How do I add additional cess to the existing taxes while creating an invoice for demerit or luxury goods?

Additional cess has to be levied on certain goods that fall under the 28% slab i.e. demerit goods and luxury goods.

- Demerit Goods are those that are considered unhealthy, degrading or socially undesirable due to the perceived negative effects on consumers. Examples of demerit goods would include tobacco, alcoholic beverages, recreational drugs, junk food etc.

- Luxury Goods are those that are considered to be not a necessity. Its demand increases as the income increases. Expensive cars, televisions, audio systems, mobile phones, refrigerators and gold coins come under this category of goods.

Let’s look at a few scenarios on how additional cess is levied on these products.

Scenario 1: Suresh sells tobacco to a customer within his state. He would have to levy an additional cess along with the CGST and SGST. In Zoho Books, he creates a tax group comprising CGST, SGST and additional cess which he can apply on the invoice.

Scenario 2: Kumar sells audio systems to a customer who is in another state. He would have to levy an additional cess along with IGST. In Zoho Books, he creates a tax group comprising of IGST and additional cess which he can apply on the invoice.

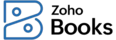

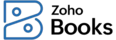

Before you can create the tax group, you would have to add the additional cess as a tax. To create a new tax:

- Click the Gear icon found on the top-right corner of the screen and select Taxes.

- To add a new tax, click + New Tax.

- Enter the Tax Name as Additional Cess.

- Enter the relevant Rate in %.

- Select Cess as the Tax Type.

- Click Save.

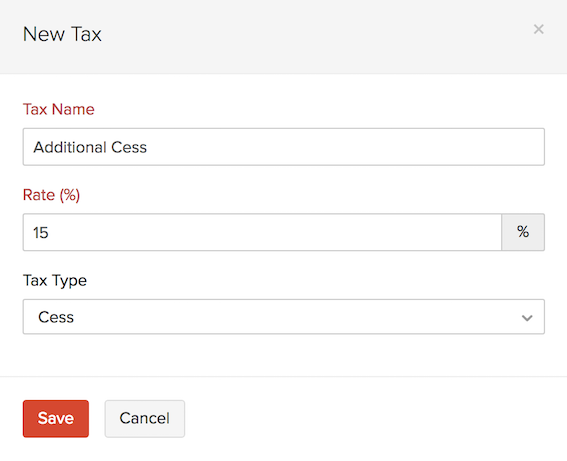

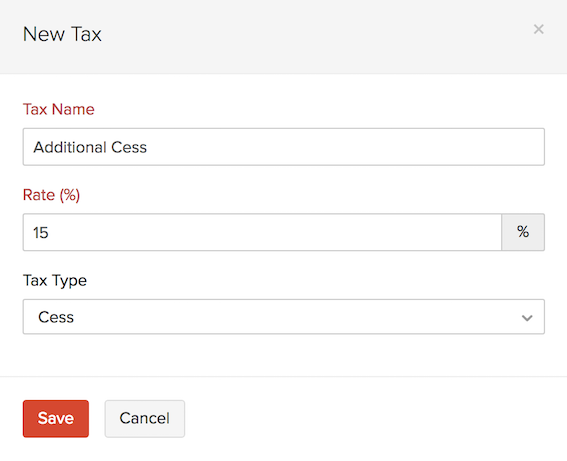

Now, you can create a new tax group with the additional cess for intra-state and another tax group for interstate transactions. To create a tax group for intrastate or inter-state transactions:

- Click the Gear icon and select Taxes.

- Select the Tax Rates tab.

- Click the + New Tax Group button on the top-right corner.

- Enter a Tax Group Name.

- Select CGST, SGST and Additional Cess for intra-state transactions or IGST and additional cess for inter-state transactions.

- Click Save.

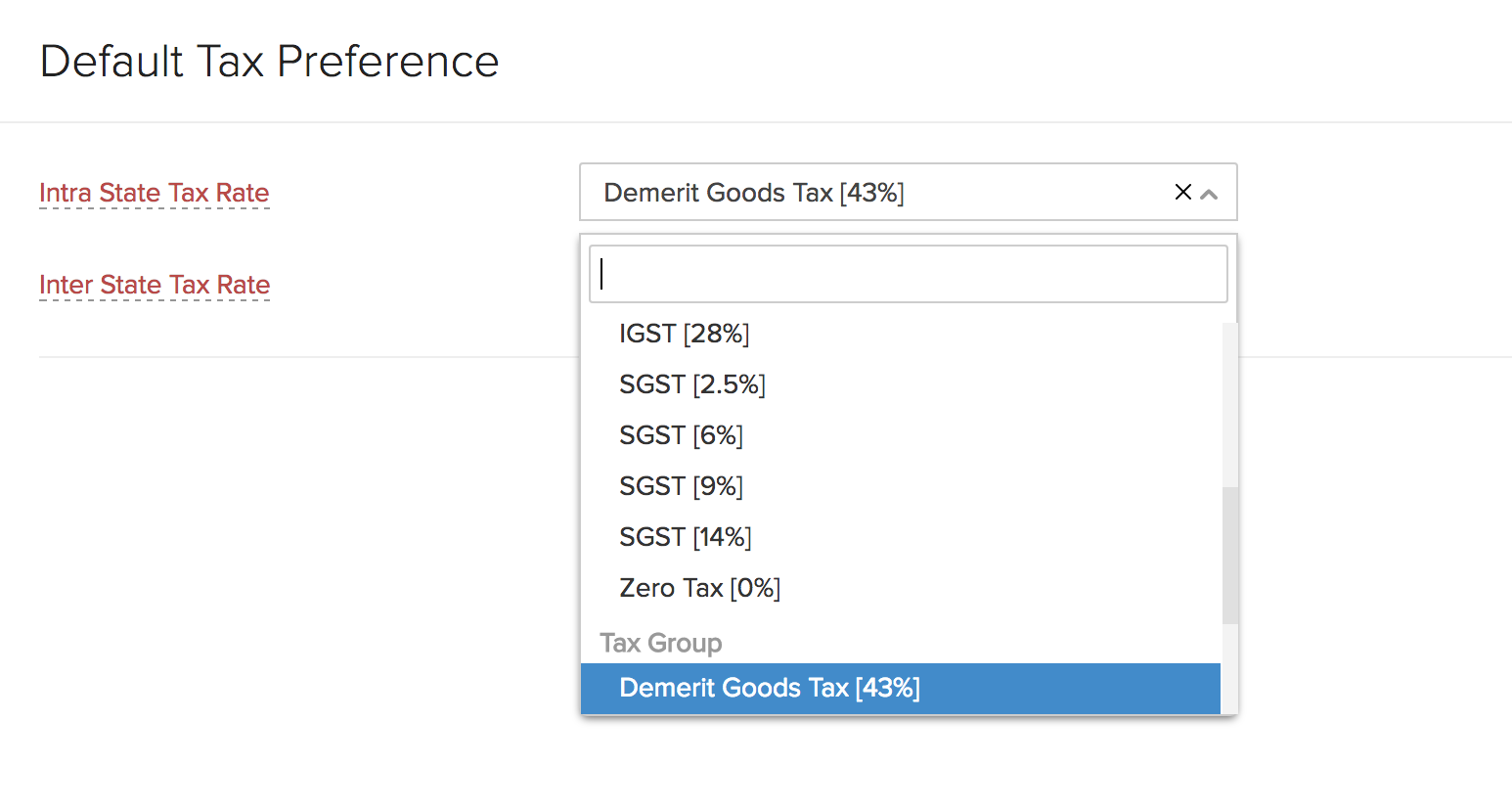

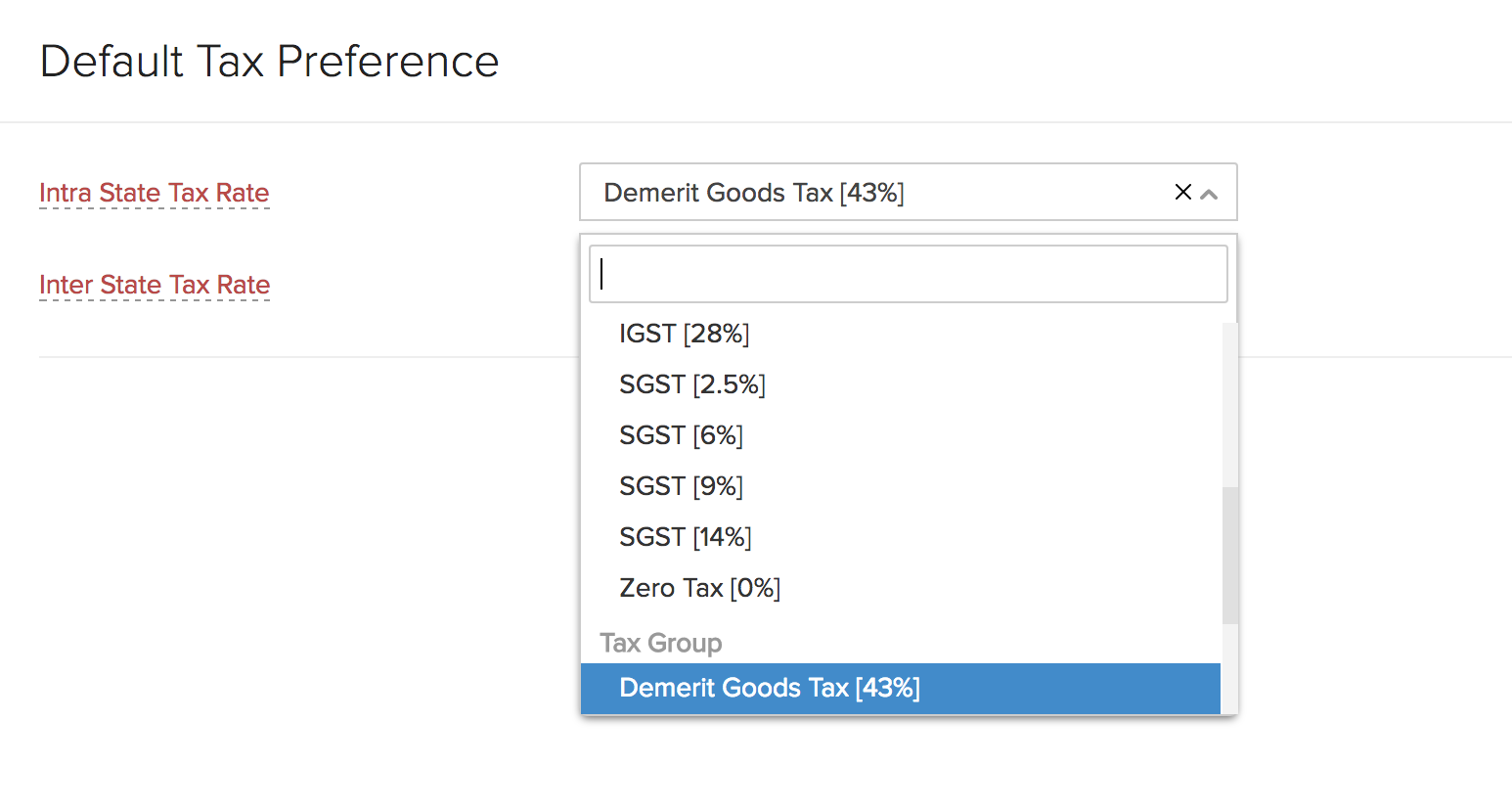

Making the tax group as the default tax

If your business involves only the sale of demerit goods and luxury goods, you can mark these tax groups as your default tax preference. This will ensure that these taxes are chosen by default when you create an item. To make this tax group as default:

- Click the Gear icon and select Taxes.

- Select the Default Tax Preference tab.

- Click the dropdown of Intra State Tax Rate and select the corresponding tax group to mark it as default.

- Click the dropdown of Inter State Tax Rate and select the corresponding tax group to mark it as default.

- Click Save.