- HOME

- Taxes & compliance

- All you need to know about sales tax returns in Texas

All you need to know about sales tax returns in Texas

TL;DR:

- A sales tax return is a report of your sales, with the details of the tax that you have to pay.

- If you have a sales tax obligation in Texas, you need to file returns duly, with the Texas Comptroller, in order to stay tax compliant.

- You need to submit details of your gross sales, taxable sales and purchases, the due tax amount and more while filing returns.

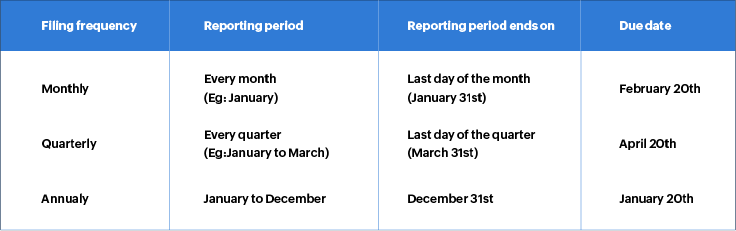

- You will be assigned a certain filing frequency by the Comptroller, which can be monthly, quarterly, or yearly. For each reporting period, the due date is on the 20th of the following month

- You need to file returns even when there are no sales taxes to report (zero returns), or if your business is shutting down (final returns).

- If you file by the due date, you will get a discount of 0.5%. This will be added with a discount of 1.25% if you make a prepayment (applicable to monthly and quarterly taxpayers).

- To avail the prepayment discount, you should make a prepayment of at least 90% of the tax due in the current reporting period, or an amount equal to or greater than the tax due in the same reporting period for the previous year.

- The due date for prepayment reporting falls on the 15th of the month.

- You can file returns via Webfile, Electronic Data Interchange (EDI), paper returns, TeleFile, and third party providers through various modes of payment.

- Those with more than $50,000 of sales tax liability should file online.

- To file online, you must create an account with the Texas Comptroller eSystems site and file returns.

- To file offline, you must download and print the form from the Texas Comptroller site, fill in the details and mail it to the Comptroller.

- You can submit an amended return online (by logging in to the Comptroller's site and entering the changes) or offline (by mailing a printed copy of the previously filed return with the corrected information).

What is a sales tax return?

A sales tax return is a report that you, as a seller with a sales tax obligation, will have to submit to the state. This report will contain your sales-related information along with the amount you have collected on taxable sales for a certain period. By doing so, you will be providing proof of your business transactions, and paying the collected tax amount to the state.

The importance of filing sales tax returns

When you have a sales tax obligation to a state, you have to file returns by the due date assigned to you by the tax authorities, to stay sales tax compliant. As the collected sales tax amount belongs to the state, failure to file returns and pay sales tax will lead to penalties and interest charges. Each state has a different set of penalties and interest charges, and Texas has its own. For example, in Texas, one of the penalties you will have to face for late filing is a $50 penalty.

The process of filing sales tax returns

Before filing your sales tax returns, you will have to calculate the sales tax amount. Then, while filing your returns, you will have to submit the necessary information, and remit the collected amount to the state. In Texas, you will have to submit this to the Texas Comptroller.

Information to submit while filing returns

- Records of gross sales and taxable sales, as well as taxable purchases (where sales or use tax was not paid) in the state, for each county, city, or special district.

- Your business location, taxpayer number, and the due tax amount.

Note:

- Taxable purchases do not include inventory of goods that are solely meant for resale.

- The expected taxable sales and collected sales tax amount should match.

When to file

Once you have registered your business with the Comptroller, you will be notified of your filing frequency, which can be monthly, quarterly, or yearly based on the average sales tax. You need to file returns on all occasions, even when there are no sales taxes to report for a particular period (zero returns), or if your business is closing (final returns). You can choose to file zero/final returns through the same filing process.

For each reporting period, the due date is on the 20th of the following month. Here's a table to show you how it works:

If the due date falls on a weekend or a state holiday, the next business day will automatically be considered as the due date. If you file by the due date, you will get a discount of 0.5%. Besides this, you can also get further prepayment discounts.

Prepayment discounts

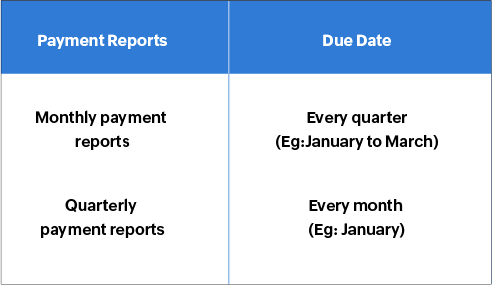

Prepayment discounts of 1.25% are applicable to monthly and quarterly taxpayers. So, along with your timely filing discount of 0.5%, you can get an added 1.25% discount for early payment/prepayment, making it a total discount of 1.75%. Such taxpayers must file a prepayment report (if payment is made by mail), and should prepay a certain amount of their sales tax liability during the entire reporting period. If you submit prepayments online, you don't need to mail the report to the Comptroller's office.

So, apart from filing your regular sales tax returns, you should also file prepayment reports and prepay a portion of your sales tax liability to be eligible for the discount. The balance amount, after prepayment, should be paid by the due date of the regular sales tax return.

So, if you are a monthly filer, you would file your prepayment report and tax prepayment by January 15th, and file your sales tax returns by February 20th. Prepayment reports and payment must be postmarked on or before the due date.

To avail the prepayment discount, you should make a prepayment of:

- At least 90% of the total tax due in your current reporting period OR

- An amount equal to or greater than the total tax due in the same reporting period for the previous year (excluding any discount on previous year's payment).

How to file

Here are the ways in which you can file your sales tax returns in Texas:

- Webfile (online filing where you have to log in and file returns)

- Electronic Data Interchange (EDI) (for large businesses with several branches)

- Downloadable forms (paper returns that can be mailed to the Comptroller)

- TeleFile (This is suggested if you have no taxable sales to report, such as zero returns)

Modes of payment:

- Electronic check/credit card (with Webfile)

- Electronic check (with EDI)

- TEXNET (You will be notified if you have to make your sales tax payment electronically via TEXNET)

- Paper check

Based on the sales tax amount that you paid in the preceding fiscal year (September 1st to August 31st for Texas), you will have to choose the reporting and payment methods accordingly. For a complete list published by the Texas Comptroller, you can visit here. The Texas Comptroller site will also direct you to the registration option for new users under each method.

Note:

- While taxpayers with any sales tax liability can opt for the Webfile option, it is necessary that those with more than $50,000 of sales tax liability should file online, and they cannot file paper returns.

- Webfile returns must be submitted before midnight (Central time) on the due date, and paper returns must be postmarked on or before the due date.

- Those who have to pay more than $10,000 have to make electronic payments.

Online filing through Webfile:

- First, you will have to create an account with the Texas Comptroller eSystems site. This can be done by visiting the Texas Comptroller site, scrolling down, and clicking on the 'Webfile login' option, where you can then sign up.

- Once you have logged in, you will have to enter your taxpayer number and will have to select the period for which you are filing.

- Then, you will be asked if you're eligible for credits and about exported sales.

- Once you have filled these details in, you will have to fill in the information in the return, review the same, and make the payment accordingly.

Offline filing:

You will have to download the form from the Texas Comptroller site, print the form, fill in the information and mail it to the Texas Comptroller office.

How to amend a return

If you have previously submitted a return with an error, you can submit an amended return. To do so by mail, you will have to print a copy of the previously filed return, enter the correct information, and write 'amended return' on top. This will have to be mailed to the Comptroller.

To amend a return online:

- Login to the the Webfile option on the homepage, and select 'Webfile/pay taxes and fees'.

- Select your taxpayer number with the account that you need to amend. You will then get an option to file an amended return.

- Select the period for which you're filing the amended return. Your return will then appear with the pre-populated data, and you can make the changes from there.

- If you have already made the payment, you will only have to pay any additional amount due.

Filing sales tax returns by the due date is key to continuing your business smoothly, but it can take up your time. Instead, with the help of great accounting software like Zoho Books, you can focus on your work better. Zoho Books is an online accounting solution that eases your tax burden by helping you manage your business, and stay tax compliant with easy sales tax management. Sign up with us here!