Mi cliente pagó una factura usando un cheque, pero el cheque rebotó. ¿Cómo grabar comprobaciones rebotadas en Zoho Books?

Si sus clientes pagan las facturas utilizando cheques, existe la posibilidad de que los cheques rebote. Para grabar comprobaciones rebotadas en Zoho Books, puede crear una cuenta (por ejemplo Pago Dishonored Payment), bajo el tipo Otros pasivos corrientes .

Para el dinero en transacción, puede registrar un depósito en el Pago deshonrado cuenta y para la transacción Money Out, puede grabar una gastos .

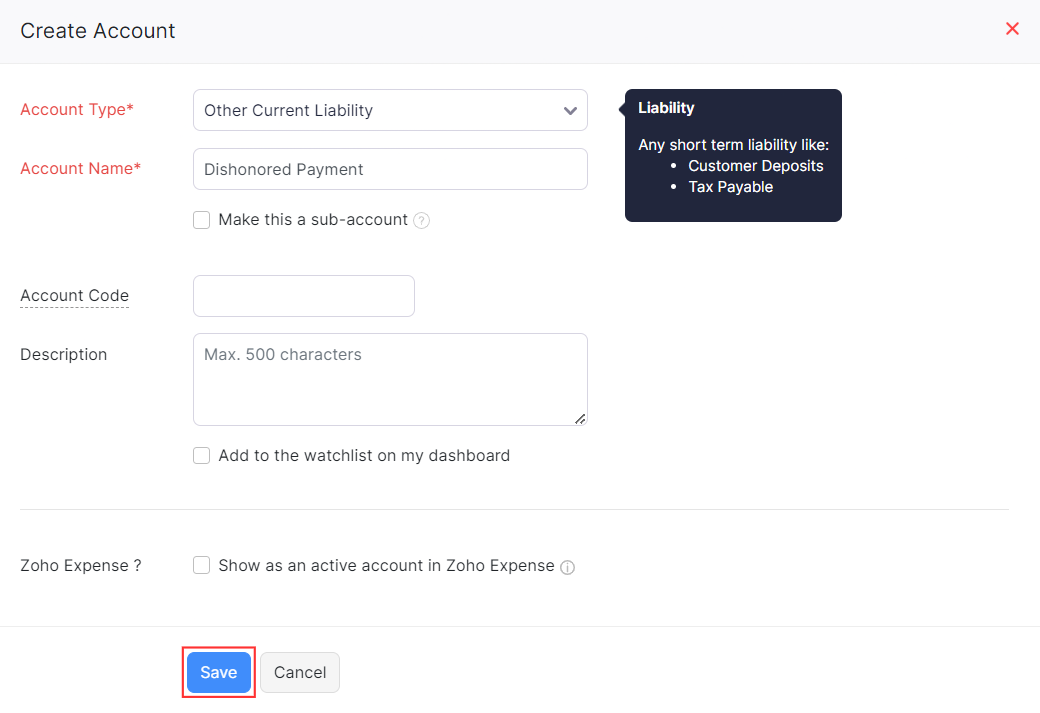

Para crear una cuenta para pagos deshonrados:

- Ir a la página principal Contable módulo en la barra lateral izquierda y seleccione Gráfico de cuentas .

- Haz clic en Haz clic en Haz clic + nueva cuenta en la esquina superior derecha de la página.

- Introduzca el Nombre de la cuenta (en inglés). Pagos deshonrados en este caso) y seleccione el Tipo de cuenta como Otros pasivos corrientes .

- Introduzca el Código de cuenta y escriba una breve descripción para la cuenta, si es necesario.

- Haz clic en Haz clic en Haz clic Guardar .

Se creará una nueva cuenta. A continuación, puede grabar un depósito. Hereâ€TMs como:

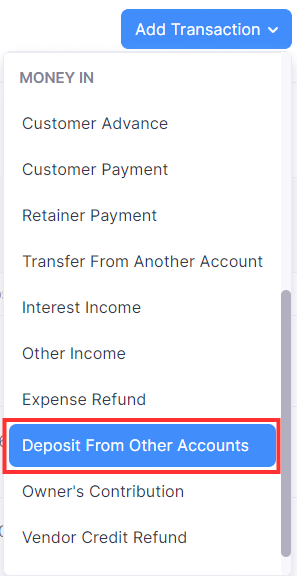

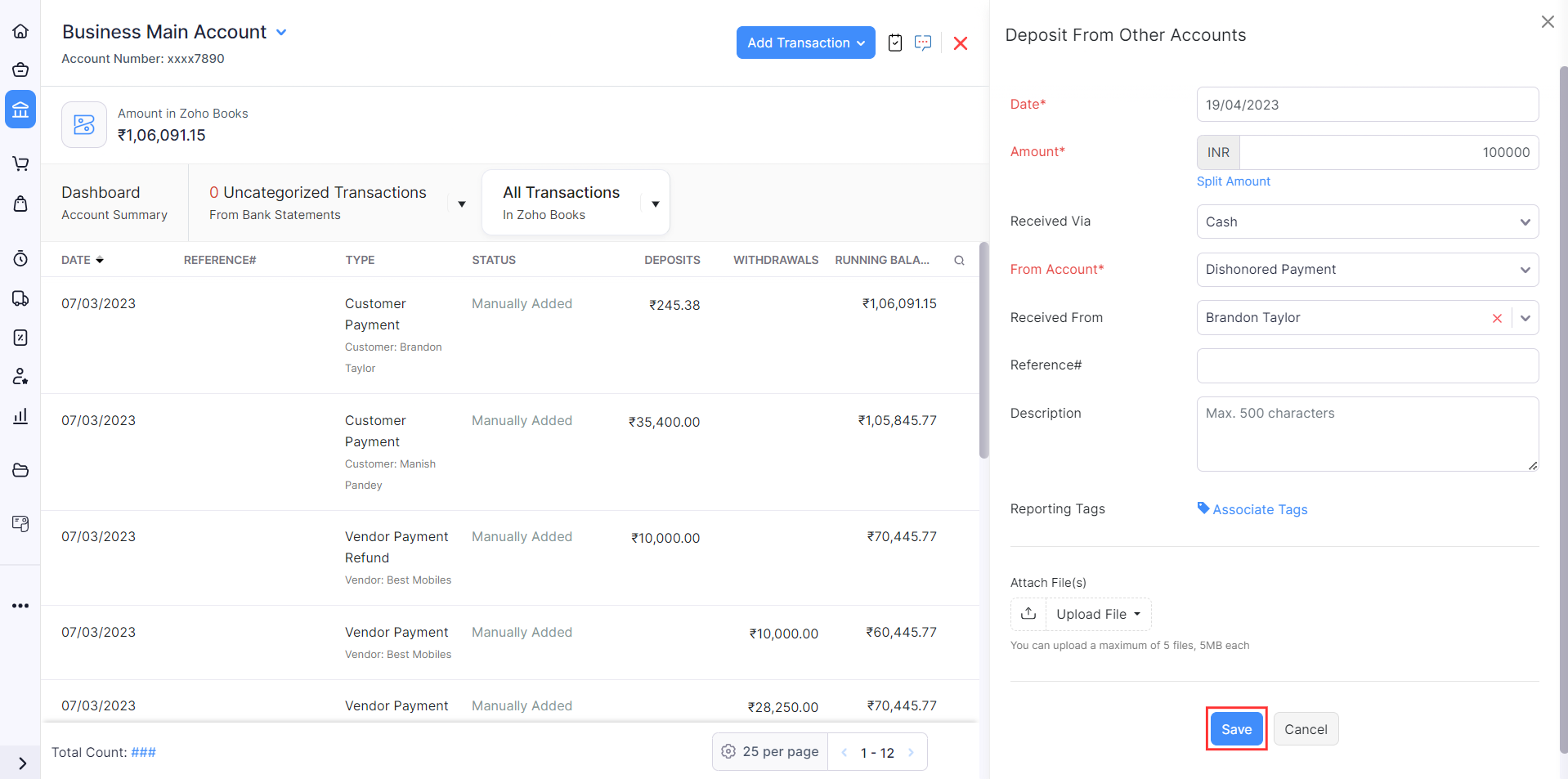

- Ir a la página principal Banca módulo en la barra lateral izquierda y seleccione la cuenta bancaria en la que desea grabar la transacción.

- Haz clic en Haz clic en Haz clic Añadir transacción y seleccione Depósito de otras cuentas bajo coste Dinero en .

- En el panel que aparece, elija el De la cuenta como Pago deshonrado .

- Rellene detalles en los campos obligatorios como Fecha y Cuantía .

- Haz clic en Haz clic en Haz clic Guardar .

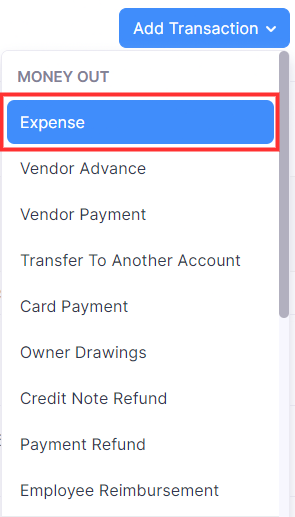

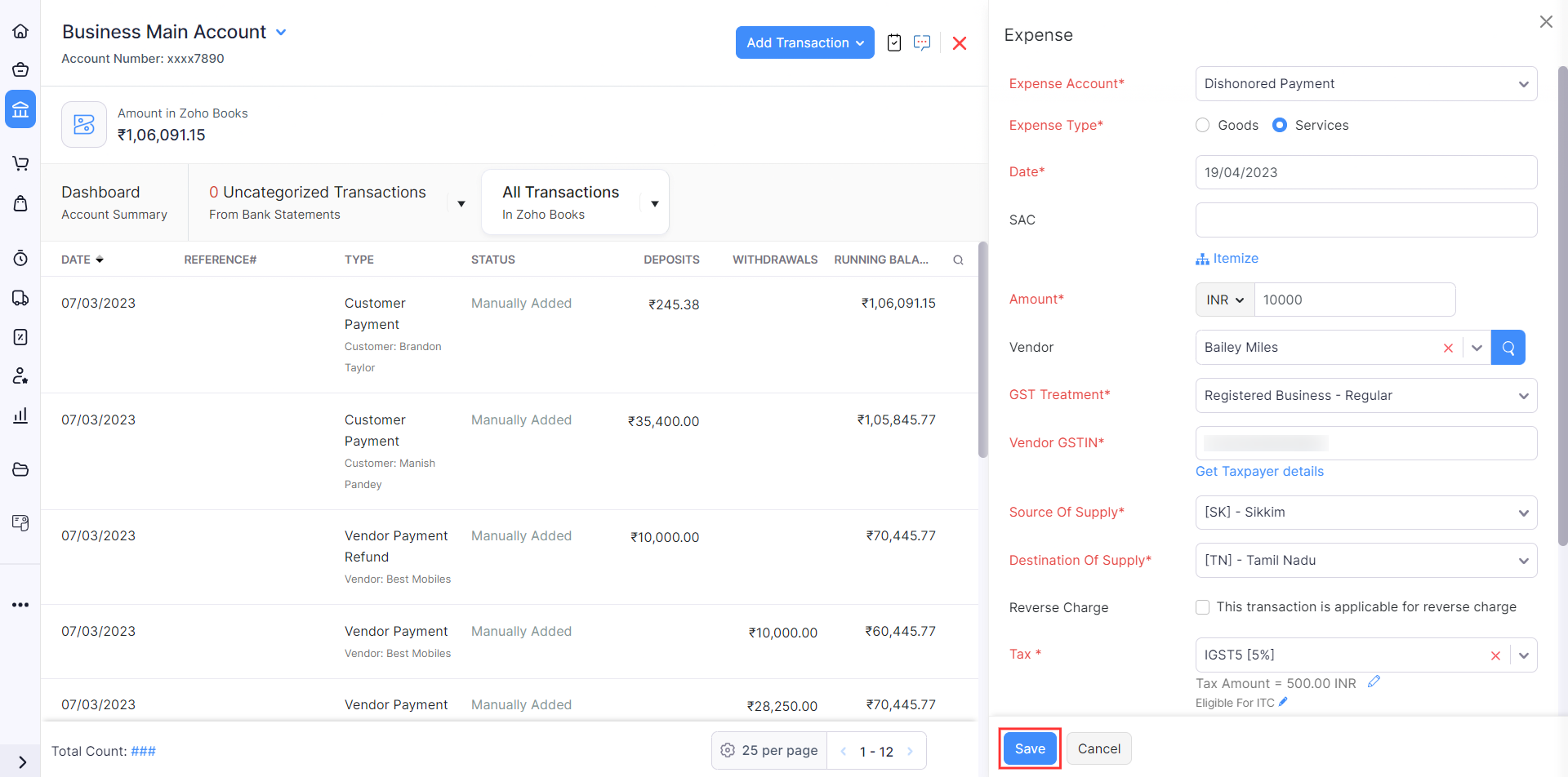

A continuación, registre un gasto. Hereâ€TMs como:

- En la misma página, haga clic en Añadir transacción y seleccione Gastos bajo coste Salido de dinero .

- En el panel que aparece, elija el Cuenta de gastos como Pago deshonrado .

- Rellene los detalles de los campos obligatorios como Cantidad, Fecha, y Número de factura .

- Haz clic en Haz clic en Haz clic Guardar .

Nota: Si ha registrado pagos con el cheque, tendrá que eliminar esos pagos ya que el cheque fue deshonrado y el pago registrado a través del cheque ya no es válido. Después de eliminar el pago registrado, el estado de la factura se actualizará a Retraso o Enviado . Además, esto garantiza que no haya discrepancias en los registros financieros de su empresa.

Yes

Yes