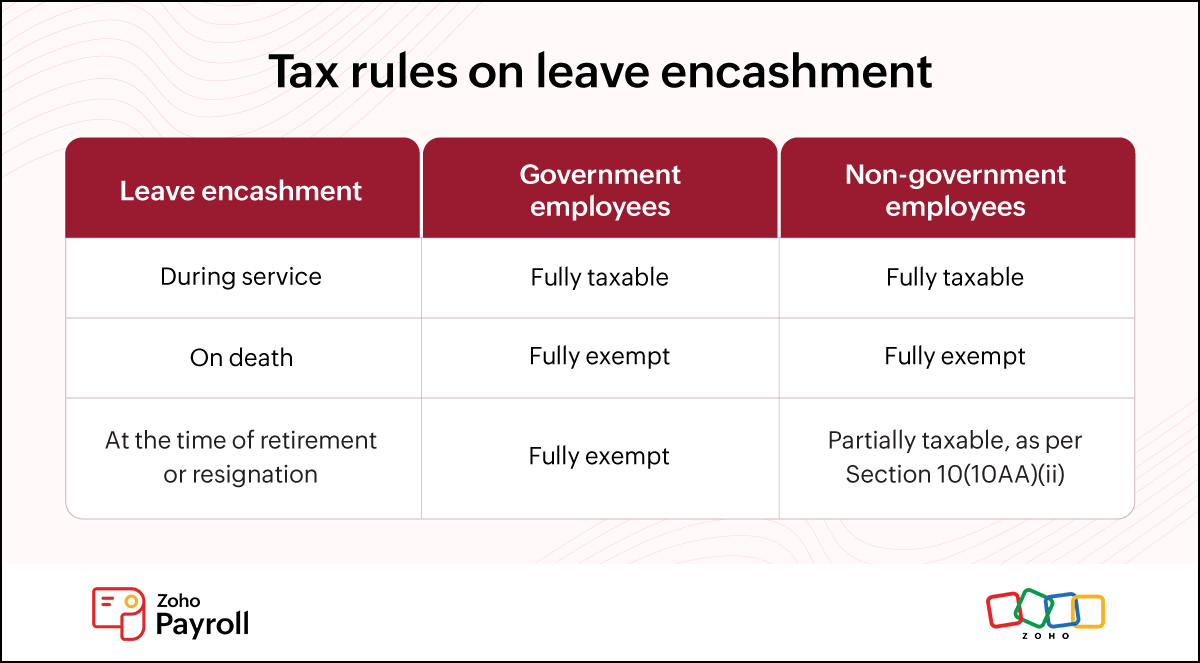

An employee's encashed leave is taxable depending on when they receive it.

Leave encashment while at the company: The encashed amount is fully taxable, as it is considered a part of salary income by the Income Tax Department. This applies to both government and private employees. However, individuals can claim tax relaxation under Section 89 of the Income Tax Act.

Leave encashment upon death: When a legal heir receives the encashment on behalf of the deceased employee, the amount is fully exempt from tax.

Leave encashment at the time of retirement or resignation: Encashment received by the Central and state government employees at the time of retirement is fully exempt from tax. In the case of non-government employees, the encashed amount is partially exempt based on the computation provided under Section 10 (10AA)(ii); the balance amount, if any, is taxable as salary income.

Let's understand how to calculate the encashment amount before we learn about the Section 10 clause.

Leave encashment calculation

Assume that Praveen retired after 20 years of service with a private company. At the time of his retirement, his basic salary was Rs. 1,20,000. The company that Praveen worked for allowed him to take 20 days of paid leave per year. Out of the 400 total paid leave days, he used only 50 and is left with 350 days of unused leave at the time of his retirement.

Leave encashment amount is calculated based on the below formula.

Encashed amount = Basic salary per day X Number of unused earned leaves

In Praveen's case the encashed amount would be:

Encashed amount = (1,20,000 / 30) X 350 = 4,000 X 350 = Rs. 14,00,000

The leave encashment amount that Praveen would receive is Rs. 14 Lakhs.

Since Praveen is a non-government employee, his encashment amount is only partially exempt from tax based on the computations under Section 10(10AA)(ii).

Now we have to calculate the exemptions allowed on his encashed amount.

Tax exemptions on leave encashment

The encashed amount is exempt from tax up to the least of the following:

Actual amount received from the organization

Average salary (basic salary plus dearness allowance) over the last 10 months

Cash equivalent of unused earned leave

Maximum limit set by the government, which is Rs. 25 lakhs, as announced in the latest Union Budget in April 2023.

Consider that Praveen had received a sum of Rs. 14 Lakhs as an actual amount from the organization at the time of his exit. His average salary over the last 10 months is: (Rs. 1,20,000 X 10) = Rs. 12 Lakhs.

The cash equivalent of unused leaves is calculated by multiplying salary per day with the unutilised leave for every year of service. The maximum cap of leave is set as 30 days per year. In Praveen's case, the cash equivalent of unused leave will be:

(1,20,000/30) X ((30 X 20) - 200) = Rs. 16 Lakhs.

The tax exemption on Praveen's encashed amount will be the minimum of any one of the below values:

| Actual amount received from the organization | Rs. 14 Lakhs |

| Average salary of last 10 months | Rs. 12 Lakhs |

| Cash equivalent of unused earned leave | Rs. 16 Lakhs |

| Maximum limit fixed by the government | Rs. 25 Lakhs |

From the above table, the amount of encashed leave exempted under Section 10(10AA)(ii) is Rs. 12 Lakhs, the least among the four.

The taxable amount is calculated by subtracting the lower value from the lump sum given by the organization. In Praveen's case, the taxable leave encashment is:

| Leave encashment received | Rs. 14 Lakhs |

| Less value among the four particulars under Section 10(10AA)(ii) | Rs. 12 Lakhs |

| Total taxable leave encashment amount | Rs. 2 Lakh |

Rs. 2 Lakhs from Praveen's encashment amount will be added to his salary income section and will be taxed according to the slab he falls under.

Summary

As an employer, you're required by law to provide a certain amount of leave to your employees. In addition to maintaining compliance, offering ample leave reflects positively on your company's work culture and increases your employee recruitment rate.

Employees after completing a specific period of service will be eligible for paid leave. Generally, the employer decides whether the unused paid leave can be encashed or carried forward to the following year.

According to the organization's leave policy, the encashment process can be carried out during various time periods.

The encashment amount received by the employee while in service is fully taxable for both government and non-government workers.

The amount received by legal heirs on behalf of a deceased employee is fully exempt from tax.

The amount received at the time of retirement or resignation is partially taxable only for non-government employees. Allowed tax exemption on the encashed amount is the least of any of the following values:

Actual amount received from the organisation

Average salary (sum of basic salary and dearness allowance) of the last 10 months

Cash equivalent of unused leaves

Maximum limit fixed by the government (Rs. 25 Lakhs)

The balance encashed amount is taxable as salary income.

Although the calculation and taxation of leave encashment can appear complicated, you can simplify the process with the help of powerful payroll software. Zoho Payroll comes integrated with an intuitive HRMS tool that keeps tabs on employee leave balances.

Next up, learn how to choose the right payroll software that takes care of tedious calculations in our article and focus on growing your business.

Comments(1)

Very well-explained information! This article has been really helpful in understanding all the important aspects of leave encashment. The calculation formula and tax rules explanation are very useful. Please share more such helpful guides!