UAE VAT Migration Guide

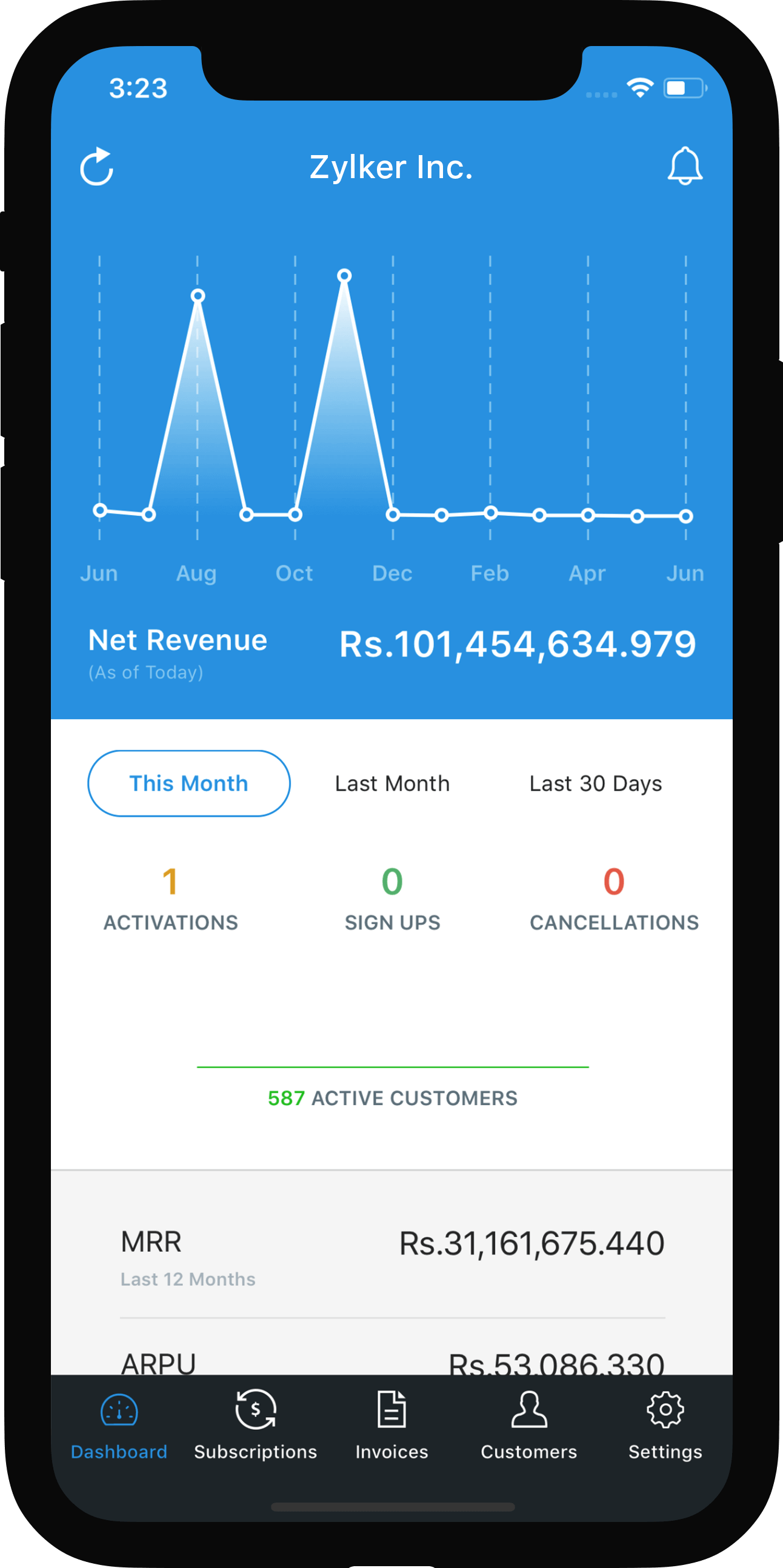

With respect to the new VAT regime starting from January 1, 2018 in United Arab Emirates and the Kingdom of Saudi Arabia, Zoho Subscriptions is gearing up to make your business VAT Ready.

Note:

We have enabled VAT modules for the organizations satisfying the below conditions

- Organization without any taxes configured

- Organization that doesn’t have VAT MOSS enabled

- Country is UAE

- Currency is AED

If your organization has not met all of the above requirements, you can raise a migration request at support@zohosubscriptions.com.

Setting up your organization for VAT

- Tax Settings

- Updating your customers

- Updating your Plans and add-ons

- Updating your Existing Subscriptions

- Setting up the Invoice Template

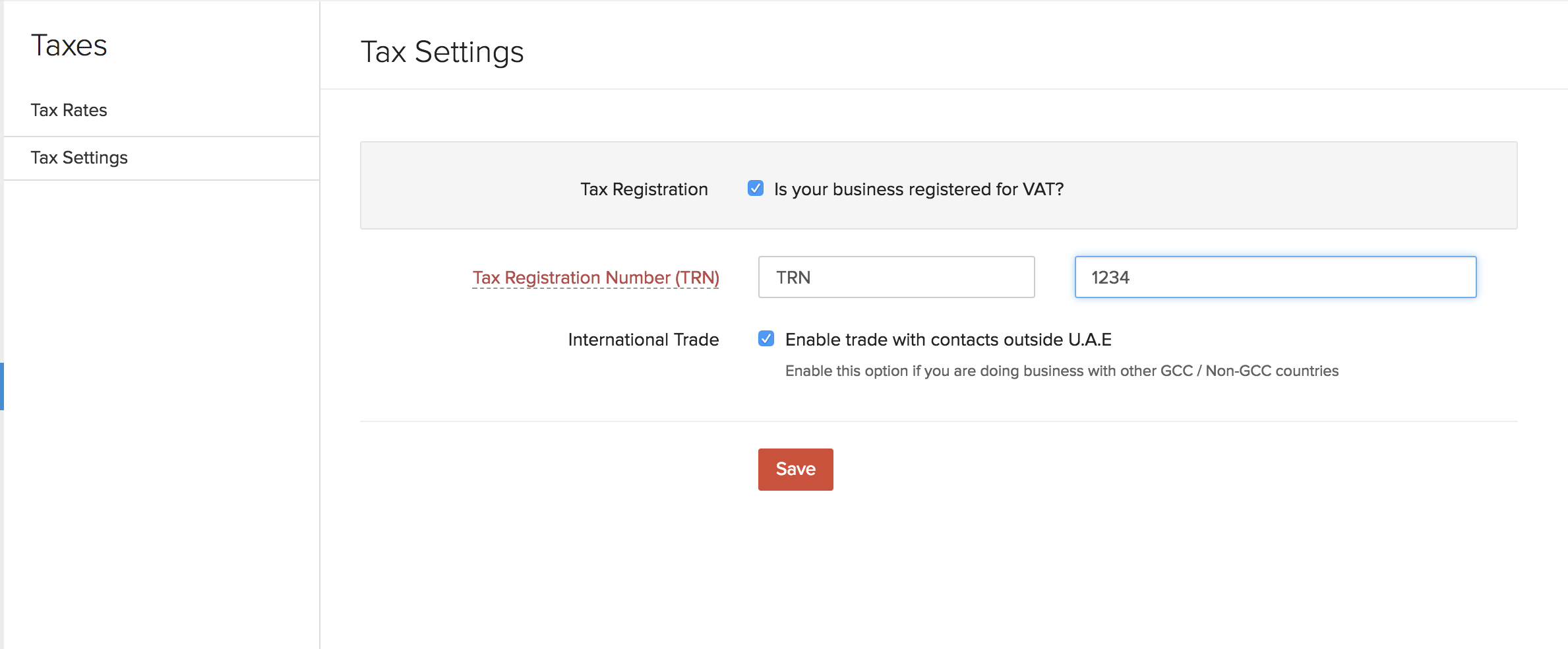

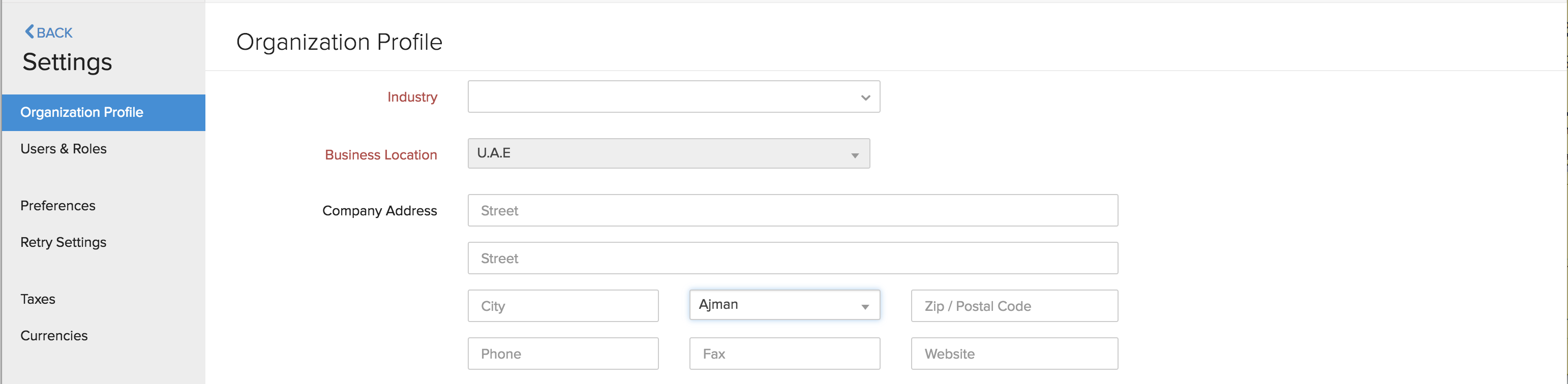

Tax Settings

Enable VAT Settings and update your organization’s Tax registration Number (TRN). If you are trading outside your country you can enable the “International trade” option, go to settings -> organization profile and ensure that the business location is U.A.E and choose your organization’s emirate.

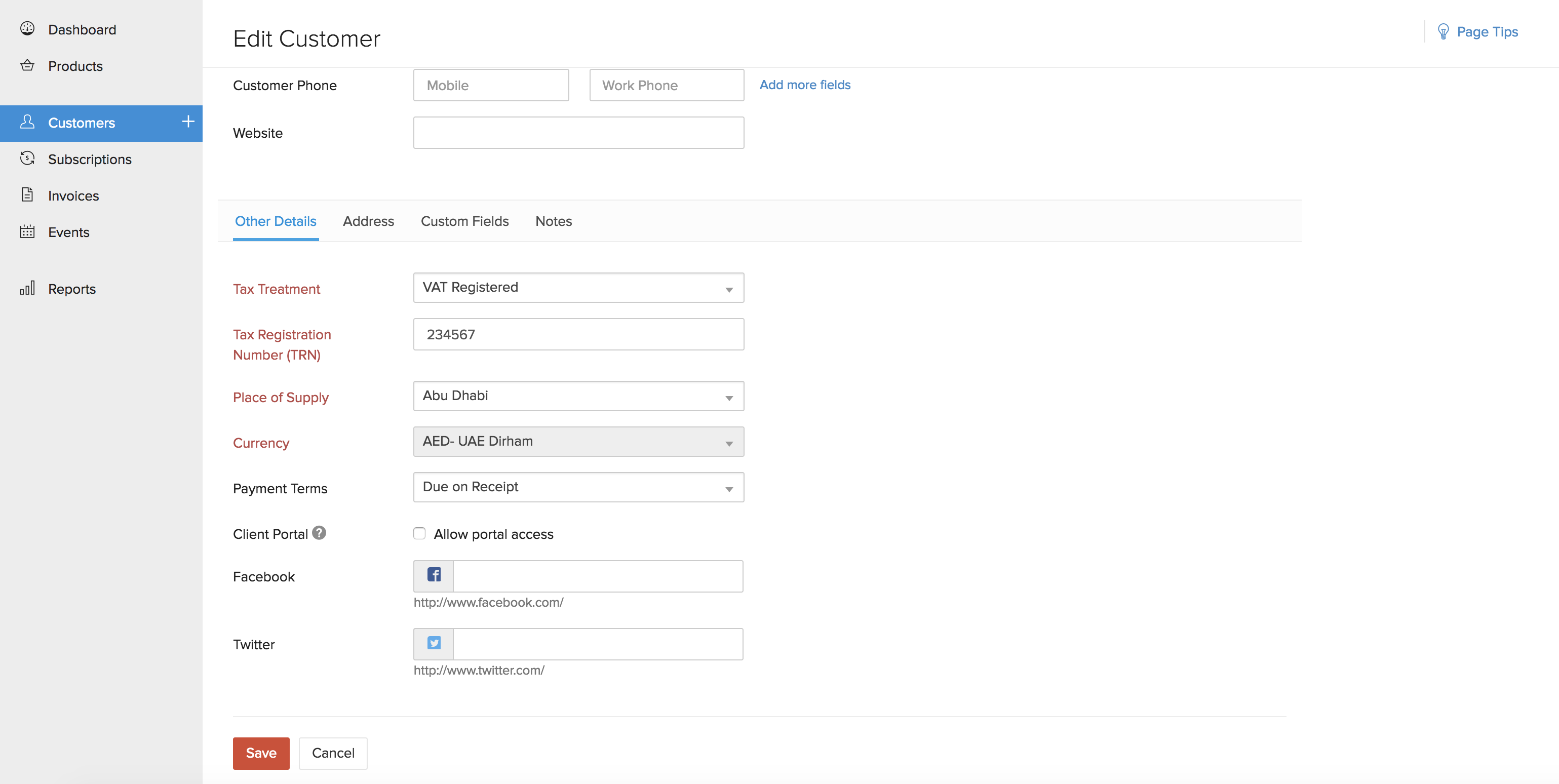

Updating your customers

Add the Tax Treatment, Tax Registration Number and the Place of supply preference for your customers as shown below in order to allow your customers to pay taxes for your subscription and collect any credit if applicable.

Note: You can use the bulk update option to make changes to your existing customer’s Tax Treatment and Place of Supply.

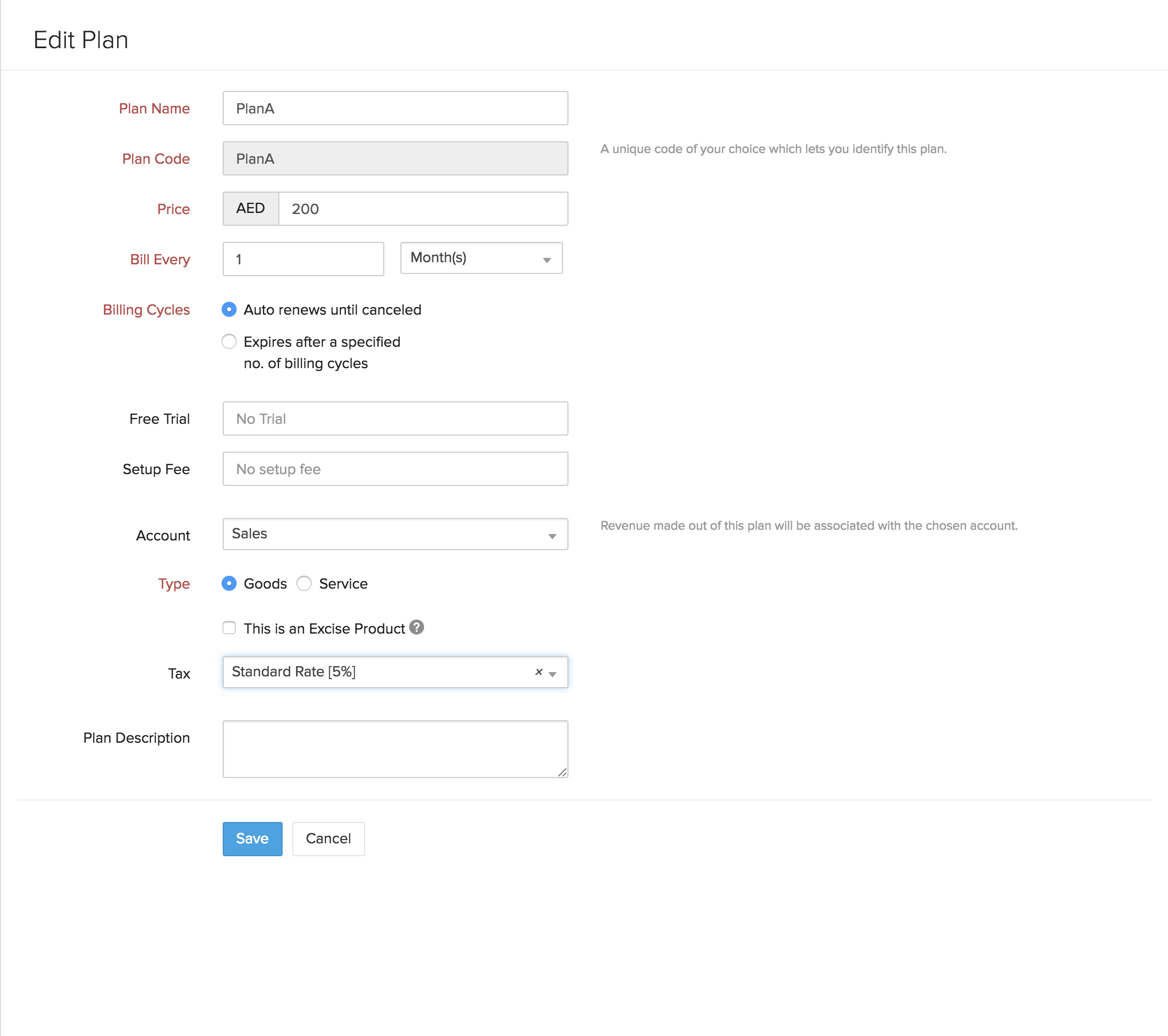

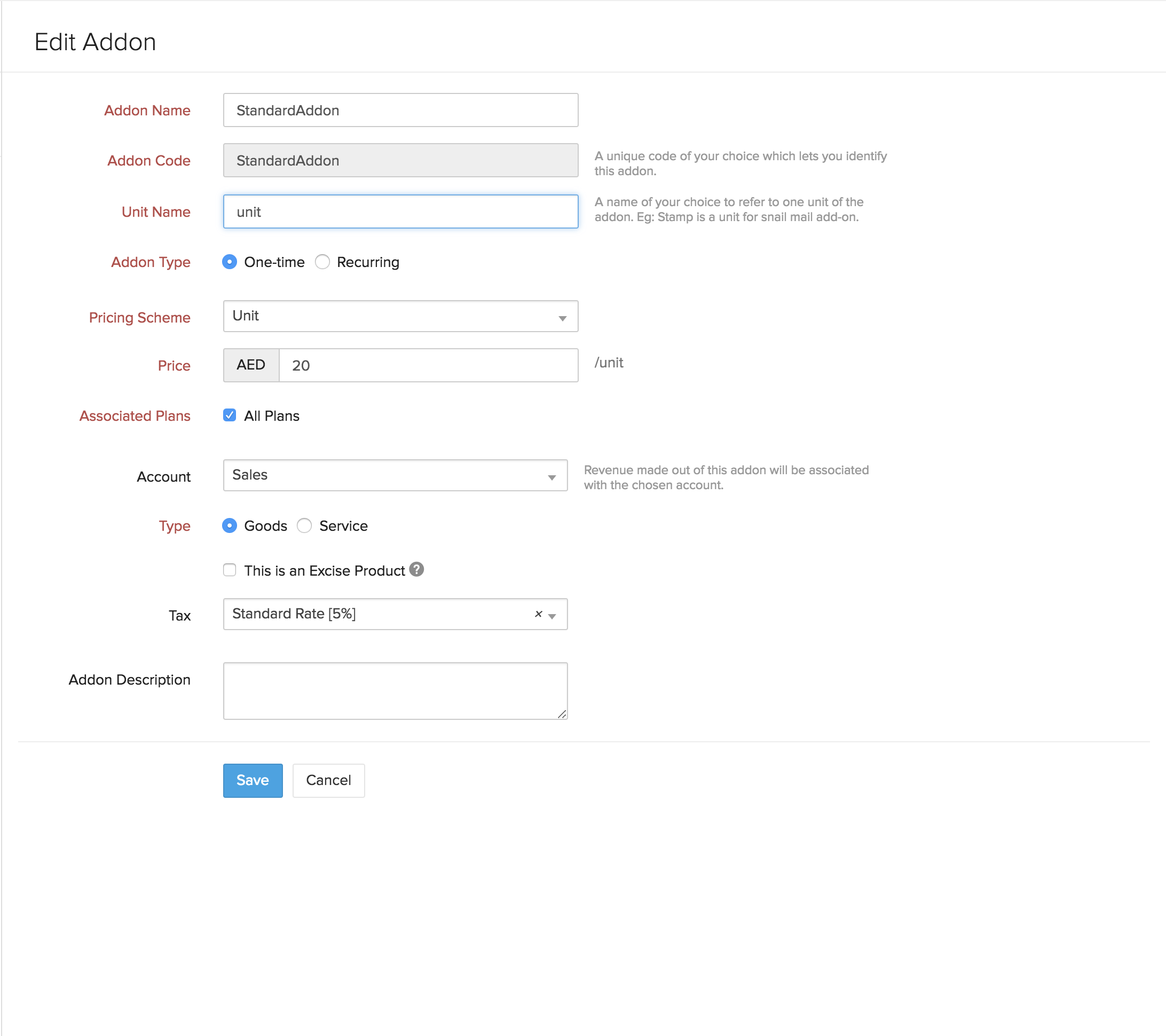

Updating your Plans and add-ons

As per the VAT Regime, taxes can be collected to subscriptions that are created after January 1st 2018. To do so, all the existing plans and addons created without the Value Added Tax can be updated with applicable taxes.

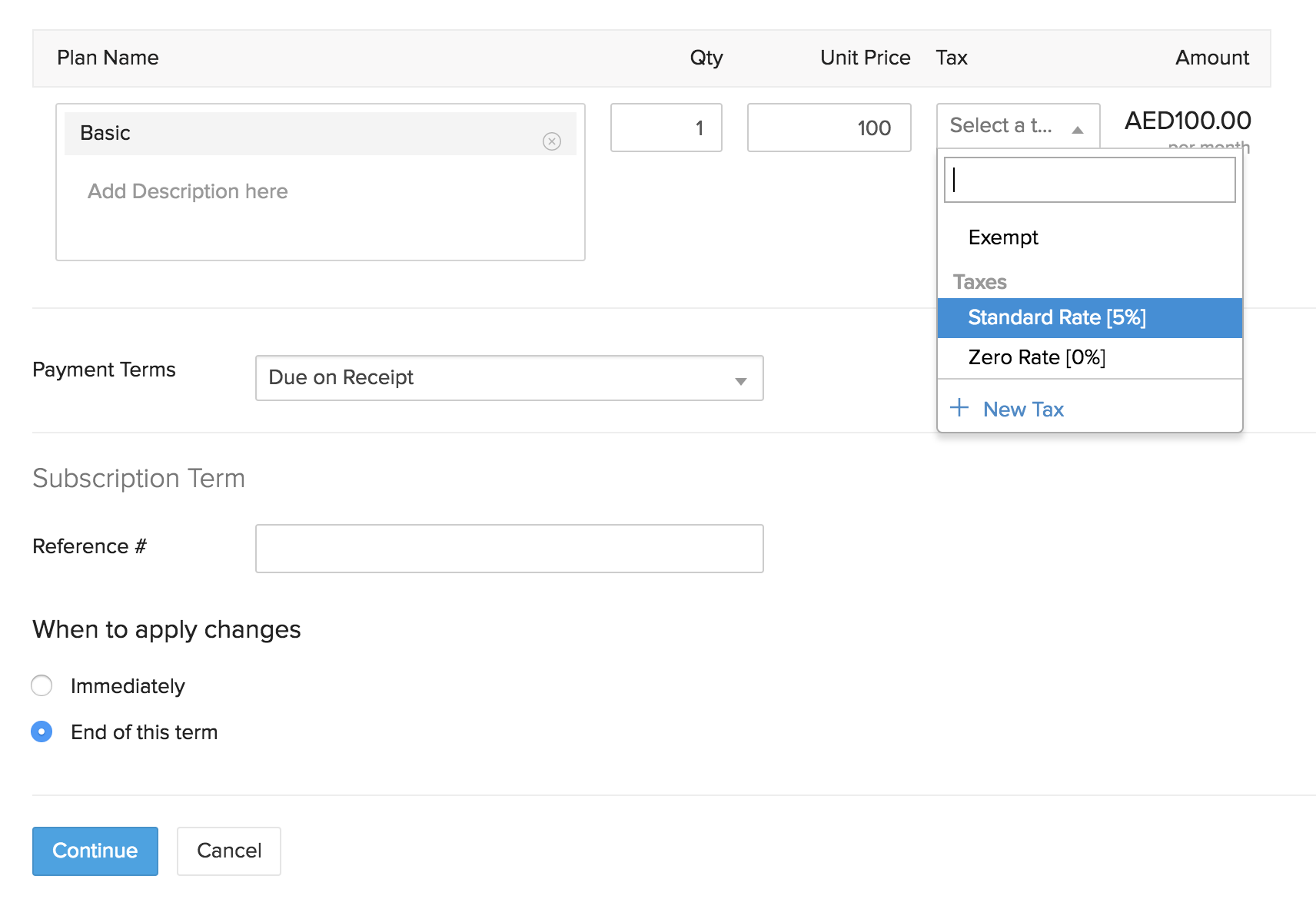

Updating your Existing Subscriptions

For Subscriptions created before January 1 2018 and whose next billing date falls under the VAT regime, taxes can be collected to the subscription. You can edit your existing subscription to associate the taxes and the changes can be set to be effected at the end of the term. This way, the upcoming invoices will be VAT compliant.

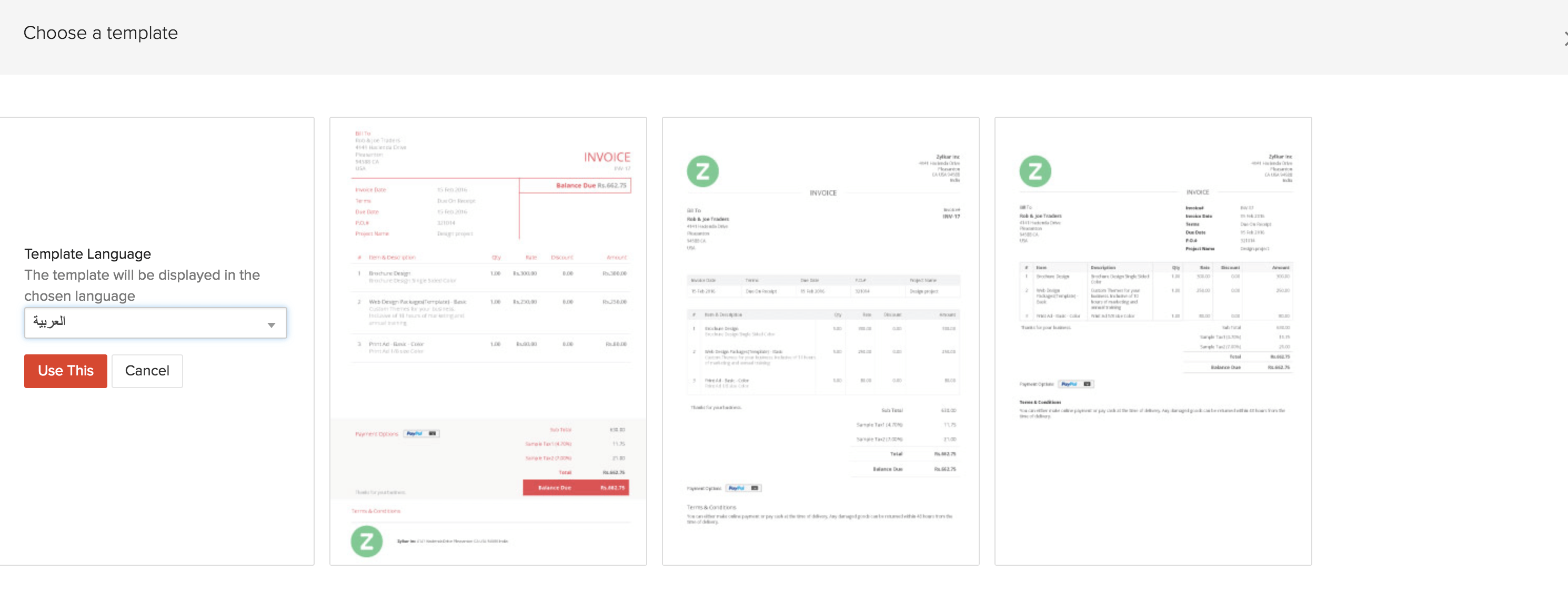

Setting up the Invoice Template

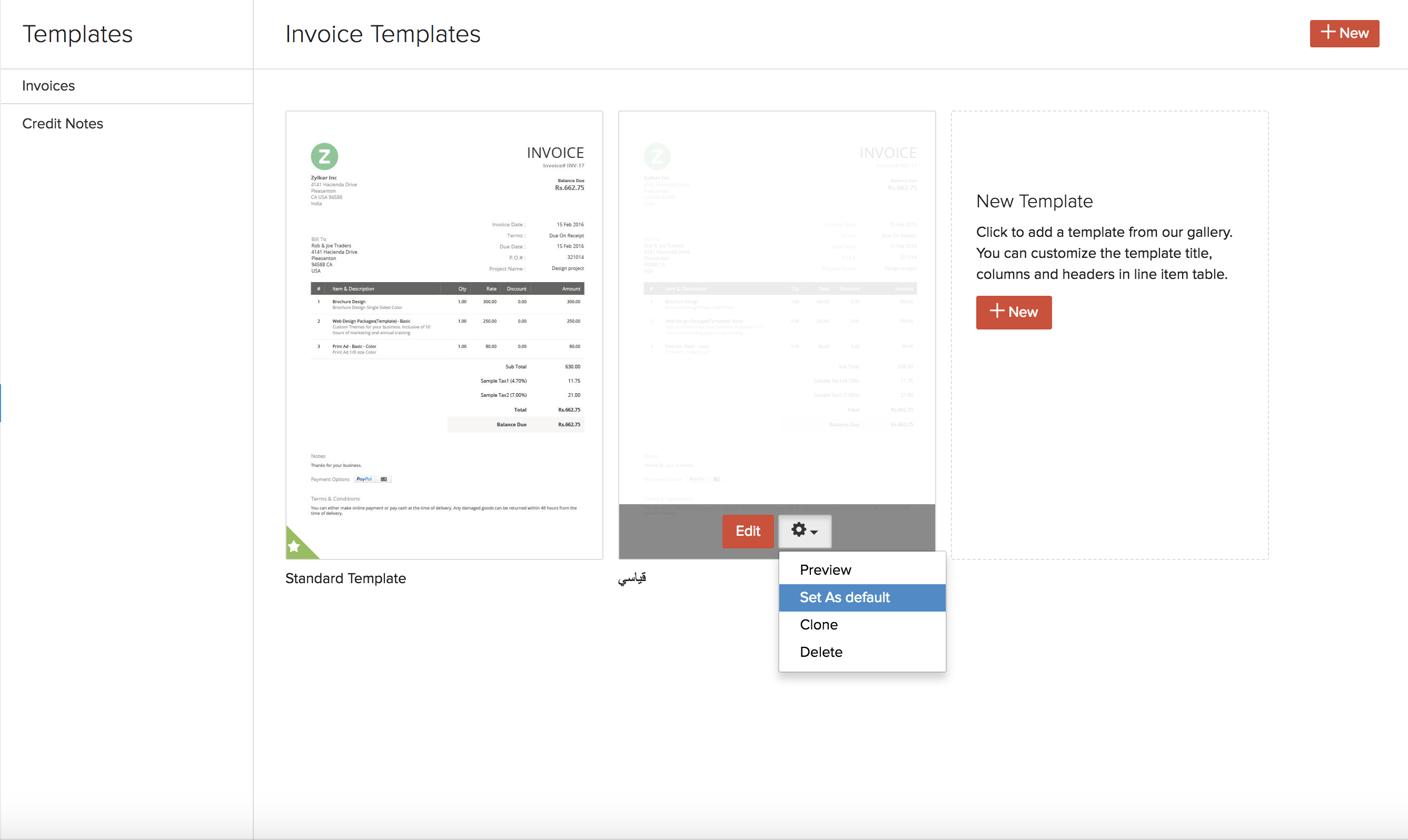

To generate invoices in Arabic click on the add new template option, you may use the standard template and select the language as “Arabic”. You can make this template as your default template by clicking on the “Set as default” option so that the invoices are generated in Arabic by default.

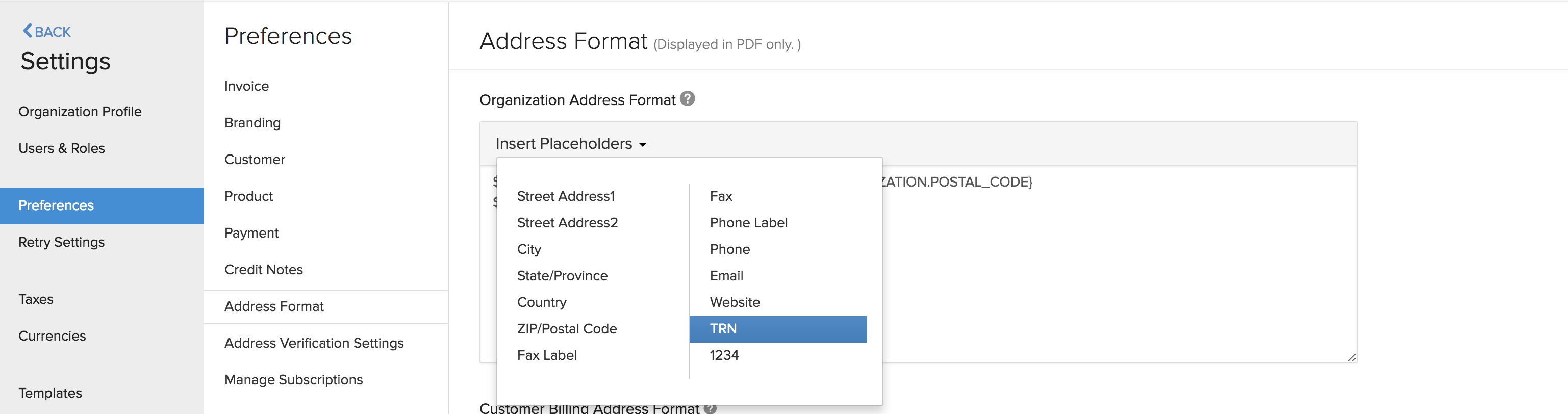

As per the VAT regime, it is mandatory to include the Tax Registration Number (TRN) of the organization in the invoice.

To include the TRN in the invoice , go to Settings -> Preferences -> Address Format -> Organization Address Format and click on the insert place holder option and choose the Tax registration number Label and its value (TRN and 1234)

Note: There is no need to configure any tax settings for the hosted payment pages. The VAT settings for the hosted payment pages are updated automatically.

Yes

Yes Thank you for your feedback!

Thank you for your feedback!